Debt yields inch up as Trump rattles markets

YIELDS on government securities (GS) ended mixed last week amid continued uncertainty over US President Donald J. Trump’s tariff policies.

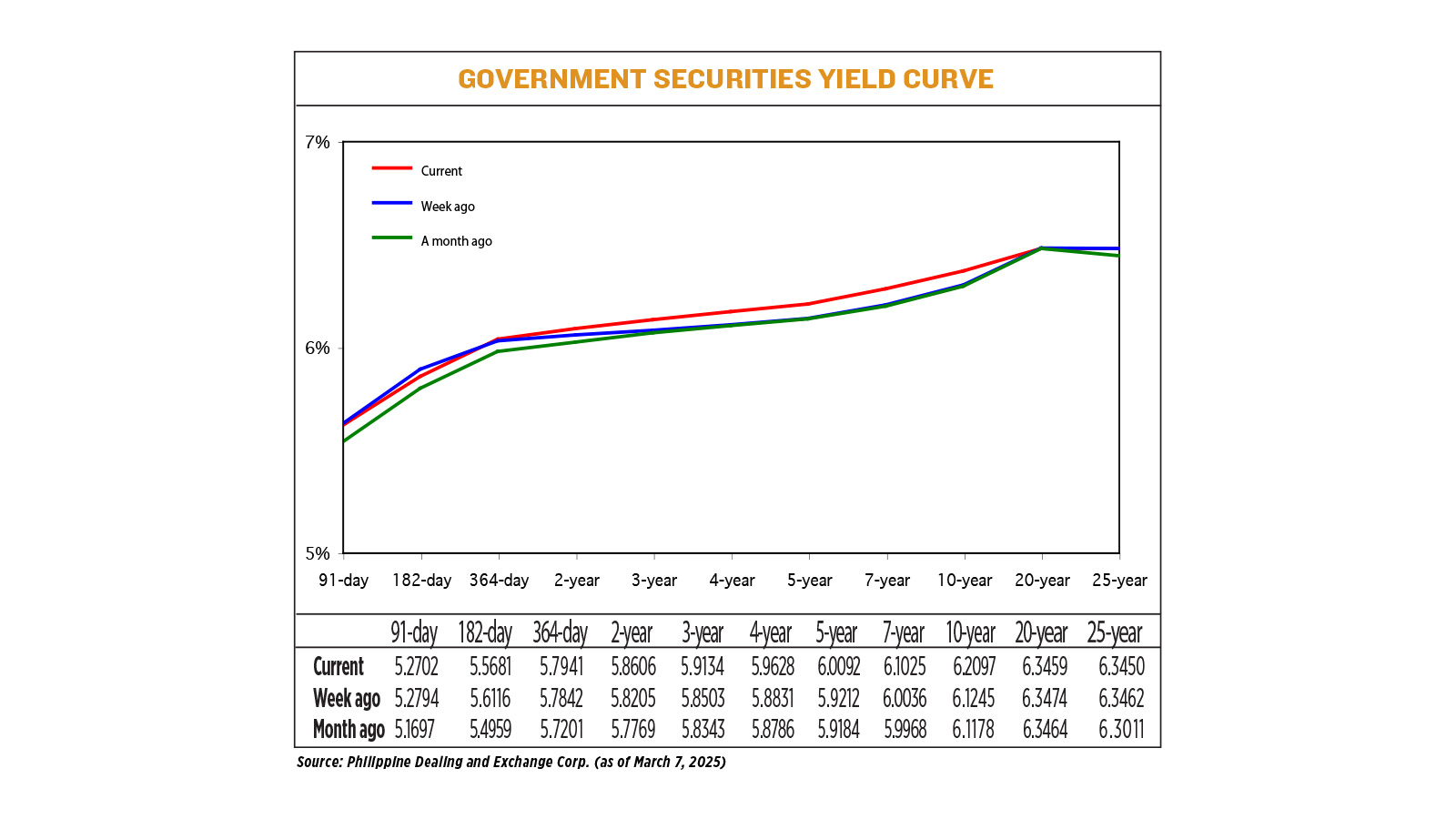

GS yields, which move opposite to prices, went up by an average of 3.72 basis points (bps) week on week at the secondary market, based on the PHP Bloomberg Valuation Service Reference Rates as of March 7 published on the Philippine Dealing System’s website.

