New demands in a post-pandemic period

Controversial French writer Michel Houellebecq recently declared that the world will be just the same after the coronavirus — only worse. Houellebecq described COVID-19 as a “banal virus” with “no redeeming qualities.” He warned that self-distancing and home-working accelerate isolation — the “obsolescence of human relationships.”

Indeed, incidents of depression and domestic abuse are reported to be higher now, worldwide.

In addition to assaulting human relationships, this pandemic is making new demands and putting pressure first on governments; second on markets; and third on science.

FIRST: DEMANDS ON PUBLIC POLICY

Governments face formidable challenges now. In normal times, government intervention in key economic sectors would be met with criticism, if not disdain. But in a crisis, a ubiquitous government is not harshly questioned. It is even expected.

In addition to seeking a coherent public package to combat the pandemic, MSMEs and big corporates now clamor for government support.

Under its proposed stimulus package, the Philippine Congress is exploring how more loans and guarantees can be granted with negative interest rates. These effectively translate into grants. If this will help small business survive and keep jobs, this might be worth pursuing. It’s a call of Congress.

Of the US economy, Nobel laureate Paul Krugman recently affirmed, “the principal job of economic policy right now isn’t to provide stimulus.” He pointed out that instead of sustaining employment and GDP, government must instead “provide life support — to limit the hardship of Americans who have temporarily lost their income.”

Since this global crisis involves human lives and jobs, this must also be true for the Philippines.

If we go by this principle, Congress may wish to pace its strategies into modules. It is too daunting for our economic managers to source funding for health mitigation, social protection and growth stimulus — all in one package.

Now, more than ever, the national budget is finite. While a few hundred billion pesos in additional public spending may be accommodated through a supplementary budget, a limit should be recognized. Funding is not free and easy.

In this time of the pandemic, heavy lifting by governments and monetary authorities around the world requires massive funding. This is achieved through 1.) raising higher revenues, 2.) more borrowings, and, 3.) public debt monetization. In this regard, during an economic lockdown, revenue-raising is futile. In the Philippines, the public sector has already tapped domestic and external capital markets for higher borrowing. The Bangko Sentral has also monetized public debt through its provisional advances.

What other recourse do we then have? What is more imperative at this time?

As we stressed in previous columns, the viciousness of the pandemic necessitates that our Congress and economic managers prioritize public health safety. Social protection and economic recovery can be pursued as a second plank of public policy.

In the spirit of recognizing trade-offs and as Congress had passed the Bayanihan to Heal as One Act, it must make the hard choice of respecting the presidential authority to realign the budget. Some infra projects should be allowed carry-over to 2021. Not only is this a matter of urgency. It is also a practical option. After all, there is limited public capacity to execute multi-year projects of the Build, Build, Build (BBB) Program. Moreover, with the approaching rainy season, and after two months of lockdown inactivity, the Department of Public Works and Highways and Department of Transportation can only do so much in the remaining six months of 2020.

Again, wise words from Krugman: “We’re going into the economic equivalent of a medically induced coma, in which some brain functions (must be) temporarily shut down to give the patient a chance to heal.” Let us heal as one.

As if the BBB Program is not already enough concern, several days ago, freelance writer William Pesek alleged that overseas sovereign credit raters are getting anxious and thus, the Philippine government should be more concerned about a different BBB: the nation’s credit rating.

Pesek needs to recognize that any possible change in credit ratings are understandable during this time of crisis. This is true not just for the Philippines, but for all nations as the global economy plunges into a recession. In the score board of the International Monetary Fund (IMF), except China and India, all major country groupings are likely to show contraction in 2020. While the growth forecasts of the National Economic and Development Authority (NEDA) and Bangko Sentral ng Pilipinas (BSP) are lower, no less than the Fund expects the Philippines to ride out 2020 with a modest growth of 0.6 percent, not a recession anyway. We know Pesek knows that as a rule, credit rating agencies are absolutely pro-cyclical.

SECOND: NEW STRESS ON MARKETS

The pandemic demands markets that work. Around the world, there was a deafening absence of resilience in supply chains for health gear like masks and gloves; health equipment like testing kits and ventilators; and health facilities like quarantine wings, hospital beds, and ICU units. Software apps for contact tracing and monitoring are also scarce.

