Stubborn inflation, high borrowing cost dampened markets in Q3

By Andrea C. Abestano, Researcher

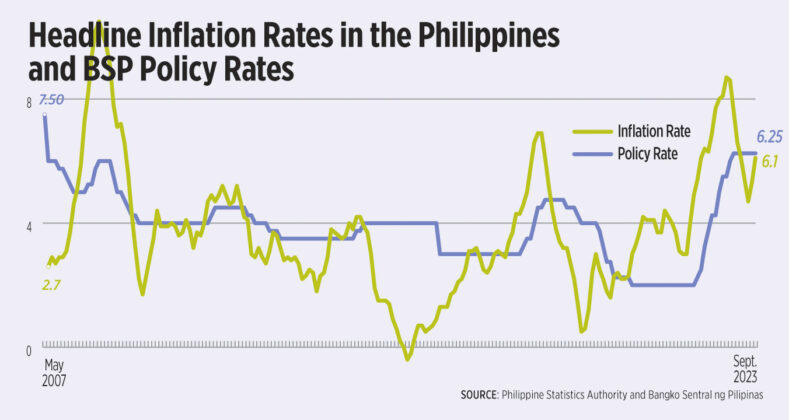

HIGH INFLATION, expensive borrowing costs continued to affect local financial markets in the third quarter, signaling volatility to persist for the rest of the year.

The barometer Philippine Stock Exchange index (PSEi) finished the July-to-September period at 6,321.24, dipped by 2.3% quarter on quarter from 6,468.07 at the end of the second quarter.

Annually, the index went up by 10.1% from the 5,741.07 finish in the third quarter of 2022.

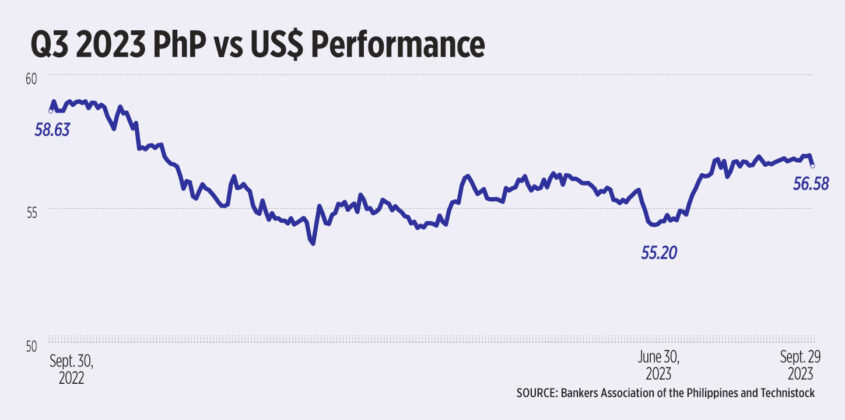

On the other hand, data by Bankers Association of the Philippines showed the peso closed P56.575 against the greenback in the third quarter, weakening by 2.4% from the second quarter finish of P55.20 to a dollar.

Year on year, the local unit strengthened by 3.6% from P58.63 finish in the same quarter last year.

The demand for Treasury bills (T-bills) auction subscription totaled P654.9 billion with a cumulative P182.6 billion offered amount in the third quarter. This was higher than the P416.6 billion subscription with P157.4 billion offered amount in the previous quarter.

The amount of oversubscription at P384.8 billion was also higher than the second quarter’s P259.2 billion.

Meanwhile, the demand for Treasury bonds (T-bonds) saw a total of P642.2 billion, lower than the P687.2 billion in the April-to-June period. Despite the decline, the demand for T-bonds in the third quarter period was higher than the aggregate offered amount of P279.7 billion.

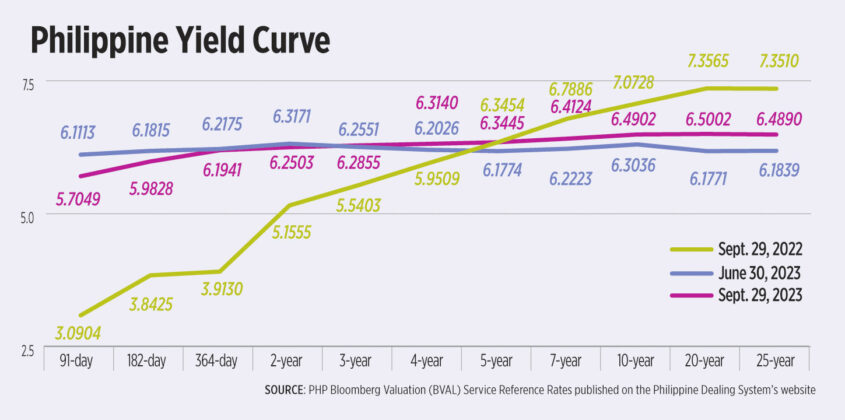

Domestic yields at the secondary bond market inched up by 0.90 basis points (bps) on average quarter on quarter, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates published on the Philippine Dealing System’s website.

