Outdoor building solutions for your commercial and residential space

In creating your home’s or business’s exterior, there are a lot of factors to consider aside from the aesthetics. The outdoor space is more exposed to different elements and weather conditions—so it is important to take note of the durability, usage, functionality, and of course, the style it provides to the overall look of your space. Here are some outdoor products from P.tech that are surely beneficial for any commercial or residential space:

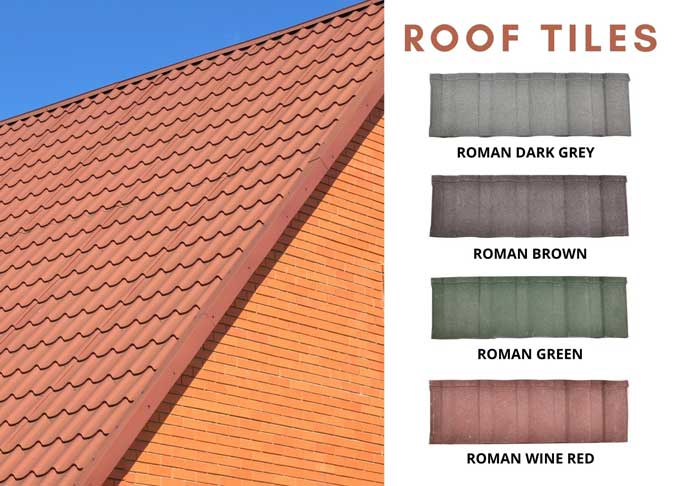

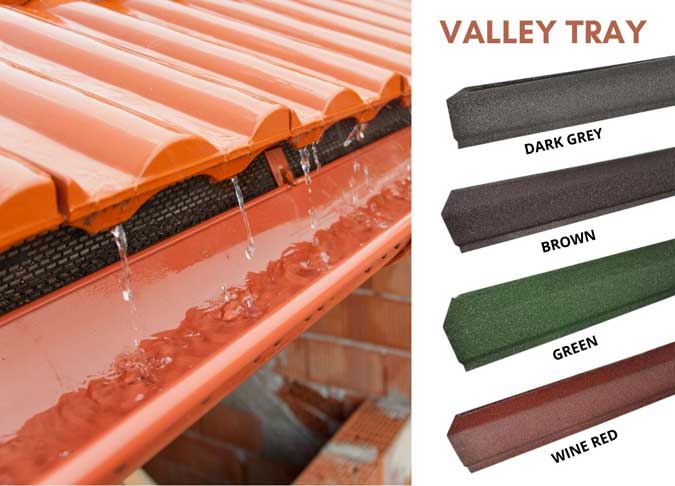

Roofing

In upgrading the overall look of your exterior, roof tiles are a top-notch choice. These types of roofing are designed to provide energy efficiency, longevity, and easy maintenance. These are lighter than other roofs as it is made from high-quality steel with a sanded finish for added style and safety while installing.

To prevent leaks from occurring, it is also essential to install some roof valleys to save you unnecessary damage in the future. It will create runoff pathways to direct water flow from the roof planes into a valley trough. These roof valleys are made from top-grade quality materials ensuring long-lasting protection for your roof.

