Mouthwash may cure ‘the clap’

PARIS — In the 19th century, before the advent of antibiotics, Listerine mouthwash was marketed as a cure for gonorrhoea. More than 100 years later, researchers said Tuesday the claim may be true.

IGNITE 2025 lights up ASEAN’s innovation scene

Previously recognized for bridging startups and investors across Asia, IGNITE has once again taken center stage, this time, for its transformative 2025 edition that brought together the brightest minds in innovation under one roof.

Held on Oct. 15, 2025, at Fairmont Makati, IGNITE 2025 carried the theme “Gateway ASEAN: Expanding Markets, Empowering Growth.” The one-day conference turned the venue into a powerhouse of ideas and collaboration, uniting startups, investors, and industry leaders from across the region to spark meaningful partnerships and expand cross-border opportunities. The conference opened with an exclusive welcome dinner at the heart of Makati City, an intimate gathering where global guests, sponsors, and investors exchange ideas over shared aspirations and conversation, a fitting prologue to a day of purposeful dialogue.

The following morning, the event came alive with opening remarks from key figures shaping regional innovation: Executive Director Kazuo Nakamura of Japan External Trade Organization (JETRO) Manila; Director III Jhino Illano of the DICT–ICT Industry Development Bureau; and Chief Technology Transfer Officer Russel Pili of DoST–PCIEERD. Their messages set the stage for a day of insight and action, grounded in shared commitment to ASEAN’s digital and innovation-driven growth.

The following morning, the event came alive with opening remarks from key figures shaping regional innovation: Executive Director Kazuo Nakamura of Japan External Trade Organization (JETRO) Manila; Director III Jhino Illano of the DICT–ICT Industry Development Bureau; and Chief Technology Transfer Officer Russel Pili of DoST–PCIEERD. Their messages set the stage for a day of insight and action, grounded in shared commitment to ASEAN’s digital and innovation-driven growth.

The momentum continued with powerful keynotes, panel discussions, and breakout sessions led by global innovators and business leaders, covering AI-powered leadership, AI trends in ASEAN, and a preview of the ASEAN Summit PH 2025. Across sessions, conversations centered on emerging trends, market access, and the future of ASEAN’s innovation economy, offering fresh insights for entrepreneurs and corporations looking to scale regionally.

A highlight of the day was the JETRO Co-Innovation Pitch Session, an innovation challenge that brought together one Japanese corporation — Enebloom — and four rising Filipino startups: Better-ed, Klimatech, Hotelblock.ai, and Alerto. This cross-border pitch session showcased how Japanese and Philippine innovators can co-create solutions that address shared challenges and unlock new market opportunities.

Meanwhile, the Startup World Cup Philippines Regional Final concluded with Edge Tutor International Pte. Ltd. emerging as the national champion, earning the opportunity to represent the Philippines at the Grand Finale in Silicon Valley in 2026 — a milestone that highlights the country’s rising visibility in the global startup ecosystem. Rounding out the top three were Xeleqt Technology Innovations Inc. in second place and Avilta in third, both delivering strong pitches that impressed the panel of judges and reinforced the depth of talent in the Philippine innovation landscape.

Throughout the day, booth exhibitions showcased cutting-edge technologies and new business solutions. The event wrapped up with a by-invitation networking dinner, where connections turned into potential collaborations — an embodiment of IGNITE’s mission to build bridges across the ASEAN startup ecosystem.

Since its launch in 2017 by TechShake and dentsu, IGNITE has grown from a 500-participant gathering into one of the Philippines’ foremostinternational innovation conferences, drawing thousands from Japan, South Korea, Taiwan, and the ASEAN region.

This year’s IGNITE 2025: Gateway ASEAN: Expanding Markets, Empowering Growth brought together over 1,000 participants, including investors, startups, and corporate innovators, supported by more than 70 community partners and a broad network of media partners such as Philippine Primer, When in Manila, Fintech News PH, and BusinessWorld.

This year’s IGNITE 2025: Gateway ASEAN: Expanding Markets, Empowering Growth brought together over 1,000 participants, including investors, startups, and corporate innovators, supported by more than 70 community partners and a broad network of media partners such as Philippine Primer, When in Manila, Fintech News PH, and BusinessWorld.

And as Gateway ASEAN opened its doors this year, it did more than showcase technology and talent. It reminded the region of its shared potential, that when markets expand, growth is empowered, and the region moves forward, together.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

Belarus security chief seeks dialogue with Ukraine

The head of Belarus’s security agency said his institution was trying to build contacts with Ukraine to help achieve a settlement of its more than 3-1/2-year-old war with Russia, the country’s state news agency reported on Sunday.

Ivan Tertel’s comments to state television followed reports last week that a senior Belarusian diplomat had held meetings with Europeans to try to ease the isolation long imposed on his country, a close ally of Russian President Vladimir Putin.

Tertel, whose remarks were reported by the Belta news agency, said meetings with Ukrainian officials were vital “in the current situation in order to come up with a consensus”.

“This work is also going on. Of course, a lot here depends on the Ukrainian side. Our president is working as much as he can to stabilize the situation in the region,” said Tertel, whose agency still uses its Soviet-era acronym KGB.

“And we have found a balance of the two sides’ interests in this very complicated situation with a tendency towards tension. I am convinced that we can eliminate this situation only through quiet talks and the search for compromise.”

Belarusian President Alexander Lukashenko allowed the Kremlin to use his country’s territory to launch part of the 2022 war with Ukraine, but has kept his armed forces out of the conflict.

Lukashenko, in power since 1994, has long been shunned by the West on grounds of human rights violations. Punitive measures intensified after security forces crushed rallies by protesters accusing the president of rigging his 2020 re-election and again because of his support for the invasion.

But US President Donald Trump has appealed to Lukashenko in recent months, calling him a “highly respected leader” and sending an envoy to Minsk, which led to the release of more than 50 political prisoners.

Belarusian media quoted Lukashenko last month as saying that he wanted to speak to Ukrainian President Volodymyr Zelenskiy to help facilitate a settlement of the war.— Reuters

Thieves rob priceless jewels from Paris’ Louvre in brazen heist

PARIS — Thieves in balaclavas broke into Paris’ Louvre museum on Sunday, using a crane to smash an upstairs window, then stealing priceless objects from an area that houses the French crown jewels before escaping on motorbikes, officials said.

