Adapting and leading the way in post-pandemic healthcare

With COVID-19 seeming like a distant memory for Filipinos, the Philippines’ focus has shifted to addressing longstanding healthcare challenges driven by the lessons Filipinos learned during the health crisis.

According to Christopher Tan, Cocolife’s Head of Sales and Marketing Department in their Healthcare Division, the pandemic impacted the healthcare industry in several ways ranging from the population’s awareness to the integration of technological advancements in healthcare.

He noted that during COVID-19, healthcare facilities were mostly availed by those requiring urgent care as the population feared the virus and the government’s restriction of public movement. Mr. Tan said that this fear and restriction led to the rise of telehealth services as the patients became more open to and complacent with virtual consultations which in turn led to greater investment in telemedicine infrastructure and technology by healthcare providers.

“Once the restrictions were lifted, the population became more comfortable with visiting healthcare facilities again. Moreover, the pandemic has raised the population’s awareness about the importance of health and preventive care; and the people are more conscious about maintaining overall health to prevent illnesses,” he said.

However, while population awareness and initiatives to maintain health are great outcomes after a health crisis, they also resulted in the rise of the so-called “revenge claims.” Mr. Tan said such a trend in healthcare insurance has caused industry losses for the past years which, coupled with the inflation of medical costs, “revenge claims” forced providers to increase their prices of membership fees.

These trends have made it challenging for healthcare insurance providers and health maintenance organizations to stay relevant and competitive in the market. In this regard, Cocolife continuously reviews its products and services to ensure they meet its members’ healthcare demands.

“During the pandemic, Cocolife has beefed up its capabilities to provide access to physicians for telemedicine by accrediting a third-party provider to complement the in-house physicians of Cocolife for the members’ needs for teleconsultation. The telemedicine capabilities of Cocolife also provide access to mental health consultants/specialists to address the increasing demand for mental health services,” Mr. Tan said.

He also stated that Cocolife continues to accredit its wide network of medical providers to give members from all over the country different options. Mr. Tan also said that his company has augmented its manpower to effectively and adequately provide convenient and satisfactory service to its growing member base.

With its team of customer service agents, he said that Cocolife has long been advocating the utilization of different communication channels to speed up and further enhance its service delivery system. This allows them to cater to their partners’ calls, emails, and messages regarding their requests and queries and provide 24/7 assistance.

Along with the launch of their Virtual Card application, Mr. Tan mentioned their investment in a company-wide system that will be used by the different divisions in its day-to-day operations and a separate system, Customer Relationship Management (CRM), developed for its customer service center to improve their operational efficiency and enhance customer satisfaction.

For Mr. Tan, these enhancements in their overall system will help automate certain tasks, eliminating or reducing the need for human intervention and thus reducing room for human error.

Cocolife Virtual Card: Healthcare on Filipino’s fingertips

While the increased awareness of Filipinos about the importance of healthcare may be seen as one of the few bright spots that came out of the COVID-19 pandemic, the increased utility and integration of online applications and technology in their daily lives can also be considered as one.

