By Beatriz Marie D. Cruz, Reporter

PHILIPPINE PROPERTY developers are pressing ahead with expansion plans for 2026, guided by long-term demand and urbanization trends, while adopting cautious, phased strategies amid slower infrastructure spending and broader economic uncertainties.

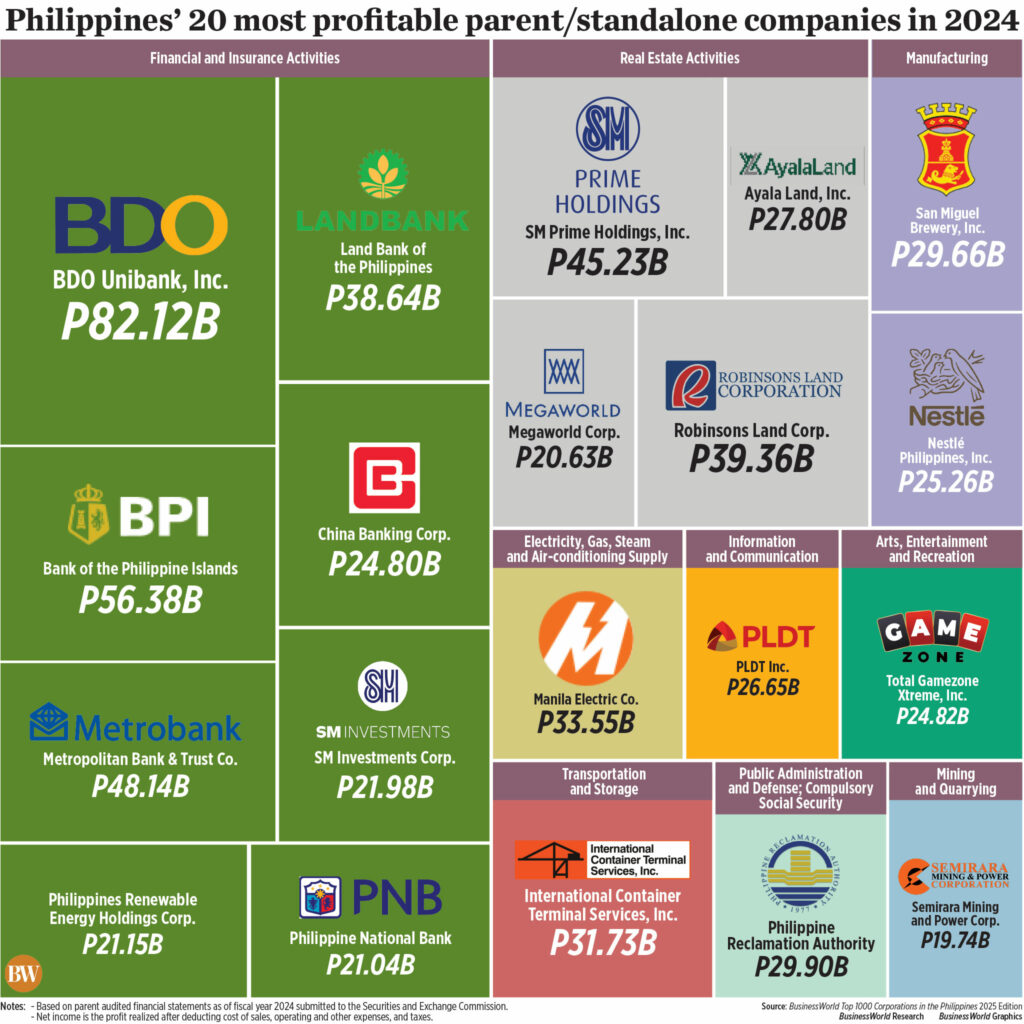

“Sentiment may remain cautious because of global and local uncertainties, but the Philippine property sector’s long-term fundamentals remain strong because of a young population, a growing middle class and continued urbanization,” SM Prime Holdings, Inc. President Jeffrey C. Lim told BusinessWorld in an e-mail.

To capture consumer demand, the Sy-led property developer is banking on its differentiated product offerings, pricing strategy, and accessible locations across its residential and commercial developments, he said.

“We expect the upscale segment to stay resilient, but overall residential take-up will likely be subdued given weak sentiment and lingering uncertainties in the market,” he added.

Gokongwei-led Robinsons Land Corp. (RLC), meanwhile, said it is prioritizing prudent capital allocation, flexible project phasing, and strong tenant and partner relationships amid external uncertainties.

“Despite a more tempered macroeconomic backdrop, we expect steady and resilient demand across our core businesses,” RLC Chief Strategy Officer Ramon S. Rivero said in an e-mailed reply to questions.

The developer’s core segments — residential, leasing, logistics, and hospitality — continue to show structural strength, supported by business process outsourcing expansion, remittances from overseas Filipino workers, and the recovery in tourism, he said.

In response, RLC will continue to “strategically expand our mall and office portfolio by tapping underserved catchments, upgrading existing assets, and integrating new formats that cater to evolving tenant and consumer needs,” Mr. Rivero said.

Mindanao-based developer Damosa Land, Inc. (DLI) expects real estate demand in the region to remain stable, particularly in its residential, industrial, and tourism-oriented developments.