The robbery raises awkward questions about security at the museum, where officials had already sounded the alarm about lack of investment at a world-famous site, home to artworks such as the Mona Lisa, that welcomed 8.7 million visitors in 2024.

“The theft committed at the Louvre is an attack on a heritage that we cherish because it is our History,” President Emmanuel Macron said on X. “We will recover the works, and the perpetrators will be brought to justice.”

ROBBERY WAS ‘VERY PROFESSIONAL’ WITH NO VIOLENCE

The thieves struck at about 9.30 a.m. (0730 GMT) when the museum had already opened its doors to the public, and entered the Galerie d’Apollon building, Paris Prosecutor Laure Beccuau said on BFM TV.

The robbery took between six to seven minutes and was carried out by four people who were unarmed, but who threatened the guards with angle grinders, she said.

A total of nine objects were targeted by the criminals, and eight were actually stolen. The thieves lost the ninth one, the crown of Napoleon III’s wife, Empress Eugenie, during their escape, Beccuau said.

“It’s worth several tens of millions of euros – just this crown. And it’s not, in my opinion, the most important item,” Drouot auction house President Alexandre Giquello told Reuters.

Beccuau said it was a mystery why the thieves did not steal the Regent diamond, which is housed in the Galerie d’Apollon and is estimated to be worth more than $60 million by Sotheby’s.

“I don’t have an explanation,” she said. “It’ll only be when they’re in custody and face investigators that we’ll know what type of order they had and why they didn’t target that window.”

Beccuau said one of the thieves was wearing a yellow reflective vest, which investigators have since recovered. She added that the robbers tried and failed to set fire to the crane, mounted on the back of a small truck, as they fled.

PROBE UNDERWAY BY SPECIALIST UNIT

Interior Minister Laurent Nunez said the probe had been entrusted to a specialized police unit that has a high success rate in cracking high-profile robberies.

Investigators were keeping all leads open, Beccuau said.

But she said it was likely the robbery was either commissioned by a collector, in which case there was a chance of recovering the pieces in a good state, or undertaken by thieves interested only in the valuable jewels and precious metals. She said foreign interference was not among the main hypotheses.

“We’re looking at the hypothesis of organized crime,” she said, adding that it could be thieves working on spec for a buyer, or seeking to get access to jewels that can be useful to launder criminal proceeds.

“Nowadays, anything can be linked to drug trafficking, given the significant sums of money obtained from drug trafficking.”

QUESTIONS ON SECURITY

The Louvre, the world’s most-visited museum, said on X it would remain closed for the day for “exceptional reasons”.

Joan and Jim Carpenter, from Santa Cruz, California, said they had been moved out of a gallery just as they were about to see the Mona Lisa.

“Well, when you rob the Louvre, that’s a big deal to all of France, so I knew something was up because of the way they swept the whole museum,” Joan Carpenter said.

The Mona Lisa was stolen from the museum in 1911 in one of the most daring art thefts in history, in a heist involving a former employee. He was eventually caught and the painting was returned to the museum two years later.

Earlier this year, officials at the Louvre requested urgent help from the French government to restore and renovate the museum’s ageing exhibition halls and better protect its countless works of art.

Macron, writing on X, said that a new government plan for the Louvre announced in January “provides for strengthened security.”

Culture Minister Rachida Dati said the issue of museum security was not new.

“For 40 years, there was little focus on securing these major museums, and two years ago, the president of the Louvre requested a security audit from the police prefect. Why? Because museums must adapt to new forms of crime,” she said. “Today, it’s organized crime – professionals.” — Reuters

Condo glut weighs on home prices

By Katherine K. Chan

SLUGGISH DEMAND and oversupply of condominium units in the market have dampened the growth in prices of residential properties in the National Capital Region (NCR), analysts said, which could persist until yearend as the glut remains.

Joey Roi H. Bondoc, director and head of research at Colliers Philippines, said weak demand for condominium units in the middle-income segment led to the slow growth of housing prices in NCR.

“I think we will attribute that to (the) slower take-up of unsold condominium units in the secondary, ready-for-occupancy (RFO) market,” he told BusinessWorld in a phone interview.

He said about 31,000 condominium units remain unsold in the RFO market, with nearly 60% under the mid-income segment or those worth P3.6 million to P12 million per unit.

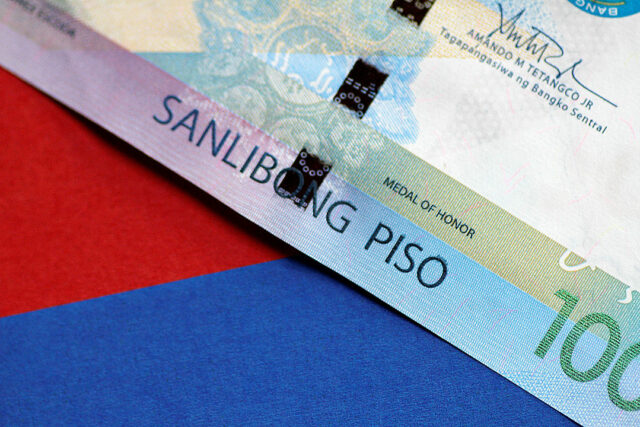

Home prices in Metro Manila posted a slower growth of 2.4% in the second quarter from 13.9% in the January-March period and 9.3% in the same quarter last year, the Bangko Sentral ng Pilipinas’ (BSP) Residential Property Price Index (RPPI) showed.

Quarter on quarter, NCR housing prices contracted by 3.6%.

Condominium unit prices also dipped by 0.2%, a reversal from the 11.5% increase a year prior and the 10.6% growth last quarter.

Roy Amado L. Golez, Jr., director for research and consultancy at Leechiu Property Consultants, said buyers’ sentiment and preferences also affected the growth of condominium prices during the period.

“The slowdown in year-on-year growth in condominium prices in NCR from Q1 2025 (13.9%) to Q2 2025 (2.4%) can be attributed to the oversupply, cautious buyer sentiment, and possible shift in buyer preferences,” he told BusinessWorld in an e-mail. “Buyers are responding with a more critical examination of their needs before making any property purchases. There are less instances of speculative purchases in the market today for NCR.”

Mr. Golez said secondary or pre-owned units sold at lower prices are also cornering some of the demand for housing.

“Note that the RPPI doesn’t cover only primary units from developers — secondary units are competing for demand, and motivated sellers sell at a discount so they can liquidate their properties,” he said.

