Yields on government debt decline as CPI data reinforce Fed cut hopes

YIELDS on government securities (GS) fell almost across all tenors last week following the release of soft June US consumer inflation data, which reinforced expectations for a September rate cut by the US Federal Reserve.

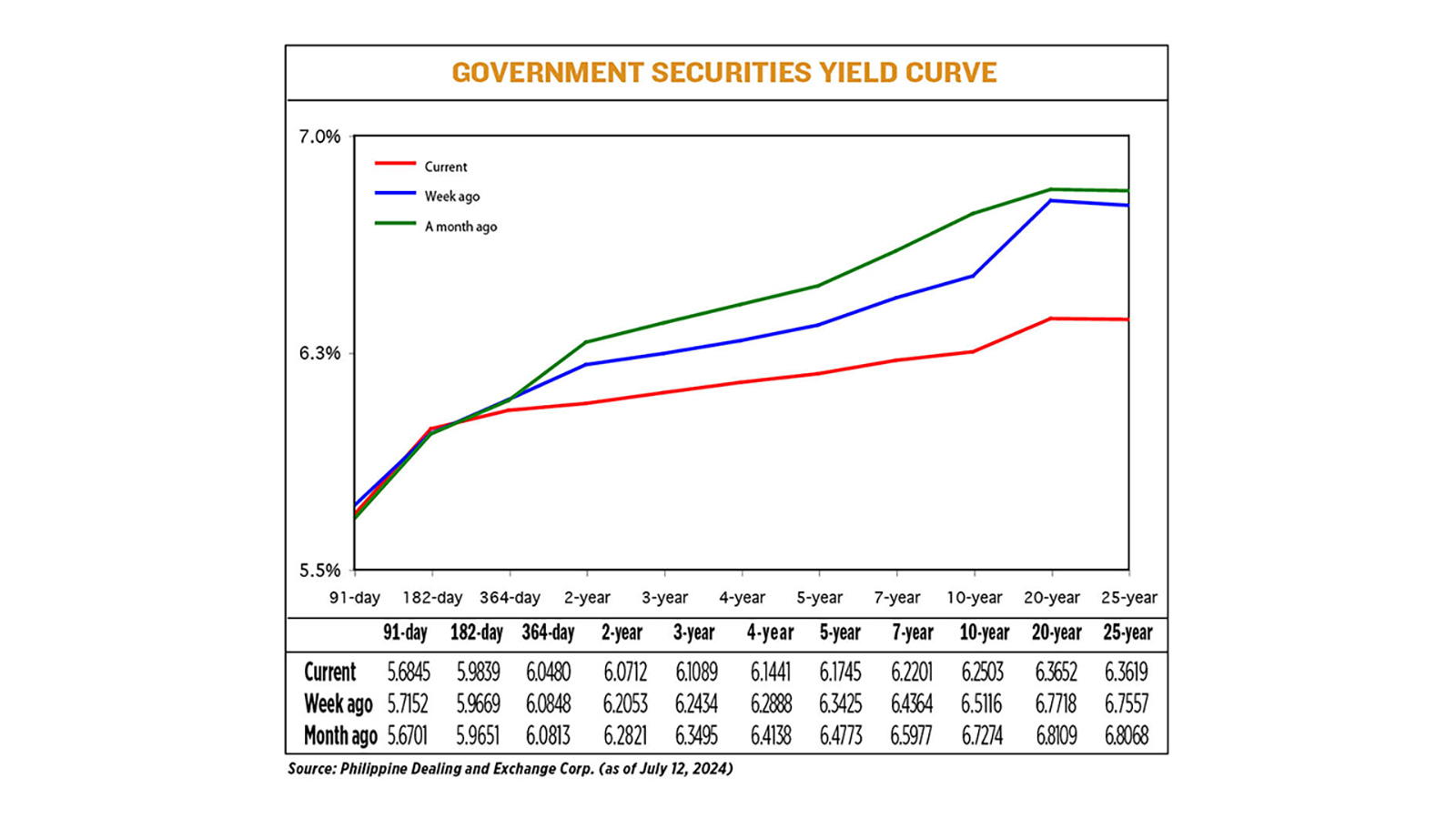

GS yields, which move opposite to prices, went down by an average of 17.36 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of July 12 published on the Philippine Dealing System’s website.

Yields declined almost across the board last week, save for the 182-day Treasury bill (T-bill), which rose by 1.7 bps to fetch 5.9839%.

Meanwhile, the rates of the 91- and 364-day T-bills went down by 3.07 bps and 3.68 bps week on week to 5.6845% and 6.0480%, respectively.

