Treatment innovations for heart matters

The human heart has already started to function some weeks after conception and would beat billion times in an average life span. While an essentially impressive organ, however, the heart can become vulnerable due to an unhealthy lifestyle.

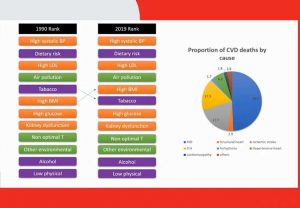

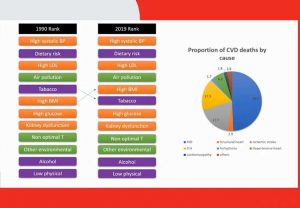

Cardiovascular diseases or CVDs are a range of conditions affecting the heart and blood vessels. Some CVD risk factors are tobacco use, high cholesterol, physical inactivity, air pollution, and others. According to the World Heart Federation, CVD causes 18.6 million deaths every year, making it the number one killer in the world.

Aiming to shed understanding on the human heart, BusinessWorld, in partnership with Mount Elizabeth Hospitals in Singapore, gathered cardiologists in an online forum themed “Understanding the Matters of the Human Heart” to share the developments on several CVD treatments.

Improving conditions

Improving conditions

Dr. Chan Wan Xian, a heart failure intensivist at Mount Elizabeth Hospital, shared the medications and devices to improve patients with heart failure, a condition wherein the heart cannot pump blood well to the body.

“The main issue with heart failure is recurrent hospital admissions, which result in impaired quality of life of the patient and the rise in healthcare expenditure. Recurrent hospitalization also worsens a patient’s prognosis,” Dr. Chan said.

There has not been a breakthrough in heart failure medications for many years, according to Dr. Chan. Yet, in the past six years, medications like Entresto and SGLT2 have emerged, which can reduce heart failure hospitalization rates and even improved survival long term.

Besides medications, there are also devices which have been developed to improve survival of heart failure patients. These include cardiac resynchronization therapy, which involves implanting a pacemaker just below the collar bone and insertion of wires to synchronize heart contraction and improve heart function. This has been shown to improve survival of heart failure patients who are eligible for the device. Another progress is the ventricular assist device, also known as a mechanical circulatory support device. A surgery is done to implant a mechanical pump into the heart to take over the heart function. Ventricular assist device has been shown to improve survival in advanced heart failure patients. Mitral clip procedure has also emerged in recent years as an option to improve symptoms and quality of life of heart failure patients.

“When it comes to advanced heart failure, there are many specialists at [Mount Elizabeth Hospital] that we work closely with,” Dr. Chan said, also assuring their group’s expertise on devices like cardiac resynchronization therapy and mitral clip, and their collaboration with surgeons for the ventricular assist device. “We work as a team to provide the latest and best treatment strategy for heart failure patients.”

Dr. Chan, who also has experience in women’s heart health services, added on the capacity of Mount Elizabeth Hospital in managing heart conditions in women. “[The hospital] has recognized the significance of heart diseases in women and the need for specialized care of certain heart conditions specific to women. The Hospital has been exploring and improving on diagnostic options to assess specific heart conditions in women. This would allow more targeted approach in managing heart diseases in women,” she said.

Groundbreaking technology

Dr. Stanley Chia, an interventional cardiologist at Mount Elizabeth Hospital, discussed the underlying causes of coronary artery disease, risk factors for atherosclerosis, implications of chronic total occlusion (CTO) lesions, as well as new treatments for these conditions.

Atherosclerosis is the buildup of cholesterol-filled plaques on the inner walls of arteries. The plaques may progressively narrow the arteries and restrict blood flow to the heart. It is estimated that one in ten patients diagnosed with significant coronary artery disease during coronary angiography may have plaques that completely blocked up the arteries, known as CTO.

“In the past, there is limited success in treating CTOs using percutaneous coronary intervention (PCI) techniques, hence patients were either treated conservatively with medication, or had to go for open-heart surgery,” Dr. Chia shared. “We now have advanced techniques and devices to tackle this problem, and patients have the option to go for less invasive treatment.”

A new, groundbreaking technology for the treatment of coronary artery disease is the Shockwave Intravascular Lithotripsy (IVL) system, which can address severely calcified and hardened deposit.