Markets were not prepared for the viral outbreak. Risk management clearly failed to provide markets with intelligence and appropriate mitigants. This is despite Bill Gates’ warning a few years ago about an approaching viral pandemic.

Markets are now only playing catch-up. The US, UK, and China are racing to produce a vaccine. Four Chinese companies were reported to be testing vaccines on humans. Israel was also reported to have succeeded in isolating a key coronavirus antibody in its Institute for Biological Research.

This game of catch-up is aggravated by the virus’ rapid spread and mutation. This means we are all vulnerable to a second surge.

Since current research for a potential vaccine has been based largely on the genetic sequence of earlier strains, the outcome may be rendered less relevant and less effective. We strongly hope this will not happen.

THIRD: LEVELED-UP SCIENCE

This brings us to the demands now put on science. The pandemic clearly demands the centrality of science in public policy. This pandemic cannot be reduced to no less than a global health issue with fatal consequences. Rather, approaches to defeat it require some balancing and careful consideration of each country’s economic and social survival.

Science works well with a multidisciplinary approach. Analysis of the current medical issues can be enriched by economics, model building, statistics, political science and psychology. In utilizing varied strategies and engaging other expertise there can be a clearer prognosis of what civil society can expect in the next few weeks and months.

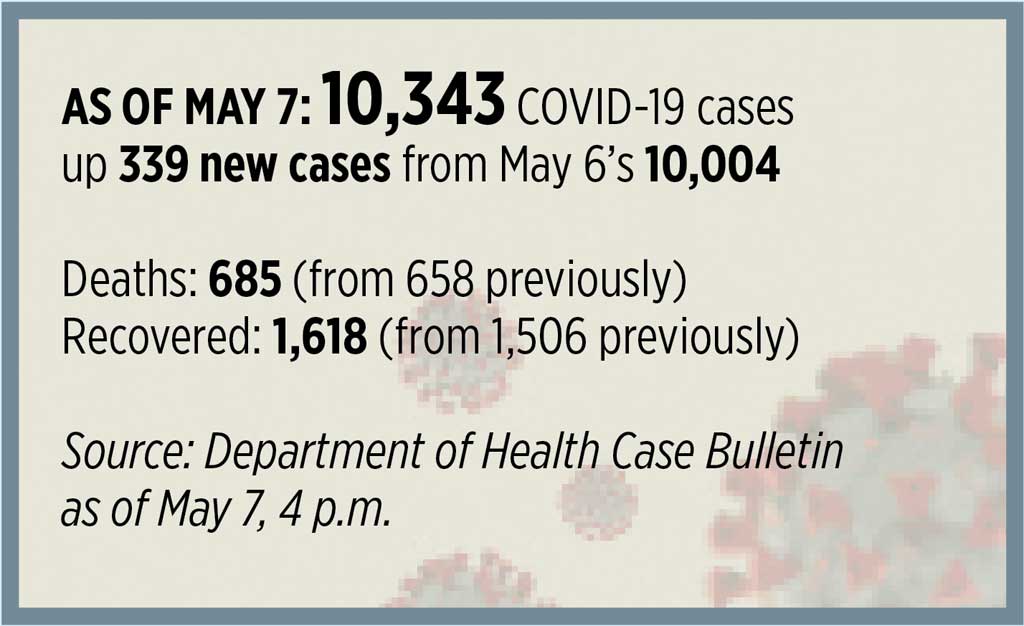

With better results from mass and random testing, as well as contact tracing, the Philippines’ Inter-Agency Task Force on Emerging Infectious Disease would have a more solid basis to make recommendations to the Executive and to formulate guidelines and protocols. Protecting and promoting the safety of the general public will be more data and evidence-based, leading to the desired outcome of a flattened epidemiological curve.

Business activities can then more carefully resume with appropriate safeguards.

Diwa C. Guinigundo is the former Deputy Governor for the Monetary and Economics Sector, the Bangko Sentral ng Pilipinas (BSP). He served the BSP for 41 years. In 2001-2003, he was Alternate Executive Director at the International Monetary Fund in Washington, DC. He is the senior pastor of the Fullness of Christ International Ministries in Mandaluyong.