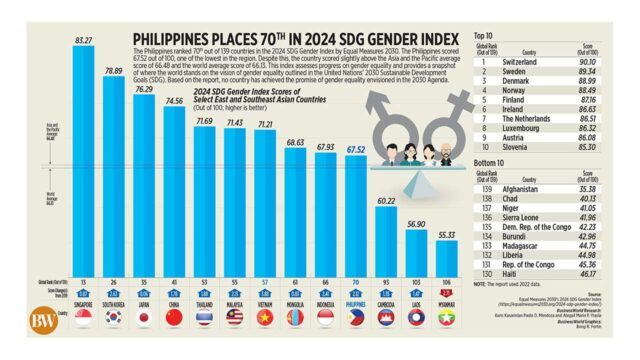

Philippines places 70th in 2024 SDG Gender Index

The Philippines ranked 70th out of 139 countries in the 2024 SDG Gender Index by Equal Measures 2030. The Philippines scored 67.52 out of 100, one of the lowest in the region. Despite this, the country scored slightly above the Asia and the Pacific average score of 66.48 and the world average score of 66.13. This index assesses progress on gender equality and provides a snapshot of where the world stands on the vision of gender equality outlined in the United Nations’ 2030 Sustainable Development Goals (SDG). Based on the report, no country has achieved the promise of gender equality envisioned in the 2030 Agenda.

Dismissed town mayor Guo arrested in Indonesia

By Chloe Mari A. Hufana and Kyle Aristophere T. Atienza, Reporters

INDONESIAN authorities in the early hours of Wednesday morning arrested a former town mayor who is wanted in the Senate for her alleged links with illegal Philippine Offshore Gaming Operators (POGO).

The Bureau of Immigration (BI) said dismissed Bamban Mayor Alice L. Guo was arrested by its Indonesian counterparts around 1:30 a.m. in a hotel in Tangerang City, Jakarta. This was also confirmed by the Philippine Department of Justice (DoJ) and the Presidential Anti-Organized Crime Commission (PAOCC).

The DoJ confirmed plans to send Ms. Guo home within the week. She is currently in the custody of the Indonesian Police at Jatanras Mabes Polri.

Philippine National Police (PNP) Spokesperson Jean S. Fajardo said in a press briefing PNP Chief Rommel Francisco D. Marbil and Interior and Local Government Secretary Benjamin C. Abalos, Jr. may personally travel to Indonesia to fetch Ms. Guo.

Stephen L. David, one of Ms. Guo’s legal counsels, welcomed the development but said they are concerned about her health, safety, and security.

“She may not know or realize it by now, but this recent event can be a good start for all her cases,” he told BusinessWorld in a text message on Wednesday night.

“We would like to remind the public that unless proven otherwise, Alice L. Guo is innocent,” he added.

He urged the public not to make “crude” and “malicious” remarks against the ousted mayor.

“All matters related to our client will be ventilated and answered in the proper forum and before courts of competent jurisdiction,” he said, adding Ms. Guo’s counsels demonstrate the highest respect for the law of the land.

The Philippines and Indonesia have extradition treaties. They are also member-states of Interpol, along with Singapore and Malaysia.

Ms. Guo is expected to be turned over to the Senate as it investigates offshore gaming operations, which have been linked to transnational crimes.

Senator Risa Hontiveros-Baraquel, who has initiated a probe into POGOs, said the Senate expects Ms. Guo to face its hearings as soon as possible.

Ms. Hontiveros was the first one to publicize Ms. Guo’s escape, citing immigration documents.

“The arrest of Alice Guo is a crucial breakthrough in our fight against organized crime and corruption,” Senate Francis Joseph Guevara Escudero said in a statement.

“Her capture not only moves us closer to bringing her to justice but also offers a chance to uncover the illegal POGO operations that have plagued our country.”

CASES AWAIT GUO

In a separate press briefing, Justice Secretary Jesus Crispin C. Remulla said the department may issue a resolution on the human trafficking complaint filed by the PNP and PAOCC against the former local chief on Friday.

On top of this, Ms. Guo is facing lawsuits before the Ombudsman, the Office of the Solicitor General, and the Commission on Elections (Comelec).

DoJ Prosecutors are also handling qualified human trafficking, tax evasion, and money laundering complaints against Ms. Guo and her cohorts.