“IVL is an integrated balloon catheter that can be deployed in the artery. It emits an electrical signal that vaporizes the fluid within the balloon. The rapidly expanding and collapsing bubbles generate sonic pressure waves that travel through the artery to break up the hardened calcium,” Dr. Chia explained.

“This is a huge technological advancement that allows us to treat our patients more safely and effectively,” he added.

Other innovations in the management of coronary artery disease he discussed included the Angiojet Thrombectomy System, Stringray Coronary System, Impella Left Ventricular Assist Device, and Diamondback Coronary Orbital Atherectomy System.

Dr. Chia has full confidence in the commitment of the medical and nursing teams at Mount Elizabeth Hospital to deliver state-of-the-art healthcare. In addition, “our priority is to provide all patients with a holistic experience as we accompany them on their journey of healing,” he said.

Safer interventions

Dr. Edgar Tay, an interventional cardiologist at Mount Elizabeth Novena Hospital, shared more heart treatment advancements such as transcatheter aortic valve implantation (TAVI) and Mitraclip.

Dr. Edgar Tay, an interventional cardiologist at Mount Elizabeth Novena Hospital, shared more heart treatment advancements such as transcatheter aortic valve implantation (TAVI) and Mitraclip.

“In the past 10 years, there is a big move towards less invasive therapies. That’s the key driver for some of these new technologies,” Dr. Tay said.

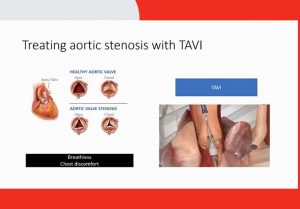

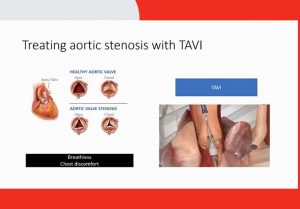

TAVI is a procedure for patients with aortic stenosis, a condition referring to the hardening of valves that obstructs blood flow. It can improve aortic stenosis symptoms like chest pain or breathlessness.

“[TAVI] essentially mimics what we do for coronary artery blockages. We put in a device that looks like a balloon, which first goes into the valve and dilates, and cracks open the valve. But we cannot just dilate it with a balloon alone. Like the coronary arteries, we need to put in this metal or stent to hold up the obstruction, so it doesn’t come back again. There are now valves sewn within these stents, which then start working immediately,” Dr. Tay explained.

Another recently developed treatment is Mitraclip. This intervention is for mitral valve regurgitation, wherein the patient’s valve does not close tight enough leading to a leaky valve that strains the heart.

Mimicking what surgeons can do, doctors and interventional engineers developed a technique where they can put in a device called a clip. This clip goes into the heart through the veins of the thigh. It helps to tighten the valve to enhance its ability to close well.

“This therapy made life a lot easier for patients because they don’t have to have their chest wall surgically opened. And typically, they can go home much earlier after the procedure,” Dr. Tay said.

These interventions, according to Dr. Tay, can extend the lives of the patients. In suitable patients, we expect up to a 50% reduction in death after TAVI and 38% after Mitra clip compared to medications alone. Such therapy can also improve the patient’s quality of life in a physical, social, and emotional sense.

Giving them the ability to do these therapies in a clean and sterile environment is the hybrid operating theater of Mount Elizabeth Hospital.

“But the most important is not just the hardware of the hospital; it’s the software, which is the people,” Dr. Tay added. “Many of these technologies, while great, require a whole team working for the patient to get good results.”

Scan this QR code for further inquiries.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber to get more updates from BusinessWorld: https://bit.ly/3hv6bLA.

Improving conditions

Improving conditions Dr. Edgar Tay, an interventional cardiologist at Mount Elizabeth Novena Hospital, shared more heart treatment advancements such as transcatheter aortic valve implantation (TAVI) and Mitraclip.

Dr. Edgar Tay, an interventional cardiologist at Mount Elizabeth Novena Hospital, shared more heart treatment advancements such as transcatheter aortic valve implantation (TAVI) and Mitraclip.

RUSTAN’S just might be a guiding star for gifts this season, announcing store renovations and an expanded personal shopper service during a press conference last week.

RUSTAN’S just might be a guiding star for gifts this season, announcing store renovations and an expanded personal shopper service during a press conference last week.