“We also continue to see strong end-user demand in suburban locations, where buyers prioritize space, nature, and long-term value,” DLI President and Chief Executive Officer Ricardo F. Lagdameo said in an interview with BusinessWorld.

The company anticipates “moderate but steady” growth, supported by its diversified portfolio and the expanding regional economy, he added.

Developers have long cited the government’s infrastructure program as a key driver of real estate activity, boosting land values and commercial developments in surrounding areas. However, a corruption scandal involving anomalous flood control projects has slowed public infrastructure spending and weighed on business sentiment.

Data from the Department of Budget and Management showed that infrastructure spending declined by 10.7% to P887.1 billion in the first nine months of 2025, from P982.4 billion a year earlier, as tighter validation of projects followed the controversy.

“Without the collateral damage of the flood control anomalies on the macroeconomy, business activities would have been sustained,” former Bangko Sentral ng Pilipinas Deputy Governor Diwa C. Guinigundo said in a Viber message.

“Public expenditure on infrastructure like new roads and bridges connect communities and urban centers, and therefore encourage business activities, including real estate development,” he added.

Tempered public spending may also slow landbanking outside Metro Manila, according to Colliers Philippines.

“The government’s infrastructure projects are crucial, especially in guiding property firms where to develop next, so delayed infrastructure implementation is likely to impede real estate firms’ development initiatives,” Joey Roi H. Bondoc, director and head of research at Colliers Philippines, said in an e-mailed reply to questions.

For Santos Knight Frank Philippines, the controversy highlights the need for stronger safeguards to improve transparency.

“It’s a great opportunity to have third-party groups come in, whether it’s quantity surveyors, appraisers, or independent groups, to validate where investments go into,” Santos Knight Frank Chairman and Chief Executive Officer Rick M. Santos told BusinessWorld in an interview.

Still, developers said slower public spending is unlikely to derail their long-term expansion plans.

“Our expansion timelines are not tied to short-term movements in public spending, so we do not expect the slowdown in government spending to materially affect the growth plans of our business segments,” Mr. Lim said, citing SM Prime’s long-term pipeline of retail, residential, and hospitality projects.

“We also believe in the Philippines’ long-term growth trajectory, and we will continue developing our projects in line with our long-term plans,” he added.

While monitoring the rollout of infrastructure projects, RLC said its expansion timelines remain intact.

“RLC has historically positioned its developments in strategic growth corridors that already benefit from completed infrastructure, such as improved road networks, airports, and district developments,” Mr. Rivero said.

The company follows a phased expansion strategy that allows flexibility in launch timing amid political and economic uncertainties, he added.

Havitas Properties, Inc., which develops vacation homes and residential projects across the Luzon countryside, said its projects are less exposed to delays in public infrastructure spending.

“Our projects are located within identified infrastructure growth areas which are mostly private sector-led. This has mitigated the risks imposed by public sector-led infrastructure projects which unfortunately are currently in the limelight,” Havitas Properties President and CEO Jonathan F. Caro told BusinessWorld.

In Mindanao, DLI said several infrastructure projects linked to its developments are already in advanced stages.

“National infrastructure spending may slow, but in Mindanao, many catalytic projects are already in advanced stages, which helps cushion the impact,” Mr. Lagdameo said.

These include the Davao Coastal Bypass Road, which was partially opened in December, and the proposed upgrade of the Davao International Airport, slated for completion by end-2026.

By segment, RLC expects stable residential take-up, supported by demand for value-driven and well-located units, particularly green-certified developments in economic hubs.

“We expect a softer residential market but steadier performance across our commercial portfolio next year,” Mr. Lim said, noting that mall leasing remains supported by regional expansion and experiential offerings.

Developers also expect the IT-BPM (Information Technology and Business Process Management) sector to continue driving office leasing demand, while hospitality and wellness tourism remain in bright spots as travel and leisure activity recovers.

“We operate with caution but confidence, prioritizing phased development and data-driven planning to ensure long-term growth despite macro uncertainties,” Mr. Lagdameo said.

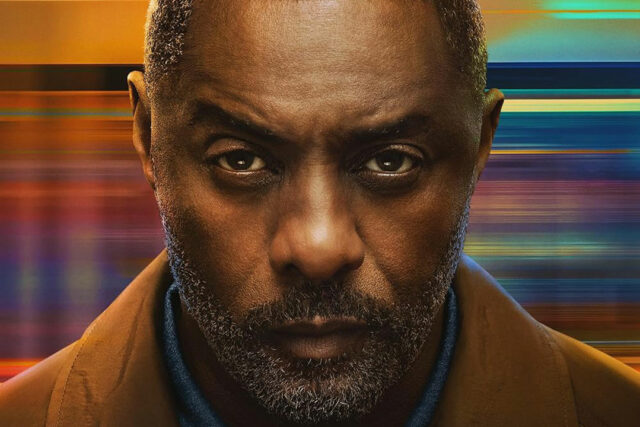

LONDON — Actor Idris Elba faces another crisis in season two of thriller series Hijack, when passengers on a Berlin underground train are taken hostage during the morning rush hour.

LONDON — Actor Idris Elba faces another crisis in season two of thriller series Hijack, when passengers on a Berlin underground train are taken hostage during the morning rush hour.