Voices

By Vince S. Socco

THE PHILIPPINE automotive industry is well on its way to recovery. By the end of the first eight months of the year, the market had grown by around 25% and is now back to pre-pandemic levels. A big factor in the growth of sales is the restoration of supply to meet the continued strong demand for vehicles. It will be recalled that the global production of autos was greatly constricted by disruptions in supply chains, particularly for semiconductors.

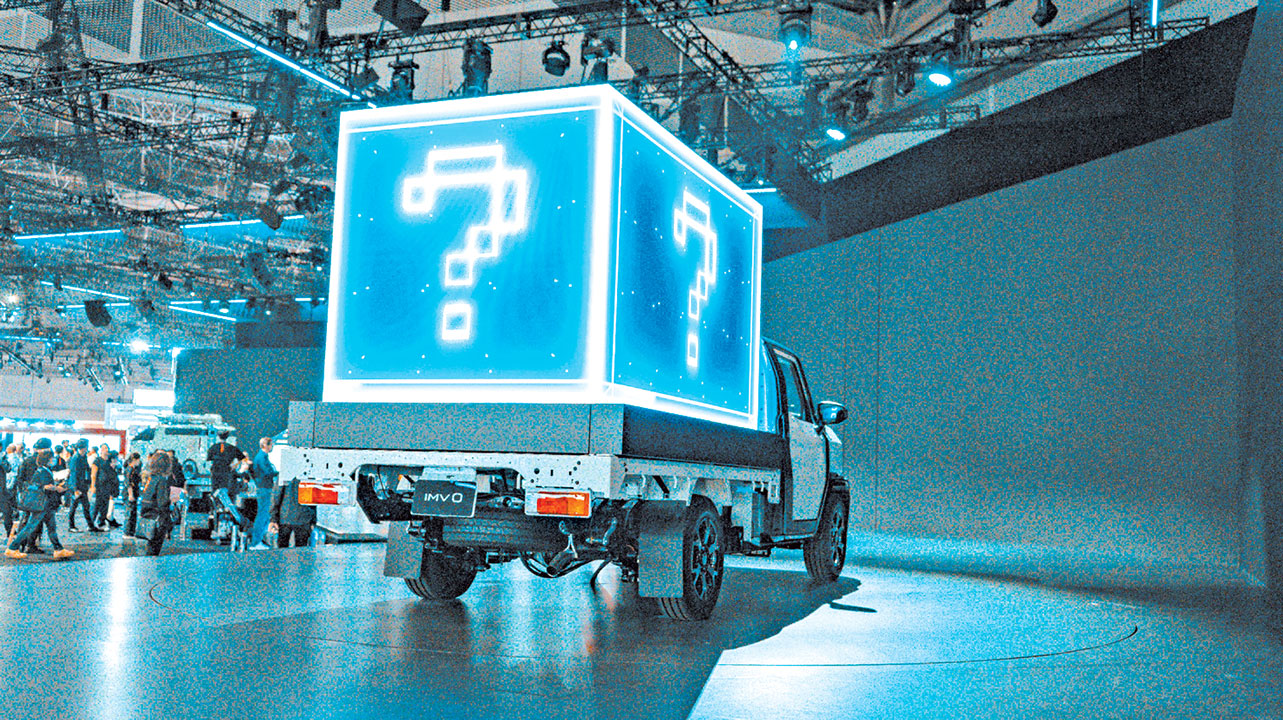

Additionally, car makers have stepped up the pace of new model introductions in the local market. Filipino motorists have been feted with a slew of brand-spanking-new SUVs, pickups, sedans, minivans, hatchbacks, luxury vehicles, and — the apparent darling of the times — the electric vehicles. The range of new product offerings and upgrades is dizzying.

Beyond the products, there is a bunch of new automotive brands finding their way to Philippine shores, either totally new or returning entrants to the market. Chinese brands seem to be landing at such a rapid pace — Geely, Chery, GAC, MG, Hongqi, Omoda, Jaecoo, Wuling, Foton, GWM, Jetour, and BYD, among others. That’s an even 12 but I’m pretty sure there are others still. Resurgence has also been noted for the Korean brands such as Hyundai and Kia as well as some European brands like Peugeot and luxury make Ferrari.

It seems that the resurrection of the industry is spurring an unprecedented pace of transformation. And one other very significant aspect of this morphing of the auto sector is the profile of players seated in the owners’ box, so to speak.

