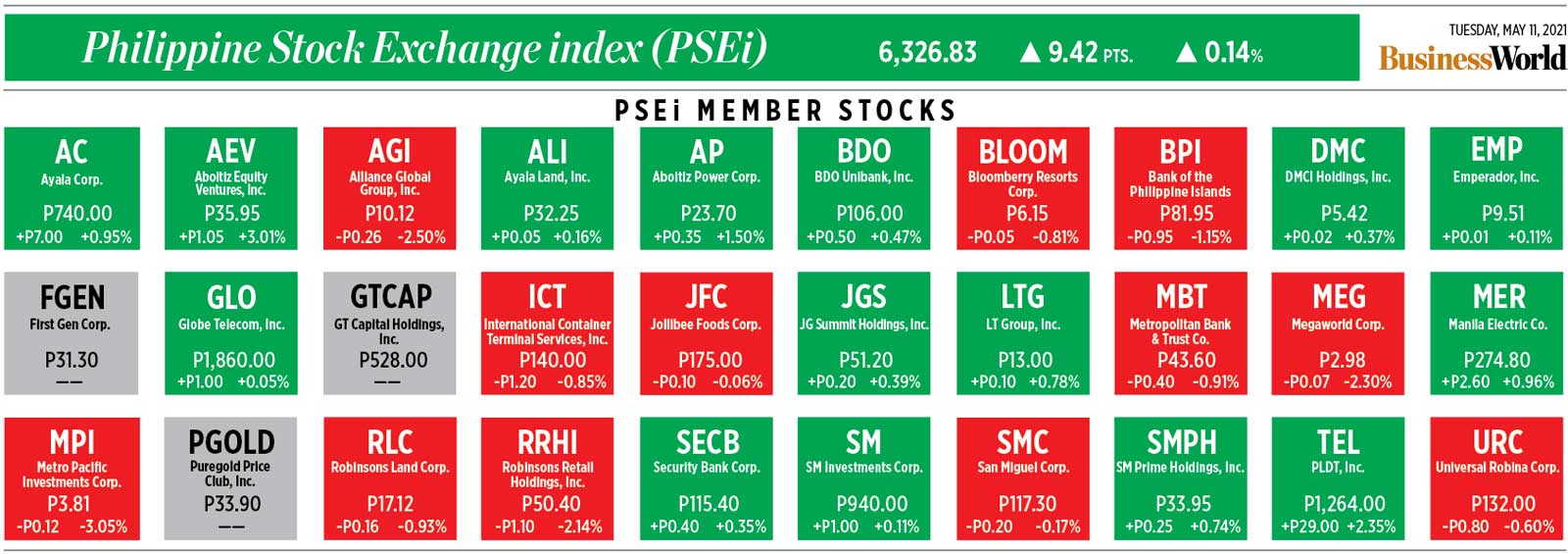

PHILIPPINE shares went up on Tuesday on last-minute bargain hunting following the market’s decline as data showed the economy contracted worse than expected in the first quarter.

The Philippine Stock Exchange index (PSEi) went up by 9.42 points or 0.14% to close at 6,326.83 on Tuesday, while the all shares index increased by 1.25 points or 0.03% to finish at 3,907.96.

Philstocks Financial, Inc. Senior Research Analyst Japhet Louis O. Tantiangco said last-minute bargain hunting after the index’s drop during the day caused it to post a gain.

“Investors took opportunity out of the market’s dip within the trading day caused by the dismal Q1 2021 GDP (gross domestic product) figures. The progress in the country’s COVID-19 (coronavirus disease 2019) vaccine procurement helped spur positive sentiment. Trading lacked conviction,” Mr. Tantiangco said in a Viber message.

The economy contracted for a fifth straight quarter in the January to March period to log its longest recession since the Marcos era, the Philippine Statistics Authority reported on Tuesday.

Philippine GDP declined by 4.2% in the first quarter, better than the 8.3% drop in the previous three-month period but worse than the 0.7% dip seen in January to March 2020. The first-quarter print was also steeper than the -2.6% median estimate in a BusinessWorld poll of 18 analysts conducted last week.

The government is targeting GDP growth of 6.5-7.5% this year, but is expected to revisit this goal in the coming weeks.

Meanwhile, the country received 193,050 doses of a vaccine developed by Pfizer, Inc. on Monday evening, which is part of the World Health Organization’s COVAX facility.

First Metro Investment Corp. Head of Research Cristina S. Ulang, meanwhile, said the country’s first quarter economic performance was “not much of a shocker as [a] worse number was widely expected.”

“[First-quarter] corporate earnings were largely resilient. Market is moving on, watchful of emerging policy drivers like more of BSP (Bangko Sentral ng Pilipinas) accommodation in this week’s meet and a further relaxation of mobility restrictions come May 15,” Ms. Ulang said in a separate Viber message.

Sectoral indices were split on Tuesday. Mining and oil fell by 286.03 points or 2.92% to 9,491.17; financials lost 4.36 points or 0.31% to 1,399.71; and industrials went down by 13.19 points or 0.15% to end at 8,655.37.

Meanwhile, holding firms gained 18.16 points or 0.28% to 6,339.02; property improved by 8.79 points or 0.28% to 3,056.86; and services added 0.05 point to close at 1,460.24.

Value turnover inched up to P4.64 billion on Tuesday with 9.95 billion shares switching hands, from the P4.57 billion with 2.05 billion shares traded on Monday.

Decliners outnumbered advancers, 122 against 82, while 43 names closed unchanged.

Net foreign selling went up to P347.88 million on Tuesday from P329.46 million on Monday. — K.C.G. Valmonte