Fiscal sustainability: Don’t drop the ball

A few days ago, no less than the Bureau of the Treasury in a press release reported that the total outstanding debt of the National Government (NG) reached P15.69 trillion, rising by some P206.5 billion in one month. The NG incurred loans with a mix of 69% domestic and 31% external.

The NG borrows from the domestic capital markets by selling government securities through accredited financial institutions for their clients and for their own accounts. On the other hand, the NG borrows from various sources including development partners like the World Bank and the Asian Development Bank for both program and project loans. Since these development loans are limited to complete the NG’s budget support, global bonds are also sold in the international capital markets.

Last Friday’s broadsheets reported that the Philippines borrowed $2.5 billion in offshore commercial borrowing with maturities ranging from 5.5 years to 10.5 years to 25 years. The NG claimed that benchmark rates have been on the decline due to lower price pressures and expected easing of monetary policy by the US Federal Reserve Board. We can believe the Government’s claim that the tight spreads of those foreign loans are significant wins because foreign funds were accessed rather cheaply to support “economic growth, create quality jobs, increase incomes and reduce poverty.”

National Treasurer Sharon P. Almanza’s point was also correct that when spreads are tight, investors have strong confidence in the country’s creditworthiness and robust growth prospects. Creditors are more convinced that their exposure in government bonds will always be whole.

But two points beg for some explanation.

One, how do such tight spreads create “more fiscal space to flow into transformative investment?”

And, two, how do these loan transactions “further strengthen the Philippine Government’s fiscal consolidation and rapid economic growth?”

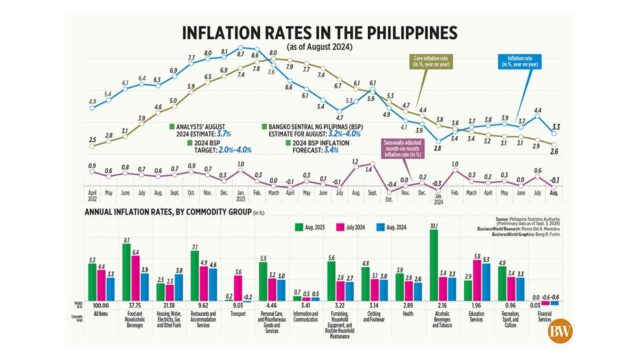

To the extent that the NG succeeds in depressing interest payments through tighter spreads, one can argue that some savings are realized. For instance, before the pandemic in 2019, the Philippines incurred interest expense in the amount of P361 billion. Due to the rapid accumulation of loans to fund COVID-19 mitigation, the NG paid interest of almost twice that amount at P628 billion in 2023. In terms of GDP, the Government increased its payments for the cost of money from 1.8% to 2.6%.

If interest on those loans were lower, the NG could have incurred less expense.

Indeed, even as the Philippines has been paying tighter spreads since its upgrade to investment credit starting 2012 compared to similarly rated, or better rated sovereigns, any enhancement would represent some savings for the country. Tighter spreads could come from, for instance, favorable credit ratings from the major credit rating agencies like Moody’s, S&P, and Fitch. Japan’s R and I is also considered by investors. They regularly assess various financial ratios to establish the sovereign’s liquidity and solvency based on its regulatory environment and policy reforms.

Any savings realized represents more public resources at the disposal of the NG, more logistics to finance investment in human capital as in stronger public health and higher quality education. Investment in hard infrastructure that enhances connectivity in this archipelagic country also builds solid capacity for higher and more sustainable economic growth. That is definitely transformative.

Moreover, banks and other lenders also use credit ratings to scrutinize the creditworthiness of private corporations floating their own bonds in the global market. This is part of their fund-raising activities when they contemplate expanding their operations or branching out to other business lines. Lower borrowing costs certainly would help their finances. Brisk business activities are definitely transformative.

