Achieving a rustic Christmas for Filipino homes

As we speak of Christmas, it is no secret that the Christmas traditions in the Philippines play a significant role in the country’s diverse and rich culture, making it home to the global’s longest-running celebration. As the holiday season approaches, the time has come to infuse your home with the warmth of Christmas, especially for the humble home of Filipinos. If you’re still scrolling to your Pinterest ideas, looking for a solid Christmas theme, you might want to consider going for a rustic Christmas vibe.

Achieving a rustic Christmas theme is primarily about embracing a warm, natural, and classic ambiance which also gives a very Filipino style. What you need are the premium items that complements your visual aim and also will last for a long haul. All the possible items you need to transform your space into a whole country charm can be found in Wilcon Depot.

Crafting Cozy and Christmas-y Vibes in your Living Room

Filipino celebrations tend to be large and loud, since the whole family and tribe come together to sing their favorite karaoke songs, engage in fun and creative games, share hearty laughter, and of course, exchange and unwrap Christmas presents.

To ensure that everyone will have a really good time, begin with setting the tone of your living room. Create an inviting atmosphere using throw pillows and fuzzy blankets. Opt for earthy tones color which can also mimic the Filipino style. Add paintings that will enhance the cultural aspect of your wall or help evoke a familial emotion that will pique the interest of your guests. There’s also a vast selection of Heim indigenous styles and designs to add into your Filipino flair.

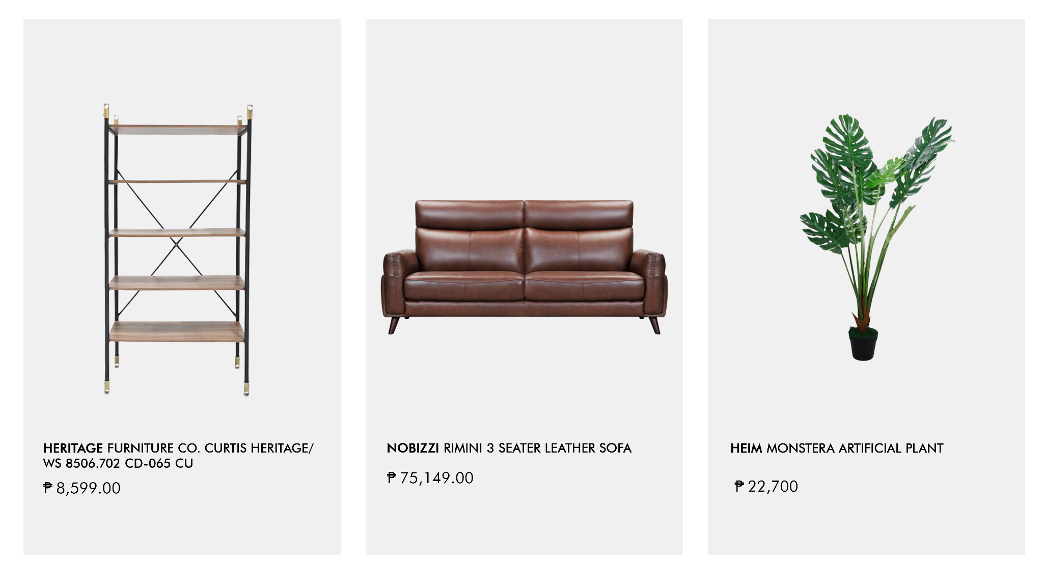

To create spaces for conversation, consider arranging a couch and two chairs so that they’re facing each other. Go for a classic leather sofa which is absolutely timeless and exudes a warm luxurious feel. Complete the setup with a sturdy center table crafted from reclaimed premium wood or one with intricate carvings.

Introduce handmade elements crafted from stones, fabric, and wood, ensuring your living space radiates a grounded aesthetic that is a true reflection of you. In embracing these design elements, you’ll be well on your way to creating a living room that captures the fuss-free festive rustic vibe.