“With the low-yield environment, some owners are finding it more attractive to flip their condominium investments and divert to alternative instruments. This can also include sales of condominium units at discounted prices that developers are offering to move their unsold inventory.”

He added that developers’ project launches in Metro Manila have slowed as they still have existing inventory.

Claro dG. Cordero, Jr., director for Research, Consulting & Advisory Services at Cushman and Wakefield, said the past quarters’ strong performances could have amplified the price growth slowdown, adding that the 13.9% growth in the first quarter was “somewhat difficult to match.”

“That doesn’t mean though that the decline was very sharp,” he added.

Mr. Cordero also linked the oversupply of condominium units to the ban on Philippine offshore gaming operators (POGOs), whose workers previously resided in such properties.

“(A) lot of the excess inventory is due to the fact that the units were vacated by POGOs… So, since the POGOs left late last year, a lot of them were brought back to the market,” he said.

Meanwhile, expensive financing and high mortgage rates are also affecting demand for condominium units in the rental market, Mr. Bondoc said.

He said the mortgage rate for a five-year term ranges from 7.7% to 7.8% and would cost more if longer than five years.

“So, the rental market is experiencing sluggishness at this point… meaning if I buy a condominium unit (and) once it’s turned over, will I be able to rent it out to a BPO employee or a foreign employee?” Mr. Bondoc said.

“Unfortunately, the rental market is slowing in Metro Manila right now because again (there are) a lot of unsold condominium units (and) owners are imposing lower rental rates,” he added.

BSP data showed that the median price for all housing types in the Philippines stood at P3.4 million in the second quarter. Condominium units had a median price of P3.8 million, while houses cost around P3.1 million.

Houses in the NCR were the most expensive at a median price of P7.01 million, while houses in other areas in the Philippines were the cheapest at about P2.7 million.

SLOW TAKE-UP TO PERSIST

Mr. Golez said condominium sales have improved as of the third quarter amid lower interest rates.

“Now… we’re seeing renewed buyer activity in the (Metro Manila) condominium market,” he said. “Lower interest rates may be fueling this rise in demand, as well as discounts and promos from developers.”

The central bank’s policy rate currently stands at 4.75%, the lowest in over three years. It has lowered benchmark interest rates by 175 basis points since kicking off its easing cycle in August 2024, and BSP Governor Eli M. Remolona, Jr. has left the door open to more cuts in the coming months to help boost domestic demand due to a softer economic outlook as a widening corruption scandal involving government infrastructure projects has affected business sentiment.

However, condominium price growth, particularly for secondary units, in NCR will likely remain flat but could recover in the medium term once supply levels become more manageable and rental yields improve, Mr. Golez said.

“The pace of recovery will depend on how quickly developers clear unsold stock, whether buyer sentiment improves, and when rental demand picks up. Until then, we can expect subdued price growth.”

Mr. Bondoc said tepid demand for condominium units in Metro Manila will likely persist until yearend as the number of unsold units remains significant. However, developers’ RFO promos and discounts could help attract buyers.

“We saw that there was an improvement in take-up of condominiums in (the) second quarter this year because of promos and discounts offered by developers. But let’s see if that will be sustained. But in terms of rental prospects and appetite for condominium units for rent, we’re likely to see slower demand for the remainder of 2025,” he added.

He said the “strong” demand seen for residential properties outside Metro Manila is making up for the slowdown seen in the capital.

“I think what’s offsetting that is still a strong take-up outside of Metro Manila. So, that has been offsetting the lukewarm appetite for condominium units in the capital region at this point. That’s still a positive for the market that we’re seeing.”

“Buyer interest is increasing for housing options outside NCR, especially for landed housing. Developers are responding in kind by continuing to develop townships outside NCR, capitalizing on infrastructure improvements and lifestyle appeal,” Mr. Golez added.

In areas outside NCR, home prices rose by 11.5% in the second quarter, faster than the 3% growth logged in the first quarter and 7.2% the previous year, BSP data showed.

Mr. Cordero said they see home prices rising in the near term, particularly in the pinch areas in emerging regions such as Cebu.

“That’s driven by sustained demand for larger living spaces and more horizontal developments as well as regional migration and infrastructural enhancements.”

ECCP outlines policy recommendations to help boost investments

THE EUROPEAN Chamber of Commerce of the Philippines (ECCP) has identified its advocacy recommendations across 12 key sectors that will help create a business environment that fosters investment, innovation, and sustainable growth.

“This year’s Advocacy Papers capture the perspectives of our committees, reflecting the expertise and dedication of ECCP members across a wide range of industries,” ECCP President Paulo Duarte said in a statement.

He said recent reforms in the country, including the passage of the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act, have been encouraging.

“Further progress in improving the ease of doing business and ensuring a level playing field for both local and foreign enterprises will be vital to unlocking the Philippines’ full potential as an investment destination,” he added.

This year’s Advocacy Papers span 12 sectors, which are agriculture, automotive, aviation, customs and logistics, environment and water, food and beverage, healthcare, human capital and education, infrastructure, renewable energy, tax and financial services, and tourism.

Under agriculture, the ECCP recommended the passage of the Animal Industry Development and Competitiveness Act to address the challenges in productivity, resilience, and market access of the Philippines’ animal sector value chains.

“The proposed law creates a unified institutional and fiscal framework, including the design of a multi-year competitiveness fund and clearer mandates for implementing agencies,” the group said.

This framework is expected to “enable sustained investments in feed and genetics, slaughter and cold-chain infrastructure, and disease-control capacity rather than the ad hoc, year-to-year programming typical under the current architecture.”

The group also recommended scaling value-chain investments around prioritized commodity roadmaps, accelerating climate-resilient cold-chain and aggregation infrastructure dispersal, institutionalizing data-driven agricultural insurance, and dedicating funding for biosecurity.

It also called for the harmonization of veterinary product regulation, integration of market access and sanitary and phytosanitary compliance for public agricultural investments, expanded financing for smallholder farmers, and the accelerated enactment of the National Land Use Act.

For the automotive sector, the ECCP asked for the elimination of import duties for European automotive brands, streamlined border procedures and certification, predictability of incentives and regulatory frameworks, and development of a support program for electric vehicle (EV) adoption.

It also called for the inclusion of road safety education into the basic education curriculum, requiring regular calibration and testing for critical electronics in EVs, and safety laws related to child car seats, dash cams, and dark car tints.

