Christmas concert goes online

VEHICLE manufacturer and automobile exporter MG Philippines brings OPM artists together in a special online edition of MG Live! titled Salubong: The Christmas Concert which will be streamed at KTX.ph on Dec. 10 and 11, 8 p.m. Directed by Paul Alexei Basinillo, Salubong is staged with by ABS-CBN’s ASAP Studio 10. The show will include performances by urban/hip-hop singer CLR, rock band Sponge Cola, and the Aegis. MG Philippines has always championed and celebrated Original Pilipino Music (OPM) through its MG Live! concert series. Aside from enjoying the performances, viewers can sing-along as song lyrics will be flashed onscreen. Shout-outs can also be sent to loved ones around the world. Send a personalized greeting via Salubong using the event’s Salu-Salo Social Wall comment and share board. Tickets are priced at P1,000.

BLASTER releases melancholy holiday song

FILIPINO experimental/alternative artist BLASTER adds to the Christmas tune canon with a new single that essays the profound sadness and grief of celebrating the holidays in the time of pandemic. His latest offering, “Pasko’y Hindi Na Masaya,” out via Island Records Philippines, is dedicated to the countless people whose lives were hit hard and are dreading experiencing Christmas after a loss. “This one is not really about celebrating Christmas,” says the eclectic singer-songwriter and producer. “It’s more of a tribute to those that we’ve lost, and a nostalgic yearning of how Christmas used to be.” The holiday track will be accompanied by a music video featuring a compilation of old Christmas videos from the 1980s and ’90s. “Pasko’y Hindi Na Masaya” is out now on all streaming platforms worldwide via Island Records Philippines.

Ortigas Malls hold holiday concert

THE ORTIGAS Malls celebrate Christmas with a star-studded cast for a meaningful cause. Christmas with the Stars is an online fundraising concert on Dec. 11, 7 p.m., on ktx.ph for the benefit of the Independent Production Workers Group (IPWG). The concert will feature Ogie Alcasid and Ian Veneracion, along with some of the country’s best OPM artists such as Gary Valenciano, Regine Velasquez-Alcasid, Martin Nievera, Jose Mari Chan, Lani Misalucha, The Company, Dingdong Avanzado, Noel Cabangon, Christian Bautista, Aicelle Santos, Ryan Cayabyab Singers, Lara Maigue, Gian Magdangal, Poppert Bernadas, Moira Lacambra, Krystle, Mr. Ryan Cayabyab and more. A ticket is free for every single or accumulated purchase receipt of P1,000 from any establishment of Ortigas Malls made between Nov. 4 to Dec. 10. Donation of P800 to P1,000 can also be exchanged for a ticket. Visit ortigasmalls.com to claim a ticket. Check out Greenhills Mall, Tiendesitas, Estancia, and Industria Facebook pages for more details!

Lighting ceremony marks beginning of UST’s Paskuhan

THE UNIVERSITY of Santo Tomas (UST) formally began its traditional Paskuhan celebrations with a lighting ceremony for its campus décor and the Eucharistic Celebration at the Plaza Mayor. It was livestreamed through the official UST Facebook page on Nov. 27. To illuminate the campus, 210,000 energy-efficient LEDs (light emitting diodes) will be lit every afternoon at 5:30 until 9 p.m. until the Feast of the Three Kings on Jan. 6, 2022. The theme, “The Pilgrimage: Our Road through Trials, Our Road to Triumph,” according to UST Secretary-General Rev. Fr. Louie Coronel, OP, EHL, is about the pilgrimage that Mary and Joseph took looking for a place where the child Jesus would be born. This pilgrimage is likewise experienced in the present as people look for answers to the many questions posed by the pandemic: how mankind will be able to conquer it, and when will we see its end. “Christmas Fireworks,” a musical piece composed by the Conservatory of Music Dean Antonio Africa, Ph.D., accompanied the lighting of the campus shown alongside a montage of previous year’s Paskuhan lighting ceremonies produced by the UST Communications Bureau. The decorations included the 70-foot-tall Christmas tree, life-sized figures of the Holy Family at the Arch of the Centuries, the Cross atop the Main Building, and many more lights framing the Benavides Park and campus streets. The Christmas Tree is made up of 50,000 blue LEDs that draw attention to the Star, with meteor lights interspersed to enliven the tree. Another 160,000 LEDs, majority of which were reused from previous years, brighten up the other campus trees and structures. Some lights form the shape of gothic arches as a throwback to a time when UST was still in Intramuros. UST’s Paskuhan season will culminate on Dec. 17, with the following activities: a celebration in its virtual Minecraft campus at 9 a.m.; and a Eucharistic Celebration at 5:15 p.m. This year marks the 30th anniversary of UST’s annual Paskuhan. The event will be livestreamed via the official UST Facebook page.

Tom Morello’s new album out now

TWO-time Grammy winner Tom Morello has released his new album, The Atlas Underground Flood, via Mom + Pop Music. The 12-track album is a follow-up to his sister album entitled The Atlas Underground Fire, which debuted this October to both fan and critical acclaim. Mr. Morello — co-founder of Rage Against The Machine, Audioslave and Prophets of Rage — has spoken at length in recent interviews that the collaborative process led to countless songs created during the pandemic, and a second album seemed almost inevitable. Featuring a slew of all-star collaborators including Nathaniel Rateliff, Jim James, IDLES, Ben Harper, Alex Lifeson, Kirk Hammett, X Ambassadors, Barns Courtney, Manchester Orchestra, Andrew McMahon in the Wilderness and more, Mr. Morello continues to showcase his signature extraordinary guitar-playing across these new genre-bending tracks. The release was accompanied by a YouTube exclusive livestream event on Dec. 3 where Mr. Morello talked about the origins and creative process for The Atlas Underground Flood. He was joined by some of the collaborators from the album for a track-by-track listening session, which featured a fan Q&A and the opportunity for viewers to donate to WhyHunger. The listening party can be viewed here: The Atlas Underground Flood Listening Party — YouTube

