Inflation likely cooled in Jan. — poll

INFLATION is expected to have decelerated in January, as a favorable base effect offset the rise in oil prices and the impact of Typhoon Odette on food supply.

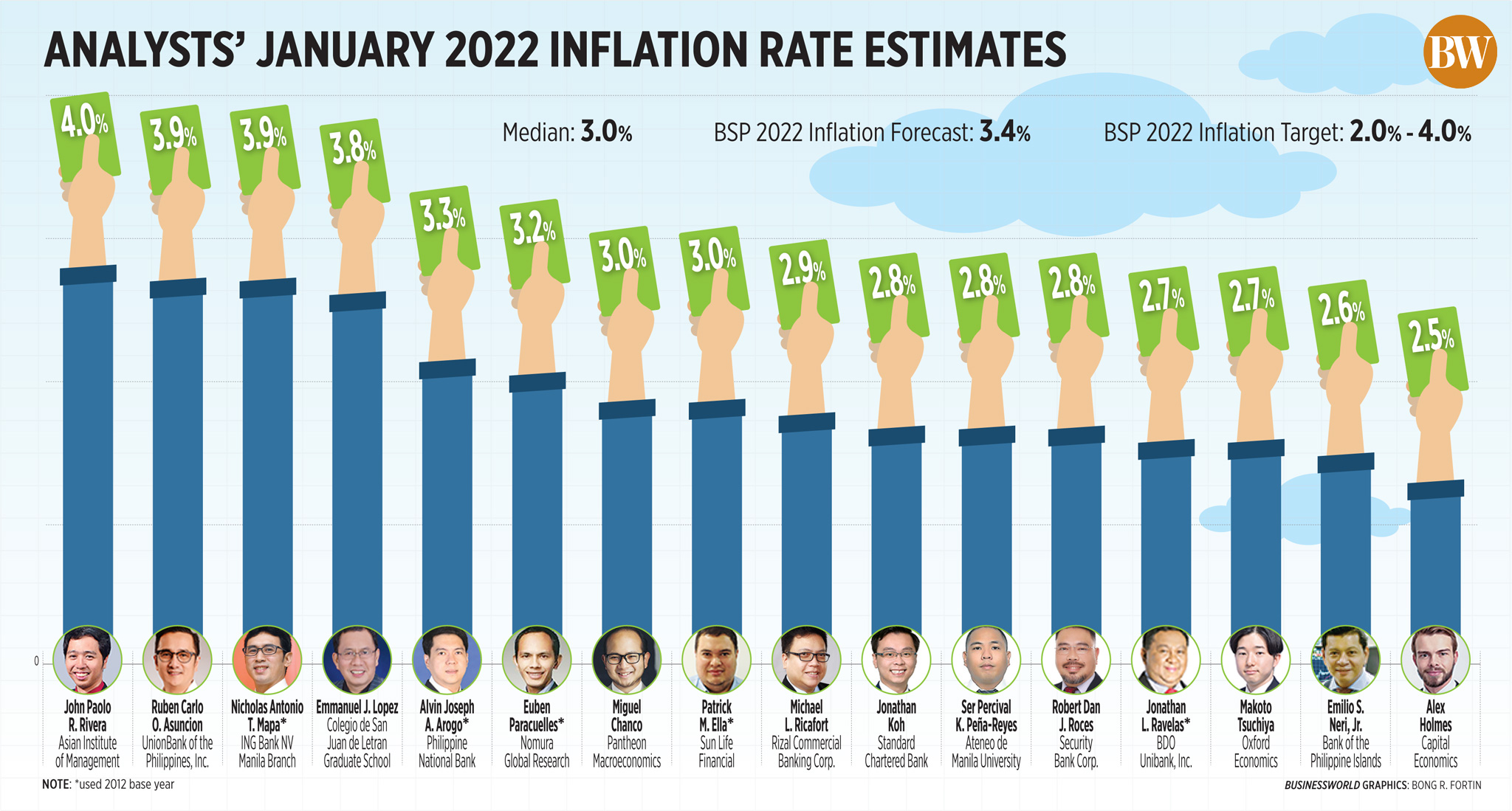

A BusinessWorld poll of 16 analysts last week yielded a median estimate of 3% for January inflation.

If realized, this will be the second consecutive month that inflation will be within the 2-4% target band of the Bangko Sentral ng Pilipinas (BSP). It will also be slower than the 3.6% in December.