Following her arrest, President Ferdinand R. Marcos, Jr. on Wednesday said the government would expedite the resolution of cases against the dismissed mayor.

Ms. Guo or Chinese national Guo Hua Ping, who went into hiding in Indonesia for weeks amid charges filed against her in the Philippines, will be “entitled to all legal protections due her under the laws of the land and pursuant to our commitment to the rule of law,” the Mr. Marcos said in a video statement.

“But we will not allow this to prolong the resolution of the case whose outcome will be a victory for the Filipino people.”

Ms. Guo is wanted by the Philippine Senate for snubbing its hearings into POGOs, which have been linked to human trafficking, scamming operations, and various transnational crimes.

She has been accused of coddling an illegal POGO in Bamban, Tarlac north of the capital Manila where she ran and won for the first time as mayor in 2022. Raided by authorities in March, an illegal hub on land she partially owned had been linked to scamming operations.

She fled the country in July, traveling to Malaysia and Singapore, then to Indonesia a month later using her Philippine passport, PAOCC earlier told BusinessWorld.

The Anti-Money Laundering Council (AMLC) and several other agencies in late August jointly filed multiple charges of money laundering against Ms. Guo and 35 others before the Justice department.

She and her cohorts built corporations to “conceal the true nature of their businesses and to make it appear they are engaged in legitimate activities,” according to a case filed by the AMLC, PAOCC, and the National Bureau of Investigation.

‘PAY THE PRICE’

Mr. Marcos, speaking to reporters on the sidelines of a disaster briefing, said those who aided Ms. Guo’s escape “will certainly pay the price.”

“We won’t just fire them, we will file charges against them,” he said in mixed English and Filipino. “What they did violates the law and is against all of the interests of the Philippine judicial system.”

Ms. Guo was also accused of spying for China, amid questions on her nationality and identity which all unfolded in Senate hearings. She has denied the allegations, maintaining that she’s a natural-born Filipino citizen.

The government has frozen her accounts over money laundering, tax fraud, and human trafficking charges.

Her assets covered by a freeze order issued by the AMLC and affirmed by the Court of Appeals included 90 bank accounts that were registered with 14 financial institutions and that were under her name and that of her business partners, luxury vehicles and one helicopter, and a dozen real estate properties.

POGOs, which mainly cater to Chinese markets and had been widely embraced by the previous administration, have been a major headache for the Philippine government, so much so that Mr. Marcos ordered a ban in July.

Mr. Marcos in his third address to Congress said POGOs have been “disguising” as “legitimate entities” but their operations have ventured into illicit areas, linking them to financial scams, money laundering, prostitution, human trafficking, kidnapping, brutal torture and “even murder.”

15 dead as Severe Tropical Storm Yagi leaves Philippines

A SEVERE tropical storm that killed at least 15 Filipinos left the country’s area of responsibility on Wednesday morning, but classes and government work across the country remained suspended amid an enhanced monsoon that was expected to bring heavy rains within the week.

Severe Tropical Storm Yagi, centered about 265 km west of northwest of Laoag City at 5 a.m., was already outside the Philippine Area of Responsibility (PAR), state weather bureau Pagasa (Philippine Atmospheric, Geophysical and Astronomical Services Administration) said in a morning report.

Still, the enhanced monsoon will bring moderate to intense rainfall in the next three days, especially in the western parts of Luzon, it said.

The bureau said later in the day that Yagi, locally known as Enteng, was moving generally westward.

The death toll from Yagi, which battered five Luzon regions as well as central and eastern Visayas, had risen to 15.

The deadliest province for Yagi was Rizal — east of the capital Manila — where authorities logged eight deaths due to drowning and landslide, Office of Civil Defense Operations Service Director Cesar Idio told President Ferdinand R. Marcos, Jr. in a situation briefing on Wednesday.

In central Philippines, Cebu City and Northern Samar logged two deaths each while Negros Occidental recorded one fatality, he said. Naga City in Bicol region recorded two deaths, he added.

Twenty-one people were reported missing while 15 others were injured, Mr. Idio said.

“These are still subject for validation.”

The OCD said about 1.72 million people or 442,804 families were affected by Yagi, adding that the Bicol region was the most affected area, followed by Central Luzon, Eastern Visayas, and Metro Manila.