On an annual basis, yields grew on average by 18.38 bps.

Analysts attributed the local financial market developments for the third quarter to global factors of rising borrowing costs, stubborn inflation, and geopolitical conflict.

The third quarter of the year saw rate pauses as the US central banks pause key monetary policies at 5.25-5.5%, the highest level in two decades.

Borrowing costs were raised by 500 bps by the US Federal Reserve since March 2022 to combat inflation.

The Bangko Sentral ng Pilipinas (BSP) also kept its key rate at 6.25% between May to September this year. Since May 2022, policy rate hikes had reached a total of 450 bps to tame inflation.

But headline inflation quickened to 6.1%, the highest since the 6.6% recorded in April.

However, in an off-cycle meeting in October, the central bank lifted its policy rates by 25 bps. Target reverse repurchase (RRP) rate was raised to 6.5%. Interest rates for the overnight deposit and lending facilities were also kept at 6% and 7%, respectively.

October inflation eased to 4.9% and further cooled to 4.1% in November, a 20-month low.

Security Bank Corp. Chief Economist Robert Dan J. Roces said in an e-mail that the local financial market in the third quarter was influenced by stubborn inflation and high borrowing costs.

China Banking Corp. (China Bank) Chief Economist Domini S. Velasquez said that “these two factors led to higher government security yields, weaker peso, and outflows from the local bourse.”

“Amid export restrictions, extreme weather conditions and fare hikes, domestic inflation remained on the upside for the first two months of the quarter,” Metrobank Research said in an e-mail.

BSP said in an e-mail interview that by the end of the [third] quarter, widening debt spreads and rising domestic and global inflation fueled “a higher-for-longer interest rate environment.”

INDICATORS TO WATCH OUT FOR

Volatility is likely to persist in the local financial markets in the near term, said Mr. Roces.

For Ms. Velasquez, the financial market will be relatively stable for the rest of the year given that “central banks have reached their peak policy rates.”

“Looking ahead, the outlook for the local financial markets remains cautious [with] inflation [still] a key concern for policymakers while elevated interest rates are a challenge to businesses,” Mr. Roces said.

Similarly, the BSP said that it “[deems] it appropriate to keep an elevated target RRP Rate for the time being until inflation expectations are better anchored and a downtrend in inflation becomes evident.”

Mr. Roces adds that although inflation may have slowed in October, further rate hikes by the BSP are still dependent on several factors, namely: inflation data, global economic developments, domestic shock due to adverse weather, and the previous Barangay and Sangguniang Kabataan (SK) elections which should increase government spending, he said.

He also expects geopolitical conflict between Israel and Palestine to be an influencing factor to look out for.

“The ongoing conflict between Israel and Palestine has the potential to disrupt global energy supplies and contribute to rising oil prices if it turns regional. This could directly impact the local financial markets by putting upward pressure on inflation,” Mr. Roces said.

On the other hand, Metrobank Research said that the conflict should not influence the local financial market in the coming months as it is still mainly a regional conflict.

“The risk of an escalation has recently receded, and there are talks already of a truce and an exchange of hostages,” it said.

“The effects of the Israel-Hamas conflict on the financial markets and economy remain manageable, for as long as the conflict does not escalate and spread to other countries in the Middle East,” Rizal Commercial Banking Corp. (RCBC) Chief Economist Michael L. Ricafort said in an e-mail.

“[The conflict’s] effect to financial markets is quite small. We saw this at the start of the war, where financial markets reacted with risk-off sentiment the day after but corrected immediately,” Ms. Velasquez adds.

On the upside, Mr. Ricafort sees a boost in the economy for the last quarter of the year as the gross domestic product (GDP) print picks up amidst increased government spending and easing global prices as of October.

He expects the Philippine economy to grow around 5.5%-6% in 2023.

In the July-to-September period, the country’s GDP posted a 5.9% annual growth, an improvement from the 4.3% in the second quarter. This brought the country’s year-to-date GDP growth to 5.5%, falling short of the 6-7% growth target by end-2023.

RATE HIKE PAUSES

“For the coming months, US and local inflation is moving closer to central bank targets and would justify at least a pause in Fed and local policy rates later in 2023,” RCBC’s Mr. Ricafort said.

Strong economic performance in the easing trend of inflation in October, four-month low prices of oil, and strong peso-dollar exchange rate are among the factors cited by Mr. Roces to warrant a pause in rate hikes.

“With local inflation likely staying above-target in the near term, an additional hike remains to be a risk although the baseline view is still a long pause followed by cuts,” the Metrobank Research said.

For near-term, it expects electricity rates and minimum wage adjustments outside the National Capital Region to be upside risks to inflation.

Meanwhile, Metrobank Research sees rate pauses for both local and US central banks since “another Fed rate hike would cause a sell-off in the US treasury bonds space.”

Similarly, Ms. Velasquez said that she expects the BSP to pause rate hikes, but a hawkish sentiment may remain with risks and inflation still “tilted to the upside.”