For aviation, the chamber sought more investments in the modernization of transport infrastructure and aviation safety oversight, improvements in the frameworks regulating the air transport sector, and the ratification of the Cape Town Agreement.

The groups asked for an incentive framework for competitive and sustainable aviation, strengthening human capital for the aviation sector, and integration of sustainability in the Philippine Aviation Strategy.

In logistics, the group asked for the promotion of ease of doing business, including operationalization of the National Single Window, enforcement and update of Citizen’s Charters, and establishment of guidelines to regulate charges imposed by international shipping lines.

The ECCP also recommended the amendments to the Philippine Ports Authority Charter and the passage of the Blue Economy Act and the Maritime Trade Competitiveness Act.

In the area of environment, the group asked for the implementation of the Extended Producers’ Responsibility (EPR) Scheme, incentive-based measures under EPR law, and the integration of environmental education in the curriculum.

Under food and beverage, the group is seeking the proper implementation of front-of-package labeling, implementation of policies regarding marketing to kids, education efforts that recognize benefits of prepackaged food, review of food taxes, and promotion of ease of doing business.

In healthcare, the group is asking for the expansion of Philippine Health Insurance Corp.’s coverage and the proper implementation of the New Government Procurement Act.

Meanwhile, ECCP is seeking enhanced curriculum for the basic education system, enhanced training programs for teachers, accelerated facility provisioning, strengthened vocational programs, enhanced support programs for private schools, and improved nutrition programs.

The group is also recommending revisions to the apprenticeship law, eased restrictions on the employment of foreign nationals, passage of the Enterprise Productivity Act, and reconsideration of across-the-board wage mandates.

In the area of infrastructure, the group is pushing for funds allocation for green infrastructure and faster blended cement adoption, implementation of the Mandanas-Garcia ruling, ensuring sanctity of public-private partnership contracts, and a level playing field for local and foreign-owned contractors.

The group is also seeking effective implementation of the Konektadong Pinoy Act, accelerated digital infrastructure development, development of a future-ready workforce, improvements in ease of doing business and cyber-resilience, and integration of regional development into the national information and communications technology strategy.

It also asked for improved ease of doing business and green financing mechanisms, effective implementation of the Energy Efficiency and Conservation Act, and the establishment of a policy framework for waste-to-energy technologies.

The group is also asking the government to digitalize and streamline tax processes, accelerate e-invoicing, resolve ambiguity in cross-border taxation, standardize tax assessment and valuations, establish a carbon credits facility, and strengthen tax awareness.

For tourism, ECCP recommended improvements to international and domestic connectivity, promotion of domestic and international tourism, restructuring of the Civil Aviation Authority of the Philippines, and integration of sustainability in a long-term tourism strategy.

The group also expressed support in the establishment of an independent agency focused on the development of Philippine airports through the Philippine Airports Authority and the creation of a Philippine Transportation Safety Board. — Justine Irish D. Tabile

PHL banks’ assets expand to P27.7 trillion as of August

THE PHILIPPINE banking sector’s total assets grew by 6.7% year on year as of end-August amid continued growth in loans and deposits.

Banks’ combined assets rose to P27.729 trillion as of August from P25.988 trillion a year prior, data from the Bangko Sentral ng Pilipinas (BSP) showed.

Meanwhile, month on month, this was 0.04% lower than the P27.742 trillion recorded at end-July.

Banks’ assets are mainly supported by deposits, loans, and investments. These include cash and due from banks as well as interbank loans receivable (IBL) and reverse repurchase (RRP) net of allowances for credit losses.

Universal and commercial banks still held the bulk of the Philippine banking system’s assets with P25.9 trillion as of August. Thrift banks followed with P1.3 trillion, rural and cooperative banks held P385.45 billion, while digital banks had P141.77 billion in assets.

Broken down, the banking sector’s total net loan portfolio, inclusive of IBL and RRP, expanded by 9.9% year on year to P15.189 trillion at end-August from P13.816 trillion a year ago. Month on month, it slipped by 0.5% from P15.259 trillion.

Banks’ net investments, or financial assets and equity investments in subsidiaries, stood at P8.167 trillion in the period, rising by 10.3% from P7.407 trillion a year prior but down by 0.9% from P8.242 trillion at end-July.

Meanwhile, net real and other properties acquired jumped by 17.9% to P130.938 billion from P111.029 billion in the same period last year. This was also up 0.9% from P129.735 billion a month prior.

Banks’ other assets likewise rose by 11.2% to P2.23 trillion as of August from P2.005 trillion a year prior. Month on month, it climbed by 1.9% from P2.187 trillion.

However, cash and due from banks slumped by 24% year on year to P2.012 trillion from P2.648 trillion. Meanwhile, this was up by 4.6% from P1.923 trillion a month prior.

BSP data also showed that the total liabilities of the banking system stood at P24.169 trillion as of August, rising by 6.3% from P22.73 trillion in the comparable year-ago period but down 0.2% from the P24.22 trillion seen at end- July.

This came as deposit liabilities climbed by 6.9% year on year to P20.454 trillion from P19.142 trillion.

Broken down, peso-denominated deposits stood at P16.811 trillion, while foreign currency deposits were at P3.643 trillion.

Philippine banks’ assets continued to grow amid the BSP’s easing cycle and cuts in their reserve requirement ratios (RRR), as these helped boost demand for credit and increase their loanable funds, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

“Faster loan growth has been the largest contributor to the continued growth in banks’ total assets,” he said. “Continued growth in bank deposits also allowed banks to increase loans and other investments, thereby leading to the continued growth in banks’ total assets.”

In August, bank lending expanded by 11.2% year on year to P13.62 trillion, the slowest growth seen in nine months. The Monetary Board this month trimmed benchmark interest rates by 25 basis points (bps) for a fourth consecutive meeting, bringing the policy rate to an over three-year low of 4.75%.

It has now slashed borrowing costs by a cumulative 175 bps since it began its rate cut cycle in August 2024. BSP Governor Eli M. Remolona, Jr. has said that more cuts are possible as they want to support the economy amid weaker growth prospects.

Meanwhile, the BSP in March cut the RRR of universal and commercial banks and nonbank financial institutions with quasi-banking functions by 200 bps to 5%.

The ratio for digital banks was also lowered by 150 bps to 2.5%, while that for thrift lenders was cut by 100 bps to 0%. Rural and cooperative banks’ RRR has also been at zero since October 2024.

