Digital tools to help MSMEs rebound and grow

BusinessWorld Insights, Eastern Communications hold webinar on SMEs in the Now Normal

Being the backbone of the Philippine economy, micro, small, and medium enterprises (MSMEs) are vital as the country steps onto the recovery stage.

According to a statement from the United Nations in 2020, MSMEs consists of 99.5% of the business establishments and employ approximately 63% of the workforce in the Philippines; and in the past years, they contributed 40% of the country’s gross domestic product.

But since the coronavirus disease 2019 (COVID-19) affected many MSMEs, they need tools for their maintenance and recuperation. Experts sought to help MSMEs by sharing details about those resources online, during a recent session of BusinessWorld Insights, in partnership with Eastern Communications, with the theme “Ready to Thrive: SMEs in the Now Normal”.

Starting off the discussion, Senen Perlada, executive vice-president and chief operating officer of Philippine Exporters Confederation, Inc., described the now normal track for MSMEs in the country.

“There is a powerful inclination among businesses, including MSMEs, [that] want the future to look much like the recent past,” Mr. Perlada said. “But this pandemic has wreaked havoc on forecasts and pro forma plans that were made simply by extrapolating recent experience into the near and distant future.”

He continued, “Many of the assumptions, tendencies, and habits that long proved to be reliable have suddenly lost much of their relevance unexpectedly. This has been more pronounced for MSMEs.”

Mr. Perlada specified that MSMEs face major challenges such as customer acquisition, conversion, and retention; hyper-competition; supply chain issues; bureaucratic opacity; lack of finance and resources; lack of digital infrastructure; connectivity issues; and digital talent acquisition and retention.

