US House targets big climate, clean energy rollbacks in budget proposal

WASHINGTON — US House lawmakers laid out plans on Monday to phase out clean energy tax credits, slash spending on electric vehicles and renewable energy, and claw back other climate-related funds as part of the Republicans’ attempt to pass a multi-trillion-dollar budget in line with President Donald J. Trump’s agenda.

The House Committee on Energy and Commerce laid out a proposal, which will be voted on on Tuesday, that would raise $6.5 billion from the repeal of climate-related parts of the Biden administration’s massive Inflation Reduction Act legislation.

The House Ways and Means panel, meanwhile, proposed the phase-out or cancellation of several lucrative tax credits from former President Joseph R. Biden’s signature climate law, including ending a consumer-facing credit for electric vehicle purchases and a tax credit for home energy efficiency improvements, and the phase out of various key clean energy subsidies for expiry by 2031, according to a document it released on Monday.

Groups representing the solar and wind industries said the moves would cost American jobs and were at odds with Mr. Trump’s goal to expand domestic energy sources.

“While American businesses are demanding more energy to compete against our adversaries, and consumers are turning to clean energy to hedge against rising electricity prices, these proposals will undermine our nation’s efforts to achieve President Trump’s American energy dominance agenda,” Abigail Ross Hopper, president of the Solar Energy Industries Association, the top solar trade group, said in a statement.

She noted that the sector has invested billions of dollars into states that elected Mr. Trump.

Mr. Trump had campaigned on a promise to end government support for electric vehicles and unwind Biden’s sweeping efforts to combat global warming, arguing that the measures are unnecessary and harmful to automakers, drillers and miners. He is also hoping that his first budget since reclaiming office will make good on his promises to slash the federal bureaucracy.

The proposed cuts from the House tax panel include a rapid phase-out of the “technology neutral” 45Y tax credits for wind, solar and other clean energy sources that include Republican-favored technologies like nuclear and geothermal.

The credits, which had no expiration previously, would phase down from 80% for a facility placed in service during calendar year 2029, to 60% by 2030, 40% by 2031 and zero after 2031.

Transferability, a provision of the 2022 Inflation Reduction Act that had allowed developers to sell their tax credits and use the funds to finance their projects’ construction, would also be eliminated, according to the proposed draft.

Meanwhile, tax credits for carbon capture and sequestration as well as direct air capture, known as 45Q — favored by the oil and gas industry -— remained mostly in tact, with some limits to foreign ownership of projects. A tax credit for sustainable aviation fuel was also extended in the proposal, in a nod to biofuel producers looking to expand their markets.

Over two dozen Republicans in the House, as well as four Republican senators whose states were beneficiaries of billions in investment due to the individual retirement account (IRA), had urged the committee to preserve several of the tax credits.

Some clean-energy advocates said the proposed phase outs were not as harsh as they could have been but still serve a huge blow to the clean energy industry.

“Dismantling the IRA clean energy tax credits will kill jobs. It will create chaos in the business community, and it will raise energy costs for families already struggling to get by,” said Nevada Democratic Senator Catherine Cortez Masto, who said it would hit her state’s burgeoning solar industry especially hard.

CLAWING BACK CLIMATE SPENDING

The House energy panel’s plan, meanwhile, would repeal major Biden administration Environmental Protection Agency rules such as one that would cut allowed emissions for light- and medium-duty vehicles starting with model year 2027.

It also includes measures aimed at speeding up permitting for liquefied natural gas exports and would direct more than $1.5 billion for the Energy Department to refill the Strategic Petroleum Reserve.

“This bill would claw back money headed for green boondoggles through ‘environmental and climate justice block grants’ and other spending mechanisms through the Environmental Protection Agency and Energy Department,” House energy panel chair Brett Guthrie wrote in a Wall Street Journal op-ed that announced the proposal on Sunday.

The bill would also rescind the remaining unspent money from the $27-billion greenhouse gas reduction fund, which has been a key target of EPA Administrator Lee Zeldin, who claimed that the money was being spent fraudulently in subsequent court cases.