The BSP is expected to give its inflation forecast for the month today (Jan. 31).

The Philippine Statistics Authority (PSA) will release the January consumer price index (CPI) report on Feb. 4 (Friday). The PSA will change the base year for the CPI to 2018 starting in the January report to reflect changing Filipino household consumption patterns.

Analysts said the base effect will be a major factor for a likely slower increase in the CPI for January.

“We are forecasting a big drop in the headline rate to 2.5% year on year in January, mainly due to a higher base for comparison,” said Alex Holmes, an economist from Capital Economics.

The CPI rose by 4.2% in January 2021, the first time inflation exceeded the target since the 4.4% in January 2020.

The 2018 base year also strengthens the case for a slower inflation reading, analysts said.

In 2018, inflation exceeded the target for most of the year as rice prices soared. It returned to within the BSP target band as rice supply increased due to the Rice Tariffication Law.

Inflation once again quickened in 2020, as pork prices spiked amid low supply due to the African Swine Fever outbreak.

“We think the rebasing could see inflation coming in somewhat lower as food will have a lower weight, and this has been a key driver of the Philippines high inflation over recent time,” Makoto Tsuchiya, an economist at Oxford Economics said.

Standard Chartered Bank economist Jonathan Koh said a “substitution effect” may also cause slower price increases.

“[This means] consumers [are] buying cheaper goods to substitute for expensive items. That will probably affect the weights on the new basket,” Mr. Koh said.

Meanwhile, Security Bank Corp. Chief Economist Robert Dan J. Roces said the Omicron-driven surge in coronavirus disease 2019 (COVID-19) infections may have also caused slower price increases in January.

“[The] impact of Omicron may have either steadied or exerted slight downward price movements in all the other baskets [apart from food and utilities], including the heavyweight restaurants and accommodation basket plus the new personal care basket, as mobility regressed back to pre-November 2021 levels this month,” Mr. Roces said.

Metro Manila and some provinces were placed under a stricter Alert Level 3 until the end of January to curb the spread of the Omicron variant.

On the other hand, some analysts said Typhoon Odette and the continued rise in oil prices may have caused faster inflation this month.

“We expect January inflation at 3.9% year on year that assumes Odette’s supply shocks may be on the low side if higher oil prices and the new CPI weights and year index affect the inflation story,” UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said.

Agricultural damage caused by the typhoon reached P13.3 billion, according to the Department of Agriculture.

The Department of Energy said as of Jan. 25, prices of gasoline, diesel and kerosene increased by P4.95, P7.20, and P6.75 year to date.

“We expect delays in the effects from both Typhoon Odette and higher oil prices in December. Moreover, the imposition of stricter lockdowns in January resulted in capacity constraints on domestic transportation,” said Alvin Joseph A. Arogo, vice-president and head of equity research division at the Philippine National Bank.

The BSP expects inflation to slow to within target at 3.4% this year. Headline inflation averaged 4.5% in 2021.

Analysts believe the central bank should have room to keep its monetary stance accommodative and support growth should inflation remain within target again in January.

“In the short run, inflation probably will be less of a concern for the BSP at its meeting next month, due to the near-term impact of the Omicron wave and related restrictions on economic activity,” Pantheon Macroeconomics Senior Asia Economist Miguel Chanco said.

BSP Governor Benjamin E. Diokno has said Omicron’s impact will be shorter than previous waves, adding the surge will subside by the middle of February or March. He said this means the 7-9% economic growth target for 2022 is still achievable.

Daily cases have declined in recent days, prompting the government to put Metro Manila and some provinces under the more relaxed Alert Level 2 starting February.

Mr. Tsuchiya of Oxford Economics said the central bank may start raising rates by the second half of the year as the improving vaccination rate could bring the economy closer to normalization.

“We have pulled forward our rate hike assumption to the third quarter of 2022 given our expectation for the Fed to hike rates four times this year, which could potentially lead to capital flight and weaker peso,” he said.

Last week, the Federal Reserve signaled it may start hiking interest rates by March to combat runaway inflation.

Mr. Diokno earlier said they would want to see four to six quarters of consecutive economic growth before considering increasing rates.

The economy grew by 7.7% in the last three months of 2021, a third straight quarter of expansion. This brought full-year 2021 growth to 5.6%, rebounding from the record 9.6% contraction in 2020.

The Monetary Board will have its first policy review for the year on Feb. 17. At its Dec. 17 meeting, it kept interest rates at record lows. — Luz Wendy T. Noble