Arts & Culture (08/28/24)

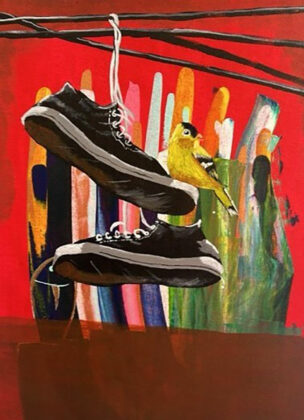

Female narratives on view at ARTablado

NOW on view at ARTablado in Robinsons Antipolo are works of six female artists. The exhibit, titled “Her Art, Her Story: Celebrating Women’s Narratives,” explores themes of identity, resilience, and the pursuit of dreams. The participating artists are Aed Solis, Dolores Van, Elizabeth Esguerra Castillo, Mary Joy Ann Cruz Tuaño, Maxi Cajayon Tungol, and Yam Tamayo. All six are members of the ARTipolo Group. Pol Mesina, head of ARTipolo chose them for their distinct styles and their surprising use of color. “Her Art, Her Story: Celebrating Women’s Narratives” runs until Aug. 31 at ARTablado in Robinsons Antipolo.

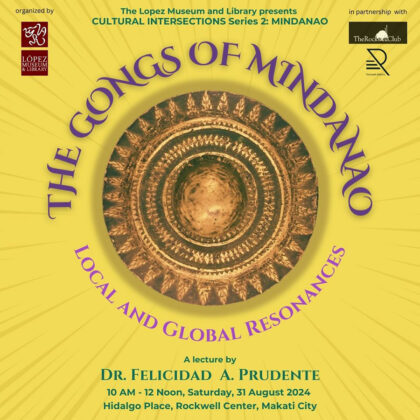

Lopez Museum spotlights Mindanao gongs

THE Lopez Museum and Library has announced the opening event for part two of the Cultural Intersections series, focusing on Mindanao music. The Gongs of Mindanao: Local & Global Resonances by Dr. Felicidad A. Prudente is a lecture-demo that explores the unique sounds of the Mindanao gongs and their evolving significance from traditional to modern contexts. The event will allow participants to experience the music of the gongs and play some of the instruments. It will be held on Aug. 31 at Hidalgo Place, Rockwell Center, Makati, for a regular entrance fee of P400. Seniors, PWDs, students, cultural workers, and Rockwell Club members can avail of it for P320. Register via https://bit.ly/gongsofmindanao.

Joy Rojas holds exhibit at ArtistSpace

THE 8th SOLO exhibition of Filipino visual artist Joy Rojas, titled “IPSO FACTO,” is currently on view at the ArtistSpace in Greenbelt, Makati. In collaboration with JRFII Studio and The Saturday Group of Artists, the exhibition presents a diverse collection of works, including mixed-media creations and sculptures. Mr. Rojas delves into the intrinsic nature of objects, producing abstraction as a distillation of ideas into their most self-evident forms. The artist reception is on Sept. 1 at 5 p.m. The exhibition runs until Sept. 3 at the ArtistSpace, located at the ground level of Ayala Museum Annex, Makati Ave. corner De La Rosa St., Greenbelt Park, Makati City.

CCP digital products available online for free

TO support Filipino artists and make their works accessible to the public, the Cultural Center of the Philippines (CCP) has shared its digital resources free of charge to readers and enthusiasts. Filipinos can learn about Jose Corazon de Jesus, better known by his nom de plume Huseng Batute, via https://josecorazondejesus.home.blog, which contains materials written by notable Filipino poets and writers on the life and works of Huseng Batute. A video performance of the King of Balagtasan is also available on the CCP’s YouTube channel. The Festival of Plays by Women held in 2020, with staged readings and performances by women, can be found at https://festivalofplaysbywomen2020atccp.wordpress.com. For children, the book Sa Pagbabasa, Hindi Ka Nag-iisa has been launched as an e-book containing artworks for children. To read about mothers’ experiences during the pandemic, the CCP put together a book titled In Certain Seasons: Mothers Write in the Time of COVID, which is now available online as well. Meanwhile, the CCP official literary journal, Ani, is going digital, starting with its 41st edition. For more information on these and many more CCP products, visit the CCP’s social media pages.

Exhibit on contemporary prints from PHL, Singapore

IN a joint presentation organized by the Metropolitan Museum of Manila (The M) and STPI — Creative Workshop & Gallery, the exhibit Chances of Contact: Contemporary Prints from the Philippines and Singapore has opened at The M. It was done in collaboration with the Singapore Embassy in Manila and co-presented by Singtel Group in time for the 55th anniversary of bilateral relations between Singapore and the Philippines. It brings together the works of 16 artists from both countries, including National Artist Benedicto “BenCab” Cabrera, Goh Beng Kwan, Han Sai Por, and Ronald Ventura, and offers new ways of appreciating the art of print and papermaking through how each artist pushed boundaries in these mediums during their residencies at STPI.

Businesswomen-led workshops at Yuchengco Museum

THE GREAT Women Engaging series of lectures is will be helmed by businesswomen. The first three sessions feature Alma Rita Jimenez, Marilen Gonzalez-Elizalde, and Jeannie E. Javelosa. The series will kick off on Aug. 31 with Ms. Jimenez’s talk on building a transformative workplace in the face of an evolving business landscape. The talk will be held at 10 a.m. at the YSpace at Yuchengco Museum, ground floor of RCBC Plaza, Makati City. The subsequent talks will be on Sept. 14 and Oct. 26, featuring Ms. Gonzalez-Elizalde and Ms. Javelosa, respectively. The regular entrance rate is P1,000, with a discounted rate of P800.