“Continued growth in banks’ net income also allows banks to increase their capital, lending, investments, and overall assets, as banks are among the most profitable businesses in the country,” Mr. Ricafort added.

Banks’ combined net income grew by 4.14% to P198.14 billion in the first half as both net interest and non-interest earnings increased year on year, BSP data showed. Universal and commercial banks’ combined net earnings stood at P184.45 billion in the first semester, while the thrift bank group booked a P10.73-billion net profit, and the rural and cooperative bank sector posted net income of P5.34 billion. Lastly, digital banks recorded a combined net loss of P2.38 billion.

“For the coming months, continued growth in the local economy… as well as possible future Federal Reserve and BSP rate cuts would continue to sustain relatively faster growth in banks’ total resources and assets, as supported by the sustained growth in loans, deposits, earnings, and investments,” Mr. Ricafort said.

The Fed last month reduced its target rate by 25 bps points to bring it to the 4%-4.25% range. Fed Chair Jerome H. Powell last week hinted at more cuts as they seek to balance the US job market’s weakness with above-target inflation. — Katherine K. Chan

Global finance chiefs wait on Trump and Xi as trade war simmers

AFTER A WEEK of talks dominated by trade spats and geopolitical distrust, finance chiefs were once again left hanging on the outcome of a potential meeting between the leaders of the world’s two largest economies.

In Washington, the mood at World Bank and International Monetary Fund (IMF) gatherings was a mix of relief that US President Donald J. Trump’s tariffs hadn’t caused a deeper slowdown and dread about the risks ahead.

Policymakers left town hoping that Mr. Trump and Chinese President Xi Jinping will meet at the end of the month, resigned to the reality that the outlook for the global economy is at stake.

The meeting coincided with some of the harshest rhetoric between Washington and Beijing in Mr. Trump’s second term, as both sides flexed their dominance with export controls in key industries — the US with advanced technology and China with its rare earths reserves.

While the anxiety mostly played out behind the scenes, with few officials willing to publicly opine on the power play, the IMF’s chief urged policymakers not to panic. IMF Managing Director Kristalina Georgieva suggested the lack of retaliation against US tariffs was helping to keep subpar global growth from collapsing.

“Our message to everybody is: Be calm,” she said in an interview on Thursday with Bloomberg Television. “And to China: Be careful, do not provoke other countries to see you as a threat to their economies.”

US Treasury Secretary Scott Bessent and China Vice Premier He Lifeng are expected to this next week to negotiate down recent escalatory measures — after Bessent upbraided a Chinese negotiator during a press conference earlier last week, describing him as “unhinged” and perhaps having “gone rogue.”

The discussions will come ahead of a potential meeting between their two presidents in South Korea on the sidelines of the Asia-Pacific Economic Cooperation leaders summit.

Earlier last week, Georgieva warned that countries “shouldn’t be complacent” given mounting fiscal and spillover concerns. Global public debt is on track to exceed 100% of gross domestic product by the end of this decade — its highest since 1948. Argentina is suffering from a depressed currency and is poised to get a $20 billion lifeline from the US.

Meanwhile, equity markets hovering near records were whipsawed all week by the latest trade drama.

AI EUPHORIA

Underpinning the recent rally are shares of US artificial-intelligence chipmakers, which fed into a drumbeat of warnings from central bankers and supervisors about high asset prices, potential complacency in financial markets and the risk of a sudden, sharp correction.

Some, including the IMF’s Georgieva and a former official at the Washington-based fund, drew comparisons with the dot-com bubble that burst in 2000. “I wouldn’t immediately agree with this opinion, but it’s something we need to watch,” European Central Bank Governing Council member Joachim Nagel said Friday.

Analysis by Bloomberg Economics found that a renewed trade war between China and the US, coupled with the threat of an AI bubble that eventually bursts poses a $1.4-trillion hit to world growth.

The mood was less grim than when officials last gathered in Washington in April, just weeks after Trump announced the biggest round of tariff hikes since the 1930s. But the fresh escalation of tensions put a lid on any optimism, said Josh Lipsky, senior director of the GeoEconomics Center at the Atlantic Council in Washington and a former adviser at the IMF.

“There’s this strange dichotomy between feeling better than they did in April and yet being very worried about all the risk, which could become a tipping point at any moment,” Lipsky said. “That tension played out throughout the week in a mixture of relief and anxiety combined.”

That subdued spirit was backed up in the IMF’s forecasts for 3.2% world growth this year and 3.1% next — both well below the historical average of about 3.7%. If trade risks materialize, global growth could be lower by 0.3 percentage point, Krishna Srinivasan, the IMF’s director of the Asia and Pacific Department, told Bloomberg TV’s Haslinda Amin.

By week’s end, though, there were signs that Trump and Xi would meet and iron out some differences. That’s the hope of rich and poor economies caught in the middle, with big stakes in ensuring the dispute doesn’t widen.

“We are monitoring the situation very closely,” German Finance Minister Lars Klingbeil said. “I am now somewhat hopeful that much can be resolved at the meeting between President Trump and President Xi.”

RARE EARTHS

While in Washington, Chinese officials tried to ease concerns over an expansion of restrictions on rare earths — minerals critical to many industries — in an attempt to soften an international backlash. Chinese delegates told their global counterparts that tightened export controls will not harm normal trade flows, according to people familiar with the matter.

Klingbeil said Germany made it clear during Group of Seven talks this week that “we disagree with China’s approach, and we will monitor the situation very closely in the hope that we can do what we can politically to ensure that there is no escalation, but rather a détente between the US and China.”

For monetary policymakers, the concern centers around their goals to control inflation, avoid sharp currency moves and sustain growth through trade dislocations.

South Africa’s central bank governor, Lesetja Kganyago, said tensions between the US and China could push prices lower in other countries at the expense of their own manufacturers.

“The interesting thing about that spillover is that it could actually depress prices elsewhere and initially it might be beneficial,” Kganyago said. “And it might actually end up looking like dumping or something along those lines.”

The combination of trade and geopolitical tensions combined with financial fragility could yet trigger market turmoil, People’s Bank of China Governor Pan Gongsheng warned during meetings of Group of 20 financial chiefs and central bank leaders.

