Celebrate pride with COS

COS worked with artist Coco Capitán on a T-shirt capsule collection, featuring three unique designs in her signature handwriting style to share messages of love, freedom and inclusivity. “Always love because love is always love” is a shout-out to love in all its forms, available at COS Manila SM Aura Premier at P3,250. Two other designs “A boyfriend called my girlfriend” and “Would you be my boyfriend girl queer friend?” explore gender orientations, inspired by Coco Capitán’s personal relationships, are available in COS EU and US. The designs are embroidered onto an organic heavy-weight cotton T-shirt to lend a boxy, structured fit and are available in unisex sizing. Alongside the T-shirts, a special edition of the repurposed cotton tote will also be available. Featuring the colors of the Progress flag, the tote utilizes excess cotton from COS’ production process, made to replace disposable packaging and 100% recyclable. A 100% of the proceeds from the sales of T-shirt capsule collection and 100% of the profits from the sales of the Pride edition tote will be donated to: Galang, a female-led non-profit organization working with and for economically disadvantaged LGBTQI (http://www.galangphilippines.org/) and Love Yourself, a non-profit LGBT organization that provides safe spaces and services (https://loveyourself.ph/).

Salvatore Ferragamo presents the new SF logo

SALVATORE Ferragamo presents the SF logo, featuring two artfully reproduced initials (S and F). The SF Logo line makes its debut with the Pre-Fall 2021 collection for men, presenting several product categories with fresh appeal and a focus on low environmental impact. Three of the brand’s best-selling footwear models are included: the loafer, the driver and the sneaker. The SF logo is presented in various ways. These include either a small, side buckle logo on the band of the shoe upper, or a central decorative logo set within a metal frame and with the two initials either varnished to match the color of the leather or decorated with rhinestones. The sneaker has a side buckle logo in light metal-effect resin or a printed, maxi, color-contrast logo. The logo has also been added to a selection of large and small leather goods and belts. The SF logo line incorporates nylon in the large leather goods, creating a unique dégradé-effect on the shoulder bag, backpack, and briefcase. Made of Econyl nylon (a fiber that has been entirely regenerated from fishing nets and from other nylon waste), sewn with thread that is made from 100% post-consumer certified recycled PET, and finished with a zip tape made with regenerated polyester yarn made from recycled plastic bottles, SF logo nylon accessories emphasize environmental consciousness. The logo features as a bold rubber version on wallets and credit card holders in the small leather goods range. Belts come in two models, with an SF logo buckle and a metal frame or with the SF initials set within Ferragamo’s iconic Gancini hook.

Uniqlo releasing new Ines De La Fressange 2021 Fall/Winter collection

GLOBAL apparel retailer Uniqlo announces its latest collaboration collection with lifestyle icon and symbol of French chic Ines de la Fressange. The inspiration for the Uniqlo/Ines De La Fressange 2021 Fall/Winter collection was the Swiss village of Rossinière, where Ms. De la Fressange spends her Christmas holidays. From a base of beige moss-green earth tones, the many items offer an expanded range of stylings such as cashmere blend knit ponchos, and 3D Knit dresses with a simple yet shapely silhouette. The collection includes items with check patterns or small floral accents, ensemble knits in a lambswool material, and a characteristically De la Fressange style of masculine jacket. Small items such as berets and reusable shopping bags in a wide variation of patterns are also included. The 41 items in the 2021 Fall/Winter collection will be available at select Uniqlo stores across the Philippines and through the uniqlo.com/ph online store starting Sept. 10.

Montblanc extends its ‘M’ pattern collection

SINCE first launching last year, the Montblanc M_Gram 4810 has quickly established itself as a signature Montblanc leather collection with its original all-over logo treatment. The collection now sees the arrival of new multi-functional medium and small leather pieces that can be worn in different ways — around the neck, cross body, carried by hand, on the belt, alone or even mixed with other pieces. The assortment has also been enriched with a selection of new pieces that stand out in a bright all blue combination. The PVC coated-canvas resistant to scratches and everyday wear is paired with black leather trimming details to enhance the craftsmanship of the Montblanc M_Gram 4810 collection, while giving it a sophisticated design twist. By simply adding a shoulder strap, available both in leather and webbing, wrist handle or necklace, the leather piece — pocket, business card holder, wallet 8cc with zip, necklace strap, and coin case zip — can be worn completely differently and have different uses. Even the smallest accessories can be worn in unexpected way, around the neck or wrist, or on a belt. The Folio Mini, and Mini Envelope, can, with the addition of a shoulder strap or wrist handle, can serve many different purposes and looks. Then there are the Backpack, Clutch, and Vanity Bag, additional functional pieces for busy days on-the-go for nights away enrich the current assortment. The necklace strap, shoulder strap, and wrist handle are sold separately.

