My Cup Of Liberty

By Bienvenido S. Oplas, Jr.

Last week, on July 31, a Regional Trial Court (RTC) in Taguig issued Civil Case No. 1039, “Complaint for Injunction with very urgent application for an Ex Parte 72-hour Temporary Restraining Order (TRO); 20-day TRO; and Writ of Preliminary Injunction.” The plaintiffs are Prime Energy Resources Development BV, UC38 LLC, Prime Oil and Gas, Inc., and PNOC Exploration Corp., and the defendant is the Manila Electric Co. (Meralco).

The RTC called on defendant Meralco “from proceeding to select and contract out the 600-megawatt (MW) net and 400-MW net power supply agreements (PSA) under the competitive selection process (CSP) whose terms are flawed, skewed or supplier-driven and grossly violative of existing laws, rules and regulations.”

The CSP should have been conducted last Friday, Aug. 2, for the 600 MW, then on Aug. 9 for the 400 MW, but with the TRO there is an automatic delay in the bidding, and this will mean a higher cost for consumers, with the reasons to be enumerated below.

Two weeks before this TRO was made by an RTC in Taguig, there was a Senate Committee on Energy public hearing (July 18) where Senator Alan Peter Cayetano, who was a former Taguig Congressman, voiced the same argument used in the RTC civil case, and harassed Meralco.

The main complaints made by the plaintiffs are the following: One, “Meralco TOR (terms of reference) does not recognize and, in fact, violates the preference given to Indigenous Natural Gas (ING) under the relevant laws, rules and regulations.”

Two, “the Meralco TOR incorporated terms and conditions which practically deny the power suppliers using ING as a fuel source the opportunity to fairly participate in the Subject CSPs.”

Three, “increased reliance on imported sources of fuel threatens the country’s energy security and energy sovereignty because these are greatly susceptible to a volatile market” as “imported coal and imported ING, the prices of both are notoriously unstable and extremely subject to external shocks in the market.”

While this is largely a legal matter, my economics-trained mind says that the TRO is wrong for the following economic reasons.

One, the CSP’s main goal is to secure the lowest price for consumers regardless of where the electricity will come from. The CSP is about price competition and selection, not environmental selection, not indigenous over imported energy selection.