Such uncertainty, according to the IMF, is a permanent fixture that will require policymakers to stay vigilant and flexible. “The reality is people are both resilient and creative and you figure out ways how to compensate things,” Pakistani Finance Minister Muhammad Aurangzeb said. — Bloomberg

Building the foundations of happiness

October is National Shelter Month in the Philippines, a celebration to promote dignified, safe, and affordable housing for Filipino families. Led by the Department of Human Settlements and Urban Development (DHSUD), this year’s theme is “Build Homes, Build Happiness,” aiming to unite government agencies, private developers, and other stakeholders in the mission of providing Filipinos with one of the most fundamental of human rights: the right to adequate shelter.

“A home is where children feel safe to dream, where parents find strength, and where families draw comfort during difficult times. More than shelters, it is about building dignified lives,” DHSUD Secretary Jose Ramon Aliling said in a statement.

“In line with President [Ferdinand] Marcos, Jr.’s directive, we will intensify the promotion of a dignified life for our fellow Filipinos through decent housing and fast, transparent public service,” he said in Filipino.

Every October, the DHSUD and its key shelter agencies mount a month-long series of events across the country to advance the national housing agenda. Regional offices lead housing summits, community caravans, training programs, and project site visits designed to foster collaboration among stakeholders and open more pathways for Filipinos to obtain safe, affordable, and resilient homes.

First declared through Proclamation No. 662 in 1995, National Shelter Month underscores housing as both a foundation of nation-building and a collective duty, one that necessitates the cooperation of the government, private developers, and communities in the pursuit of inclusive human settlements.

THE ROLE OF THE PUBLIC SECTOR

As of 2023, according to the UN-Habitat Philippines, there is a backlog of 6.5 million housing units in the country, with an estimated 3.7 million informal settler families directly impacted by this deficit. Compounding the problem are the increasing rate of urban migration due to a host of factors displacing Filipinos from their homes, such as armed conflict, systemic inequity, and climate change.

Furthermore, the backlog is bottlenecked by declining housing production as result of slow bureaucratic, regulatory and approving procedures, a high reliance on private sector investment, and inadequate budget allocation for housing. It is highly likely this gap has widened since 2023.

The DHSUD has been established for this very purpose, as it serves as the Philippines’ lead agency for housing, human settlements, and urban development. Established on Feb. 14, 2019 through Republic Act No. 11201, it unifies housing policy, regulation, and planning under one institution. The law consolidated the functions of the former Housing and Land Use Regulatory Board and the Housing and Urban Development Coordinating Council, while transferring adjudication duties to the Human Settlements Adjudication Commission (HSAC).

As the government’s central policy-making and regulatory body for shelter and urban development, the DHSUD’s mission is to ensure that every Filipino has access to affordable, safe, and livable communities. It oversees four key shelter agencies: the National Housing Authority (NHA), which leads public housing production; the Pag-IBIG Fund, which mobilizes national savings and provides low-cost housing finance; the Social Housing Finance Corp. (SHFC), which implements socialized housing programs for low-income and informal settler families; and the National Home Mortgage Finance Corp. (NHMFC), which sustains affordable housing loans through a secondary mortgage market.

Each key shelter agency plays a role in the overall mission. For instance, the NHA this year made huge strides in furthering the administration’s flagship housing initiative, the Expanded Pambansang Pabahay Para sa Pilipino (4PH) Program. Last May, President Marcos signed into law a new measure expanding and strengthening the mandates of the NHA, and extending the agency’s corporate life by another 25 years effective July 31.

Among the important provisions of the new law is the inclusion of two expert parallel members with expertise in housing, urban planning, and development in the agency’s board to allow more active private sector contributions to the development of a more inclusive government housing program. Also included are provisions for three assistant general managers to enable more efficient management and operations within the agency’s day-to-day affairs, compared to only one in the old charter.

Meanwhile, agencies like the SHFC and NHMFC are working on ways to make housing more accessible. A recent example is a moratorium on amortization payments for borrowers affected by natural disasters such as Tropical Storm “Crising” and the southwest monsoon last July.

This temporary payment relief allows families to focus on recovery without the immediate pressure of monthly dues. It forms part of a broader government effort, alongside the DHSUD, NHA, and Pag-IBIG Fund, to provide financial breathing room and preserve homeownership stability for disaster-stricken communities.

For this year’s National Shelter Month, Secretary Aliling highlighted two key milestones that mark significant progress in tackling the country’s housing challenges. The first is a newly approved memorandum of agreement with the University of the Philippines (UP) to launch a pilot rental housing project for informal settler families within the UP Diliman campus — a pioneering initiative that aims to provide secure, affordable shelter in urban areas. The Home Development Mutual Fund, more known as Pag-IBIG Fund, have expressed support for this initiative as well.

“This is just the beginning,” Mr. Aliling said. “More rental housing projects will be rolled out in line with President Marcos, Jr.’s directive to ensure dignified living for all Filipinos.”

The second milestone is the forthcoming distribution of certificates of award to families who have lived for decades on lands covered by Presidential proclamations. This long-awaited step, he added, will finally grant thousands of long-term occupants the security of tenure and peace of mind they have sought for generations.

“When we build homes, we strengthen our nation. When we build happiness, we fulfill the highest purpose of public service, uplifting lives and giving every Filipino family the future they deserve,” Mr. Aliling said.

“Every home we build is a story of hope, and every family we serve is a testament to why public service matters. Together, we can make Bagong Pilipinas a reality — one home, one community, one future at a time,” he had said. — Bjorn Biel M. Beltran

Greentech Ecobooster named Top Innovator, wins P1-M funding at Shell LiveWire Awards

Greentech Ecobooster wins big at the Shell LiveWire 2025 Final Pitch Day held in September during Echelon Philippines 2025 at the SMX Convention Center, Pasay, bringing home P1,000,000 in equity-free cash funding from Shell Pilipinas Corp. (SPC).

This year’s winning project, Greentech Ecobooster, is a fuel-optimization device designed to enhance combustion-engine performance while reducing fuel consumption and greenhouse-gas emissions. During the program, the startup highlighted its initiatives with tricycle drivers in Parañaque, where the device helped lower daily fuel costs and improve vehicle efficiency.

“Our focus has always been to think beyond innovation and work toward inclusive growth. Shell LiveWire has provided a great platform for us to sharpen our vision and further develop our product, starting with tricycle drivers and ultimately expanding its benefits on a larger scale. Our goal is to improve fuel combustion in engines and boost overall performance for a world chasing energy efficiency,” said Rowena Bernardo, co-founder (Systems & Communication), Greentech Ecobooster.