When sovereigns like the Philippines are able to reduce their interest payments, there is more in the budget for infrastructure and social services. At this time when the NG is aspiring to expand its fiscal space by, among others, fiscal consolidation, tighter spreads are indispensable. When the NG has opted not to consider new tax measures, or impose higher tax rates, tighter spreads are more than helpful. If the Supreme Court decides, for instance, to declare as unconstitutional the Department of Finance’s directive to sweep all “unused” funds of government owned and controlled corporations (GOCCs) like the Philippine Health Insurance Corp. and the Philippine Deposit Insurance Corp. — better known as PhilHealth and PDIC, respectively — any reduction of spreads by a single basis point is as precious as gold.

There is no better time for having lower spreads than today. Revenue effort has been stagnant as still water. Before the pandemic, revenue as a share of GDP stood at 16.1%. Last year, it was even lower at 15.7%. Without tax measures, revenues would have a hard time funding ambitious infrastructure programs from Luzon to Visayas to Mindanao, or to ensure meaningful investment in human capital. How does one think about consolidating public finance without tax measures, or simply relying on sleeping funds from GOCCs which, in the first place, largely originated from government subsidies? It is no more than a repurposing of public money without additionality.

It should be no puzzle anymore that in the same breath that a significant dollar bond was successfully issued last week, the NG was talking of more and cheaper funding. Not a small amount of hope is also pinned on the Bangko Sentral ng Pilipinas’ (BSP) sustained easing of monetary policy because it curtails borrowing cost of government, a price leading act no less.

Of course, the NG should be forewarned that the stock of debt is fast accumulating. Before the pandemic, the NG debt was comfortably at P7.7 trillion or only 39.6% of GDP. Thanks to COVID-19, and the Pharmally scandal perhaps, NG debt multiplied like crazy. At the end of 2023, public indebtedness stood at P14.6 trillion or, yes, 60.1%, or half as much. At the end of July 2024, NG debt reached a new high of P15.7 trillion, probably close to 61%.

Based on BSP data, the country’s foreign debt has been exhibiting a parallel trend. In 2019, external debt was only $83.6 billion when the country’s gross international reserves (GIR) tipped the scale at $87.8 billion. At the end of last year, a reversal became obvious. External debt rose to $125.4 billion while the GIR rose to only $103.8 billion. End-March 2024 foreign obligations continued to pile up at $128.7 billion, matched by the latest available data on foreign exchange reserves at $106.7 billion for July 2024. The saving grace is that in terms of imports of goods and payment of services and income, GIR remained steady at just less than eight months.

If growth stalls or imports start to surge, our debt sustainability may be ultimately unhinged as much as our reserve adequacy. It pays to know the markers of sustainable indebtedness, or comfortable reserves cover.

Our fiscal authorities are fully aware that the country’s debt sustainability can be preserved, or the breathing space prolonged. It starts in the Palace, and Congress can pick it up — that push for good governance in the budget process. Sensible and progressive tax measures, perhaps on wealth, minimizing unprogrammed appropriations or elimination of any semblance of pork barrel, prohibiting congressional insertions up to the bicameral conference, stronger and uncompromising oversight on public expenditure complete with scorecards of deliverables, eagle-eyed auditors from the Commission on Audit, and unmitigated access to the Ombudsman and Sandiganbayan — let’s consider them all as a package gift wrapped in political will, strong political will.

The point is to aim for higher growth with as little fiscal drag as possible, minimize the cost of debt financing and, over time, reduce the size of public debt. No rocket science is needed to establish that a lower fiscal deficit means lower stress on public resources. Talks about gains in productivity in the public sector should be pursued.

It is not too much to expect that no one drops the ball this time.

Diwa C. Guinigundo is the former deputy governor for the Monetary and Economics Sector, the Bangko Sentral ng Pilipinas (BSP). He served the BSP for 41 years. In 2001-2003, he was alternate executive director at the International Monetary Fund in Washington, DC. He is the senior pastor of the Fullness of Christ International Ministries in Mandaluyong.