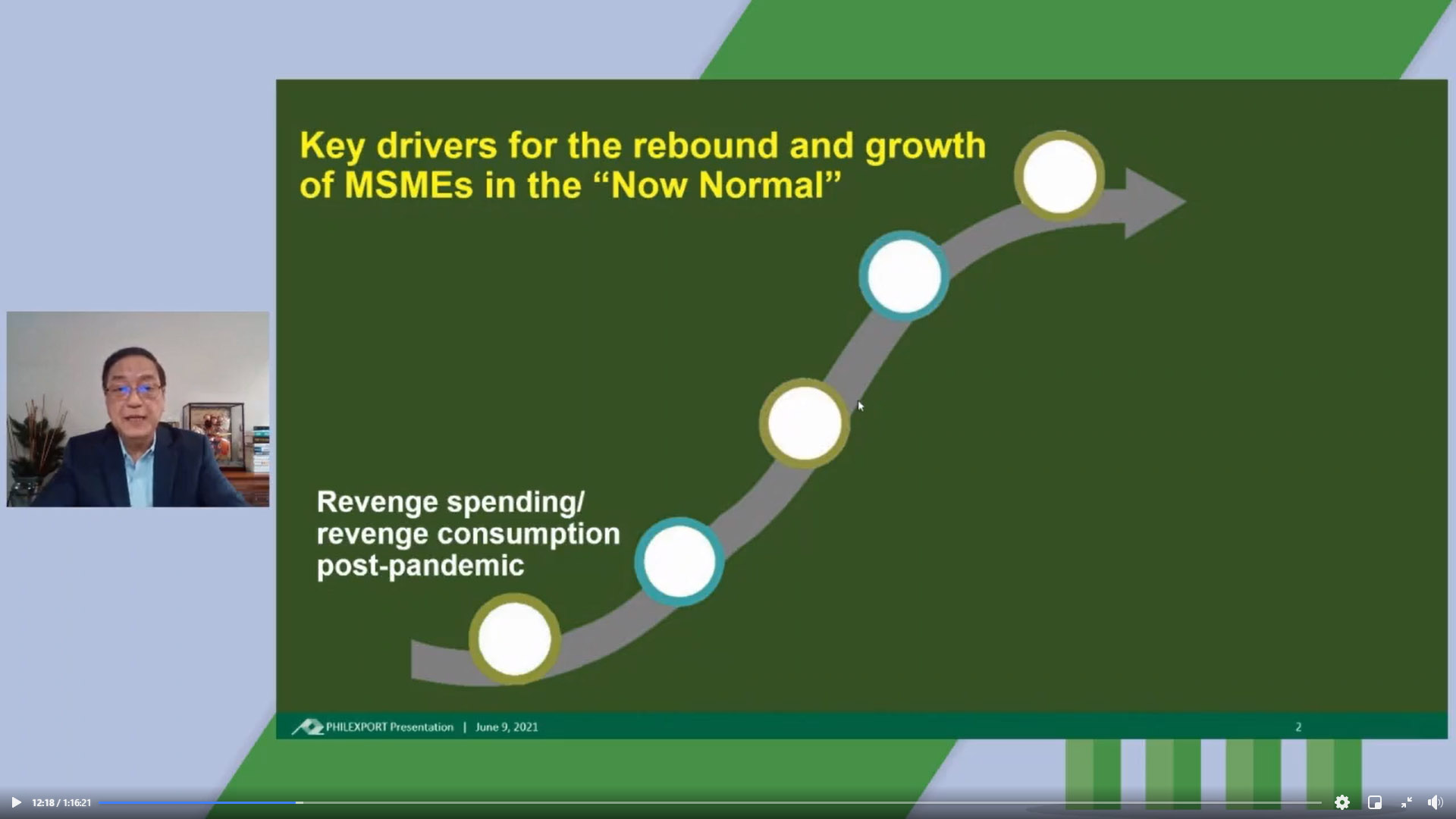

Nevertheless, he said there are key drivers for MSMEs to rebound and grow in the now normal. These are revenge spending; information and insight on “platformification”; accelerated digital transformation; greater global connections; and new opportunities for “phygital” business models.

Mr. Perlada also recognized MSMEs’ crucial contribution to job creation and the economy. “So for MSMEs, there is an urgent imperative to adjust to the new realities now to survive and eventually thrive on to the next normal,” he said.

Electronic guides for entrepreneurs

Innovative and useful resources are available online to guide MSMEs for their survival and recovery, as shared by Butch Meily, president of the Philippine Disaster Resilience Foundation (PDRF).

“One of our most important initiatives is helping MSMEs, both in being prepared for disasters and helping them recover,” Mr. Meily said.

He first talked about PDRF’s MSME guidebook. “It’s meant to be the primary reference material for small businesses to learn how to do business continuity plan, and to make them aware why it’s important,” he said.

MSMEs can also receive online mentoring with specific problems and other information about business recovery through a one-stop, digital hub called SIKAP. Another free online resource is QBO, which is established by a partnership between public and private sectors. The idea behind QBO is to help in priming startups, said Mr. Meily.

He also mentioned the iADAPT platform at PDRF’s website, where several courses are available.

Meanwhile, MSMEs may find inspiration from the comic book, Dimatinag. This creative guide features a superhero named Tina, whose journey encompasses trials as an MSME owner during the pandemic.

“Tina, while going through her struggles with her [small business], finds a gift to help her recover and prepare for disasters. And this is a Katatagan in a Box, a mobile app that everyone can make use of and download,” Mr. Meily explained.

The app shows “how to come up with a business continuity plan, prepare your small business for a crisis, and how to recover,” he added.