The two other finalists, Agridom and Pili AdheSeal, Inc., also received P500,000 each and presented solutions that reflect the diversity and ingenuity of Filipino innovators, ranging from smart agriculture to sustainable construction materials. Their projects showcase how innovation can address pressing local challenges while opening opportunities for scalable impact in their respective sectors.

Shell LiveWire, launched 40 years ago and introduced in the Philippines in 2020, is part of Shell’s flagship enterprise designed to nurture startups and local enterprises that drive innovation and support the transition to cleaner, more sustainable energy solutions.

The startups receive mentorship, financial support for team and product development, and expert guidance to refine their businesses. Since its inception, the program has supported more than 180 businesses, creating and sustaining over 900+ jobs, with 80% of these start-ups remaining operational for at least two years. Its impact extends globally, with five Philippine start-ups earning a spot in the Global Top Ten Innovators and 16 businesses entering Shell’s supply chain.

Shell LiveWire continues to champion innovation that drives inclusive growth, empowering people, uplifting communities, and contributing to a shared sustainable future. Baste Quiñones, executive director of Pilipinas Shell Foundation, Inc. (PSFI) said this commitment goes beyond technology; it is about building a Philippines that leads Asia’s growth through collaboration and progress.

Guided by PSFI’s “sama-samang pagtulong, sabay-sabay na pagsulong,” the program has evolved into a platform that helps build a robust pipeline of innovators that lead the charge to power the Philippines’ transition toward an inclusive and future-ready economy.

For future updates on the next Shell LiveWire, including announcements and key events, follow Shell Pilipinas Corp.’s official website and social media channels (Facebook, TikTok, Instagram, YouTube, and LinkedIn).

SparkUp is BusinessWorld’s multimedia brand created to inform, inspire, and empower the Philippine startups; micro, small and medium enterprises (MSMEs); and future business leaders. This section will be published every other Monday. For pitches and releases about startups, e-mail to bmbeltran@bworldonline.com (cc: abconoza@bworldonline.com). Materials sent become BW property.

Real women represented in RAJO Store holiday collection

Rajo Laurel collaborates with his sisters

THE RAJO STORE has new designs for ready-to-wear pieces which were recently unveiled by Rajo Laurel along with his sisters Venisse Laurel-Hermano and Gela Laurel-Stehmeier, who helped the fashion designer keep things real.

The collection is meant to mark the 10th anniversary of the store. The pieces, first showcased in a fashion show for family, friends, and the press on Oct. 14, are now available at the store in Power Plant Mall, Rockwell Center, Makati.

Known as the 2025 holiday collection, the new pieces also mark the first time the three siblings have collaborated.

Mr. Laurel had previously worked with them in different capacities — Ms. Laurel-Hermano, who is his chief operations officer, and Ms. Laurel-Stehmeier, who is a famed makeup artist. This is the first time they all worked together on fashion design.

Notably, the collection consists of essential wardrobe pieces that are classic and contemporary. One example is an A-line black knit dress that flatters multiple body types.

At the show, the designs that turned heads included a crisp cotton button-down shirt accented with organza piping, and — a favorite of the sisters — a wide-leg cropped trousers elevated with sleek side panels.

Compared to previous RAJO Store designs, the new collection leans toward practicality and accessibility, accounting for a broader range of sizes and colors.

For Mr. Laurel, the collection is built on a philosophy of intentional design. It is meant to “create empowering pieces that encourage consumers to buy smarter.”

DESIGNED FOR REAL WOMEN

By drawing inspiration from the lives and perspectives of his sisters, the holiday collection is meant to be suited to modern lifestyles.

“It’s our 10th anniversary. Like with anything, it’s always nice to reinvent yourself and refresh,” Mr. Laurel told BusinessWorld at the store reopening before the fashion show. “The newest thing is that my sisters are involved in the design process. That’s why, in terms of collaboration, you’ll notice [the designs] all look more real.”

He explained that he tends to design with the fantasy that everyone is 5’10” and 100 pounds. “My sisters were telling me, ‘Rajo, not everyone is like that, you know!,’ and so that’s reflected in the designs.”

The process was more rigorous as a result. “Ideas were tested, decisions were questioned, but the direction became clearer with every step,” according to Mr. Laurel.

Meanwhile, Ms. Laurel-Hermano, who usually works behind-the-scenes in operations, added: “Rajo and I never crossed each other’s areas of work until now. The great thing about Rajo is that he’s adaptable. He listens. I’m a career mother, so fashion, to me, must be practical, versatile, and timeless.”

Ms. Laurel-Stehmeier added that, as the “creative at heart,” her role was to push the boundaries.

“I question everything… details, cuts, colors, fabrics. The beautiful thing about collaborating with family is we can be vulnerable and honest. We find creative solutions together,” she said.

REIMAGINED SPACE

The boutique space itself was reimagined to be aligned with the new collection, its architecture and layout more fluid. For Mr. Laurel, another notable thing is how the line is no longer “gender-controlled.”

“It’s for men, women, trans — everybody’s welcome. It used to be segregated into genders, but now it is completely for all genders,” he said.

He concluded that having his sisters’ creative voices in the dialogue fostered “a conversation of sorts … from a solo act now to a trio, a synergy of voices making it all complex and nuanced.”

“With this particular collection, my sisters are representing real women with real lives. They’re working mothers with full lives, and they need clothes. When they told me they wanted to do this because they lack things in their wardrobe, I said, ‘this is it; if you need it, other people will need it too,’” he said.

Mr. Laurel recommended the collection’s envelope pants and the convertible jacket that can be used for day and for night.

The Holiday 2025 Collection is available at The RAJO Store, 2nd Level Power Plant Mall, Makati City. — Brontë H. Lacsamana

Straw Innovations launches the Philippines’ first Rice Straw Bioenergy Hub to reuse farm waste

The Philippines’ first Rice Straw Bioenergy Hub was officially launched in Pila, Laguna on Oct. 7, bringing together national leaders, local officials, international partners, and farmers to showcase groundbreaking solutions that transform rice straw from waste into valuable products.

The event was attended by the Economic and Climate Counsellor Lloyd Cameron of the British Embassy Manila, Regional Executive Director of the Department of Agriculture (DA) Region IV-A Fidel L. Libao, Chair of the Committee on Agriculture for the Province of Laguna, Hon. Karla Adajar-Lajara, representatives from other DA agencies, institutional partners, farmer leaders, and local government officials from the province of Laguna.