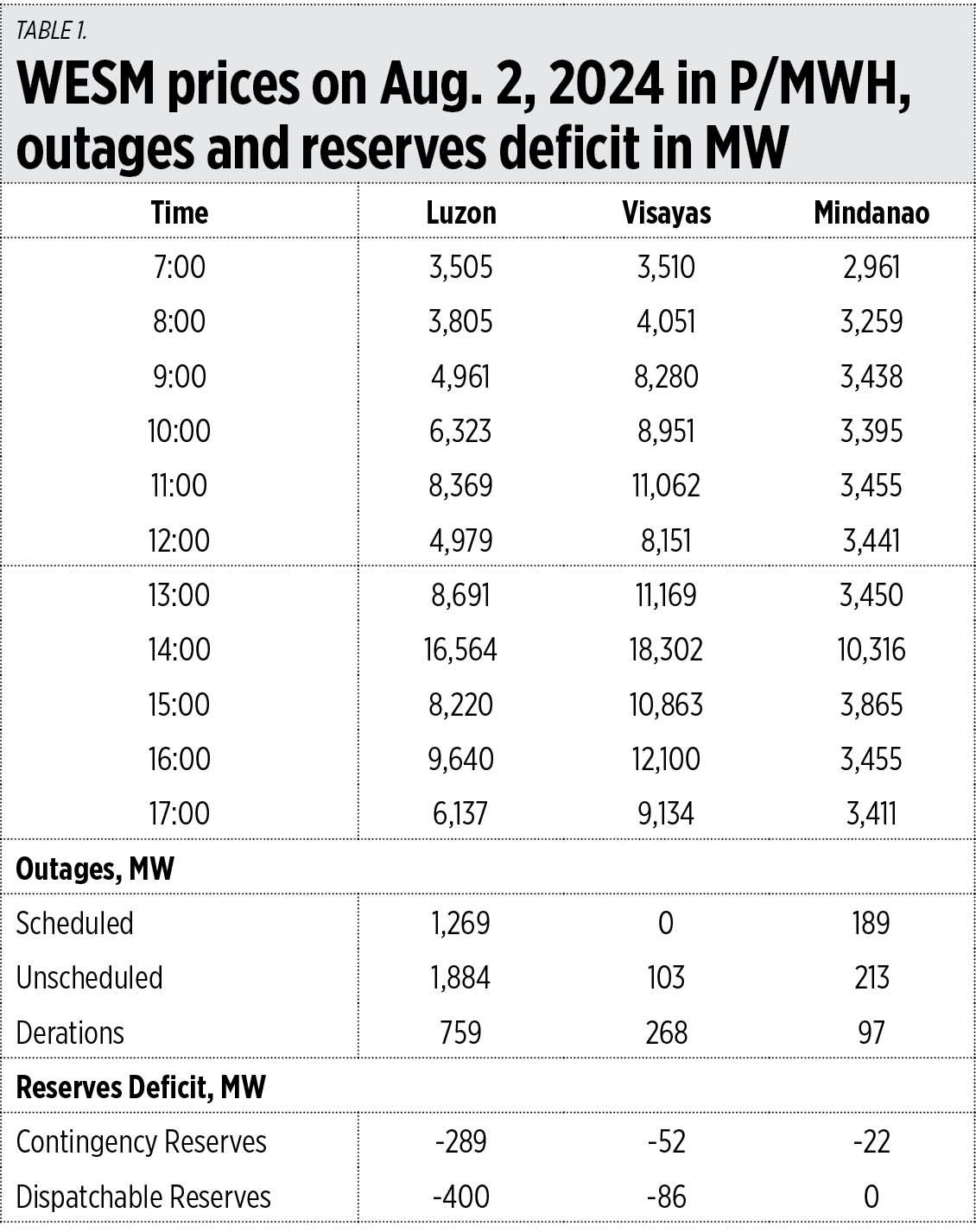

Two, cheaper electricity for consumers means the price should be locked at a stable and low level for many years and not subject to wild price swings at the Wholesale Electricity Spot Market (WESM). On Aug. 2, the day where the CSP for 600 MW should have been held, WESM prices fluctuated wildly in Luzon, from P3.50 per kilowatt hour (kWh) at 7 a.m. to P16.56/kWh at 2 p.m., then P9.64/kWh at 4 p.m.

The main reason was that many power plants had unscheduled or unplanned outages plus derating or reducing output for other plants that continued running. The dispatchable reserves that day were -400 MW (a deficit) in the Luzon grid and -86 MW in the Visayas grid (see Table 1).

Three, delaying the bidding will expose the consumers to an “unnecessary burden in the amount of billions of pesos in the form of higher power rates” as noted by Jose Ronald V. Valles, Meralco SVP and Head of Regulatory Management. The wild swing in prices within a period of 10 hours on Aug. 2 is proof of this.

Four, the claim of high price volatility of imported LNG and coal also applies to the ING Malampaya gas price because it is pegged at Dubai crude oil prices. Dubai, WTI, and Brent oil prices have experienced wild price fluctuations and volatility at almost the same periods as the price volatility of LNG and coal, like in 2008, 2011-2014, and 2022 (see Table 2).

So, favoring ING and demonizing imported LNG and coal based on an argument of price volatility is not a valid argument as it has no basis.

Five, the Philippines need long-term cheap electricity to power its industrialization dream. The industry sector comprises 30% of the country’s GDP, the manufacturing sub-sector comprises 20% of GDP, and recently these sectors were growing slowly partly due to expensive electricity. With the ongoing degrowth and deindustrialization in Europe, we should expect that many businesses there will move to Asia — including the Philippines — and cheaper electricity should be one of the attractions we can offer them.

Data from the Independent Electricity Market Operator of the Philippines (IEMOP) shows that electricity generation and consumption in gigawatt/hours (GWh) was growing at 14% to 24% over the last two years. Meralco electricity sales, also in GWh, had muted growth last year but high growth this year (see Table 3).

Related to my projection in this column last week that GDP growth in the second quarter (Q2) of 2024 would range from 6% to 6.2%, the main reason I said so was because of the base effect — the low growth of only 4.3% in Q2 2023 — and this would allow for high growth in the current year. More particularly in the manufacturing and industry sectors (which had only 1% and 2% growth respectively in Q2 2023), I think they should be doing around 4% and 7% this Q2 2024. (The Philippine Statistics Authority will release the Q2 GDP data on Thursday, Aug. 8. — Ed.)

Six, Meralco is not the sole buyer of power from big generation companies (gencos) and big gas producers. WESM is also a big market for gencos with an ample supply of electricity to offer. WESM spot quantity was 4,060 GWh in the first half (H1) of 2022, and this jumped to 7,938 GWh in H1 2023, and further jumped to 12,447 GWh in H1 2024 (data from IEMOP).

Seven, lawyer Paris Real has correctly pointed out that the plaintiffs are not participants in the CSP as they are not gencos that will compete in giving low price offers to Meralco. And the legal entity that should handle this should be the Energy Regulatory Commission (ERC), not an RTC. The lawyer is correct because the ERC, as a quasi-judicial body, has powers similar to the courts on legal matters related to energy.

High inflation is the number one concern of most Filipinos and other people around the world. Not climate, not imported energy, not POGOs, not inequality, and so on — just high consumer prices. The Meralco CSP is meant to secure the lowest bid price for its customers, and sticking to its goal of protecting consumers is the correct path to help fight high inflation in the country. The plaintiffs are wrong in putting their corporate interests over consumer interests. And the Taguig RTC is wrong in issuing the TRO. May these mistakes not happen again.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.