Towards a flat income tax of 10% to 15%

An interesting study was released recently by the Congressional Planning and Budget Research Department (CPBRD) of the House of Representatives entitled “Progressivity, Fairness, and Efficiency: An Evaluation of the Impact of the TRAIN Law on the Distribution of the Income Tax Burden,” CPBRD Policy Brief No. 2025-04. The authors were David Joseph Emmanuel Barua Yap, Jr., Edrei Y. Udaundo, and Jubels C. Santos.

The old name of the CPBRD was the Congressional Planning and Budget Office (CPBO) and I worked there from 1991-1999.

Among the study’s findings were that the tax share of the top earners — those who earned at least P1.35 million in 2017 and P1.43 million in 2023 — increased from 72.4% (P183 billion) to 88.1% (P258 billion) under the Tax Reform for Acceleration and Inclusion (TRAIN) Law of 2017. See this report about it in BusinessWorld by Kenneth Basilio, “Flat tax seen easing burden on top earners — think tank” (March 18).

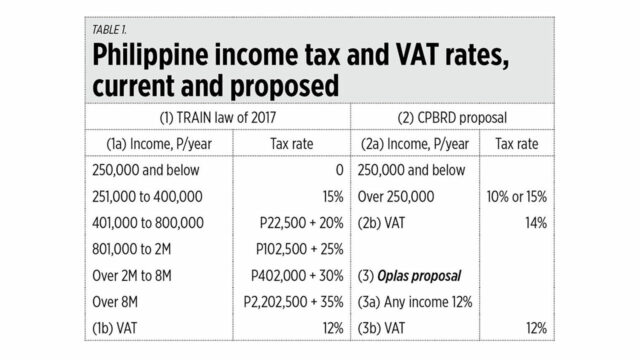

Among the recommendations of the CPBRD paper are that there should be a flat income tax of 10% to 15%, VAT should be hiked from 12% to 14%, and that there be a 10% reduction in government bureaucracy.

I support these suggestions except the value-added tax (VAT) hike to 14%. Currently our 12% VAT is among the highest in Asia, with most of our neighbors having VAT or sales taxes of 7-10%.

In the accompanying table I summarized the existing and proposed tax rates, including my own proposal. An income tax cut often leads to a broader tax base because those who evade paying income taxes at 20% to 35%, or who downscale their declared income to avail of lower tax rates, will be encouraged to declare their real income and pay only 10% to 15%.

I think a flat 12% national income tax regardless of income level will attract more people to be more honest about their real income. Then we can allow the local government units (LGUs) to impose their own income tax.

The CPBRD paper also proposes a spending cut, which is among my favorite advocacies. They estimate that a 10% reduction in the government payroll would save taxpayers some P160 billion, equivalent to half of the 2023 income tax take.

I checked the reactions to the report of two officials in charge of taxation and spending. Department of Finance (DoF) Secretary Ralph G. Recto said that: “We are committed to maximizing tax administration efficiency and ensuring a progressive tax system. Right now, our priority is to collect what is already on the table by accelerating digitalization and closing tax loopholes. By doing so, we can maximize revenue collections without placing an additional burden on our people through new taxes.

“One of the critical mandates of the DoF is to ensure that economic growth is inclusive and equitable by providing more government assistance to those who are in greater need. This can only be done through a progressive tax system, wherein higher-income brackets can contribute more, enabling the government to provide more public services and support to vulnerable sectors.”

Meanwhile, Budget Secretary Amenah F. Pangandaman was happy that the National Government Rightsizing Program (NGRP) was mentioned in the study as they really intend to streamline and make public spending more efficient and not wasteful.

OK then, Secretaries Recto and Pangandaman.

I hope that some legislators someday will be bold enough to push for a flat income tax 10% to 15%. My idea is to have a flat 12% national income tax, then allow the LGUs to impose their own income tax, encourage more devolution of functions to LGUs and then they will have social services competition, infrastructure competition, and peace and order competition among themselves.

Currently 10 countries and territories have zero income tax. Bless them (see Table 2).

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.