Philippine bond yields end mixed as markets position for possible BSP cut

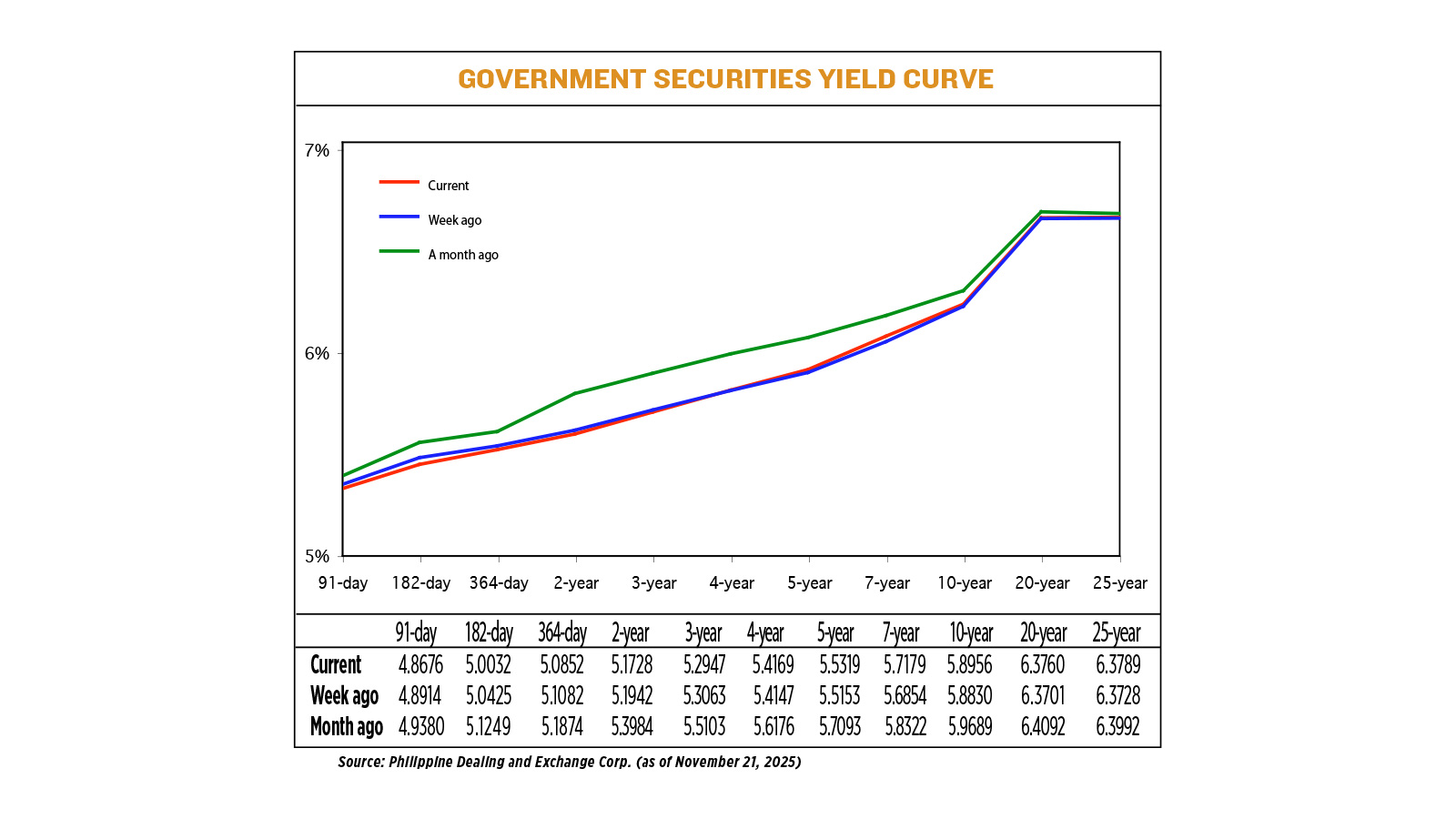

YIELDS on Philippine government securities were mixed last week as traders positioned for a possible rate cut by the Bangko Sentral ng Pilipinas (BSP) in December.

Short-term Treasury bill rates slipped, reflecting expectations that the Monetary Board could lower borrowing costs at its Dec. 11 meeting. Moves across the rest of the curve were uneven, with some medium- and long-tenor bonds drifting higher as investors factored in inflation risks linked to a softer peso.

“The declines on the short end reflected market expectations of continued BSP rate cuts in December and in 2026,” a bond trader said.

Governor Eli M. Remolona, Jr. said earlier this month that a reduction is possible and would likely come in a quarter-point step. The central bank has lowered policy rates several times since mid-2024 as growth momentum cooled and inflation stayed subdued.

Investor sentiment remains fragile following revelations of irregularities in state flood-control spending, which some economists say may drag public outlays and slow expansion. Former Finance Secretary Ralph Recto recently said full-year growth might settle below 5%, adding to expectations of a rate reduction.

Inflation held steady in October while staying within target, according to data from the Philippine Statistics Authority. Still, pressure from the weaker peso has kept some medium- and long-tenor yields slightly elevated as markets assess potential pass-through to consumer prices.

The peso softened against the dollar late last week, with trading volumes thinning as investors awaited delayed US economic releases following the government shutdown.

Despite the mixed performance across the curve, traders said the broader backdrop still favors lower yields.

“The fundamental case for lower yields remains intact,” the trader said. “We have below-target inflation, subdued growth momentum and a favorable bond supply calendar. Given this environment, the balance of risks for peso government security yields is clearly skewed to the downside.”

A second trader said any further softening in US data could strengthen the case for a Federal Reserve rate cut in December, easing pressure on the BSP and supporting a domestic policy move. Markets are also watching speeches from Fed officials for fresh guidance ahead of next month’s meeting.

Bond turnover for the week was slightly lighter, with participants taking smaller positions as they waited for clearer signals from both the Fed and the BSP.

Overall, traders expect yields to continue drifting lower, barring any surprise from global data releases or sudden shifts in currency sentiment. — Heather Caitlin P. Mañago