Debt yields mixed on US rates, peso

YIELDS on government securities (GS) were mixed last week amid the result of a bond auction, the rise in US Treasury rates, and the persistent weakness of the peso against the dollar.

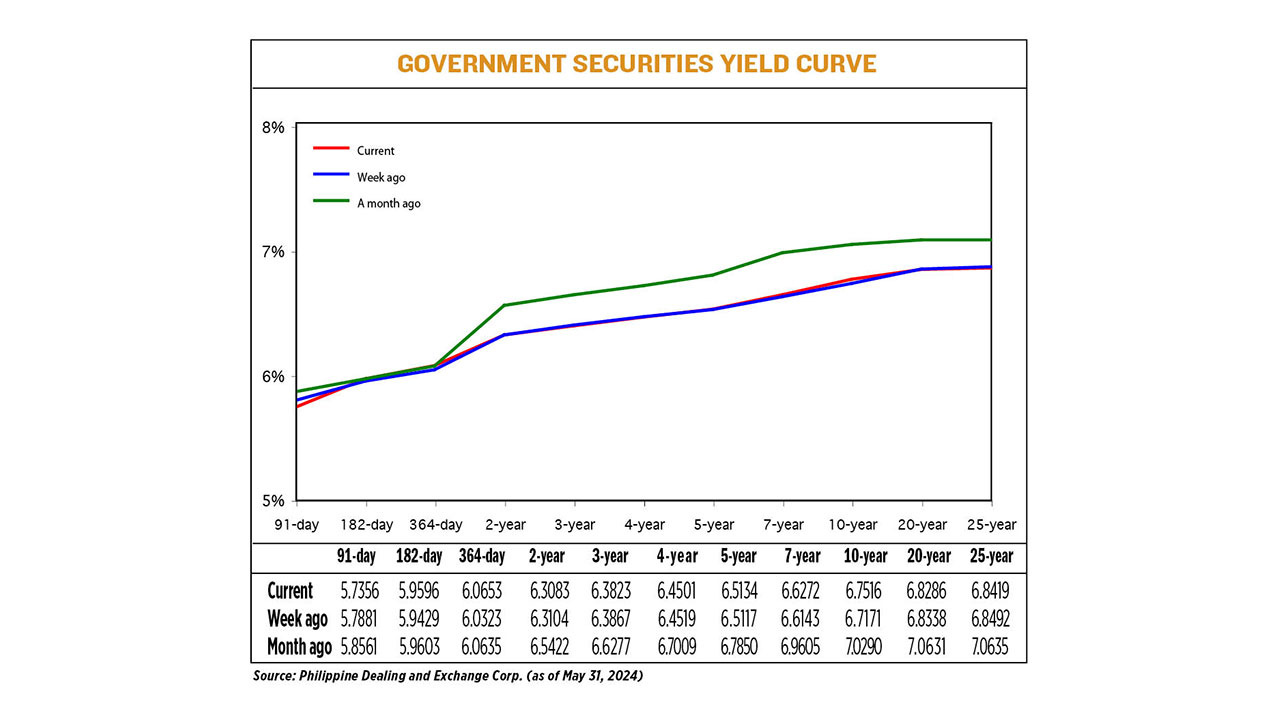

Bond yields, which move opposite to prices, inched up by an average of 0.23 basis point (bp) week on week, based on PHP Bloomberg Valuation Service Reference Rates as of May 31 published on the Philippine Dealing System’s website.

Rates at the short end of the curve mostly went up last week, with the 182- and 364-day Treasury bills (T-bills) rising by 1.67 bps and 3.3 bps to 5.9596% and 6.0653%, respectively. Meanwhile, the 91-day T-bill fell by 5.25 bps week on week to yield 5.7356%.

At the belly, yields mostly declined as the two-, three-, and four-year Treasury bonds (T-bonds) dropped by 0.21 bp (to 6.3083%), 0.44 bp (6.3823%), and 0.18 bp (6.4501%), respectively. On the other hand, the rates of the five- and seven-year T-bonds rose by 0.17 bp (to 6.5134%) and 1.29 bps (6.6272%).