The storm caused P350.85 million worth of damage in agriculture, with 13,623 farmers affected. Production losses hit 14.814 metric tons in 8,893 hectares of agricultural land involving rice, corn and high-value crops.

A 6 a.m. report by the Department of Public Works and Highways (DPWH) showed that the storm and an enhanced southwest monsoon left an initial P54.26 million worth of damage to infrastructure.

It said damaged roads, bridges, and flood control structures were reported in the Cordillera, Central Visayas and Eastern Visayas.

Central Visayas incurred the most damage with P25.78 million, followed by Eastern Visayas with P23.64 million, and Cordillera with P4.8 million.

OCD said about P33 million worth of food and non-food items have been distributed to affected people.

P23-BILLION AGRI-DAMAGE

In a separate briefing, the Agriculture department said the damage due to El Niño coupled with recent weather disturbances was estimated at P23.19 billion.

“These are due to the combined effects of El Niño, shearline, southwest monsoon, Typhoon Aghon, Typhoon Carina, and the (Severe Tropical Depression) Enteng,” Agriculture Assistant Secretary Arnel V. de Mesa said in a media briefing. A

According to data from the Agriculture department, the total volume loss for crops was estimated at 964,310 metric tons (MT), to date.

The weather events had affected 558,174 farmers and fisherfolks, with total affected area spanning 408,479 hectares of farmland.

He added that rice crops bore the brunt of the impact from the recent weather disturbances with total volume loss reckoned at 373,000 MT.

“This is already close to the annual average of 500,000 MT to 600,000 MT in losses for rice,” Mr. De Mesa said. Total estimated damage for rice crops was at P8.13 billion.

He added that the incoming La Niña could still pose a threat to local rice production amid the increase likelihood of storms.

According to the state weather bureau, PAGASA the incoming La Niña could form in the next three months with a 66% likelihood between the months of September to October.

PAGASA said that about eight to 14 tropical cyclones are forecast to enter the Philippine Area of Responsibility until January 2025.

“This all depends on when the peak of La Niña will be felt. But, if you look at the current trend of typhoons, the amount of water they bring is huge,” Mr. De Mesa said. — Kyle Aristophere T. Atienza and Adrian H. Halili

Senate ratifies bicam report on PHL sea lanes

THE SENATE on Wednesday approved a bicameral conference committee report of a bill that seeks to set up sea lanes at the Balintang Channel, Celebes and Sulu Seas, among other waterways, to assert Manila’s sovereignty.

Based on a copy of the joint explanation of the reconciled version of Senate Bill No. 2665 and House Bill No. 9034, the measure would adopt the principles on the passage of foreign vessels found in the Convention on International Civil Aviation and the United Nations Convention on the Law of the Sea (UNCLOS).

The reconciled Philippine Archipelagic Sea Lanes bill also recognizes the immunities of foreign warships and military aircraft for non-commercial purposes found under UNCLOS and international law, according to a copy of the conference committee report sent to reporters via Viber.

Once passed into law, the sea lanes measure would be submitted to the International Maritime Organization (IMO) to notify countries of what it entails, Senate Majority Floor Leader Francis N. Tolentino, who sponsored the Senate version of the bill, told the plenary.

“The IMO enforces strict compliance mechanisms, and if they (foreign vessels and aircraft, including military warships and aircraft) do not comply, we can deny them access under this measure,” Mr. Tolentino explained.

Under the bill, which the Senate approved last month, Philippine archipelagic territories would be established along three axis lines, with the first connecting the Philippine Sea, Balintang Channel and the South China Sea.

The second axis will fall within the Celebes Sea, Sibutu Passage, Sulu Sea, Cuyo East Pass, Mindoro Strait and the South China Sea.

A third axis lies within the Celebes Sea, Basilan Strait, Sulu Sea, Nasubata Channel, Balabac Strait and the South China Sea.

The measure complements the Philippine Maritime Zones Bill that establishes the country’s maritime territories extending to the South China Sea, which had been ratified in August. The two bills are among the priority measures outlined by the Legislative-Executive Development Advisory Council. — John Victor D. Ordoñez

Polish envoy asks China to abide by international law

POLAND’s Foreign Minister on Wednesday urged China to follow international law and a 2016 arbitration ruling that reaffirmed Manila’s claims in the South China Sea.

