IN THE US, sales of meat at grocery stores are down by more than 12% from a year ago. In Europe, overall beef demand is predicted to fall 1% this year. And in Argentina, home to one of the world’s most carnivorous populations, per-capita beef consumption has dropped almost 4% from 2020.

While some of those numbers might seem small, even a tenuous decline is a rarity in the meat world, which until the pandemic hit last year saw years-long growth in consumption to ever-new record highs. Now demand is waning across the globe in what could signal the start of a new broad shift away from animal protein.

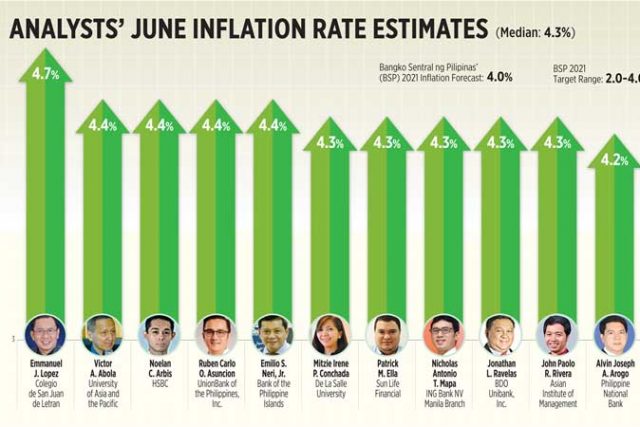

The biggest demand deterrent has been a relentless climb for prices that started in October, propelled higher by tightness in global supplies of animal feed and supply-chain disruptions. The United Nations’ global meat price gauge has risen for eight straight months, the longest streak since 2011, and is near a multi-year high. The price shock comes at a time when consumers are still dealing with COVID’s economic fallout, forcing families from Brazil to the Philippines to buy less and swap in other proteins like eggs if they can afford it, or instead just fill their plates with rice or noodles.

For Eudelia Pena, a 48-year-old who lives in New York City with her husband and one of her three children, meat has become a luxury. Retail ground beef prices in the US have surged about 6% since before the pandemic, while whole chickens are up about 9% and pork chops jumped 13% to roughly $3.88 a pound in May, government data show. That’s making animal protein almost unaffordable for Pena’s family, which is now down to one income after she lost her job at a clothing store.

“With what I spend today, I don’t bring back even half of what I used to,” she said. “I used to buy two chickens. Now I just buy one and split it in half.”

But demand has waned with previous financial downturns, only to bounce back. What’s different now, of course, is the plant-based boom. More consumers are choosing to forgo meat because of concerns about the environment, animal welfare and health. And that shift isn’t just limited to California’s fad dieters and East London hipsters. Increasingly, it’s being taken up across the world and across income groups — so much so that the twin forces of inflation and food trends are now coming together to signal a seismic shift away from meat eating in the world.

“Meat is under threat like possibly never before,” said Tom Rees, industry manager at market researcher Euromonitor International in London.

“When meat becomes too expensive to eat, then absolutely consumers will move away from it if they can’t afford it. The fundamental changes come about more from consumers shifting” in their attitudes about things like health and climate impact, Rees said.

Take the case of Mario Cruz, a public school teacher who lives north of Manila in the Philippines’ Bulacan province. As the country suffered through one of Southeast Asia’s biggest economic hits from the pandemic, Cruz started growing vegetables in his backyard last year to feed his family of four. Before that, he used to spend almost P2,000 a week on meat. Now, he buys almost nothing. Cruz, a diabetic, said he planted the vegetable garden “to meet our needs and survive,” but it’s had an unexpected outcome.

“We’re now on a mostly plant-based diet, and I feel healthier,” he said.

In some parts of the world, the change to a plant-based diet is coming amid the proliferation of more alternatives like Beyond Meat veggie burgers. But in others, it’s just a back-to-basics approach of eating more beans and vegetables. In either case, climate campaigners might rejoice over the shift away from meat. By some measures, agriculture accounts for more global greenhouse gas emissions than transport, thanks in large part to livestock production.

But this shift can’t be seen as some kind of universal good. In fact, for many, forgoing meat is exacerbating one of the deepest inequalities in the world: who gets enough food with enough sources of nutrition, and who doesn’t.

Insufficient access to livestock and other animal-sourced foods is a major factor behind high rates of malnutrition that persist in many parts of Asia and Africa, UN Nutrition warned in June. Analysis from the group shows that meat and other animal products can help combat the undernourishment that causes stunting in about a fifth of young children worldwide.

“Vegetables, fruits, legumes and cereals are essential. But nutrient-dense animal products are uniquely effective for pulling young children back from the brink of acute and chronic malnutrition,” Naoko Yamamoto, the chair of UN Nutrition and the World Health Organization’s assistant director-general for universal health coverage, said in a statement.

That’s a point deeply felt by Fabiana Ribeiro da Silva, a 36-year-old mother of four who lives on the outskirts of Colombo in Brazil’s southern state of Parana. She’s been forced to cut back on spending after losing her job in elderly care. Before the pandemic, chicken was on her family’s dinner table almost daily and beef once a week. Now, they mostly eat just rice and beans. Once in a while she gets some temporary cleaning work, which allows the very rare purchase of some eggs or chicken. Her three-year-old is only able to have a bit of milk when there’s extra money to come by, and she worries about her five-year-old daughter, who’s started to lose weight.

“She is not eating much,” Da Silva said.

There’s no one data point that’s the smoking gun showing falling global meat demand. That’s because most comprehensive measures estimate consumption only in relation to production. It’s assumed that when supply is available, it will all be eaten. And livestock production is expected to grow this year as China recovers from an outbreak of African swine fever, a pig-killing disease that had devastated the country’s hog herd. Given that formulation, the United Nations’ Food and Agriculture Organization estimates global per-capita meat consumption to grow 1.2% in 2021 after contracting 0.7% last year, with its forecast mostly driven by the scale of the rebound for China’s pork production.

Regional sales data that show declines from last year may also be somewhat skewed because of the surge in grocery buying during the first few months of the pandemic, partly fueled by restaurant shutdowns. Still, interviews with consumers, food sellers, analysts and experts across the globe point to a clear trend: meat demand is under what looks to be a long-term threat.

Even in China, where meat inflation is now relatively tame compared with some other regions, plant-based eating is gaining new traction, according to Darin Friedrichs, a Shanghai-based analyst at StoneX Group, Inc. Younger generations are increasingly health conscious and more likely to opt for less meat or poultry, while trendy and upscale restaurants now serve plant-based options, he said.

Meanwhile, things have gone quiet for Ricardo Lamboglia who works as a butcher in the Mataderos neighborhood of Buenos Aires. The area — nicknamed Nueva Chicago because of its similar historic roots as a hub for slaughterhouses and meat shops — used to be buzzing, with “hardly room to move” on the sidewalks where sellers advertise their wares on colorful signs.

“The pandemic has killed us,” Lamboglia said pointing to the mostly empty street from the open-air entrance of his store.

“We used to sell 4,000 to 5,000 kilos a month, and it’s now more like 2,000. People these days are counting their pennies.” — Bloomberg