The most recent shuffle happened with BYD — the second largest global producer of electric vehicles next to Tesla — whose distribution in the Philippines was taken over by the Ayala Group. Hyundai transitioned ownership amid the COVID-19 crisis and is now a wholly owned and operated subsidiary of Hyundai (Korea). The sales and servicing of Ferrari in the country is now handled by Ramon Ang through Velocita Motors. It will be remembered that he also took over the BMW franchise not too long ago under the SMC Asia Car Distributors Corp. Astara — one of the largest European car dealer groups — assumed the distributorship of Peugeot and GAC. While Inchcape PLC acquired control of the Mercedes-Benz operations in the country and the other brands under the Auto Nation Group, it also tucked Chinese brand Changan into its portfolio. A few years back, Hino (Japan) took over the majority of its Philippine operations. MG has also transitioned and is now owned and operated by the Chinese parent, Shanghai Automotive Industry Corp.

All these changes in ownership underscore a seeming consolidation or redirection of the industry from what used to be partnerships with private and independent businessmen to larger corporate players, even wholly owned subsidiaries. On one hand, this trend marginalizes what may have been long-standing relationships, pitting the proverbial David against the Goliaths of business. On the other, it highlights the capital-intensive nature of the auto business that is essential to its sustainable growth. For me, one thing that’s sure is that the shifts in alliances augur well for the Philippine automotive industry. It means that our market is on the radar of the major players. And why not?

The Philippines has one of the lowest motor vehicle densities in the region, topping only Vietnam. We are a developing economy that requires a more mature and robust transport and mobility network. We have a young population and a growing middle class whose spending capacity is expected to rocket. And 99% of the business sector in the country is made up of micro, small, and medium enterprises that rely on a vast vehicle fleet of people and goods movers.

Having noted all these changing of hands, so to speak, there are a number of players that still preserve their original partnerships. Honda Cars Philippines, for example, is one. Ford Philippines was already a wholly owned subsidiary of Ford when it started and it remains so today. Isuzu Philippines Corp. is still — as it has been — owned by its Japan parent. And Mazda Philippines remains owned by Bermaz Auto of Malaysia since after the break in the global alliance between Ford and Mazda.

Among the long-standing players in the country, Mitsubishi also underwent a change in ownership, albeit a good many years ago. From a local joint venture tie-up in its earliest years, Mitsubishi Motors Philippines — formerly Canlubang Automotive Resources — is now wholly owned by Mitsubishi (Japan). Nissan Motor Philippines (now Nissan Philippines) was also taken over by the Japanese parent company where before it was a joint venture first with Universal Motors and then with Yulon of Taiwan.

Then, of course, there is Toyota Motor Philippines Corp. (TMP). It replaced the previous distributor of Toyota in the country — a wholly owned Filipino corporation — when it halted operations in the early ’80s. TMP was established as a joint venture among Toyota Motor Corp. (TMC), Mitsui & Co. Ltd (Japan) and the Metrobank Group — subsequently GT Capital Holdings — as majority owner.

Sometime in 1985, Dr. George SK Ty, then President and owner of Metrobank, was invited by Dr. Shoichiro Toyoda, then President of TMC, to be the sole assembler and distributor of Toyota in the Philippines. Mr. Ty hesitated because although Metrobank was among the leading Philippine banks at the time, it had no experience in the automotive business. He was concerned about what he could contribute to the partnership. Mr. Ty was invited to visit Japan to learn and understand more about Toyota. After several exchanges, the partnership was formed and TMP was incorporated on Aug. 3, 1988.

Fast-forward 35 years and TMP is stronger than ever. Literally, it has grown from strength to strength in line with the growth of the Philippine economy. From 9,000 units sold in its first year of sales, it is on track to achieve a new all-time sales record of close to or over 200,000 units in 2023. In 2022, it posted its highest-ever market share of 50%, the highest for Toyota in the Asia region and, perhaps, the world.

The partnership between GT Capital and Toyota — as well as between the Ty and Toyoda families — is one that was founded on mutual trust and respect. It was the strength of these bonds that allowed TMP to overcome the most serious crises such as the Asian Financial Crisis of 1997, the various political disruptions in the country, the Lehman shock of 2008, the great earthquake of Japan and the floods of Bangkok in 2011, and the aforementioned COVID-19.

TMP has contributed much to building the Philippine nation in terms of job creation, investments, payment of taxes and duties, transfer of technology, promotion of exports, and giving back to society. The way things are looking, it seems that TMP — and the partnership that underlies it — will continue to grow stronger even as the musical chairs in the ownership of other automotive brands rages on.

Have we seen the last of the shifts in alliances? I doubt. As the industry transitions from auto manufacturing to the much broader and complex field of mobility, I expect that the landscape will continue to evolve. The road ahead is wide open.

The author is an automotive executive with extensive experience in the field of marketing and sales. Mr. Socco was significantly involved in the start-up of business operations for Toyota in the Philippines — a brand with which he has more than 40 years of involvement. He also has a broad executive experience in distributor operations as well as regional and global headquarter responsibilities. He is currently Chairman of GT Capital Auto Dealership Holdings, Inc.