The Hub demonstrates how rice straw, an abundant but often wasted by-product of rice farming, can be transformed into valuable products such as renewable energy, biochar, and soil amendments. This innovation offers solutions to some of the Philippines’ most pressing challenges in rice farming: open-field burning, greenhouse gas emissions, high production costs, and low farmer incomes.

The Hub, developed by Straw Innovations, Inc. with partners Aston University, Southeast Asian Regional Center for Graduate Study and Research in Agriculture (SEARCA), Koolmill Systems, Takachar, and Innovate UK, demonstrated how rice straw can be upcycled into biochar, renewable energy, soil amendments, and livestock bedding while also providing farmers with new business opportunities and reducing harmful methane emissions.

At the launch, participants witnessed live demonstrations of new technologies such as Straw Traktor, a world-first 3-in-1 machine capable of collecting rice straw even in wet conditions, while simultaneously spreading soil amendments and rotavating the land. Also featured was the Takavator, developed by Takachar, a portable system that converts rice straw into biochar — an innovation that enhances soil health and opens up opportunities for carbon credits.

The event also showcased Koolmill, a next-generation rice mill that consumes up to 90% less energy and minimizes grain breakage, allowing farmers and processors to increase their profits. In addition, a live demonstration on biogas production showed how low-quality rice straw can be repurposed to generate clean, renewable energy for rural communities.

Beyond technology, the Hub is designed to put farmers at the center of innovation. By making machinery financially accessible, local farmers and entrepreneurs can run profitable businesses offering harvesting and land preparation services. In pilot sites, some operators have already improved their livelihoods to the point of renovating their homes and supporting their families’ education.

Rice straw is also being piloted as deep-litter bedding for swine farmers, reducing waste management costs and producing compost as an additional income source. These early interventions demonstrate how straw management can support farming communities socially, economically, and environmentally.

SparkUp is BusinessWorld’s multimedia brand created to inform, inspire, and empower the Philippine startups; micro, small and medium enterprises (MSMEs); and future business leaders. This section will be published every other Monday. For pitches and releases about startups, e-mail to bmbeltran@bworldonline.com (cc: abconoza@bworldonline.com). Materials sent become BW property.

Collaborative efforts to solve the Philippines’ housing crisis

Millions of people around the world live their lives in search of a place they can call home. After all, access to adequate shelter remains a challenge, particularly in areas affected by natural disasters, conflict, or rapid urban growth.

Homelessness charity Depaul International estimates 4.5 million people are experiencing homelessness in the Philippines, and about two-thirds of this number are in Metro Manila.

To combat this, both government initiatives and the efforts of private organizations and nongovernment organizations are addressing the housing crisis, which often becomes magnified during times of peril and uncertainty.

The main housing program of the administration of President Ferdinand R. Marcos, Jr. is the Pambansang Pabahay Para sa Pilipino (4PH) Program, which aims to build 6.5 million housing units through government-led housing initiatives and address the country’s current housing backlog by building one million housing units yearly until 2028.

Established under Executive Order No. 34, s. 2023, the government’s flagship program was conceptualized to address the country’s current housing needs and features an innovative framework that has eased the burden brought by two major bottlenecks in the housing sector: affordability and access to funds.

Headed by the Department of Human Settlements and Urban Development (DHSUD), the latest news on the project includes the launch of a website dedicated solely to the endeavor, offering information and services related to the government’s flagship program. Additionally, it has been reported that a total of 42 private developers have committed to deliver 251,846 socialized housing units under the administration.

In the same way, the National Grid Corporation of the Philippines (NGCP) has also helped the cause in recent years. Together with Gawad Kalinga, the NGCP turned over a housing project in 2020 to the City Government of Valenzuela, which cost over P82 million, and comprised of 22 three-storey low-rise buildings with 792 units.

As the power grid operator, the NGCP worked with the City of Valenzuela to relocate residents previously living within the transmission right-of-way corridor to prevent any accidents from happening due to their proximity to the high-voltage power lines. The housing project is located in Disiplina Village, Lingunan, Valenzuela City, and is a joint in-city housing project for informal settler families.

Several developers have also given back to communities through their corporate social responsibility. Among the big names providing housing assistance is the real estate arm of the Lucio Tan Group, Eton Properties, which has provided safe, dignified housing for underserved communities in Nueva Vizcaya, in partnership with the Tan Yan Kee Foundation.

Named the Eton Bahay Liwanag Project, the developer recently turned over four newly built homes in the area to carefully selected families based on their circumstances and resilience despite difficult living conditions in the hinterlands of Nueva Vizcaya. Launched in 2019, the Eton Bahay Liwanag Project has completed 12 homes in the province to date.

Similarly, DMCI Homes has been actively supporting social housing initiatives in partnership with Habitat for Humanity Philippines and local governments through its Kaakbay sa Pamayanan program.

The company’s efforts include a P4-million donation to help construct homes for poor families and teachers in the Bistekville I project in Quezon City, as well as sponsorship of 92 homes at a relocation site for informal settlers in Parañaque. Volunteers from DMCI Homes also contribute directly by painting and maintaining these houses, helping to provide safe, affordable shelter for disadvantaged communities.

Nongovernment organizations (NGOs) have also done their part in building homes for Filipinos. For example, Habitat for Humanity Philippines brings people together to build homes, communities, and hope, “seeking to put God’s love into action.”

In 2019, Habitat for Humanity joined forces with the Hilti Foundation to expand the use of disaster-resilient Cement Bamboo Frame Technology and help close the housing gap in Negros Occidental. Named the Negros Occidental Impact 2025 (NOI25), the initiative seeks to create sustainable communities where homes are safe, green, resilient to disasters, and supportive of families’ long-term security and well-being. Six years later, the NGO has built over 400 disaster-resilient homes and helped families live in sustainable communities.

Likewise, the Manny Pacquiao Foundation, named and founded on behalf of boxing legend Manny D. Pacquiao, has programs aimed at creating lasting change for communities and inspiring people to make a tangible difference in the world. Among the group’s programs is a housing project that has already constructed 300 homes in three locations for hundreds of families in need.

Addressing the housing crisis in the Philippines requires the combined efforts of government programs, private developers, and NGOs working to provide safe, affordable, and resilient homes. Through these partnerships, more families can gain the shelter that they need to thrive. — Jomarc Angelo M. Corpuz