PANGILINAN-LED Metro Pacific Investments Corp. (MPIC) reported a 14% increase in consolidated core net income to P23.6 billion for the first nine months, driven by stronger performance across its portfolio.

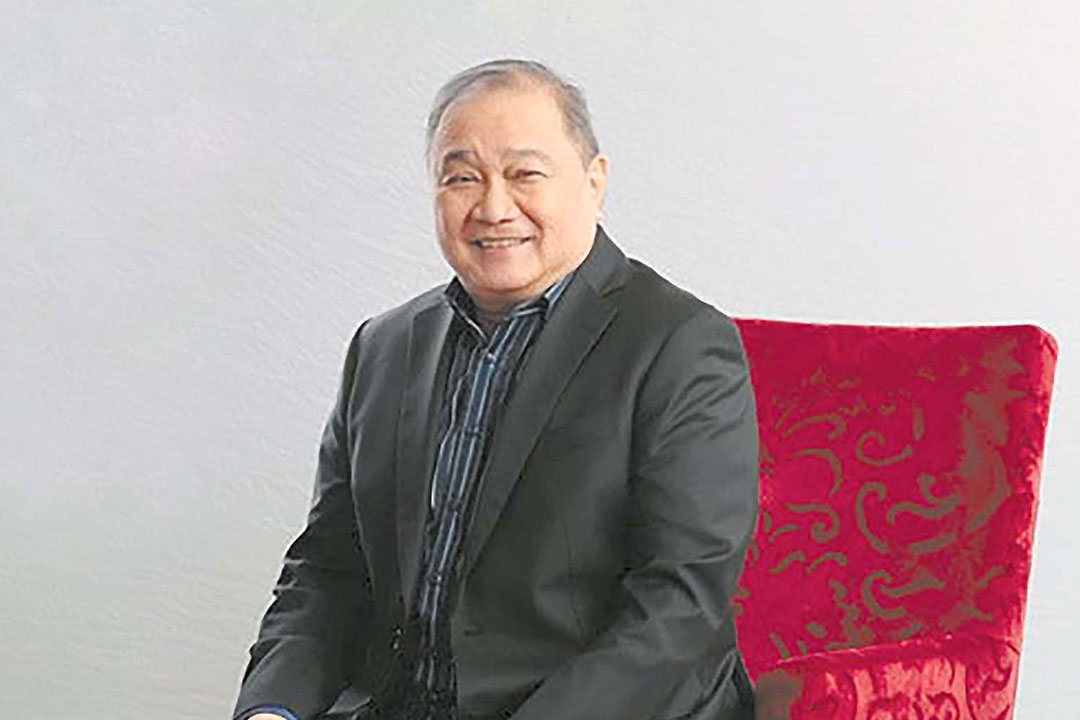

“Our performance in the first nine months of the year underscores the resilience of our core businesses. Power and Water continued to post strong results, while Toll Roads managed near-term challenges stemming from higher financing costs and are expected to regain momentum as the newer roads mature,” MPIC Chairman, President, and Chief Executive Officer Manuel V. Pangilinan said in a statement on Monday.

Operational contribution rose 12% to P27.2 billion, led by growth in Meralco’s power generation, higher tariffs at Maynilad, and increased patient numbers in the Metro Pacific Hospitals network.

“The listing of Maynilad presents an opportunity to unlock greater value and reinvest in improving water supply and access,” Mr. Pangilinan added. Maynilad became the second and last company to list on the Philippine Stock Exchange this year and the largest since Monde Nissin Corp.’s P48.6-billion offering in 2021.

Among MPIC’s core businesses, power accounted for P17.6 billion, or 65% of Net Operating Income (NOI), followed by water and toll roads with P5.8 billion and P4.4 billion, respectively.

Reported income grew 7%, slower than core net income, as last year included a one-time gain from a subsidiary.

Meralco’s revenue rose 5% from higher pass-through charges, retail electricity sales, and improved power generation, while its core net income increased 14% to P40 billion.

Maynilad’s revenue climbed 10% to P27.7 billion after an 8% tariff increase, with core net income up 18% to P11.4 billion, supported by higher revenues and better cost control. Non-revenue water improved to 32.8%, recovering about 231 million liters daily through intensified leak repairs and advanced detection methods.

Metro Pacific Tollways Corporation’s revenues grew 17% to P27 billion due to toll hikes and higher traffic, while core net income fell 2% to P4.8 billion due to higher financing costs from the JTT acquisition and the end of interest capitalization. Reported net income declined 7% to P4.5 billion following last year’s reversal of contingent considerations.

“MPIC remains committed to creating long-term value across our portfolio — particularly in areas critical to national progress such as energy, water, and food security,” Mr. Pangilinan said.

MPIC is one of three key Philippine units of Hong Kong-based First Pacific Co. Ltd., alongside Philex Mining Corp. and PLDT Inc. Hastings Holdings, Inc., a unit of MediaQuest Holdings, Inc., holds a majority stake in BusinessWorld through the Philippine Star Group, which it controls. — Alexandria Grace C. Magno