Yields end mixed amid cautious trade

YIELDS on government securities (GS) traded in the secondary market were mixed last week as the market was in a cautious mood after the Trump administration announced a 20% tariff on Philippine exports to the United States.

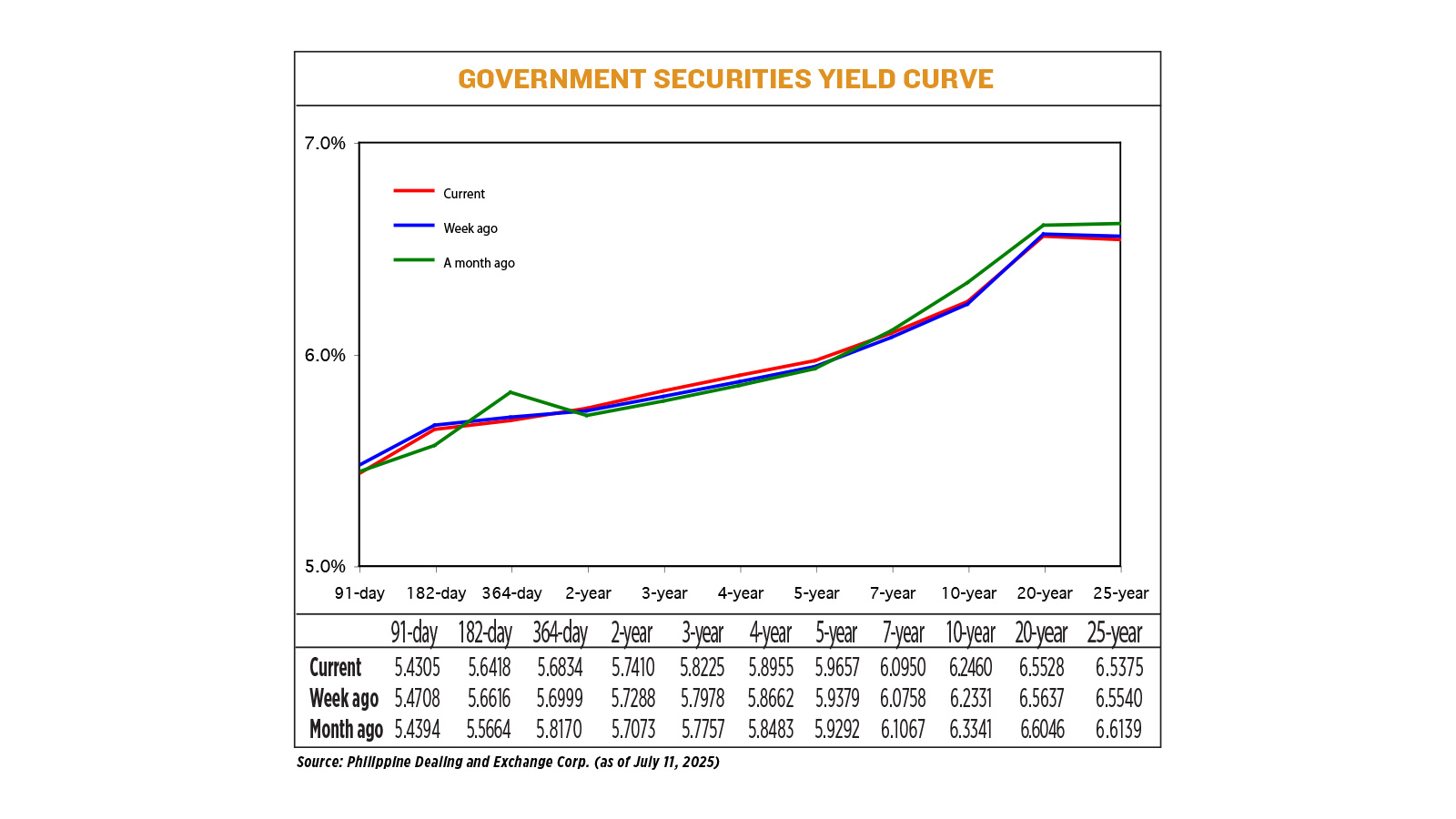

GS yields, which move opposite to prices, inched up by an average of 0.2 basis point (bp) week on week, according to the PHP Bloomberg Valuation Service Reference Rates as of July 11, published on the Philippine Dealing System’s website.

At the short end, rates of the 91-, 182-, and 364-day Treasury bills (T-bills) fell by 4.03 bps, 1.98 bps, and 1.46 bps week on week to 5.4305%, 5.6148%, and 5.6834%, respectively.

Meanwhile, at the belly, yields on the two- three-, four-, five- and seven-year Treasury bonds (T-bonds) went up across the board, rising by 1.22 bps (to 5.741%), 2.47 bps (5.8225%), 2.93 bps (5.8955%), 2.78 bps (5.9657%), and 1.92 bps (6.0950%), respectively.

Tenors at the long end fetched mixed rates. The 20- and 25-year debt papers saw their yields decline by 1.09 bps (to 6.5528%) and 1.65 bps (6.5375%). Meanwhile, the 10-year T-bonds went up by 1.29 bps to 6.246%.

GS volume traded reached P22.07 billion on Friday, significantly lower than the P56.07 billion recorded a week earlier.

Alessandra P. Araullo, chief investment officer at ATRAM Trust Corp., said in a Viber message that the local bond market traded sideways for most of the week, with the result of the Bureau of the Treasury’s (BTr) auction of reissued 10-year bonds held on Tuesday showing cautious sentiment.

“The Bureau of the Treasury fully awarded the P30-billion offering of FXTN 10-69, attracting a total of P64.04 billion in bids — more than twice the offered amount. Despite the strong demand, the accepted average rate of 6.128% landed close to the bid-side of secondary levels, reflecting investor reluctance to significantly extend duration,” she said in a Viber message.

“This also suggests that market players are wary of the persistent supply pressure building up on the belly of the curve.”

Meanwhile, shorter tenors benefited from the Bangko Sentral ng Pilipinas’ (BSP) hints on more rate cuts this year, Ms. Araullo said.

BSP Governor Eli M. Remolona, Jr. earlier said they have room for two more rate cuts this year amid benign inflation and weak economic growth. The Monetary Board has reduced benchmark borrowing costs by a cumulative 125 bps since it began its easing cycle in August last year.

“Offshore developments also played a role in capping yield movements. Tariff uncertainty and the rising risk of trade friction abroad sparked concerns about global growth moderation,” she added.

Nicholas Antonio T. Mapa, chief economist at Metropolitan Bank & Trust Co., said the market’s mood was generally cautious throughout the week after Mr. Trump announced that they plan to impose a 20% tariff rate on Philippine exports to the US.

For this week’s trading session, Ms. Araullo said GS yield movements could be driven by the BTr’s auction of P25 billion in reissued 10-year T-bonds on Tuesday. She said the bonds could fetch rates of 6.22% to 6.27%.

“This will be another gauge for investors’ demand for extending duration,” she said.

“Beyond domestic supply conditions, external factors — including potential inflation surprises and renewed global volatility stemming from fiscal or trade developments — may influence market sentiment,” Ms. Araullo added. — Abigail Marie P. Yraola