At the belly, yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) dropped by 13.41 bps (to 6.0712%), 13.45 bps (6.1089%), 14.47 bps (6.1441%), 16.80 bps (6.1745%) and 21.63 bps (6.2201%), respectively.

At the long end of the curve, the rates of the 10-, 20- and 25-year T-bonds fell by 26.13 bps (to 6.2503%), 40.66 bps (6.3652%) and 39.38 bps (6.3619%), respectively.

Total GS volume traded reached P41.72 billion on Friday, higher than the P32.15 billion seen on July 5.

“Domestic bond yields broadly moved lower [last] week after amid dovish remarks by US Federal Reserve Chair Jerome H. Powell during his US Congressional testimony and was supported by the softer US consumer inflation report,” a bond trader said in an e-mail.

These solidified market expectations of a policy rate cut from the Fed as early as September, the trader added.

“The week started out strong as buying momentum continued to be seen, especially in the first two trading sessions for the week. The rally was spurred when US yields fell, an indication of a softening labor environment as shown by the latest non-farm payrolls results,” Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message.

Mr. Powell, over his two days of commentary before the Senate and House committees that oversee the central bank, indicated the Fed was edging closer to a rate cut decision, while also insisting that he was not yet ready to declare that inflation had been beaten, Reuters reported.

Mr. Powell and other Fed officials have said they will not cut interest rates until they have gained even greater confidence that inflation is headed back to the central bank’s 2% target after a breakout surge during the pandemic.

The Fed next meets on July 30-31.

US consumer prices fell for the first time in four years in June amid cheaper gasoline and moderating rents, firmly putting disinflation back on track and drawing the Fed another step closer to cutting interest rates in September.

The second straight month of benign consumer price readings reported by the Labor Department on Thursday should help to bolster confidence among officials at the US central bank that inflation is cooling after surging in the first quarter.

The report also showed a measure of underlying inflation posting the smallest increase since August 2021 on a monthly basis. Financial markets saw a very high probability of the Fed starting its easing cycle in September.

The consumer price index (CPI) dipped 0.1% last month, the first drop since May 2020, after being unchanged in May, the Labor department’s Bureau of Labor Statistics said.

In the 12 months through June, the CPI climbed 3%, the smallest gain since June 2023. That followed a 3.3% advance in May. Economists polled by Reuters had forecast the CPI ticking up 0.1% and gaining 3.1% year-on-year.

Financial markets saw a roughly 85% chance of a rate cut at the Fed’s September meeting, compared with about a 70% chance seen before the report. Two rate cuts are anticipated this year.

The central bank has maintained its benchmark overnight interest rate in the current 5.25%-5.5% range since last July. It has hiked its policy rate by 525 bps since 2022.

Optimism also grew after Bangko Sentral ng Pilipinas (BSP) Governor Eli M. Remolona, Jr. reiterated the possibility of an August rate cut, adding that the central bank cannot wait long before starting its easing cycle as this could dampen economic growth, Ms. Araullo added.

“Because of these comments, better buying interest was observed, especially in the belly portion of the curve,” she added.

Mr. Remolona last week said the central bank is trying to “strike a balance” between supply and demand to ensure stable prices.

He said the Monetary Board remains “on track towards reducing rates” despite risks to the inflation outlook. He earlier said that the central bank could cut by 25 bps in the third quarter and by another 25 bps in the fourth quarter.

The BSP last month kept its policy rate at a 17-year high of 6.5% for a sixth straight meeting. It raised rates by a cumulative 450 bps from May 2022 to October 2023 to tame inflation.

The last time the BSP cut borrowing costs was in November 2020 when it slashed its key rate by 25 bps to a record low of 2% to support economic recovery amid the coronavirus pandemic.

For this week, Ms. Araullo expects the 10-year T-bond auction to be the main market mover. The Bureau of the Treasury will auction off P30 billion in reissued 10-year bonds with a remaining life of nine years and six months on Tuesday.

“If demand remains strong for the bond, we may see follow-through buying in the market as investors may still be keen on locking rates at current levels given the BSP’s hawkish rhetoric,” she said.

“Yields are likely to continue its downtrend, potentially taking dovish cues from the European Central Bank (ECB) policy decision and weaker Chinese economic growth in the second quarter, both of which could support views of monetary policy easing by various central banks this year,” the bond trader added.

Latest China gross domestic product will be released on July 15 (Monday), while the ECB will hold a policy meeting on July 18 (Thursday). — Lourdes O. Pilar with Reuters