AYALA Corp. was among the most actively traded stocks last week amid the approval of its planned follow-on offering (FOO) by the market operator, following a treasury share sale and market sentiment from the US central bank interest rate cut.

Ayala Corp. was the seventh most actively traded stock last week, with a total of 2.58 million shares worth P1.8 billion having exchanged hands from Sept. 23 to 27, according to data from the Philippine Stock Exchange (PSE).

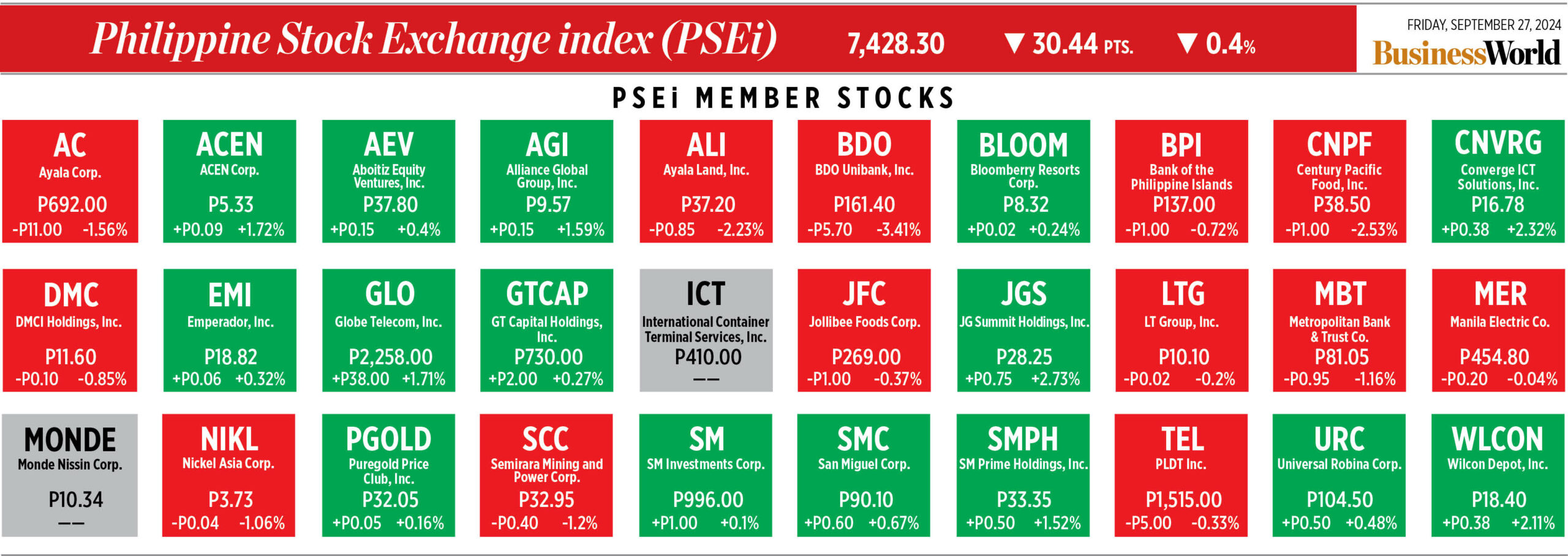

Its shares closed at P692 apiece on Friday, up 0.3% week on week. Since the start of the year, the stock increased by 1.6% from P681 per share.

“Ayala Corp. became one of the most actively traded stocks this week due to its high-profile financial activities and strategic announcements. The company disclosed its plans to raise P15 billion through an FOO shortly after it successfully generated P2.21 billion from a treasury share sale,” Toby Allan C. Arce, head of Sales Trading at Globalinks Securities and Stocks, Inc., said in an e-mail.

Mr. Arce added that the disclosure created significant interest in the market, as investors sought to capitalize on Ayala Corp.’s plans to bolster its capital and to be used for expansion and other corporate activities.

“These developments were seen as a sign of Ayala’s strategic financial management, driving up its liquidity and making it one of the week’s top-traded stocks,” added Mr. Arce.

Last week, the PSE approved Ayala Corp.’s application for the reissuance from treasury of up to 7.5 million Class B preferred shares to cover the planned FOO.

The conglomerate foresees having P14.89 billion in net proceeds if the oversubscription is fully exercised, which will be utilized for the redemption of the P15-billion Class B preferred shares callable on Nov. 29.

The FOO consists of a base offer of up to five million shares or P10 billion, with an oversubscription option for 2.5 million shares or P5 billion, both priced at P2,000 per share, based on Ayala Corp.’s prospectus dated Sept. 25.

Ayala’s consolidated revenues rose by 8.7% to P92.67 billion in the second quarter, bringing its top line in the first half to P179.44 billion, growing by 9.6%.

The conglomerate’s attributable income in the April-to-June quarter rose by 12.5% to P9.21 billion from P8.19 billion in the same period last year.

In the first semester, net income attributable to the owners of the parent company inched up by 21.1% to P22.29 billion from P18.41 billion a year ago.

Mr. Arce said that the company is poised to perform relatively well, especially if the proceeds from the FOO are deployed effectively toward growth opportunities.

“Given its strong portfolio in infrastructure, real estate, and other sectors, the Philippine conglomerate could continue to post solid revenues, especially with signs of recovery in various industries post-pandemic. However, external economic factors such as inflation and interest rates may temper this growth, making the outlook moderately positive but still subject to external risks,” added Mr. Arce.

He projected the full-year 2024 net income to reach P45.9 billion.

“Overall market sentiment lifted Ayala Corp. as the United States Federal Reserve (US Fed) started cutting interest rates. This is bullish news for the PSE Index, lifting all sectors, especially the financial and property sectors,” Mercantile Securities Corp. Head Trader Jeff Radley C. See said in a Viber message.

“Investors will likely see capital raising due to the strong performance of the market,” Mr. See added.

Headline inflation averaged 3.6% in the first eight months of the year, slower than the 6.6% recorded in the same period last year.

Inflation data for September will be released on Oct. 4 by the Philippine Statistics Authority.

The Monetary Board cut rates by 25 bps, bringing the benchmark rate to 6.25% from the over 17-year high of 6.5%.

In a Reuters report, the US Fed cut its policy rate to the 4.75%-5% range, delivering a bigger-than-usual half-of-a-percentage-point cut. In addition to approving the half-percentage-point cut, Fed policy makers projected the benchmark interest rate would fall by another half of a percentage point by the end of this year, a full percentage point next year, and half of a percentage point in 2026, though they cautioned that the outlook that far into the future is necessarily uncertain.

Looking forward, Mr. Arce said that the stock’s performance could see fluctuations depending on investor response to its capital-raising initiatives and broader market trends.

“In the short term, a range-bound movement is anticipated unless there’s a significant macroeconomic development or news event that influences market sentiment,” Mr. Arce added.

Mr. Arce pegged Ayala Corp.’s stock at an immediate support of around P656 per share and resistance of P735 per share.

Mr. See expects Ayala Corp.’s stock to move sideways to down as investors will experience profit taking in the short term.

He gave support levels at P660 apiece and P630 apiece, while the resistance level is at P720. — Lourdes O. Pilar