Lastly, yields at the long end of the curve inched lower, with the 20- and 25-debt papers going down by 0.52 bp (to 6.8286%) and 0.73 bp (to 6.8419%), respectively. The rate of the 10-year bond rose by 3.45 bps to 6.7516%.

On Friday, the total GS volume traded climbed to P12.51 billion from P9.62 billion on May 24.

Last week’s yield movements came amid mixed market catalysts, with sentiment initially being boosted by a strong three-year bond auction, ATRAM Trust Corp. Vice-President and Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said in an e-mail.

“Investors deemed that supply in the front end of the curve will be limited in June given the Bureau of the Treasury’s (BTr) planned borrowing, so players opted to deploy in this tenor,” he said.

The BTr on Tuesday raised P30 billion as planned via the reissued three-year bonds it auctioned off as total bids reached P71.399 billion, or more than twice the amount on offer.

The bonds, which have a remaining life of two years and seven months, were awarded at an average rate of 6.347%. Accepted yields were 6.3% to 6.375%.

The Treasury’s borrowing plan for this quarter showed it aims to raise a combined P120 billion from P30-billion weekly offerings of seven-, 10-, 15-, and 20-year T-bonds.

“Despite the initial boost in market appetite in the recent auction, the weakening peso and the highest in a month US yields reversed the sentiment,” Mr. Ulpo added.

He said the peso’s weakness translates to higher import costs on the local side, which could affect inflation expectations. Currency volatility could also affect foreign investor appetite for government debt, Mr. Ulpo said.

“A cautionary stance on both local and global markets has dampened trading demand, leading to higher bond yields [last] week,” he added.

On Thursday, a rout in US Treasuries pushed up yields, which boosted the dollar, Reuters reported.

The index tracking the US currency against its major peers climbed to 105.18 that day, the highest since May 14, and was slightly lower at 105.05 in early European trading.

A two-day, 15-bp jump above 4.6% for long-term Treasury yields helped push the dollar higher. The rise in yields, which move inversely to prices, has been driven by a spate of stronger-than-expected data, tough words from Federal Reserve officials, and a run of poorly received bond auctions.

The dollar’s strength caused the peso to hit a near 19-month low on Thursday, closing at P58.635 per dollar, its worst finish since its P58.80 finish on Nov. 3, 2022, data from the Bankers Association of the Philippines showed.

On Friday, the dollar fell with Treasury yields as data showed a modest rise in US inflation in April, Reuters reported.

Before the market opened on Friday, the US Commerce department said the personal consumption expenditures (PCE) price index, widely seen as the Federal Reserve’s favored inflation indicator, increased 0.3% last month, in line with expectations and the March increase, while core PCE rose 0.2%, compared with 0.3% in March.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, fell 0.15% to 104.61 and was showing its first monthly decline in 2024 after the data.

In Treasuries, yields fell after the signs of inflation stabilization in April, suggesting to some that the potential for the Fed to cut rates later this year remained intact.

The yield on benchmark US 10-year notes fell 5.1 bps to 4.503% from 4.554% late on Thursday while the 30-year bond yield fell 3.4 bps to 4.6511% from 4.685%.

The 2-year note yield, which typically moves in step with interest rate expectations, fell 5.2 bps to 4.8768% from 4.929% late on Thursday.

The correction caused the peso to climb by 12.5 centavos to close at P58.51 a dollar on Friday.

For this week, GS yields may move higher if the peso’s weakness against the dollar persists, Mr. Ulpo said.

“Future yield movements will also be dictated by the upcoming inflation figures, particularly the personal consumption expenditures price index in the US for April and the local consumer price index (CPI) for May,” he said.

May Philippine CPI data will be released on Wednesday, June 5.

“Developments in local and global monetary policies will likely influence yield movements. The US Federal Reserve and BSP (Bangko Sentral ng Pilipinas) will have their regular monetary policy meetings on June 12 and 27, respectively. If the Fed maintains a higher-for-longer rate stance due to persistent inflation, the expectation of yield increases may strengthen, tempering market expectations for rate cuts. This could add upward pressure to local yields, as Philippine markets are highly sensitive to US rate developments,” Mr. Ulpo added. — A.C. Abestano with Reuters