Yields on gov’t debt end lower

YIELDS on government securities (GS) went down last week as Philippine inflation eased in June and as US data released last week led to renewed Federal Reserve rate cut bets.

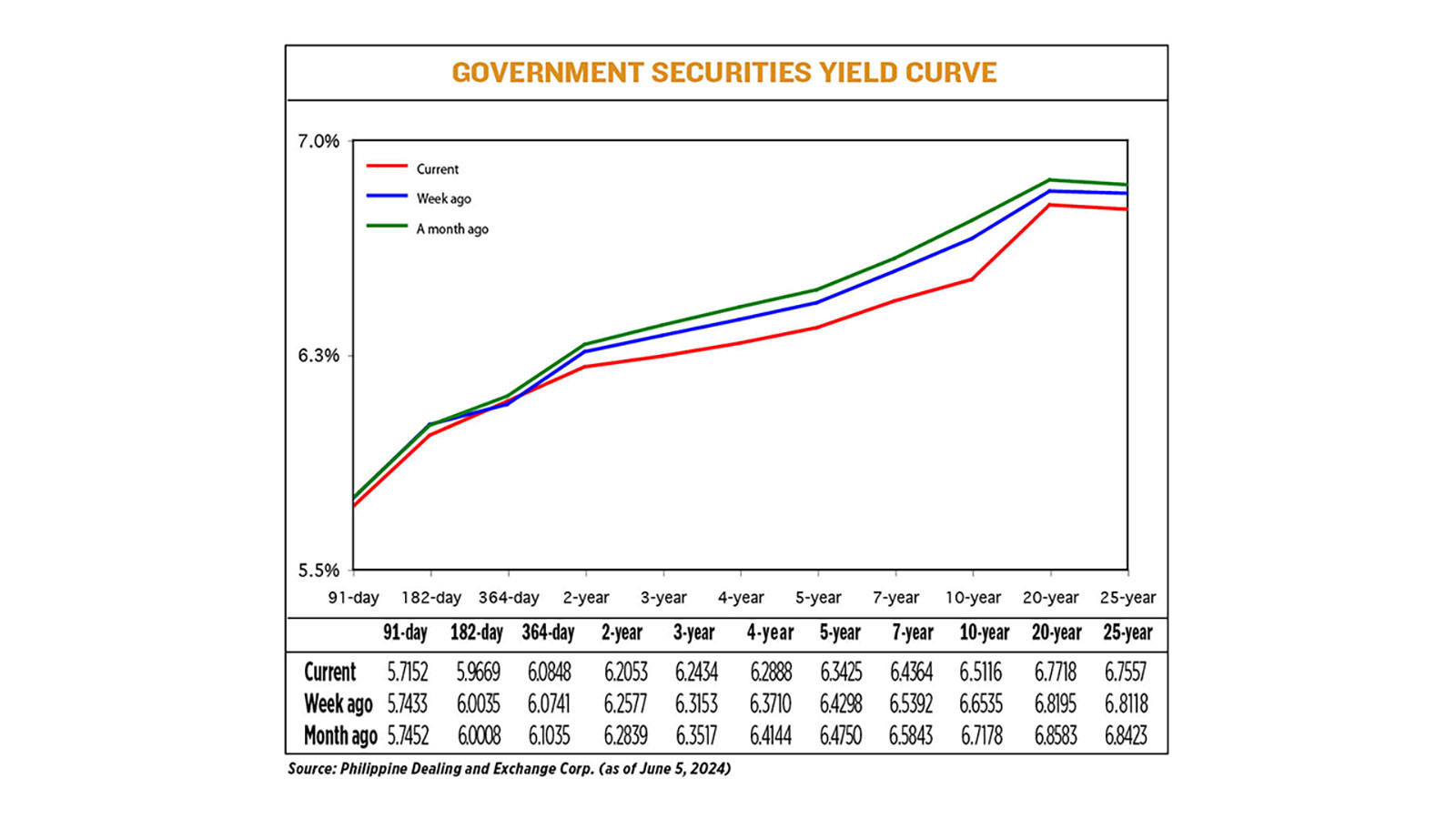

GS yields, which move opposite to prices, fell by an average of 6.33 basis points (bps) week on week, according to data from the PHP Bloomberg Valuation Service Reference Rates as of July 5 published on the Philippine Dealing System website.