Lacoste presents new sneaker silhouette

LACOSTE presents its new footwear silhouette, the L001, which takes Lacoste’s rich tennis heritage and twists it into a new modern shoe. The sneaker’s key details are taken from the Lacoste archive; the Rene, the first ever shoe created by Rene Lacoste, and a vintage racket from the 1980s. The retro shape and mood of the Rene informs the spirit of the new L001, while kinetic lines running along the racket’s handle are directly transferred into an angular triangular design on the sneaker’s upper. The all-new shoe pays tribute to the iconic details and recognizable motifs of classic sportswear; the clean stripes and the subtle use of primaries brights and classic hues; timeless white, court green, rich navy, light mahogany, plum, saffron, classic red and mint. Clean, geometric lines compliment a classic herringbone-patterned upper, which nods to classic footwear styles. A thick yet streamlined sole has a nostalgic appeal, while a smooth tumble leather makes this an elevated choice, workable for all occasions. While there is visible Croc branding on the heel, logos are treated lightly and subtly, crafting a minimalist look that ensures longevity. In the Philippines, the L001 will be available at Lacoste retail stores and lacoste.com.ph (http://laco.st/RHnzUdNA) starting Sept. 8, and is now available at Zalora PH (https://zlrph.com/3AClV60).

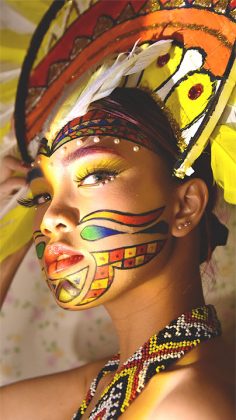

PH art and culture honored in online make up tilt

LET’S Get Glam, an online make-up competition, celebrated Filipino tradition and heritage, culture and arts amid the lockdowns as it challenged aspiring and budding make-up artists to interpret some of the biggest Philippine festivals into works of art. Themed “Buwan ng Wika: Hala Bira,” the virtual tourney was hosted to recognize freelancers and creatives behind small businesses who support their families during these trying times. First prize was awarded to Andrea Asuncion, an advertising student from De La Salle University, who gave a glimpse of the treasures of Davao City in her Kadayawan-inspired look, incorporating indigenous tribal patterns, the colors of the Philippine flag, and images of the Philippine eagle and the South Sea and fresh water pearls. Second place went to Pangasinan-based make-up artist Nyle Lyndon Lalata, who encapsulated the Pintados Festival in a complementing clash of prints and colors; third place went to De La Salle-College of Saint Benilde (DLS-CSB) Culinary Arts student Emmanuel Ochoa for his detailed floral painting suggesting the Panagbenga Festival. The contest was spearheaded by the Let’s Get Glam Organization, composed of culinary arts and tourism management students from the School of Hotel, Restaurant, and Institution Management from DLS-CSB.

PayMaya makes hopping easy for BLK Cosmetics

FOR BLK Cosmetics Co-Founder Jacqe Gutierrez, the company is staying true to its mission in bringing “uncomplicated beauty” to its customers with PayMaya’s digital payments solutions. Gutierrez, together with her partners Anne Curtis-Smith and Stephanie Abellada, launched BLK Cosmetics in 2017, offering a line of makeup essentials such as lipsticks, foundations, blush, and eyeliners, among others. Because BLK Cosmetics had a strong presence online even before the coronavirus disease 2019 (COVID-19) pandemic, the company was able to easily shift its focus and strengthen its business in the digital space. Gutierrez and their team expanded the product line, launched campaigns, and offered personal consultations with their beauty advisors to give customers a similar shopping experience online as they would get in-store. Since BLK Cosmetics had already been using the PayMaya One all-in-one payment terminal in the physical stores, it was an easy decision to also enable their e-commerce store with the PayMaya Checkout online payment gateway solution, which allows them to easily manage and track all of their transactions coming from various channels in a single platform via the PayMaya Business Manager. The PayMaya online payment gateway enables BLK to seamlessly accept PayMaya, Visa, Mastercard, and JCB credit, debit and prepaid cards, as well as other e-wallet accounts. To know more about PayMaya’s products and services for enterprises, visit www.enterprise.PayMaya.com.