Cloud-based solutions for work

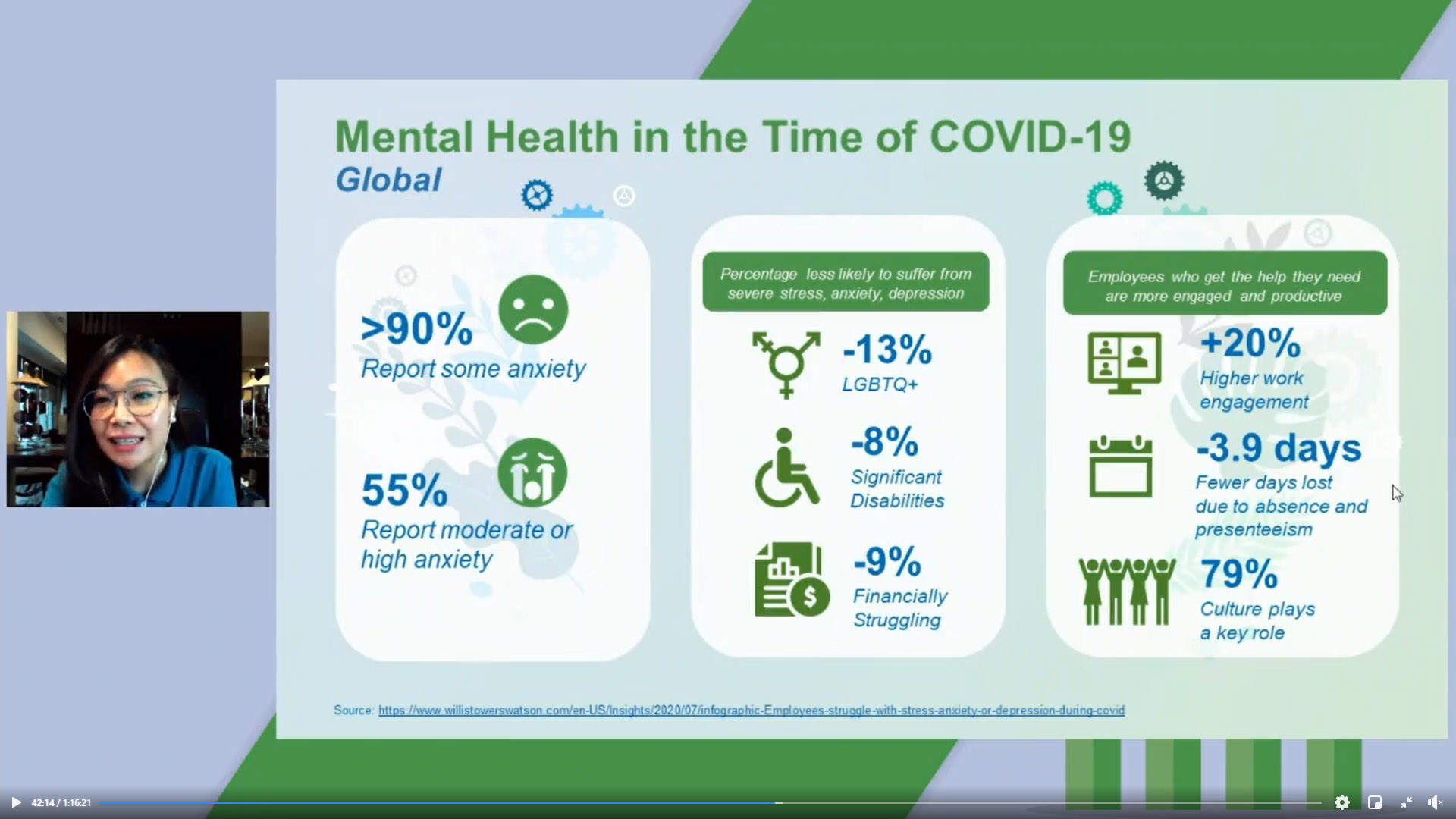

Addressing the concerns in remote work such as collaboration and communication difficulties, loneliness, and unable to unplug, Diana Crizel Montes, strategic segment marketing manager of Eastern Communications, shared how cloud-based solutions help in the effectiveness and well-being of the workforce.

“[There are] cloud-based applications that can allow for smooth, secure communication and collaboration even if you’re at different places,” Ms. Montes shared.

She explained how an app helps in their video call experience and allows them to work on reports or files together.

Meanwhile, to monitor a project or design a workflow, they use a project management tool.

“Given these tools, even we don’t see each other physically, we get to work as a team productively and effectively,” Ms. Montes said.

Eastern Communications also maximizes the use of these collaboration apps by staying connected even in activities not related to work, shared Ms. Montes.

“We have participated in physical and mental wellness activities such as yoga and other social events. These activities get to give us a sense of comfort, camaraderie, fun, and entertainment,” she said.

Ms. Montes also shared that she received reports on her amount of time using collaboration tools, which give her an idea of when to take on more work or slow down.

“So what [MSMEs] can do is to access and be informed of resources like activity and collaboration tools that can be made available to you to evolve and digitalize your business,” Ms. Montes advised. “And in the process, let’s not forget our employees and team members’ well-being. [They] remain to be one of our best resources.”

Rewatch the latest BusinessWorld Insights with the topic, “Ready to thrive: SMEs in the New Normal.”

The Philippines holds many stories of striving for freedom — before and even after the public reading of the “Act of the Proclamation of Independence of the Filipino People” on June 12, 1898.

The Philippines holds many stories of striving for freedom — before and even after the public reading of the “Act of the Proclamation of Independence of the Filipino People” on June 12, 1898.

Ms. Gamboa, who was recruited by her cousin, managed to convince her parents to invest in Wonka Cash as well. By the time the corporate regulator stopped the Ponzi scheme in April, her relatives had lost P230,000.

Ms. Gamboa, who was recruited by her cousin, managed to convince her parents to invest in Wonka Cash as well. By the time the corporate regulator stopped the Ponzi scheme in April, her relatives had lost P230,000.