Embracing the Rustic and Filipino Spirit of Christmas: Cozy Cabin Dining Room Ideas

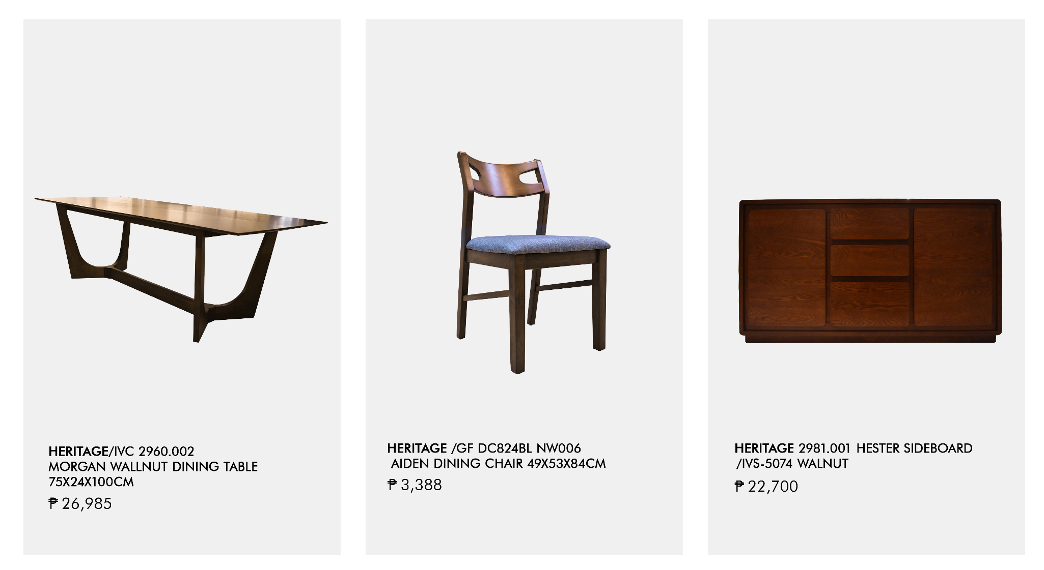

Explore the new items from Wilcon Depot and bring the rustic cabin vibe into your dining room as well. From large tables to an exuberant table setting, let’s delve into the elements that will transform your dining room into the heart of holiday cheer.

First on your checklist should be a classic chandelier with an antique look. This statement lighting piece does more than just illuminate the room; it sets the perfect ambiance for sharing good food and laughter with your loved ones. The soft and gentle glow will envelop the dining area, creating a comforting and safe atmosphere that encourages good conversation.

You may also want to play a little with your table setting. This holiday season, bring out your ditsy prints, playful stripes, and delicate laces. Layer them creatively and lay them neatly across your table, building a tablescape that’s both visually captivating and inviting. To maintain an air of sophistication, opt for white dinnerware, elegant gold and silver utensils, and native placemats. For a distinctive Filipino touch, consider using native placemats that bring a touch of tradition to your holiday celebration. Combine these intricate details with wooden dining chairs and tables for an absolute Filipino ambiance. The warmth of wood complements the rustic cabin theme, and the familiarity of these elements invokes a sense of nostalgia.

The essence of the Christmas spirit should be conveyed through every element on your table, from the serveware to the elegant table settings. This holiday season, extend the cozy cabin atmosphere from your living room into your dining room while preserving your Filipino traditions. Incorporate rustic elements, classic lighting, creative table settings, and a blend of Filipino and cabin-inspired decor to create a dining experience that embodies the true spirit of Christmas. Let the warmth of your home and the love of your family shine as you celebrate this festive season in style.

Planning for your next project? Do it with Wilcon!

For more information about Wilcon, visit www.wilcon.com.ph or follow their social media accounts on Facebook, Instagram, and Tiktok. or subscribe and connect with them on Viber Community, LinkedIn, and YouTube. Or you may contact Wilcon Depot Hotline at 88-WILCON (88-945266) for inquiries.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld website. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

“They need opportunities to pilot programs and proofs-of-concept, which the company can do small-scale. Give them that safe space to fail,” said Jericho P. Go, senior vice-president and business unit general manager at Robinsons Land Corp.

“They need opportunities to pilot programs and proofs-of-concept, which the company can do small-scale. Give them that safe space to fail,” said Jericho P. Go, senior vice-president and business unit general manager at Robinsons Land Corp.