Fintechs to drive growth in credit card issuance

CREDIT CARD ISSUANCES could grow faster this year, driven by heightened competition among financial technology (fintech) players, the Credit Card Association of the Philippines (CCAP) said.

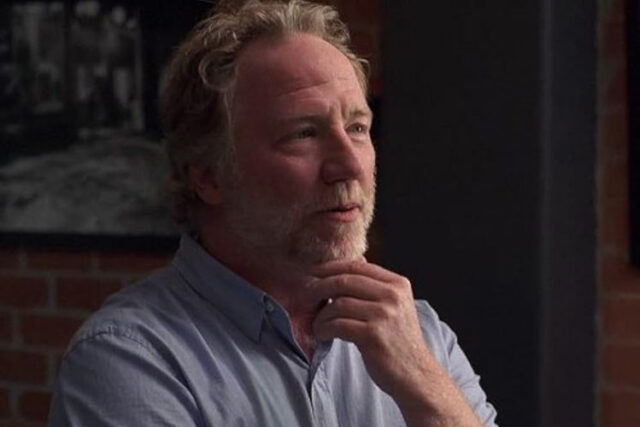

“[Credit card issuance growth will] probably go faster because there’s more competition coming in. Fintechs are starting to land, but that’s also helpful to us because they’re ushering in these non-credit borrowers into the credit market and eventually, we feel that they will trade up to a credit card,” CCAP Executive Director Alex G. Ilagan said at a media briefing on Tuesday.

Card issuance increased by 12% year on year to 18.5 million in 2025, Mr. Ilagan said, citing data from a quarterly survey of its members.

“It’s still quite low in terms of penetration, considering the adult population is probably 17 million — so, it’s very low penetration. We feel there’s still a very deep potential market that we can tap into.”

The entry of new fintechs gives consumers access to more credit products like buy now, pay later (BNPL), which could eventually lead to them getting credit cards, the official said.

He added that applying for cards has become easier as the National ID initiative has helped streamline documentary requirements, and with more credit information now available through efforts of the Credit Information Corp. (CIC) to address the data gap.

“These two major hindrances in the past have already been addressed. So, it’s just a matter of making the market aware that this is now available. You can now apply for a credit card, you can now apply for loans from registered lenders. Even microfinance and credit cooperatives, this will be very useful for them. And that’s what we’re trying to educate them on, especially in the provincial areas.”

However, growth in the cards market and the resulting increase in credit card receivables could pose some asset quality risks, Mr. Ilagan said.

“As long as the delinquency level is under control, we don’t mind the credit card receivables growing fast. That’s a natural result when people revolve, meaning they don’t pay in full,” he said.

“As long as they continue to behave well, meaning they pay on time and they don’t become passive, we feel it’s going to be a very healthy situation because we’re able to extend credit.”

RATE CAPS

Meanwhile, CCAP is pushing for the removal of the cap on credit card rates, Mr. Ilagan said, adding that the group submitted a position paper to the Bangko Sentral ng Pilipinas (BSP) late last year, which has already been discussed by the Monetary Board.

“We still feel that they should lift the cap. We feel that the market will eventually determine what’s the best rate,” he said. “There’s no decision yet so we’re still waiting for the subsequent meetings. Maybe in the coming months, they might make a decision.”

“That has always been the policy of BSP ever since. We were surprised when during the term of Governor [Benjamin E. Diokno], they imposed that. In the past, it’s always been market driven. There will be competition… So, we feel that a cap is unnecessary at this point. There’s no more pandemic.”

He added that lifting the ceiling could boost credit card penetration as issuers will be able to charge higher rates to lend to riskier segments.

“That’s natural, because if you offer unsecured credit to a risky segment, then you have to compensate by charging higher,” Mr. Ilagan said.

In August 2023, the BSP retained the interest rate ceiling on unpaid outstanding card balance at 3% per month or 36% a year. The limit on the monthly add-on rate that issuers can charge on installment loans was also maintained at 1%.

The maximum processing fee on the availment of credit card cash advances was likewise retained at P200 per transaction.

The BSP increased the cap by 100 basis points in January 2023 from 2% to match the cumulative rate hikes previously delivered by the Monetary Board to tame elevated inflation. The higher cap was also meant to mitigate the impact of inflation on banks and credit card issuers following the coronavirus pandemic. — Aaron Michael C. Sy