LOPEZ FAMILY-LED real estate developer Rockwell Land Corp. said it saw a 70% year-on-year increase in first-quarter (Q1) reservation sales to P8.2 billion.

Of this amount, P3.5 billion came from new horizontal projects, Rockwell Land President and Chief Operating Officer Valerie Jane L. Soliven said during the company’s virtual annual stockholders’ meeting on Wednesday.

The company reported strong take-up of The Samanean at Paradise Farms in Bulacan and Molinillo at Rockwell Center Lipa following their launch in December 2024.

The first phase of Lauan Ridges by Rockwell in Mataasnakahoy and Lipa, Batangas, is currently more than 50% sold after its February launch, the company said.

The Edades West high-end condominium development in Rockwell Center Makati contributed 20% to total Q1 reservation sales, it noted.

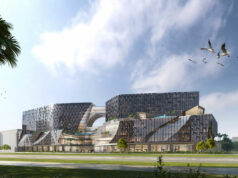

Regarding project launches, Ms. Soliven said Rockwell Land will open a full-service hotel at its Aruga Resort and Residences – Mactan in Cebu by the third quarter.

The developer is also acquiring a 7,500-square-meter property adjacent to its IPI Center Done Rockwell mixed-use development in Cebu City as part of its expansion efforts.

“Raising the bar and setting standards have always been our guiding principles. These values have kept us on course, even in uncertain market conditions,” Rockwell Land Chairman and Chief Executive Officer Nestor J. Padilla said.

“This is how we will approach our next 30 years — relentlessly striving for excellence and innovating beyond the ordinary — alongside those who shape our brand’s success: our people and loyal customers,” he added.

Meanwhile, Rockwell Land Executive Vice-President Davy T. Tan said during the meeting that the company has over 500 hectares of landbank to support the expansion of its residential, retail, and office portfolio.

On the residential condominium oversupply in Metro Manila, Ms. Soliven said Rockwell Land is not affected, as the company’s portfolio focuses on the high-end segment.

“The reported oversupply is primarily concentrated in the mid-market. Our portfolio has always been driven by high-end projects,” she said.

For Q1, Rockwell Land recorded a 5% increase in attributable net income to P773 million from P734 million last year.

January-to-March total revenue climbed 15% to P4.45 billion from P3.88 billion last year.

Real estate sales rose 26% to P3.1 billion, driven by higher bookings and revenue recognition from various projects. Lease income improved by 9% to P642 million on higher average retail and office rental rates.

Rockwell Land shares rose 2.13%, or four centavos, to close at P1.92 per share on Wednesday. — Revin Mikhael D. Ochave