DUBAI, Dec 20 (Reuters) – 2025 will be a year of reckoning for Israeli Prime Minister Benjamin Netanyahu and his country’s arch foe Iran.

The veteran Israeli leader is set to cement his strategic goals: tightening his military control over Gaza, thwarting Iran’s nuclear ambitions and capitalising on the dismantling of Tehran’s allies — Palestinian Hamas, Lebanon’s Hezbollah and the removal of Syrian president Bashar al-Assad.

Assad’s collapse, the elimination of the top leaders of Hamas and Hezbollah and the destruction of their military structure mark a succession of monumental wins for Netanyahu.

Without Syria, the alliances Tehran has nurtured for decades have unraveled. As Iran’s influence weakens, Israel is emerging as the dominant power in the region.

Netanyahu is poised to zero in on Iran’s nuclear ambitions and missile program, applying an unyielding focus to dismantling and neutralising these strategic threats to Israel.

Iran, Middle East observers say, faces a stark choice: Either continue its nuclear enrichment program or scale back its atomic activities and agree to negotiations.

“Iran is very vulnerable to an Israeli attack, particularly against its nuclear program,” said Joost R. Hiltermann, Middle East and North Africa Program Director of the International Crisis Group. “I wouldn’t be surprised if Israel did it, but that doesn’t get rid of Iran.”

“If they (Iranians) do not back down, Trump and Netanyahu might strike, as nothing now prevents them,” said Palestinian analyst Ghassan al-Khatib, referring to President-elect Donald Trump. Khatib argued that the Iranian leadership, having demonstrated pragmatism in the past, may be willing to compromise to avert a military confrontation.

Trump, who withdrew from a 2015 agreement between Iran and six world powers aimed at curbing Tehran’s nuclear goals, is likely to step up sanctions on Iran’s oil industry, despite calls to return to negotiations from critics who see diplomacy as a more effective long-term policy.

DEFINING LEGACY

Amid the turmoil of Iran and Gaza, Netanyahu’s long-running corruption trial, which resumed in December, will also play a defining role in shaping his legacy. For the first time since the outbreak of the Gaza war in 2023, Netanyahu took the stand in proceedings that have bitterly divided Israelis.

With 2024 coming to an end, the Israeli prime minister will likely agree to sign a ceasefire accord with Hamas to halt the 14-month-old Gaza war and free Israeli hostages held in the enclave, according to sources close to the negotiations.

But Gaza would stay under Israeli military control in the absence of a post-war U.S. plan for Israel to cede power to the Palestinian Authority (PA), which Netanyahu rejects. Arab states have shown little inclination to press Israel to compromise or push the decaying PA to overhaul its leadership to take over.

“Israel will remain in Gaza militarily in the foreseeable future because any withdrawal carries the risk of Hamas reorganising. Israel believes that the only way to maintain the military gains is to stay in Gaza,” Khatib told Reuters.

For Netanyahu, such a result would mark a strategic victory, consolidating a status quo that aligns with his vision: Preventing Palestinian statehood while ensuring Israel’s long-term control over Gaza, the West Bank and East Jerusalem — territories internationally recognised as integral to a future Palestinian state.

The Gaza war erupted when Hamas militants stormed into Israel on Oct. 7, 2023, killing 1,200 people and taking 250 hostages, according to Israeli tallies. Israel responded with an air and land offensive that has killed 45,000 people, health authorities there say, displaced 1.2 million and left much of the enclave in ruins.

While the ceasefire pact would bring an immediate end to the Gaza hostilities, it would not address the deeper, decades-old Palestinian-Israeli conflict, Arab and Western officials say.

On the ground, prospects for a Palestinian state, an option repeatedly ruled out by Netanyahu’s government, have become increasingly unattainable, with Israeli settler leaders optimistic that Trump will align closely with their views.

A surge in settler violence and the increasing confidence of the settler movement – highway billboards in some West Bank areas bear the message in Arabic “No Future in Palestine” – reflect a growing squeeze on Palestinians.