Security Bank’s Mr. Roces, on the other hand, said that “the Fed’s commitment to keeping interest rates ‘higher for longer’ and the possibility of a further rate hike by the end of the year could put renewed pressure on the local markets in the coming months.”

“Even if the Fed does not hike anymore and decides to hold its policy rate at 5.25%-5.50% for longer, expect the global markets to start pricing in rate cuts even before the Fed starts talking about it,” Metrobank Research said.

As for the BSP, it said that it is “prepared to adjust all policy levers as necessary to contain second round effects and prevent the disanchoring of inflation expectations.”

EQUITIES MARKET

Metrobank Research: Given the uncertainties in the equity markets, maintaining a cautious stance is advisable. Various threats, both local and global, including persistent higher interest rates and elevated inflation, may continue to keep investors cautious. The current market valuation appears attractive, and selective bottom-fishing, particularly for stocks that have experienced significant declines and have valuations significantly deviating from their historical averages, may be warranted.

Security Bank’s Mr. Roces: For the fourth quarter of 2023, equities is seen to rise modestly on the back of holiday spending season amid relatively light trading activity and net foreign selling.

RCBC’s Mr. Ricafort: The COVID state of public health emergency finally lifted since July 22, 2023, after no more large lockdowns since 2022, and no more lockdowns as a policy priority, going forward, thereby improving sales/revenues, earnings/net income, employment/jobs, more business/economic opportunities; all of which would help support higher/better investment valuations, though offset by still relatively higher prices/inflation and still relatively higher interest rates/borrowing costs/financing costs.

BSP: For Q4 2023, the PSEi may be supported by some optimism over strong corporate fundamentals with hopes of higher economic activity as the Christmas season nears. Nonetheless, worries about persistent inflation along with the high interest rate environment may limit gains in the PSEi. Risk sentiment may be weighed by worsening geopolitical tensions globally (Israel-Hamas, Ukraine-Russia, North-South Korea, China-Taiwan, and China-Philippines).

FIXED-INCOME MARKET

Metrobank Research: By year-end, we expect the curve to be very flat, with one-year to 10-year yields between 6.25% to 6.50%. Bonds greater than 10 years may still yield above 6.50% but no greater than 6.90% as high excess liquidity keeps yields capped. However, the three-month treasury bill yields will likely end between 5.65% to 5.90% as this is where foreign portfolio investors park much of their short-term peso investment requirements.

Mr. Roces: Fixed income markets are expected to be relatively stable in the fourth quarter, with yields likely to remain range bound. The BSP’s messaging to continue raising interest rates if warranted could put some upward pressure on yields, but this is likely offset by the global slowdown and lower inflation expectations.

Mr. Ricafort: Easing trend in local interest rate benchmarks yields which could lead to lower borrowing and financing costs locally. Improved fiscal performance in terms of narrower budget deficit and lower national government debt-to-GDP ratio, as well as the continued affirmation of the country’s credit ratings at 1-3 notches above the minimum investment grade would also support sentiment on the local fixed income markets.

China Bank’s Ms. Velasquez: For [the fourth quarter], we have already experienced a rally since the start of the quarter. Ideally, a continuation of the rally would be preferred, however at the time of writing, we expect prices and yields to stabilize until the end of the year, meaning there would not be much movement in the market for a while.

BSP: For Q4 2023, the local bond market may continue to be supported by the lower-than-expected October CPI data, and as the lagged effects of the previous rate hikes work their way into slowing economic activity. On the international front, concerns over the ongoing geopolitical tensions may also limit the expected drop in yields.

FOREIGN EXCHANGE

Metrobank Research: The view is that the USD/PHP exchange rate will end 2023 at around P55.10 as seasonal effects push the peso to appreciate, given peak OFW remittances during the Christmas period, the unloading of dollars by the Business Process Outsourcing (BPO) sector to fund employee bonuses, and a general lack of import activity in the fourth quarter.

Mr. Roces: The peso is expected to remain relatively stable against the US Dollar in the fourth quarter. However, the possibility of a further rate hike by the US Federal Reserve could put some downward pressure on the peso in the coming months.

Mr. Ricafort: Easing of the US dollar-peso exchange rate especially as the markets expect seasonal trends to be a positive factor in the foreign exchange market. By the latter part of the fourth quarter, seasonal increase in OFW remittances and conversion to pesos during the holiday season will peak causing peso exchange rate to appreciate versus the US dollar.

Ms. Velasquez: The Philippine peso would continue to benefit from a relatively weak US dollar and remittances coming from abroad. We expect the USDPHP to remain at the 55.0-56.0 range for the rest of the year.

BSP: For Q4 2023, the peso may be supported by dollar inflows from seasonal remittances toward the end of the year. Nonetheless, gains in the peso may be limited by risk aversion due to worsening geopolitical tensions globally (Israel-Hamas, Ukraine-Russia, North-South Korea, China-Taiwan, and China-Philippines)