Remittances made faster and safer with Visa

For better or worse, Filipino culture nowadays is inextricably linked with overseas Filipino workers. Almost everyone has or knows someone who has family and relatives working abroad as their primary source of income, and many young Filipinos today continue to dream of doing the same.

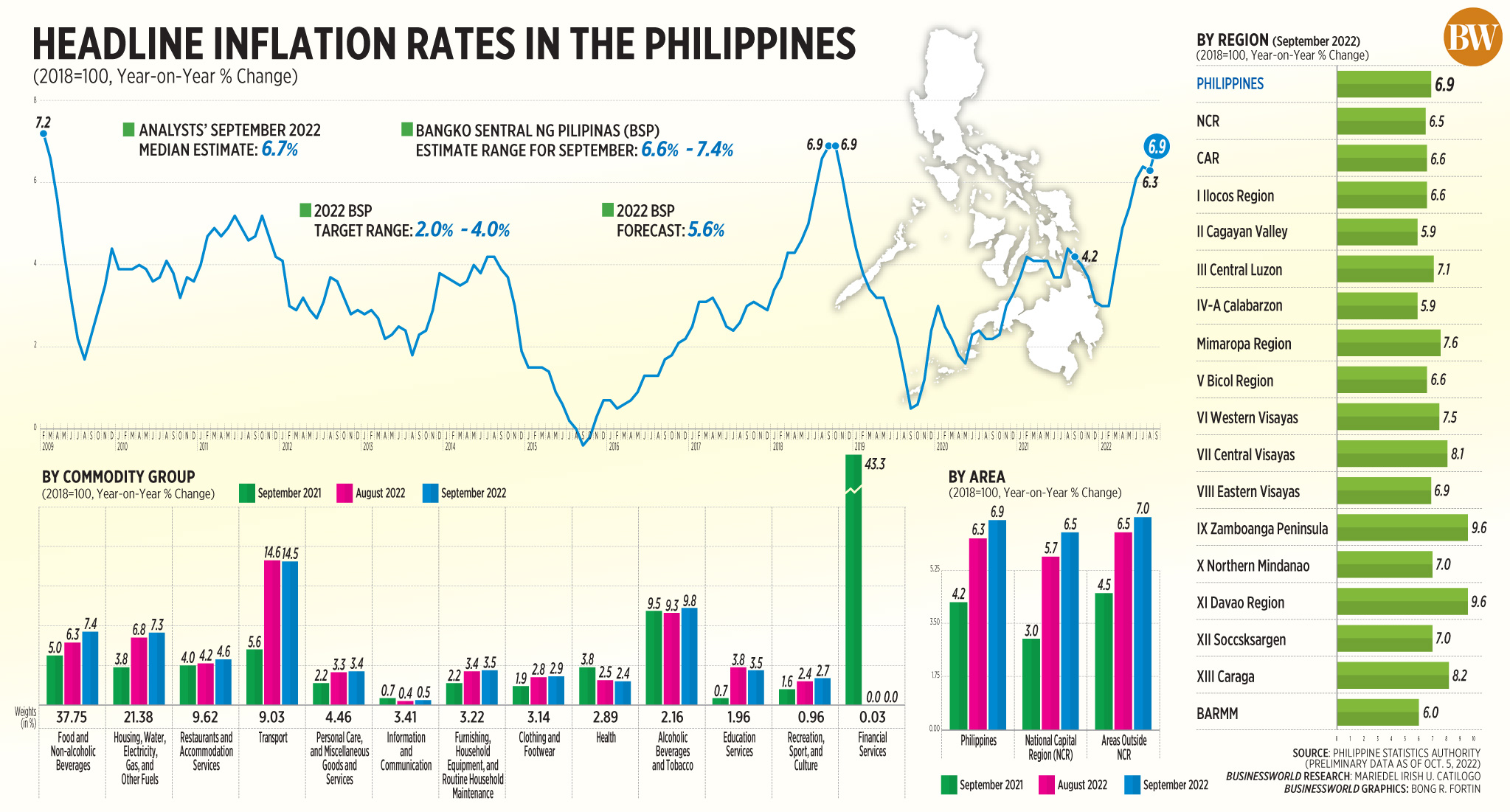

The latest data released by the Bangko Sentral ng Pilipinas (BSP) showed cash remittances sent through banks stood at $2.75 billion in June, the biggest amount since December of last year. The growth in cash remittances was also the fastest in seven months or since the 5.1% rise seen in November 2021.

“The expansion in cash remittances in June 2022 was due to the growth in receipts from land-based and sea-based workers,” the BSP said in a statement.

In June, remittances from land-based workers jumped by 4.9% year on year to $2.23 billion, while money sent by sea-based workers increased by 2.6% to $514 million. For the first six months of 2022, cash remittances rose by 2.9% to $15.35 billion, from $14.91 billion in the comparable period last year.

In a separate discussion paper titled, “Remittances from Overseas Filipinos in the Time of COVID-19: Spillovers and Policy Imperatives”, the BSP re-emphasized the importance of remittances as a driver of growth in the Philippine economy.

“Remittances will continue to be a significant force in the Philippine economy over the medium term. For one, rising incomes in host countries will continue to serve as a magnet to those whose skills are in demand overseas,” the BSP wrote.

The BSP further projected cash remittances to grow 4% this year, after the 5.1% rise to a record $31.418 billion in 2021. This is because the significance of cash remittances will only continue to grow as global demand for overseas workers, particularly medical workers, grow with the reopening of multiple economies worldwide.

The massive role of remittances in Filipino life demands a reliable, efficient, and most importantly, secure way of conducting them. Visa, the world leader in digital payments, provides a fast, convenient, and safe way of doing just that wherever, whenever.

With its reputation of facilitating financial transactions across a global network of consumers, merchants, financial institutions and government entities across more than 200 countries and territories, Visa ensures that sending and receiving money is simple and easy, whether for two individuals are standing in the same room or organizations operating on different sides of the globe.

Anyone can send a Visa Personal Payment through over 100 financial institutions in 20 countries to over a billion enabled Visa cardholders. It’s as easy as entering the recipient’s 16-digit Visa card number and the amount you want to send. The funds will be then be instantly credited to the recipient’s Visa credit, debit or prepaid card.

The recipient can use the received funds at any Visa merchant or ATM. When sent to a Visa credit card, the received amount is offset against the card’s outstanding balance.

With a mission is to connect the world through the most innovative, convenient, reliable and secure payments network, Visa enables individuals, businesses and economies to thrive. And with how important remittances are to the Philippine economy, allowing a fast and secure means of sending and receiving them not only will ensure the livelihood of countless Filipino families all over the country, but energize its onward march towards progress and economic development.

Visit the website to know more about Visa’s remittance partners.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber to get more updates from BusinessWorld: https://bit.ly/3hv6bLA.