It would also take back unspent funding from nine IRA renewable energy and electrification subsidy programs, such as tribal energy loan guarantees and transmission facility financing, and remove unspent IRA funds from the Energy Department’s loan office.

It would rescind unspent funding made available by the IRA for methane reduction at oil and gas facilities and for greenhouse gas reporting, funds to reduce air emissions at ports and manufacturing facilities and schools as well as funds for low-income communities to access clean energy.

“Their proposal guts investments that are cutting energy costs, powering a domestic manufacturing boom, and delivering essential healthcare to the communities that need it most,” said environmental group Evergreen Action Executive Director Lena Moffitt. — Reuters

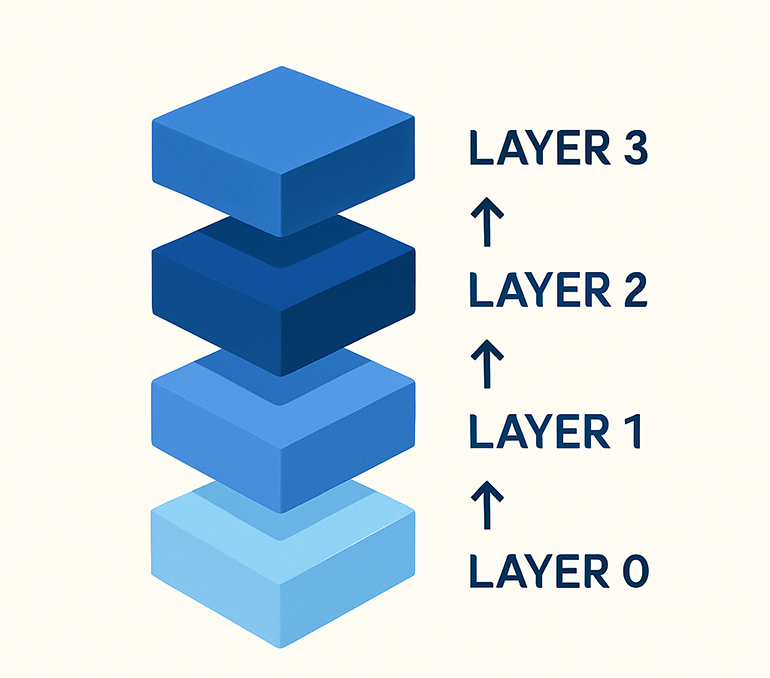

In just a few years, the blockchain industry has made major strides in solving the scalability puzzle. But each new solution, be it modular chains, app-specific layers, or interoperability protocols has introduced trade-offs, particularly in user experience and liquidity distribution.

In just a few years, the blockchain industry has made major strides in solving the scalability puzzle. But each new solution, be it modular chains, app-specific layers, or interoperability protocols has introduced trade-offs, particularly in user experience and liquidity distribution.

Under the bright lights of Auto Shanghai 2025, JETOUR officially unveiled its GAIA Architecture and showcased the G700 and G900 — both now equipped with the GAIA architecture — marking a significant milestone in the brand’s evolution into the premium and intelligent 3.0 era.

Under the bright lights of Auto Shanghai 2025, JETOUR officially unveiled its GAIA Architecture and showcased the G700 and G900 — both now equipped with the GAIA architecture — marking a significant milestone in the brand’s evolution into the premium and intelligent 3.0 era. Global media test drive

Global media test drive JETOUR held its “Travel+” tour of Shanghai, featuring the city’s most renowned landmarks. JETOUR’s media and influencers enjoyed views from the Oriental Pearl Tower, then explored the historic alleys of Town God’s Temple. The group later soaked in the sights of the Bund. The tour concluded at the Grand Halls in Shanghai, just north of the Bund.

JETOUR held its “Travel+” tour of Shanghai, featuring the city’s most renowned landmarks. JETOUR’s media and influencers enjoyed views from the Oriental Pearl Tower, then explored the historic alleys of Town God’s Temple. The group later soaked in the sights of the Bund. The tour concluded at the Grand Halls in Shanghai, just north of the Bund.