As we hold public officers and employees to higher standards of conduct and ethics, we also recognize the importance of supporting them in fulfilling these exacting principles of public service. This will reduce the burden of generally perceived low wages, and even boost morale. Given limited resources, it has become a normal practice for concerned and reputable businesses to voluntarily provide their services at discounted prices, with the aim of contributing to the well-being of those who serve the public.

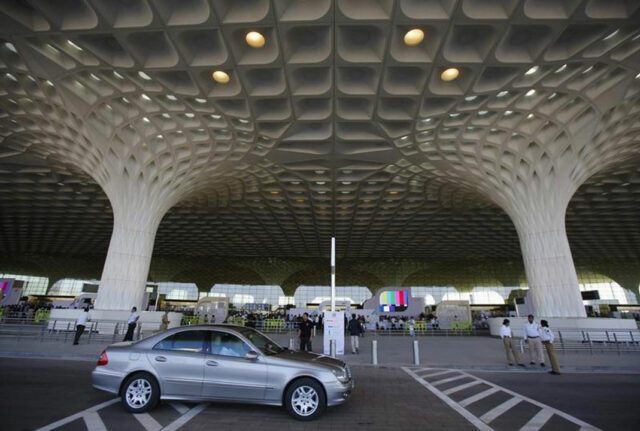

For several years, the Civil Service Commission has teamed up with numerous private business establishments to offer discounts and freebies to civil servants and retired government workers. These business establishments include banks, food chains, retail stores, health and wellness clinics, travel agencies, hotels, and amusement parks. In fact, not a few airlines have partnered and signed a Government Fares Agreement with the Procurement Service of the Department of Budget and Management to give discounted fares to government employees on official business trips. Even government workers using the MRT and LRT fares have been given discounts.

In August, the Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) No. 88-2024, publishing the full text of the Memorandum of Agreement (MoA) between the BIR and the Philippine-Chinese Charitable Association, Inc. (PCCAI). The PCCAI is the owner and operator of the Chinese General Hospital and Medical Center.

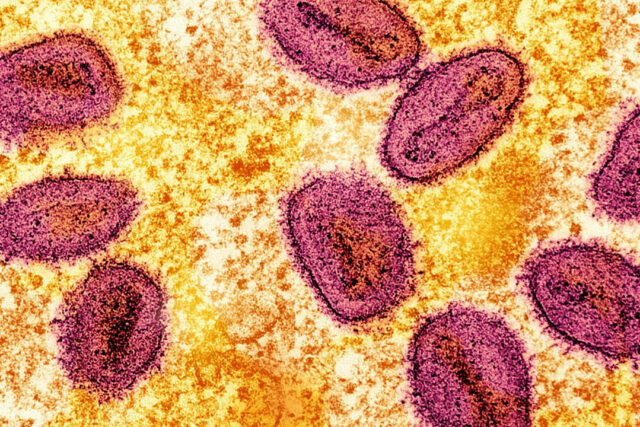

Under the MoA, the PCCAI offers its medical facilities and services at a discount to the BIR for a year (subject to extension), through its hospital as a charitable project. PCCAI is to provide diagnosis and treatment to officials and employees of the BIR and grant a 50% discount on charges for room occupancy and a 30% discount on laboratory (except blood related procedures), pulmonary (except for the embedded professional fee in ABG) and x-ray (except handling fee) services. This also includes out-patient medical services but excludes the cost of medicine. With this MoA, the BIR aims to provide adequate medical services available to its officials and employees thereby ensuring their health, welfare, and safety.

The MoA clearly provides BIR officials a brief respite to the high cost of medical services in the Philippines, and both the BIR and PCCAI can be lauded for coming up with this. To the curious though, how are these discounts to government workers viewed under Philippine law?

Discounts may potentially be seen as “gifts.” Republic Act (RA) No. 6713 or the Code of Conduct and Ethical Standards for Public Officials and Employees, defines a “Gift” as referring to a thing or a right to dispose of gratuitously, or any act or liberality, in favor of another who accepts it. It does not include an unsolicited gift of nominal or insignificant value not given in anticipation of, or in exchange for, a favor from a public official or employee. What is considered a gift of nominal value will depend on the circumstances of each case, taking into account the salary of the official or employee, the frequency or infrequency of the giving, the expectation of benefits, and other similar factors.

The RA prohibits public officials and employees from soliciting or accepting (either directly or indirectly) any gift, gratuity, favor, entertainment, loan or anything of monetary value from any person in the course of their official duties or in connection with any operation being regulated by, or any transaction that may be affected by the functions of their office.

Moreover, RA 3019, or the Anti-Graft and Corrupt Practices Act and its Implementing Rules and Regulations (IRR), define the act of “receiving any gift” by a public officer as including accepting, directly or indirectly, a gift from a person other than a member of the public officer’s immediate family, on behalf of himself or of any member of his family or relative within the fourth civil degree (either by consanguinity or affinity), even on the occasion of a family celebration or national festivity like Christmas, if the value of the gift is under the circumstances manifestly excessive.

With the oft-repeated adage that a public office is a public trust, it has been the consistent policy of the State to promote high ethical standards in public service. Thus, public officials and employees are encouraged to discharge their functions with the utmost responsibility and integrity.

While discounted healthcare is a tremendous gift in the general sense, in my view, it does not appear to violate the prohibitions under the RA since the discount seems gratuitously given to everyone at the BIR. Likewise, the BIR’s acceptance is made in consideration of its employees’ health, welfare, and safety. It does not appear to be given by PCCAI in the course of the BIR’s conduct of official duties, or connected to any operation or transaction that may be affected by the functions of their office.

Perhaps some may be concerned that unlike the discounts given by other private businesses to all government workers, the discount under the MoA is given only to a specific government agency — the BIR. As humans, we may, at times, be influenced by special treatments given to us. Perhaps, in the future, a partnership that involves the broader government, though possibly with a lower discount, might warrant less scrutiny.

The views or opinions expressed in this article are solely those of the author and do not necessarily represent those of Cabrera & Company. The content is for general information purposes only, and should not be used as a substitute for specific advice.

Charilyn Caliwag is a senior legal advisor of Cabrera & Co., a Philippine member firm of the PwC network.

charilyn.caliwag@pwc.com