Gov’t digitalization push to sustain demand for fintech services

DEMAND for financial technology (fintech) services is expected to be sustained following the increase seen during the coronavirus pandemic, driven by the government’s digitalization initiatives.

“With the Philippine government prioritizing the digitalization of financial transactions and showing strong support for the fintech industry, we are highly optimistic that Filipinos will not only continue to embrace cashless payment methods but also emerge as one of the fastest adopters of financial technology in the region,” Robin Wong, president and chief executive officer of fintech firm Mocasa, said in an e-mail.

The industry’s sustained growth will also be driven by digital payments, Rizal Commercial Banking Corp. (RCBC) Executive Vice-President and Chief Innovation and Inclusion Officer and Fintech Alliance PH Chairman Angelito “Lito” M. Villanueva said.

“There will be no way by which Filipinos will be going back to the usual cash or manual means of payment transactions,” he said.

A 2020 study by the Cambridge Centre for Alternative Finance at the University of Cambridge Judge Business School, the World Bank Group and the World Economic Forum showed the global fintech industry saw an increase in demand during the coronavirus pandemic, making it an outlier as most sectors were hit by the health emergency.

“In 2020, firms saw an average rise of 13% compared to 11% growth in previous years. The expansion of transactions was noticeably higher in countries with strict COVID-19 lockdown measures, where growth was 50% higher compared with firms who were operating in countries with looser lockdown measures,” according to the study.

Fintechs related to digital asset exchanges, digital payments, digital savings and wealthtech saw significant growth.

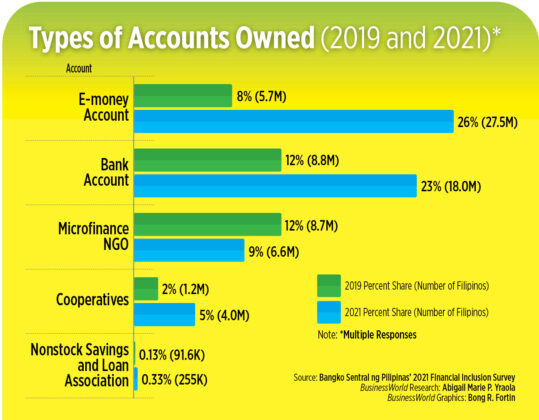

In the Philippines, digital lenders and e-wallets are leading the fintech industry’s expansion, said Enrico P. Villanueva, senior lecturer of economics at the University of the Philippines Los Baños (UPLB).

As of June, 40% of retail transactions in 2022 were done digitally, higher than 30.3% seen the prior year, according to central bank data.

Moving forward, the fintech industry will need to develop a sustainable credit scoring system, especially when rates begin to ease, UPLB’s Mr. Villanueva said.

“There will always be room for platforms that allow cheaper and more convenient ways to remitting money or doing fund transfer. The fintech companies that can do better will likely enjoy fast growth,” he added.

Fintechs have recalibrated their long-term goals amid the increased demand and fast growth seen by the industry, RCBC’s Mr. Villanueva said.

“Digital now becomes at the forefront of any strategic corporate plan — in terms of having to scale your operations, scale your business and definitely how to ensure that you can make yourself relevant,” he said.

Due to the pandemic, fintech firms had to tap new technologies to cope with demand, such as artificial intelligence (AI), he added.

However, he said AI is a double-edged sword as it could take over jobs done by humans, which means companies should help upskill and educate their employees.

“Going digital is not just about technology. It’s also about culture… Technology is just a portion of the whole proposition. Because for any digital transformation to survive, to be successful or even thrive, you need to have a change in culture or a change in mindset in the whole organization,” RCBC’s Mr. Villanueva said.

However, fintech adoption could be hampered by the high costs of smartphones and internet connections, said Calixto V. Chikiamco, Foundation for Economic Freedom president.

“The cost of smartphones and of data connectivity will have to fall further before more C and D segments of the population can make use of fintech. Accessibility is also an issue as many parts of the country, particularly in the countryside, have spotty signals,” he said. — A.M.C. Sy