YIELDS on government securities (GS) traded in the secondary market fell last week, driven by the slowdown of headline inflation as well as the economy’s bounce back in the third quarter.

Bond yields, which move opposite to prices, declined by 11.8 basis points (bps) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of Nov. 10 published on the Philippine Dealing System’s website.

Last week, rates were mixed across all tenors with yields on the 91-, 182- and 364-day Treasury bills (T-bills) rising by 1.35 bps, 6.14 bps and 0.89 bp to 6.1845%, 6.4582%, and 6.5917%, respectively.

Meanwhile, the belly of the curve went down as yields on the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) fell by 11.04 bps (6.4822%), 13.77 bps (6.5022%), 18.32 bps (6.5184%), 23.27 bps (6.5413%), and 29.22 bps (6.6209%), respectively.

At the long end, the rates of the 10-, 20-, and 25-year debt papers likewise, decreased by 25.62 bps (6.7416%), 8.90 bps (6.8905%) and 8.03 bps (6.8850%), respectively.

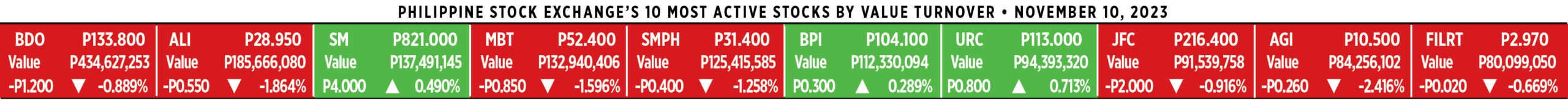

On Friday, total GS volume traded fell to P11.43 billion from P16.43 billion, a week earlier.

The local bond market moved lower this week due to slower-than-expected headline inflation in October, a bond trader said in an e-mail.

“Market participants likewise considered the prospects of no further US rate hikes in the near term following the Fed’s dovish pause this month,” the bond trader added.

For Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., both local and global catalysts leaned hawkishly in October to put significant pressure on local rates.

“Long-end US Treasury yields surged to fresh year-highs towards the 5% level amid a backdrop of a still-hawkish sounding Fed,” she said in a Viber message.

She added that the country’s latest consumer price index (CPI) “surprised to the upside” after reversing back to the 6.1% level in September and having hit a low of 4.7% earlier in the year.

In October, headline inflation slowed down to 4.9%, significantly slower than the 6.1% in September and 7.7% in the same month a year ago, due to easing food prices.

This marked the slowest pace in three months or since July’s 4.7%.

The October figure also marked the 19th straight month that inflation breached the Bangko Sentral ng Pilipinas’ (BSP) 2-4% target band.

Overseas, surging US Treasury yields sapped investors’ risk appetite and weighed on stocks over the last few months by helping tighten financial conditions as they raised the cost of borrowing for companies and households, Reuters reported.

The report added that some US Federal Reserve officials last month said rising yields could substitute for further rate hikes by the central bank as they tightened financial conditions.

A lot can — and has — changed over the course of a week, Ms. Araullo said.

“[US Treasury yields] have since rallied significantly back below the 4.6% area due to myriad factors, not the least of which is a more dovish sounding Fed,” she said.

Locally, she added that the central bank has similarly tilted dovishly, ruling a November hike out of play and reiterating data dependency.

“BSP rhetoric leaned more aggressively, with an off-cycle hike similarly taking us to a 6.5% policy rate with post-hike rhetoric still indicating further action in November,” she said.

The Monetary Board will have its meeting on Thursday, Nov. 16.

For the bond trader, the downturn in local inflation has beneficially moved inflation expectations lower and its impact on bond yield levels for next year.

“Moreover, the stronger Philippine gross domestic product (GDP) report for the third quarter has bolstered views that the BSP might consider holding the policy rate steady in its November meeting in order to support the rebound in the domestic economic activity,” the bond trader said.

In the third quarter, the Philippine economy expanded by 5.9% driven by the recovery in government expenditures, better than the 4.3% expansion in the previous quarter.

The third quarter economic performance ended three straight quarters of slowing growth.

However, this was still slower than the 7.7% growth a year earlier.

“While the thesis for an immediate reversal on policy from both the BSP and the Fed has been pushed back towards the second half of 2024 potentially — relevant factors indicate that they have decelerated, indicating that the highs hit last week are toppish — with momentum unlikely to push yields significantly higher,” Ms. Araullo said.

She said she had seen a return of buying interest at these levels and continues to see value, reiterating a view on fixed income moving towards yearend and into the first quarter of 2024 when rates are expected to have dropped lower.

This week, the bond trader sees GS yields declining due to some market caution ahead of the BSP policy meeting.

“On the international front, potentially softer US consumer and producer inflation reports for October might support the declining trend in inflation which could exert less pressure for the US Fed to consider more policy rate hikes,” the bond trader said. — Abigail Marie P. Yraola