Yields on gov’t debt end lower on US inflation data

YIELDS on government securities (GS) fell last week as US consumer inflation posted its slowest increase in more than two years, reducing the possibility of further rate hikes from the US Federal Reserve beyond this month.

YIELDS on government securities (GS) fell last week as US consumer inflation posted its slowest increase in more than two years, reducing the possibility of further rate hikes from the US Federal Reserve beyond this month.

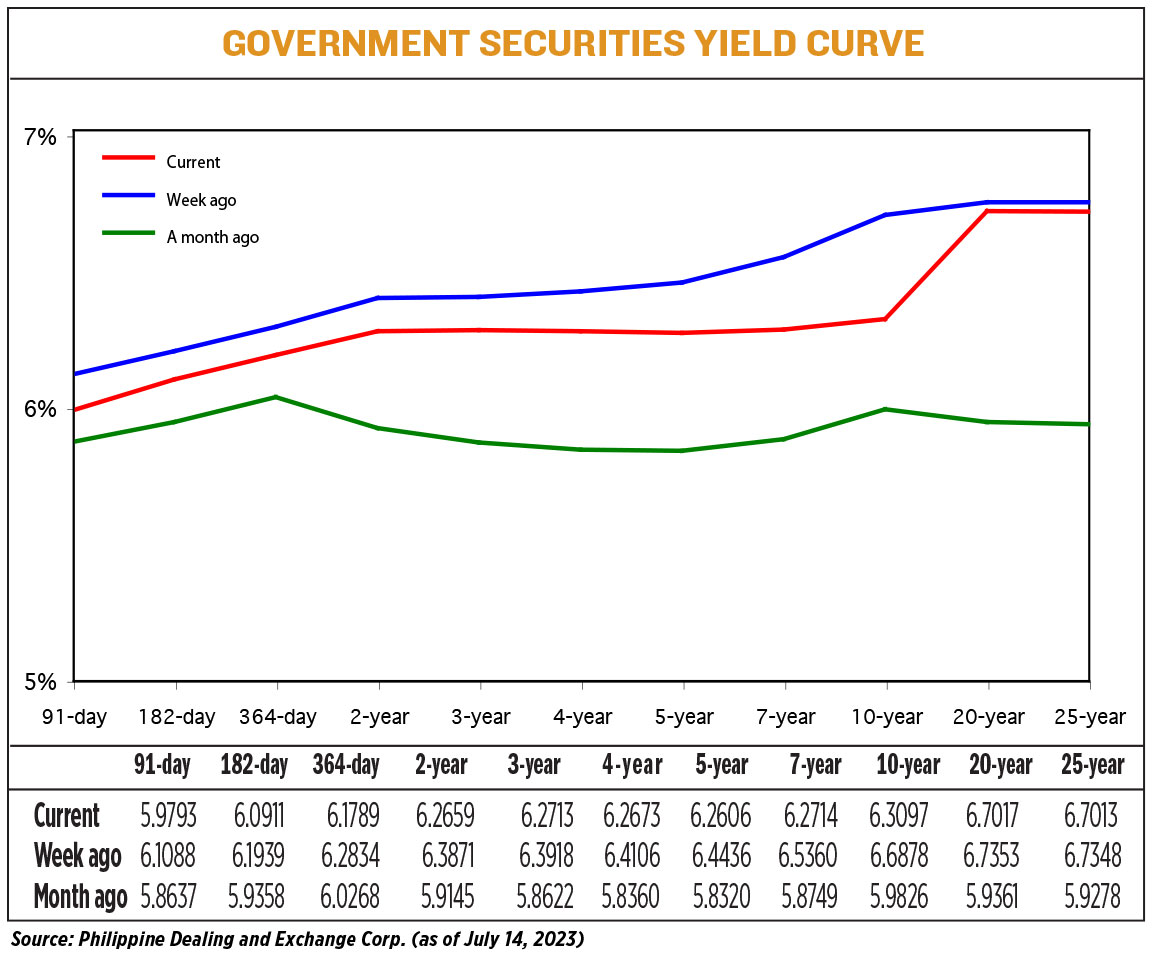

GS yields at the secondary market dropped by an average of 14.68 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of July 14 published on the Philippine Dealing System’s website.

Rates went down across all tenors as the short end of the curve saw yields on the 91-, 182-, and 364-day Treasury bills drop by 12.95 bps (to 5.9793%), 10.28 bps (6.0911%), and 10.45 bps (6.1789%), respectively.

At the belly, yields on the two-, three-, four-, five-, and seven-year Treasury bonds declined by 12.12 bps (to 6.2659%), 12.05 bps (to 6.2713%), 14.33 bps (6.2673%), 18.30 bps (6.2606%), and 26.46 bps (6.2714%), respectively.

At the long end, the rates of the 10-, 20-, and 25-year debt papers went down by 37.81 bps (to 6.3097%), 3.36 bps (6.7017%), and 3.35 bps (6.7013%), respectively.

Total GS volume traded reached P44.96 billion, higher than the P7.02 billion recorded on July 7.

Analysts attributed this week’s yield movements to the weaker-than-expected US consumer inflation report.

“Local bond yields fell week on week as market participants cheered the lower-than-expected inflation out of the US, thereby reducing the chances that the Fed will hike rates beyond July,” a bond trader said in a Viber message.

US consumer prices rose in June as headline and core inflation continue to subside, but probably not fast enough to dissuade the Federal Reserve from resuming raising interest rates this month, Reuters reported.

In the 12 months through June, the consumer price index (CPI) advanced 3%, making the smallest year-on-year increase since March 2021 and followed a 4% rise in May.

The Fed will meet to discuss policy on July 25-26. It raised its target interest rate by a cumulative 500 bps to a range between 5% and 5.25% before pausing its tightening cycle last month.

“Moreover, onshore, it is anticipated that inflation will continue to ease and reach the BSP’s (Bangko Sentral ng Pilipinas) inflation target by the fourth quarter. Obviously, these are bond-friendly catalysts, and so market players decided to lock in while yields are still relatively high compared to the expected direction of inflation,” the bond trader added.

BSP Governor Eli M. Remolona on Friday said inflation may return within their 2-4% target in the fourth quarter and may go below 2% early next year.

Headline inflation rate eased to a 14-month low of 5.4% in June but was above the central bank’s target for the 15th consecutive month.

In the first half, inflation averaged at 7.2%, also above the BSP’s forecast of 5.4% for 2023.

“[This] week, we will see more economic releases which could further provide clarity on the direction for the US. What is certain is that one hike for the Fed is etched in stone. A second one will depend on the coming economic figures,” Security Bank Corp. Chief Investment Officer for Trust and Asset Management Group Noel S. Reyes said in an e-mail.

“This week, it seems that this bond-buying spree may have further momentum, causing yields to adjust even lower. However, some profit taking may limit the rally,” the bond trader said. — Mariedel Irish U. Catilogo with Reuters