Rates at the short end were mixed, with the 91- and 182-day Treasury bills (T-bills) going down by 2.81 and 3.66 bps to yield 5.7152% and 5.9669%, respectively. Meanwhile, the yield on the 364-day paper went up 1.07 bps to 6.0848%.

At the belly of the curve, yields went down across all tenors. The two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) dropped by 5.24 bps (to 6.2053%), 7.19 bps (6.2434%), 8.22 bps (6.2888%), 8.73 bps (6.3425%), and 10.28 bps (6.4364%), respectively.

Lastly, at the long end, the rates of the 10-, 20-, and 25-year debt papers declined by 14.19 bps (to 6.5116%), 4.77 bps (6.7718%), and 5.61 bps (6.7557%), respectively.

GS volume traded rose to P32.15 billion on Friday, up from P25.17 billion the previous week.

Yields on government debt mostly went down last week on expectations of slower June headline inflation, Jonathan L. Ravelas, senior adviser at Reyes Tacandong & Co., said in a Viber message.

“Since the market has been anticipating this, yields moved lower. However, we also observed profit taking at [Friday’s] levels as some issues are already back to April levels,” a bond trader likewise said in a Viber message.

Philippine headline inflation eased to 3.7% in June after four straight months of acceleration due to a slower rise in electricity and transport costs, the Philippine Statistics Authority reported on Friday.

The consumer price index (CPI) rose to 3.7% year on year in June, easing from 3.9% in May and 5.4% in the same month a year ago.

This fell within the Bangko Sentral ng Pilipinas’ (BSP) 3.4-4.2% forecast for the month and was slightly slower than the 3.9% median estimate in a BusinessWorld poll of 14 analysts.

This also marked the seventh straight month that the CPI settled within the BSP’s 2-4% target band.

The June print was the slowest pace in four months or since the 3.4% clip in February. It also matched the 3.7% print in March.

For the first six months of 2024, headline inflation averaged 3.5%, slightly faster than the central bank’s 3.3% full-year forecast but still well within its annual goal.

BSP Governor Eli M. Remolona, Jr. earlier said that the Monetary Board is “on track” to deliver its first rate cut in over three years at its Aug. 15 meeting as they expect inflation to continue easing this semester.

The central bank may cut by 25 bps in the third quarter and another 25 bps in the fourth quarter, the BSP chief added.

Data out of the US last week also caused GS yields to decline as these boosted bets of a Fed rate cut within the year, the trader added, which also increases the likelihood of the BSP kicking off its easing cycle as planned.

US employment increased solidly in June, but government and healthcare services hiring made up about three-quarters of the payrolls gain and the unemployment rate hit a 2-1/2-year high of 4.1%, pointing to a slackening labor market that keeps the Federal Reserve on course to start cutting interest rates soon, Reuters reported.

The Labor Department’s closely watched employment report on Friday also showed the economy created 111,000 fewer jobs in April and May than previously estimated, suggesting the trend in payrolls growth was slowing.

When added to the moderation in prices in May, the report could boost Fed policy makers’ confidence in the inflation outlook after the disinflationary trend was disrupted in the first quarter. Financial markets expect the US central bank, which aggressively tightened monetary policy in 2022 and 2023, to start its easing cycle in September.

Nonfarm payrolls increased by 206,000 jobs last month, lifted by government hiring, the Labor department’s Bureau of Labor Statistics said. Economists polled by Reuters had forecast payrolls would increase by 190,000 last month, with the unemployment rate unchanged at 4%.

Traders of federal funds futures saw a roughly 77% probability of a rate cut at the Fed’s Sept. 17-18 meeting, according to CME Group’s FedWatch tool. Traders are also pricing in a rising chance of a second rate cut in December.

The Fed has maintained its benchmark overnight interest rate in the current 5.25%-5.5% range since last July. The minutes of the central bank’s June 11-12 meeting, which were published on Wednesday, showed policy makers acknowledged the economy appeared to be slowing and that “price pressures were diminishing.”

The ADP employment report and weekly jobless claims last week also signaled easing labor market conditions, while a measure of services sector activity dropped to a four-year low and factory orders slumped unexpectedly.

Yields may continue to move sideways to down in the near term on expectations of lower borrowing costs here and in the US, Mr. Ravelas said.

“The market will need more catalysts to warrant further downside in yields,” the bond trader added. — K.K.P.D.Mendoza with Reuters