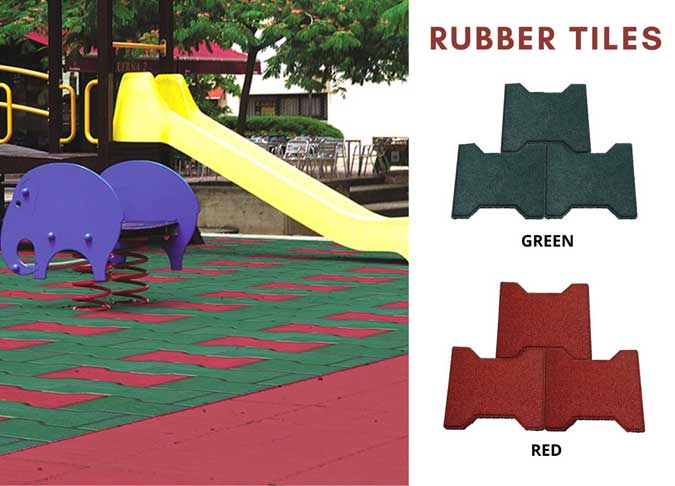

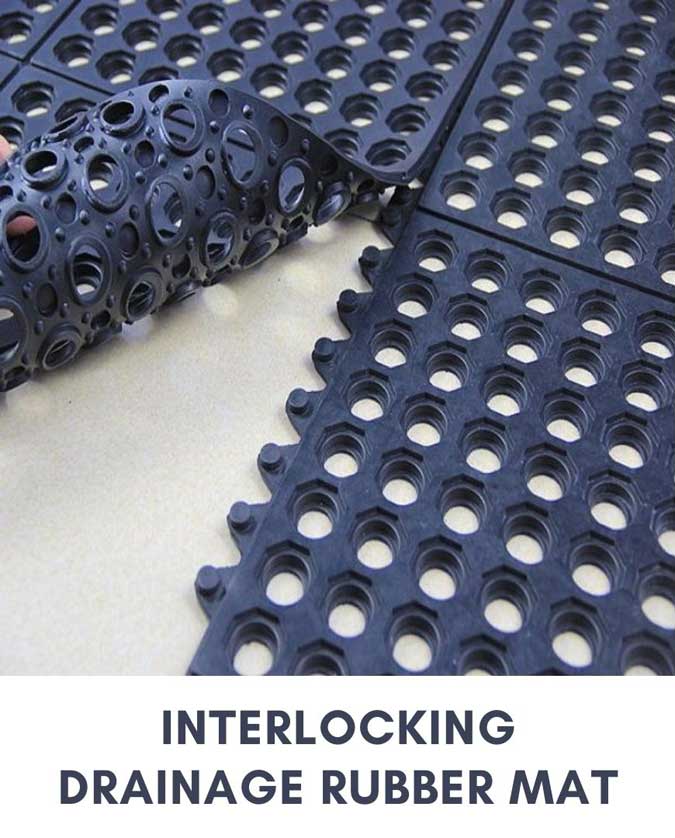

Flooring

For long-lasting flooring, it is a must to choose something that can withstand extreme weather elements as well as a high volume of foot traffic in busy areas of your home and business space. One of the most highly recommended options is the cement tiles. It is made with high-grade materials that are 100% waterproof and are highly durable, This type of flooring is also designed with a matte surface to ensure non-slip advantages while perfectly mimicking real wood or stone for a more natural feel.

Another safe and excellent addition to the floor is rubber tiles. These are designed to prevent breaking your floors due to heavy impacts. It comes with top-notch features including water, compression, and impact resistance, anti-skid, shock absorption, and large friction. This type of tile is very easy to install since it requires no glue or adhesive—just like laying out a puzzle mat.

Aside from rubber tiles, another type of flooring is the interlocking drainage rubber mat. It is made to provide a safer and easier solution to spaces that are normally wet and slippery. The holes in the rubber mat allow water to be filtered while keeping the surface dry and safe for small children and the elderly. Installing is also hassle-free since you only need to interlock the sides to create a wide rubber matted surface.

Landscape

If you’re aiming for a cleaner and safer option to install in your outdoor space, opt for some high-quality eco grass. One of the best qualities of faux grass is it never withers. Maintaining is also effortless since lawn mowing and watering are not essential to keep it in good shape. You can ensure a green, vibrant, and aesthetically pleasing outdoor space for years.

Walls

An outdoor wall panel is an excellent way to give any outdoor structure or building an attractive finish. It offers the quality, feel, and characteristics of wood, but is more robust and eco-friendly. It is very simple and convenient to install due to its profile with a standard size

Another exemplary addition to your outdoor space is the wall cladding. It is made with long-lasting strength, resistance to water, moisture, and decay. It is also very easy to maintain, cost-effective, and provides an extra layer of insulation. The overall appearance of your outdoor space is largely determined by the exterior wall cladding, it can turn your walls into an exquisite and modern structure.

Doors

Apart from its sophisticated look, a steel door is also one of the most durable kinds of door materials making it safer and more secure. It can withstand strong weather conditions and is highly resistant to warping and distortion. To add protection to your steel doors, consider installing a door canopy. It is made to prevent heavy rains, strong winds, as well as scorching heat from the sun from causing extensive damage to your doors and windows. It will also prevent other elements in your outdoor space from degrading quickly saving you more repairs in the future.

Start your building or renovating projects and get all your needed materials from P.tech, exclusively available at Wilcon Depot. Visit any of their 65 stores nationwide and explore the limitless product selections that Wilcon offers ranging from Tiles, Sanitarywares, Plumbing, Furniture, Home Interior, Building Materials, Hardware, Electrical, Appliances, and other DIY items.

Adhering to health and safety protocols to fight against COVID-19, Wilcon continuously implements necessary precautionary measures inside all of its stores to ensure their employees and valued customers’ safety, health, and well-being a priority.

You can also browse their Digital Catalogue and shop conveniently while at home through your personal shopper with the Browse, Call, and Collect/Deliver service. BROWSE the items you want to purchase at shop.wilcon.com.ph and www.wilcon.com.ph, CALL/Viber/text the Wilcon branch of your choice, and schedule a COLLECT/DELIVER. For the list of participating stores with their pick-up and delivery contact details, click this link: www.wilcon.com.ph/content/328-bcc-branches.

Another shopping alternative is the Wilcon Virtual Tour. An online shopping option wherein customers can contact the nearest Wilcon store via Facebook Messenger App. Customers can contact the nearest stores, and the Wilcon team will take you on a virtual tour where you can explore the available products inside their physical stores.

Wilcon also provides contactless payment options to its customers like bank transfers, GCash, PayMaya, InstaPay, PesoNet, WeChat, and Alipay for customers’ convenience.

For more information about Wilcon, you can log on to www.wilcon.com.ph or follow their social media accounts on Facebook and Instagram, and subscribe and connect with them on Viber Community, LinkedIn, and YouTube

BulacanSol now plays a significant role in One MERALCO Group’s long-term sustainability agenda.

BulacanSol now plays a significant role in One MERALCO Group’s long-term sustainability agenda.