Wish Ko Lang holds month-long Christmas special

ACTRESSES Barbie Forteza, Kim Domingo, Max Collins, and Jean Garcia banner the line-up of Wish Ko Lang this December dubbed “Pasko ng Pag-asa: The Wish Ko Lang Christmas Specials.” With fresh episodes airing every Saturday afternoon, the award-winning GMA Public Affairs show hosted by Vicky Morales features stories that spark hope and inspiration among viewers. After the initial special which aired on Dec. 4, the next shows are “Lihim ng Punerarya” airing on Dec. 11 starring Kim Domingo, “The Affair” on Dec. 18 headlined by Jean Garcia, and “Gayuma” on Dec. 25 bannered by Max Collins. The Christmas special episodes of Wish Ko Lang air every Saturday, at 4 p.m. on GMA. Viewers outside the Philippines can catch Wish Ko Lang on the Network’s international channel, GMA Pinoy TV.

GMA Affordabox promo in December

GMA Network suggests giving its digital TV receiver GMA Affordabox as a gift with a special Christmas price discount promo of P799 until Dec. 31. With GMA Affordabox, viewers can enjoy a clearer view of GMA’s channels — GMA, GTV, I Heart Movies, Heart of Asia, Hallypop, and DepEd TV — as well as other free-to-air channels in digital broadcast available in the area. Among GMA Affordabox’s free features are the Personal Video Recorder, which lets users record GMA programs so that they can watch highlights of their favorite shows; the Multimedia Player feature to watch videos, listen to music, and view photos; an auto-on alert feature and a nationwide Emergency Warning Broadcast System (EWBS) that receives alerts from the NDRRMC about calamity warnings. GMA Affordabox is available in select locations in Metro Manila, Benguet, La Union, Pangasinan, Bulacan, Pampanga, Nueva Ecija, Tarlac, Batangas, Cavite, Laguna, Quezon, Rizal, Ilocos Sur, Abra, Bohol, Cebu, Leyte, Bacolod (and adjacent areas), Davao de Oro, Davao del Sur, Davao del Norte, Misamis Oriental (including Cagayan de Oro City), Camiguin, Iloilo, Guimaras, with Naga, and General Santos It is available in appliance stores and malls, or online via the official GMA Store and on Shopee and Lazada. For more details, visit www.GMAaffordabox.com and its official social media accounts via the handle @GMAaffordabox.

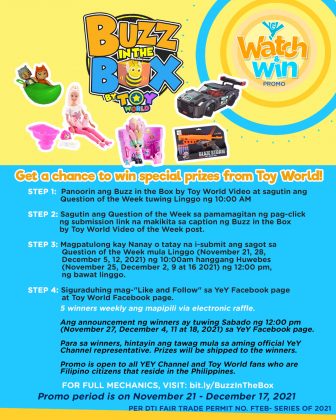

YeY launches Christmas promo

THE ABS-CBN kids’ channel YeY recently launched the Buzz in the Box Watch and Win Promo for Christmas. To join, participants should watch the featured Buzz in the Box by Toy World video of the week on its Facebook page, then answer the question of the week by visiting bit.ly/BuzzInTheBox. Those with the correct answer are entitled to join the weekly draw for a chance to win gift packs from Toy World. Every week, five winners are drawn and will be announced on YeY’s Facebook page. Promo runs until Dec. 17. For updates on its shows, events, and promos, parents can follow YeY on Facebook (fb.com/yeychannel), Instagram (@yeychannel), TikTok (@yey.channel), and YouTube accounts. Children can catch YeY shows on ABS-CBN Entertainment’s Just Love Kids website at ent.abs-cbn.com/justlovekids.

Alex Bruce releases self-titled EP

AFTER a series of hip-hop singles, Alex Bruce releases her self-titled debut EP under Sony Music Philippines. On the five-track EP, Ms. Bruce offers sharp, playful tunes that celebrate life, young love, and being a young girl trying to make her way in the competitive hip-hop music landscape dominated by men. The EP features co-writing and production duties from some of the biggest names in the global and Philippine music industry, including BTS and Justin Bieber collaborator August Rigo on “Go Crazy,” Michael Cursebox on “Yakap” and “Fake Friends,” Jim Poblete on “Pull It Off,” Markbeats with Brian Lotho on “Dime Girls,” and Bok Bruce on majority of the tracks. Alex Bruce’s self-titled EP is available on all digital music platforms worldwide.

Indie singer JAPPH releases debut single

INDIE singer-songwriter JAPPH has released his official debut single, “I Will,” a feel-good piece with laid-back singing. The song is accompanied by the release of a music video that JAPPH directed himself with cinematography by Welvin Medina. Its visual narrative takes listeners to Liwliwa, a surf town in San Felipe, Zambales. “‘I Will’ is a song about a situation that gives you relief and peace,” the 27-year-old reggae/pop/folk artist said in a statement. “…the one that inspired me is a place called Liwliwa, a small town in San Felipe, Zambales. Whenever I’m there, I always feel that I’m in my safe haven.” “I Will” is the carrier single off JAPPH’s upcoming album, Life Is Way Too Short For Bad Vibes, which will be released in January. Watch the music video of “I Will” at https://www.youtube.com/watch?v=crerb_8i77k.