“Freedom of navigation is a fundamental principle enshrined in the United Nations Convention on the Law of the Sea (UNCLOS) that has already been mentioned,” Polish Foreign Minister Radoslaw Sikorski told a news briefing in Makati City.

“We think that the arbitrations under UNCLOS should be followed, should be honored, and therefore the Philippines has our solidarity on this matter.”

The Chinese Embassy in Manila did not immediately reply to a Viber message seeking comment.

At the same briefing, Philippine Foreign Affairs Secretary Enrique A. Manalo said both countries are keen on more partnerships on maritime education, environmental protection and defense ties amid tensions with China in the South China Sea.

“In an era marked by unprecedented challenges and complex geopolitical dynamics, it is imperative that we uphold the principles that safeguard the sovereignty and rights of all nations… and ensure all states fulfill their obligations under international law,” he said.

The Chinese Foreign Ministry on Monday urged the Philippines to remove an “illegally anchored” vessel at Sabina Shoal in the South China Sea after a collision between their ships on Saturday.

A Philippine task force handling sea disputes with China on Saturday accused a Chinese vessel of “deliberately” ramming the Philippines’ largest coast guard vessel named BRP Teresa Magbanua thrice near Sabina Shoal.

The Chinese Coast Guard vessel caused significant damage to the ship and endangered the lives of its personnel, it said.

Based on data released by the Philippine Navy, there were about 203 Chinese vessels within the Philippine exclusive economic zone from Aug. 27 to Sept. 2, up from 163 a week earlier.

“I think we can work together to see how we can promote greater awareness of the importance, especially in today’s world of enhancing commitment to international law as agreed and also in a rules-based order,” Poland’s top diplomat said.

Mr. Manalo earlier said the Philippines had expressed its displeasure with China after Saturday’s collision — the second confrontation in days — adding that it did not help cool tensions in the South China Sea.

He said the Chinese side had, in response, “accused us, as usual, of doing this and that.”

The government of President Ferdinand R. Marcos, Jr. has filed 176 diplomatic protests against China, 43 of which were filed this year, Philippine Foreign Affairs spokesperson Ma. Teresita C. Daza told reporters in a WhatsApp message late Monday.

In 2016, a Hague-based arbitration court upheld the Philippines’ rights to its exclusive economic zone within the waterway. It rejected China’s claim to most of the sea based on a 1940s nine-dash line map that Philippine Foreign Affairs Secretary Enrique A. Manalo has said “had no basis in law.”

Manila has been unable to enforce the ruling and has since filed hundreds of protests over what it calls encroachment and harassment by China’s coast guard and its vast fishing fleet.

The US, New Zealand and Australian embassies in Manila have expressed concern over the incident, urging China to follow international law.

Meanwhile, Mr. Manalo also asked his Polish counterpart to encourage more Polish businesses engaged in agriculture and in the automotive industry to expand their operations in the Philippines.

“I also expressed our desire for more Polish companies to look into investing in the Philippines especially in the automotive industry, transport logistics, energy and green technologies,” Manila’s top envoy said.

Mr. Sikorski said Poland’s deputy ministers for digitalization, defense and agriculture are set to meet with their Philippine counterparts to explore cooperation between these sectors.

“We also want to better reflect the potential of our economies and to achieve even better results,” he said.

“That is why Secretary Manalo, and I discussed today how we can improve market access for our products, including agri-food products.” — John Victor D. Ordoñez

Marcos ‘fine’ amid hospital rumors

PRESIDENT Ferdinand R. Marcos, Jr. dismissed on Wednesday as fake news reports claiming he had been hospitalized.

He said he was at the presidential palace doing paperwork and attending a command conference when news of him supposedly having been hospitalized spread online.

“Do I look sick? That’s the kind of fake news we need to watch out for, unless it comes from a credible source,” he told reporters in mixed English and Filipino on the sidelines of a disaster briefing.

“I had a meeting in the morning. I had a command conference with some of our commanders, and I spent the rest of the day reading my briefs and doing paperwork.”

The President said he had received calls from concerned friends asking about his condition.

“It’s totally and completely fake. I do not even have a cold. I do not have anything wrong with me. I’m fine.”

Mr. Marcos attended a peace summit at the presidential palace on Monday, even telling reporters that he had instructed authorities to announce suspension of classes and government work amid heavy downpours before bedtime. — Kyle Aristophere T. Atienza

Two drug rehab models developed

A PARTNERSHIP between the Japan International Cooperation Agency (JICA) and the Department of Health (DoH) yielded two drug rehabilitation programs to prevent drug abuse in the country.

