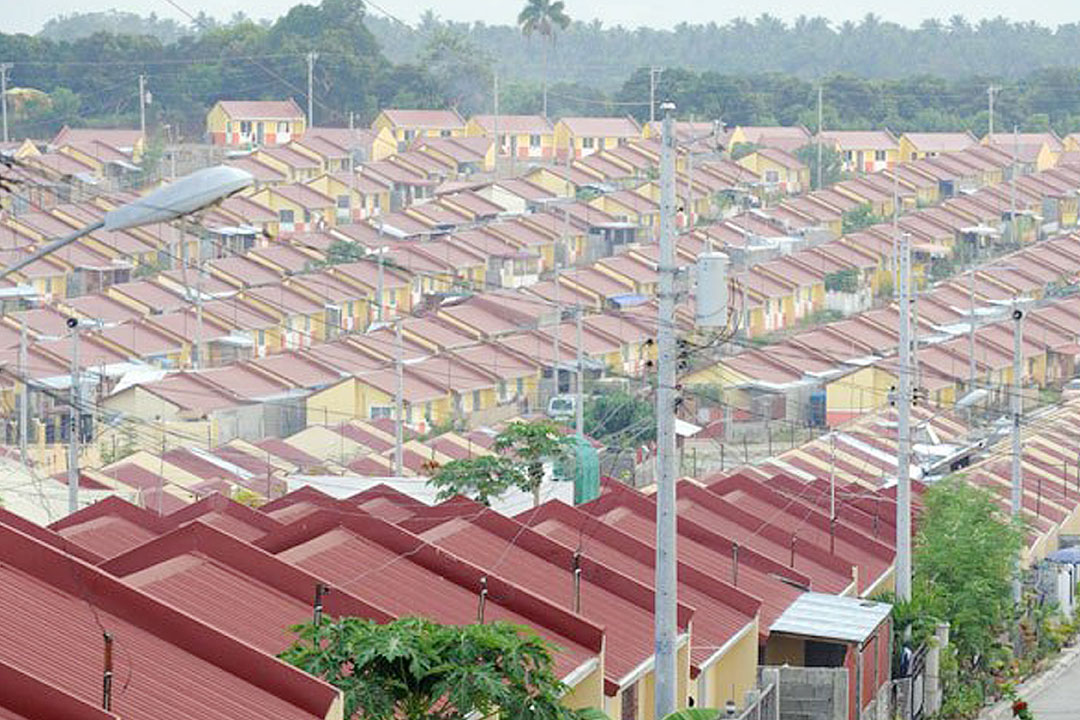

Housing activity seen picking up to clear pandemic backlog

THE housing industry is expected to grow this year as developers clear up the backlog that built up during the pandemic, an industry association said.

“In 2020, all private developers experienced a downward trend. Sales were not as good and collections were a challenge. We understand some of our buyers lost their jobs or shifted their priorities. Fortunately, towards the end of 2020 and 2021, a lot of developers were able to recover, but not yet to pre-pandemic levels,” May P. Rodriguez, president of the Subdivision and Housing Developers Association, Inc. at a virtual briefing.

“Private developers were able to accomplish 50 to 70% of what they were doing pre-pandemic, and I think the outlook is it will continue to improve in 2022,” Ms. Rodriguez added.

According to a recent Colliers International Philippines report, the housing sector is headed for a “rebound” in 2022.

“We see the economic expansion supporting demand in the residential sector, whether in the pre-selling or secondary markets. While we saw initial headwinds at the start of the year, especially with the spread of the Omicron variant, the gradual return of foreign professionals and turnaround in business and consumer confidence should help fuel the take-up of more residential units. We also see rents and prices recovering in the next 12 months. These indicators bode well for the residential market,” according to the report.

Director of the Housing and Real Estate Development Regulation Bureau Angelito F. Aguila said there is opportunity in idle government land for long-term and medium-term development.

“There is so much land from the government which can be (made) available to… informal settlers and even the private sector. If we have to increase housing production, we need to make land more accessible,” he said.

During the pandemic, Ms. Rodriguez said developers struggled to build projects due to quarantine protocols.

“We have commitments we have to deliver. We needed consent to extend the timetable for development. There was a circular allowing additional time to complete and then when that got approved, we started talking to buyers,” she said.

“We came up with quick measures to address the needs of developers in light of the pandemic. We gave them extension of time to develop. Our primary mandate is buyer protection, so we also granted a grace period to buyers,” Mr. Aguila added.

The industry is working with the Board of Investments (BoI) to accelerate housing development, participants at the briefing said.

“We are discussing with the BoI the housing gap, which is mostly in socialized housing. We need incentives so there are more houses in the affordable market. We stressed the fact that housing provides employment (and) has a multiplier effect. In the private sector, providing decent housing is something we want to do. Socialized housing has a price ceiling, so it goes back to affordability. Private businesses need to recover the cost of houses we are selling. Aside from that, we welcome incentivized compliance to balance the housing market,” Ms. Rodriguez said.

Rental housing is an emerging segment due to the pandemic, and should be encouraged by the government, Mr. Aguila said.

“We have to come up with other modes of security with housing. We have rental housing so that those not ready for home ownership due to affordability or whatever reason can avail of temporary rental housing. Rental housing can be incentivized by the government this way,” he added.

“Rental housing is something the private sector can undertake with local government units (LGUs). LGUs have idle land that… can be used to develop something to rent to government employees or informal settlers,” Ms. Rodriguez said.

“We can say that rental properties are thriving. Currently, those who are working are the ones renting (to minimize commuting). Even students, those coming from the provinces and would like to study elsewhere. There is a market for rentals,” she added.

Mr. Aguila cited the need to make the process for approving housing projects faster and more efficient.

“We need to come up with one, single housing regulatory system. Right now, it’s still fragmented, and we come up with one system to make implementation effective and efficient,” he said.

Mr. Aguila and Ms. Rodriguez said potential clients of the housing industry are not making the most of the Home Development Mutual Fund (Pag-IBIG Fund), which can help them get on the property ladder.

“The loans of Pag-IBIG are developer assisted, so we want to educate our buyers because they are afraid to take out loans. We have to… tell them that Pag-IBIG loans are very affordable. For P450,000 to P480,000 houses, your monthly amortization can be less than P2,000 for a 30-year loan. It’s something not everyone realizes is available,” Ms. Rodriguez said.

“Pag-IBIG is not a bank, they’re not restricted by banking rules. It has a way for coming up with lenient requirements for lower income classes,” Mr. Aguila added. — Luisa Maria Jacinta C. Jocson