PHL ends 2021 with P11.7-trillion debt

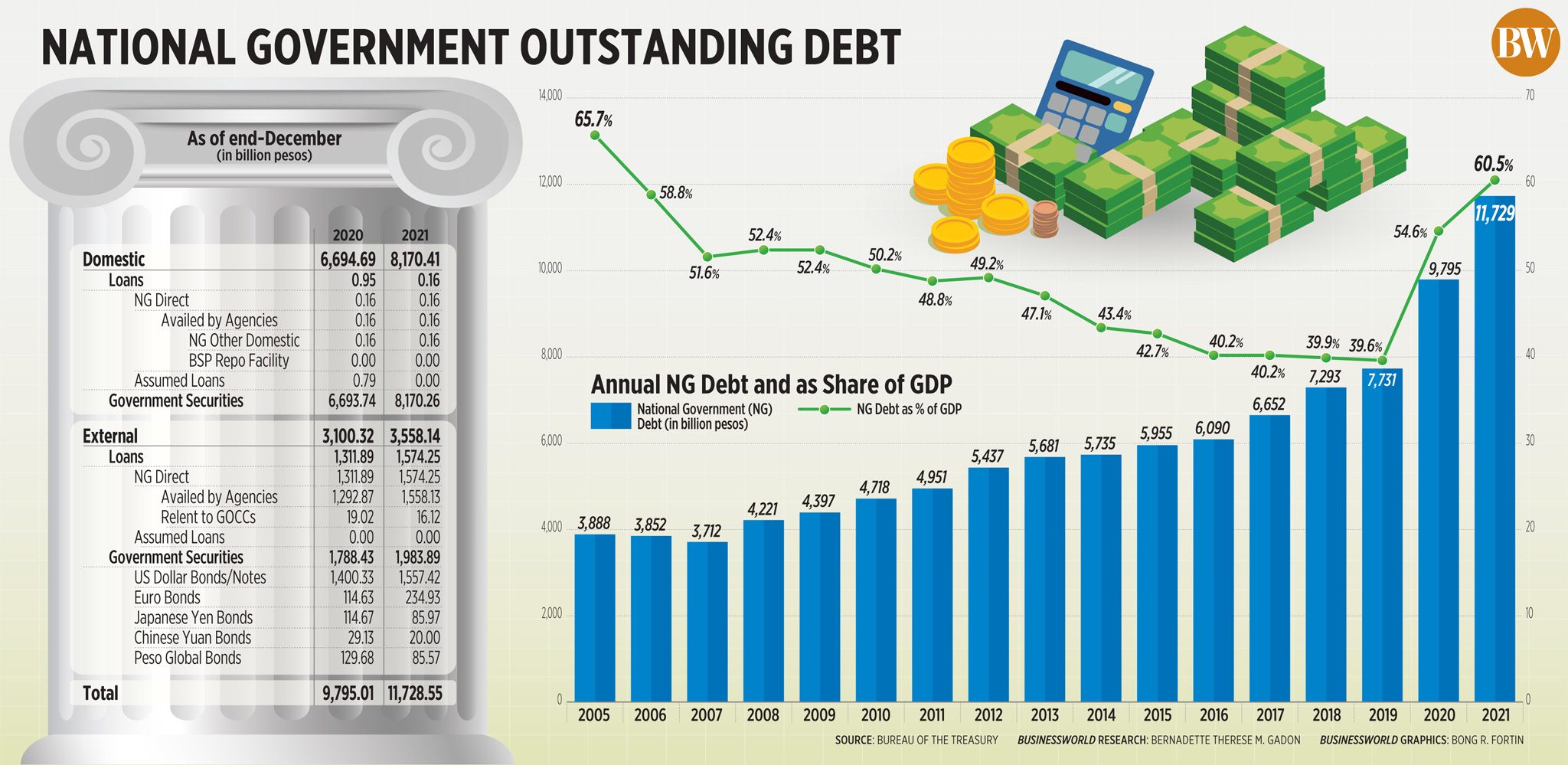

THE National Government (NG) recorded P11.73 trillion in outstanding debt as of end-December, pushing the debt-to-GDP ratio past the international threshold, preliminary data from the Bureau of the Treasury (BTr) showed.

Government debt over the course of 12 months grew by nearly P2 trillion, or by 19.7% year on year.

The year-on-year debt growth was slower than the 26.7% expansion in 2020 due to better fiscal performance and lower financing requirements, the BTr said in a statement on Tuesday.

Month on month, the debt stock slipped by 1.7%, mostly because of the net redemption of domestic securities, BTr added.

The end-December debt figure meets the government’s P11.73-trillion projection.

However, this meant the debt-to-GDP ratio is now at 60.5%, higher than the 54.6% a year earlier and slightly above the 60% threshold considered as manageable by multilateral lenders for developing economies. It is also the highest debt-to-GDP ratio since the 65.7% seen in 2005.

“(The ratio is) still within the accepted sustainable threshold as the economy continues to recover from the effects of the pandemic,” the Treasury said.

The Philippine government has ramped up borrowings to finance its pandemic response, which included the purchase of coronavirus vaccines.

Domestic borrowings represented 69.7% of the debt total, while the rest was sourced from foreign creditors.

As of end-December, domestic debt fell by 3.2% to P8.17 trillion from the previous month, but grew by 22% year on year.

This consisted of P8.17 trillion in government securities, which went up by 3.4% from P7.9 trillion as of end-November and increased by 22.1% from 2020.

The state’s other domestic obligations stood at P156 million, after its P540-billion loan from the central bank was repaid in December.

The growth of local debt is “in line with the domestic borrowing program which favors domestic issuance to mitigate foreign exchange risk and support local capital market development,” BTr said.

Meanwhile, foreign debt inched up by 1.9% to P3.56 trillion month on month and increased by 14.8% from full-year 2020.

“For December, the increment in external debt was attributed to the impact of Peso depreciation against the USD (US Dollar) amounting to P40.87 billion and the net availment of external obligations amounting to P33.83 billion,” the Treasury said.

Broken down, foreign debt included P1.57 trillion in loans, which rose by 1.9% since end-November.

Government securities also edged higher by 1.1% month on month to P1.98 trillion.

This included P1.56 trillion in dollar notes, P235 billion in euro bonds, P86 billion in yen securities, P19.9 billion in yuan notes and P85.6 billion in peso global bonds.

Total outstanding guaranteed debt jumped by 1.5% to P423.91 billion as of end-December from a month earlier.

However, outstanding guaranteed debt slid by 7.5% from a year earlier.

The end-2021 debt level is better than expected, UnionBank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion said.

“This is may be due to the better-than-expected performance of the economy toward the end of 2021, with improving revenue collection performance versus 2020,” he said in a Viber message.

The economy grew by 5.6% in 2021, thanks to a 7.7% gross domestic product expansion in the fourth quarter as lockdown restrictions were loosened.

Mr. Asuncion said the debt-to-GDP ratio has improved since the 63.1% seen in September.

“This is welcome news and may bode well for markets and partially pacify uncertainties hovering over the country’s fiscal situation, especially as the national elections draw near.” — Jenina P. Ibañez