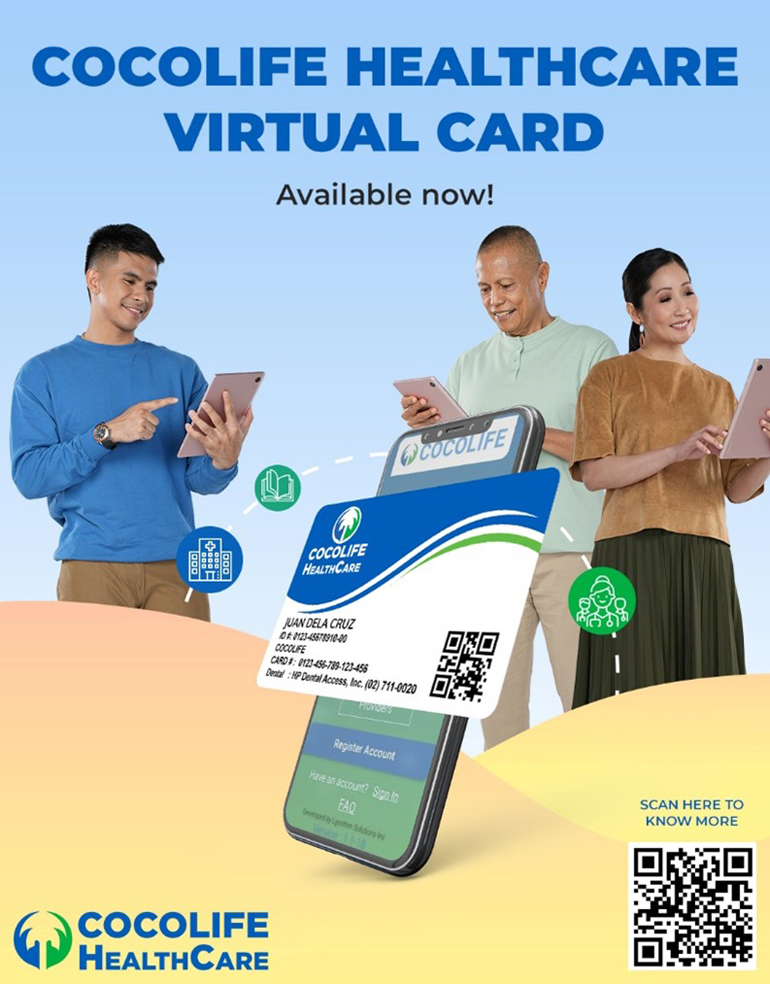

Recognizing this trend, some in the healthcare insurance and health maintenance organizations industry embraced digital transformation, developing apps designed to enhance access to medical services and improve overall patient care. The premier healthcare app making waves in the Philippines is Cocolife’s Healthcare Virtual Card. Launched in December last year, the virtual card is a comprehensive healthcare solution that aims to bring quality healthcare to Filipinos’ fingertips.

According to Atty. Paulo Rabanal, Head of Technical Services and Compliance Department, Cocolife’s Healthcare Division, the application was developed to achieve the company’s mission to provide the highest quality standards of products and services to all its stakeholders as well as to improve the quality of life for Filipinos.

“Ensuring that Cocolife provides the best possible healthcare experience for its members is one of the top priorities. As part of this effort, Cocolife is consistently embarking on service and product innovations to cater to the evolving needs and requirements of its partners,” Mr. Rabanal said.

The virtual healthcare card has redefined and improved Cocolife’s service capabilities by providing quicker access to medical services, making it more convenient and efficient for its members. Through the app, members can view and manage their profile and benefits details, access and review the availment process, their respective medical benefits, and the limitations of their insurance.

The virtual card’s Provider Directory feature allows the member to search for Cocolife’s accredited medical providers whether the closest hospitals and clinics or their preferred physicians and dentists.

“Cocolife’s Provider Directory is a valuable resource that allows members to easily search from Cocolife’s wide network of accredited medical providers. The Provider map feature enables members to locate the nearest facility with ease, making it convenient to access the care they need,” Mr. Rabanal noted.

Users of the Virtual Card application can also request for electronic letter of authorization (LOA) for their consultation or outpatient diagnostic procedures. Additionally, it serves as an alternative to the members’ physical cards as well.

“The members can easily request LOA through Virtual Card application, print it out, and submit it to their doctors and/or facility for their procedures. This saves them time and effort allowing them to focus on what matters most – their health and well-being,” Mr. Rabanal said.

These unique features set the Cocolife Virtual Card apart from other digital healthcare solutions. Aside from a seamless experience for all their healthcare needs, the innovative tool offers users of the app unparalleled convenience and efficiency in managing their authorization processes.

As Filipinos continue to use the services given on the internet daily and emphasize the importance of maintaining their health, Cocolife’s Virtual Card provides the answer to their needs, sets a precedent for future advancements in the healthcare industry, and ensures that quality care is always within reach for every Filipino.

For more information, visit https://www.cocolife.com/products/healthcare/.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.