YIELDS on government securities (GS) fell last week following the Treasury bond (T-bond) auction result and as the market awaited the updates from the US Federal Reserve’s Jackson Hole symposium.

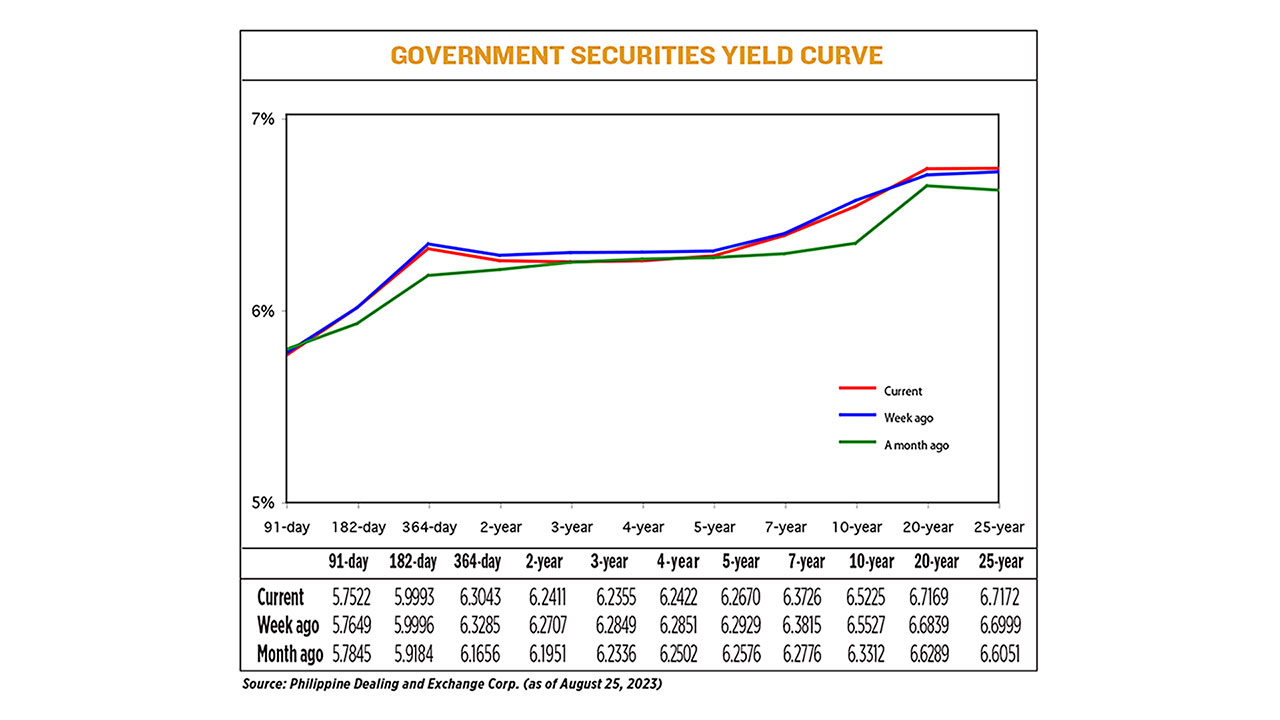

GS yields declined by 1.58 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Aug. 25 published on the Philippine Dealing System’s website.

Rates of most tenors declined last week, except for the 20- and 25-year T-bonds, which rose by 3.3 bps and 1.73 bps, respectively, to fetch 6.7169% and 6.7172%.

At the short end of the curve, the 91-, 182-, and 364-day Treasury bills (T-bills) went down by 1.27 bps (to 5.7522%), 0.03 bp (5.9993%), and 2.42 bps (6.3043%), respectively.

At the belly, the yields on the two-, three-, four-, five-, and seven-year T-bonds decreased by 2.96 bps (to 6.2411%), 4.94 bps (6.2355%), 4.29 bps (6.2422%), 2.59 bps (6.2670%), and 0.89 bp (6.3726%), respectively.

The 10-year T-bond also fell by 3.02 bps to yield 6.5225%.

Total GS volume traded on Friday amounted to P10.26 billion, lower than the P10.68 billion seen on Aug. 18.

“Yields were mostly lower as they tracked US Treasury yields, which have corrected from recent highs. The rejection of last Tuesday’s auction also helped as investors looked for other outlets,” said the first bond trader in a Viber message.

Last week, the government rejected all bids for its P30-billion offer of reissued 20-year T-bonds with a remaining life of 15 years and five months last week despite tenders reaching P35.302 billion.

Had the Bureau of the Treasury (BTr) made a full award, the issue’s average rate would have jumped by 158.6 bps to 6.927% from the 5.341% quoted for the bond when it was last offered on Nov. 28, 2019, with yields ranging from 6.723% to 7.24%.

“Yields on the short-dated and longer-dated securities rose, in line with global bond yield movements. The move was driven by anxiety ahead of the Jackson Hole conference where US Fed Chair Jerome H. Powell will be delivering a speech,” Nicholas Antonio T. Mapa, senior economist at ING Bank N.V. Manila, said in an e-mail.

The Federal Reserve may need to raise interest rates further to cool still-too-high inflation, Mr. Powell said on Friday, promising to move with care at upcoming meetings as he noted both progress made on easing price pressures as well as risks from the surprising strength of the US economy, Reuters reported.

The second bond trader said local yield movements were attributable to various developments.

“GS yields declined on the average [last] week from downbeat outlook on the local economy following the softer Philippine gross domestic product (GDP) report. Likewise, views of a global slowdown were fueled after the sharp decline in various PMIs (S&P Global Philippines Manufacturing Purchasing Managers’ Index) from major economies in August 2023 and the recent downgrade of S&P Global Ratings on small- and medium-sized US banks,” the bond trader said in an e-mail.

GDP growth slowed to 4.3% in the second quarter from 6.4% in the first quarter and 7.5% in the same period a year earlier.

For the first half, GDP growth averaged 5.3%, lower than the government’s 6-7% target.

Meanwhile, the S&P Global Philippines Manufacturing Purchasing Managers’ Index stood at 51.9 in July, up from the 11-month low of 50.9 in June.

For this week, the first bond trader said the market will look at the BTr’s aggressiveness during its auctions and await the release of its September borrowing schedule.

“Investors will likely watch out for clues if BTr will issue more bonds next month to match the expected maturity amounting to P144 billion on Sept. 10,” the trader said.

The second bond trader said local yields are likely to move higher as market participants expect that the Fed will keep rates higher for longer.

“This view might be supported by a slight uptick in the US Fed’s preferred inflation gauge in July and a robust US labor market for August, both of these crucial economic data are due to be released this week,” the second bond trader said.

“[This] week, markets will take their cue from the speech of Mr. Powell as well as the Bangko Sentral ng Pilipinas’ inflation forecast range for August inflation,” Mr. Mapa added.

The government will release August inflation data on Sept. 5. — Lourdes O. Pilar with Reuters