In a statement, JICA said the Intensive Treatment and Rehabilitation Program for Residential Treatment and Rehabilitation Centers (INTREPRET), and the Enhanced Treatment Program Outpatient Services (ENTREPOSE) seek to revolutionize drug dependence treatment for the Health department’s Drug Abuse Treatment and Rehabilitation Centers nationwide.

The training modules for the programs, both available in English and Filipino, can now be accessed on the DoH Academy E-Learning platform, according to the Japan-based multilateral lender.

Both the INTREPRET and ENTREPOSE integrate cognitive behavioral therapy, social support, psycho-education, and self-help groups to prevent drug dependence, JICA said.

“While patterned after the US-based Matrix Model, both INTREPRET and ENTREPOSE incorporated Filipino cultural perspectives to better care for local patients.” — Beatriz Marie D. Cruz

PhilHealth transfer ‘utterly illegal’

THE PHILIPPINE Health Insurance Corp.’s (PhilHealth) transfer of P89.9 billion of its unutilized funds to the National Government’s coffers is illegal, a congressman said on Wednesday, citing a Supreme Court ruling that said funding clauses in laws cannot be amended by other measures.

A provision within the 2024 General Appropriations Act (GAA) allowing PhilHealth to remit the money back is outright invalid as there are already “substantive laws” outlawing it, Cagayan de Oro Rep. Rufus B. Rodriguez said during a congressional budget briefing.

He alleged that PhilHealth’s transfer violated the Universal Health Care Act, the Tax Reform for Acceleration and Inclusion (TRAIN) Law, and measures placing excise taxes on liquor and tobacco products.

“The transfer of the Secretary of Finance, with the approval of the [Department of Health] Board, is utterly illegal,” he said.

“When they signed the provision of the GAA which allowed the Secretary [of Health] to transmit… the Supreme Court already ruled you cannot do that if there’s substantive law,” he added. — Kenneth Christiane L. Basilio

CSC opens 800 gov’t jobs

AROUND 800 jobs are up for grabs in a three-day government job fair organized by the Civil Service Commission (CSC).

In a Viber message to BusinessWorld, the commission said that around 800 slots are up for grabs for the 2024 Government Job Fair. 26 government agencies are also hiring, including state universities.

The job fair ran from Sept. 3-5, providing Filipinos eyeing to pursue a public service career an avenue to meet with recruiters.

For the capital region, the Government Job Fair is being conducted today, Sept. 5, at the Taguig Convention Center in Taguig City starting at 8 a.m.

“Through the job fair, government agencies across 16 regions nationwide are opening doors to a new batch of dedicated individuals who are eager to serve the public,” it added. — Chloe Mari A. Hufana

Minor dead, 10 Mati Road mishap

COTABATO CITY — A 13-year-old student died on the spot while 10 other minors were badly hurt in a road accident on Monday, Sept. 2, in Barangay Macambol in Mati City.

The students were on their way to school when the passenger van carrying them rolled over and landed on its side while its driver was maneuvering through a stretch of the highway in Barangay Macambol in Mati City.

It was reported that the Mati City local government extended initial assistance to the family of the student who perished in the accident and to other passengers who are confined in a hospital.

Radio reports here on Wednesday morning quoted officials of the Mati City Police Office as saying that probers and barangay officials suspect the driver lost control of the vehicle due to a mechanical problem that caused the accident. — John Felix M. Unson

Yagi leaves no casualty in Baguio

BAGUIO CITY — Baguio City logged no casualties from severe tropical storm Yagi (Enteng) even as the city was battered by heavy rains since Sunday.

The city’s Disaster Risk and Reduction Management Office (DRRMO) noted that there were no evacuations of residents living along low-lying areas in the city that were perennially flooded during continuous rains.

Baguio City Mayor Benjamin Magalong suspended classes from Kindergarten to Elementary on Wednesday as monsoon rains continued in the city though “Enteng” is exiting the PAR.

Some local government units in the Cordillera Region also opted to declare class suspensions as occasional strong winds and rains are still being experienced.

Authorities have continued reminding the public to be on alert because of the enhanced SouthWest Monsoon that may still cause landslides and flooding. — Artemio A. Dumlao