Even if the Trump administration were to push for an end to the conflict, “any resolution would be on Israel’s terms,” said Hiltermann of the Crisis Group.

“It’s over when it comes to a Palestinian state, but the Palestinians are still there,” he said.

In Trump’s previous term, Netanyahu secured several diplomatic wins, including the “Deal of the Century,” a U.S.-backed peace plan which Trump floated in 2020 to resolve the Israeli-Palestinian conflict.

The plan, if implemented, marks a dramatic shift in U.S. policy and international agreements by overtly aligning with Israel and deviating sharply from a long-standing land-for-peace framework that has historically guided negotiations.

It would allow Israel to annex vast stretches of land in the occupied West Bank, including Israeli settlements and the Jordan Valley. It would also recognise Jerusalem as the “undivided capital of Israel” – effectively denying Palestinian claims to East Jerusalem as their capital, a central aspiration in their statehood goals and in accordance with U.N. resolutions.

SYRIA AT CRITICAL CROSSROADS

Across the border from Israel, Syria stands at a critical juncture following the overthrow of Assad by Hayat Tahrir al-Sham (HTS) rebel forces, led by Ahmad al-Sharaa, better known as Abu Mohammed al-Golani.

Golani now faces the monumental task of consolidating control over a fractured Syria, where the military and police force have collapsed. HTS has to rebuild from scratch, securing borders and maintaining internal stability against threats from jihadists, remnants of the Assad regime, and other adversaries.

The greatest fear among Syrians and observers alike is whether HTS, once linked to al-Qaeda but now presenting itself as a Syrian nationalist force to gain legitimacy, reverts to a rigid Islamist ideology.

The group’s ability – or failure – to navigate this balance will shape the future of Syria, home to diverse communities of Sunnis, Shi’ites, Alawites, Kurds, Druze and Christians.

“If they succeed in that (Syrian nationalism) there’s hope for Syria, but if they revert to their comfort zone of quite strongly ideologically-tainted Islamism, then it’s going to be divisive in Syria,” said Hiltermann.

“You could have chaos and a weak Syria for a long time, just like we saw in Libya and Iraq.” – Reuters

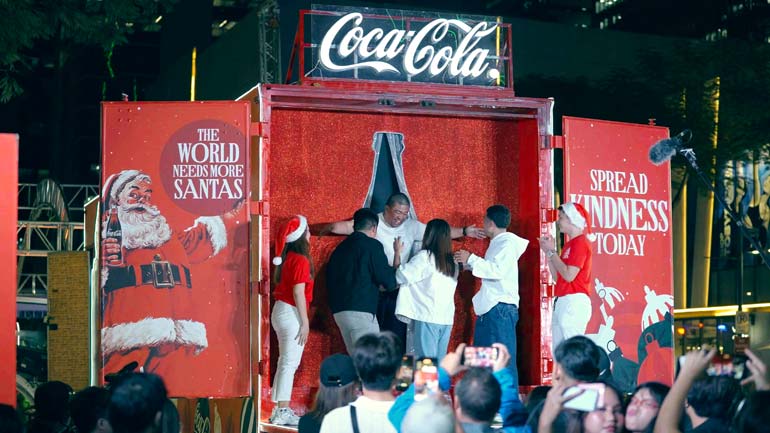

To set up the surprise, the Colina children were told they won a weekend stay in Bonifacio Global City to experience Coca-Cola’s Christmas parade. There, they were asked to participate on stage in one of the parade’s activities where they had to shout “Ho ho ho!” out loud to get special prizes from Coke, not knowing that their dearly missed father was behind the curtains, waiting to surprise them.

To set up the surprise, the Colina children were told they won a weekend stay in Bonifacio Global City to experience Coca-Cola’s Christmas parade. There, they were asked to participate on stage in one of the parade’s activities where they had to shout “Ho ho ho!” out loud to get special prizes from Coke, not knowing that their dearly missed father was behind the curtains, waiting to surprise them. “

“ Watch it here:

Watch it here: