Entertainment News (07/09/21)

Warner’s ADA Asia partners with Lilystars Records

ADA Asia, part of Warner Music Group’s independent artist and label services division, has announced jointly with Lilystars Records, an independent record label based in Manila, that they have formed a strategic alliance. The deal will see ADA Asia support the Lilystars label — collaborating on new releases, catalogues, brand partnerships, as well as live and synchronization deals — marketing and distributing its artists’ music across South East Asia and beyond. Artist-owned independent record label Lilystars Records was founded by Clem Castro, the frontman of alternative rock and indie pop band Orange & Lemons, which led the revival of Original Pilipino Music in the early 2000s. Currently, the label’s roster of artists includes ADR, Bryan Estepa, Day & Dream, Dey Rose, Dragonfly Collector, Dustybuns, Galaxy Lodge, Hey, Jane!, Kubra Commander, Lily On The River, Orange & Lemons, Paper Satellites, Parasouls, Project Orange, The Bernadettes, The Camerawalls, The Geeks, The Gentle Isolation, The Midnight Greetings, The Sun Days, Them Bloody Royals, Sunflower Station, and Svvell. Lilystars Records is the first partner in the Philippines that ADA Asia has signed a strategic cooperation agreement with.

Itchyworms releases music video

POP-ROCK band The Itchyworms kick off their 25th anniversary in the music industry with the official video release of “The Life I Know,” a piano-backed ballad off their fifth studio album, Waiting For The End To Start — released on digital music platforms via Sony Music Philippines. Filmmakers Marie Jamora and Jason McLagan of Indie Pop Films with animation by Apartment D, the music video is a first of its kind in the Philippines to feature a stop-motion animation format that is embedded with Filipino cultural sensibilities.

Two new HBO Asia original docus out in July

HBO’s six-part, half-hour documentary series, Catch and Kill: The Podcast Tapes, and HBO Asia Original documentary series Traffickers: Inside the Golden Triangle, will both be released this month. Catch and Kill: The Podcast Tapes brings to life Ronan Farrow’s hit podcast. Intimate, revealing interviews with whistleblowers, journalists, private investigators and other sources, were conducted for the Pulitzer-Prize winning journalist’s podcast and bestselling book Catch and Kill: Lies, Spies and A Conspiracy to Protect Predators. The series expands on the podcast and the book, with never-before-seen footage and new insights into this culture-shaking story. It will debut with two back-to-back episodes on July 13, 9 a.m., exclusively on HBO and HBO GO. Two new episodes will air back-to-back every subsequent Monday at the same time. Meanwhile, Traffickers: Inside the Golden Triangle exposes the secretive epicenter of illicit drug production inside the Golden Triangle. The documentary series premieres exclusively on HBO GO from July 23 and follows the rise and demise of three infamous drug kingpins in Thailand, Myanmar, and Laos. The three-part hour-long documentary series is the first documentary that lifts the lid on the hidden world of drug production in the Golden Triangle and dives into this mysterious secretive criminal underbelly revealing tales of some of the most infamous drug lords in the region. In English, Thai, Burmese and Lao, the documentary series was filmed on location in the Golden Triangle, Thailand, Burma, China, the USA, Malaysia, the Philippines and Australia. Stream or download Traffickers: Inside the Golden Triangle on HBO GO.

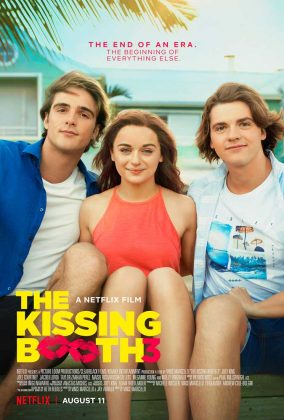

The Kissing Booth 3 out on Netflix in August

THE THIRD installment of The Kissing Booth will premiere in August, Netflix announced. It’s the summer before Elle heads to college, and she’s facing a hard decision: whether to move across the country with her boyfriend Noah or fulfill her lifelong promise to go to college with her BFF Lee. Directed by Vince Marcello, the series stars Joey King, Joel Courtney, Jacob Elordi, Taylor Zakhar Perez, Maisie Richardson-Sellers, Meganne Young, and Molly Ringwald. The story is based on the books of the same title by Beth Reekles. The Kissing Booth 3 premieres Aug. 11.

South Korea’s Voice 4 is now on iQiyi

THE FOURTH season of the South Korean crime thriller series Voice is now streaming on iQiyi and iQ.com. Created by screenwriter Ma Jin-won and director Shin Yong-hwi, Voice 4 trails Derek Jo (Seung-heon), the team leader of the LAPD Olympic Division’s Gang Unit, as a hunt for American gangsters takes him to South Korea. However, his sister is murdered when she witnesses a crime, prompting him to collaborate with the Golden Time Team led by Kang Kwon-joo (Ha-na) to track down the suspect, Circus Man. The show features a mix of South Korea’s veteran and upcoming actors, including returning cast members Lee Ha-na, Son Eun-seo, Kim Joong-ki and Song Boo-gun along with new cast members Song Seung-heon and Kang Seung-yoon (of the boy group Winner). Episodes of Voice 4 will drop every Saturday and Sunday on iQiyi. Download the iQiyi app or log in to www.iQ.com.

J Loonyo, Rockboi salute frontliners in song

THREE months after the success of his trendsetting summer dance anthem, DJ Loonyo has released his second single, “Kaya Natin ‘To.” In line with the single’s release, a month-long video contest is being held on Facebook with the hashtag #KayaNatinTo and #SalamatFrontliners. The objective is to create a video honoring the hard work of frontliners. Winners will get a chance to win P20,000 and will be announced on DJ Loonyo’s Kumu livestream on July 31. Stream “Kaya Natin ‘To” on Spotify and Apple Music.

My Sunset Girl out soon on iWantTFC

METRO Manila Film Festival (MMFF) 2020 Best Actress Charlie Dizon stars in a new iWantTFC mini-series. My Sunset Girl follows 18-year-old Ciara who suffers from xeroderma pigmentosum, an illness that could turn deadly if she is exposed to sunlight for too long. As a result, Ciara is unable to travel the world, but she makes up for this by watching travel vlogs and making friends online. She develops a bond with a travel enthusiast Lucas (Jameson Blake) who promises to help her accomplish her travel bucket list. But her strict mother Melissa (Mylene Dizon) and Lucas’s father Elias (Joem Bascon) get in the way. Co-produced by Dreamscape Entertainment and All Blacks Media, the iWantTFC original series is directed by Andoy Ranay. My Sunset Girl will start streaming on the iWantTFC app (iOs and Android) and on iwanttfc.com on July 14, 8 p.m.

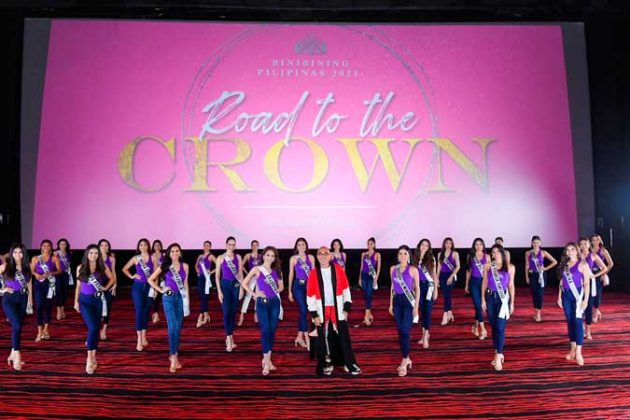

Boy Abunda in Binibining Pilipinas contest primer

THE BINIBINING Pilipinas 2021 candidates faced TV host Boy Abunda in a quick Q&A mentorship session at the Gateway Mall Atmos Cinema in Araneta City as part of this year’s Road to the Crown pageant primer. The quick but intensive and rigorous Q&A training with the King of Talk tested the contestants’ wit, spontaneity, and grace under pressure. Livestreamed via the official YouTube channel of Binibining Pilipinas, the 2021 primer bared the candidates’ ability to survive the interview segment of the pageant. The Binibining Pilipinas 2021 Grand Coronation Night will be aired live on July 11 at 9:30 p.m. on A2Z Channel, Kapamilya Channel, and Metro Channel. It will also be simultaneously livestreamed on iWantTFC and the official Binibining Pilipinas YouTube page.

Gov’t song writing contest deadline set on July 23

GOVERNMENT workers with a talent for song writing may join the Civil Service Commission (CSC) National Song Writing Contest. The deadline for submission of entries is on July 23. Job Orders and Contracts of Service may also join the contest, which is part of the upcoming 121st Philippine Civil Service Anniversary celebration in September. Regional and national winners will receive cash prizes, and the winning entry will be featured as the competition song in the next Government Choral Competition, also hosted by the CSC in partnership with the Cultural Center of the Philippines. Contestants may submit a maximum of two entries, and each entry must not exceed four minutes. They can be in any Filipino language or dialect (including the English translation), and should adhere to the PCSA 2021-2031 theme, “Transforming Public Service in the Next Decade: Honing Agile ang Future-Ready Servant-Heroes.” Interested parties may download the complete mechanics and entry form from visit the CSC website at www.csc.gov.ph, or send an e-mail to ro04@csc.gov.ph or pcsa@csc.gov.ph.

BT21 x Sunsilk packs available on Lazada

FANS of the global K-pop sensation BTS fan are probably also BT21 fans. BT21 is a collection of characters created by the BTS members with Line Friends. Sunsilk has now come out with an official BT21 merchandise collection. The limited edition BT21 x Sunsilk packs will be available on July 12 on Shopee and on July 14 on Lazada. Each BT21-branded box includes two 350ml Sunsilk bottles as well as a limited-edition official BT21 pouch featuring the various characters. The BT21 x Sunsilk packs are available for P699 per box or P2,696 for the four sets.