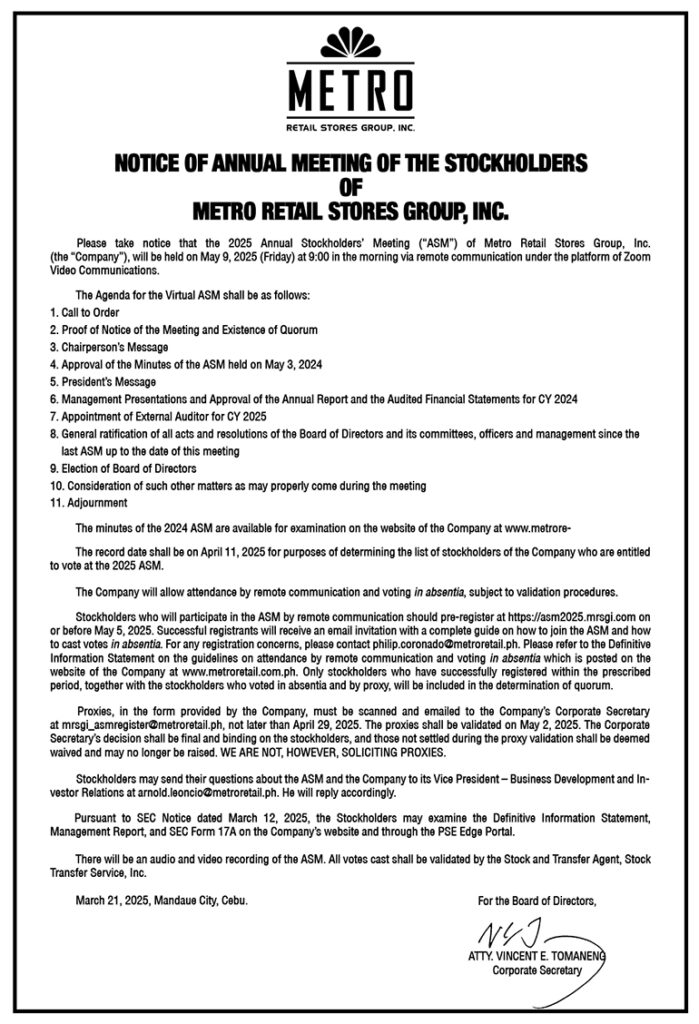

Cash remittances rise 2.7% in Feb.

MONEY SENT HOME by migrant Filipinos rose by 2.7% year on year in February, the slowest in nine months, data from the Bangko Sentral ng Pilipinas (BSP) showed.

Cash remittances from overseas Filipino workers (OFWs) coursed through banks increased to $2.72 billion from $2.65 billion in the same month in 2024.

The growth in February remittances was slower than the 2.9% rise in January, and the slowest since the 2.5% growth in June 2024.

Cash remittances from land-based workers went up by 3% to $2.19 billion, while money sent home by sea-based workers inched up by 1.2% to $520 million

For the first two months of the year, cash remittances jumped by 2.8% to $5.63 billion, from $5.48 billion a year ago. The bulk came from land-based workers at $4.52 billion, up 3.2% from a year ago, while the rest came from sea-based workers at $1.11 billion, up 1% from a year ago.

“The growth in cash remittances from the United States, Saudi Arabia, Singapore, and the United Arab Emirates (UAE) mainly contributed to the increase in remittances in January-February 2025,” the BSP said.

The United States was the main source of cash remittances with a 40.9% share of the total so far this year. It was followed by Singapore (7.6%), Saudi Arabia (6%), Japan (5.2%), the United Kingdom (4.8%), the UAE (4%), Canada (3.2%), Taiwan (2.9%), Qatar (2.8%) and Hong Kong (2.6%).

Meanwhile, personal remittances, which include inflows in kind, rose by 2.6% to $3.02 billion in February from $2.95 billion a year ago.

Personal remittances from workers with contracts of one year or more increased by 2.8% to $2.37 billion in February, while those from workers with contracts of less than a year went up by 2% to $580 million.

In the January-February period, personal remittances grew by 2.7% to $6.27 billion from $6.1 billion a year earlier.

For the two-month period, personal remittances from workers with contracts of one year or more jumped by 2.9% to $4.89 billion, while those from workers with contracts of less than one year increased by 2.2% to $1.23 billion.

“The continued single-digit growth (in remittances) nevertheless is still a good signal/bright spot for the overall economy as an important growth driver, especially in terms of consumer spending, which accounts for nearly 75% of the Philippine economy,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said.

“The net increase in the US dollar versus the peso by about 12% over the past three years would require the sending of lower amount of remittances to pay for the amount of expenses in pesos but higher prices since 2022,” he added.

The peso strengthened by 37 centavos to close at P57.995 per dollar on Feb. 28 from its P58.365 finish on Jan. 31.

“The modest remittance growth reflects a mix of seasonal normalization after the holiday surge and the impact of forex dynamics, particularly the stronger PHP in that period, which may have affected remittance behavior,” Philippine Institute for Development Studies Senior Research Fellow John Paolo R. Rivera said in a Viber message.

Mr. Rivera said slower global growth and “labor market adjustments” tempered the rise in remittances in February.

“Moving forward, remittances are likely to remain resilient, supported by stable overseas employment and the continued demand for OFWs. However, geopolitical risks, currency volatility, and potential slowdowns in advanced economies may keep growth moderate in the coming months,” he added.

The US government’s protectionist policies, as well as stricter immigration rules, may also weigh on remittances from US-based OFWs, Mr. Ricafort said.

“The Trump administration could tighten immigration rules in the US in an effort to create and protect more jobs for US citizens, thereby potentially slowing down OFW remittances from the US,” he said.

“Trump’s threats of higher tariffs/reciprocal tariffs and other America-first policies could also slow down global trade, investments, employment including some OFW jobs, and overall world economic/GDP growth, thereby also indirectly slowing down the growth in OFW remittances from other countries around the world.” — AMCS