Rates at the short end of the curve were mixed. Yields on 91- and 182-day Treasury bills went down by 0.92 bp and 4.35 bps to 5.2702% and 5.5681%, respectively. Meanwhile, the 364-day debt inched up by 0.99 bp to fetch 5.7941%.

At the belly, yields rose across the board. Rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bond) went up by 4.01 bps (to 5.8606%), 6.31 bps (to 5.9134%), 7.97 bps (to 5.9628%), 8.80 bps (to 6.0092%), and 9.89 bps (to 6.1025%), respectively.

Lastly, yields at the long end of the curve were mixed, with the 10-year T-bond rising by 8.52 bps to fetch 6.2097%, while the 20- and 25-year notes inched down by 0.15 bp (to 6.3459%), and 0.12 bp (to 6.3450%), respectively.

Total GS volume traded amounted to P27 billion last week, higher than the P24.79 billion recorded on Feb. 28.

GS yields mostly rose as concerns over the US’ trade policies and their impact on domestic inflation affected market sentiment, a bond trader said in a Viber message.

“The recent CPI (consumer price index) data was a welcome development, but not enough for the market to turn bullish on bonds just yet,” the trader said.

“Uncertainties dampened the mood locally as Trump tariffs continue to dominate the headlines. The tit-for-tat tariffs between the US, Mexico, Canada and China added some risk-off sentiment in the local market. Players opted to either stay on the sidelines or reduce holdings due to heightened volatility in global markets,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., likewise said in an e-mail.

GS yields were range-bound despite slower-than-expected February Philippine headline inflation as the market remained focused on external risks, Mr. Aquino said.

On Thursday, Mr. Trump suspended tariffs of 25% imposed on most goods from Canada and Mexico over the US fentanyl crisis, for 30 days, Reuters reported.

In a Fox Business Network interview aired earlier on Friday, Mr. Trump said he had granted the 30-day break for goods compliant with a regional free trade deal to help automakers. But he added that the reprieve was a short-term measure and tariffs could go up over time.

Mr. Trump said that on April 2, reciprocal tariffs would be implemented to equalize any duty rates between the three countries.

White House trade adviser Peter Navarro told CNBC that under the reciprocal tariff plan, the US will match both tariff rates of other countries and non-tariff barriers.

He added that those tariff adjustments would be made through industry-specific and country-specific investigations.

There are multiple other Trump tariff actions in play.

This Wednesday, Mr. Trump’s administration will effectively raise tariffs on steel and aluminum by rescinding longstanding exemptions for duties of 25% on steel and raising the rate to 25% for aluminum.

US stock indexes rose on Friday after Federal Reserve Chair Jerome H. Powell said the US economy continues to be in a good place and it remains to be seen if the Trump administration’s tariff plans will prove to be inflationary, while US 10-year Treasury yields also turned higher.

The yield on the benchmark US 10-year Treasury note rose 3.8 bps to 4.32%. For the week, the 10-year yield was up about 9 bps, on track to snap a five-week streak of declines.

Meanwhile, Philippine inflation in February eased to 2.1% in February from 2.9% in January and 3.4% a year ago, the government reported last week, below the 2.2%-3% forecast from the Bangko Sentral ng Pilipinas (BSP).

This was the slowest inflation print in five months or since the 1.9% clip in September 2024. The February CPI was also below the 2.6% median estimate in a BusinessWorld poll of 18 analysts.

Headline inflation averaged 2.5% in the first two months, well within the central bank’s 2-4% target.

For this week, GS yields may continue to move sideways as the market awaits clarity on the BSP’s policy easing path, the trader said.

“With the CPI surprising to the downside, an April cut is on the table. If inflation remains favorable next month and the peso’s strengthening continues, the BSP can reduce policy rates despite the external risks presented by the Trump tariffs,” Mr. Aquino said.

“Yields remain attractive at current levels and are hence biased to move lower once the BSP resumes its easing cycle.”

The Monetary Board will hold its next policy meeting on April 3.

The BSP unexpectedly kept rates steady last month after cutting rates by 25 bps for three straight meetings since it began its easing cycle in August 2024.

BSP Governor Eli M. Remolona, Jr. has said the central bank is still in easing mode, signaling the possibility of up to 50 bps worth of cuts this year. — Matthew Miguel L. Castillo with Reuters