Gov’t debt yields mixed as US downgrade roils bond markets

YIELDS on government securities (GS) traded in the secondary market ended mixed last week as investors repositioned in the aftermath of Moody’s Ratings’ downgrade of the United States’ credit rating.

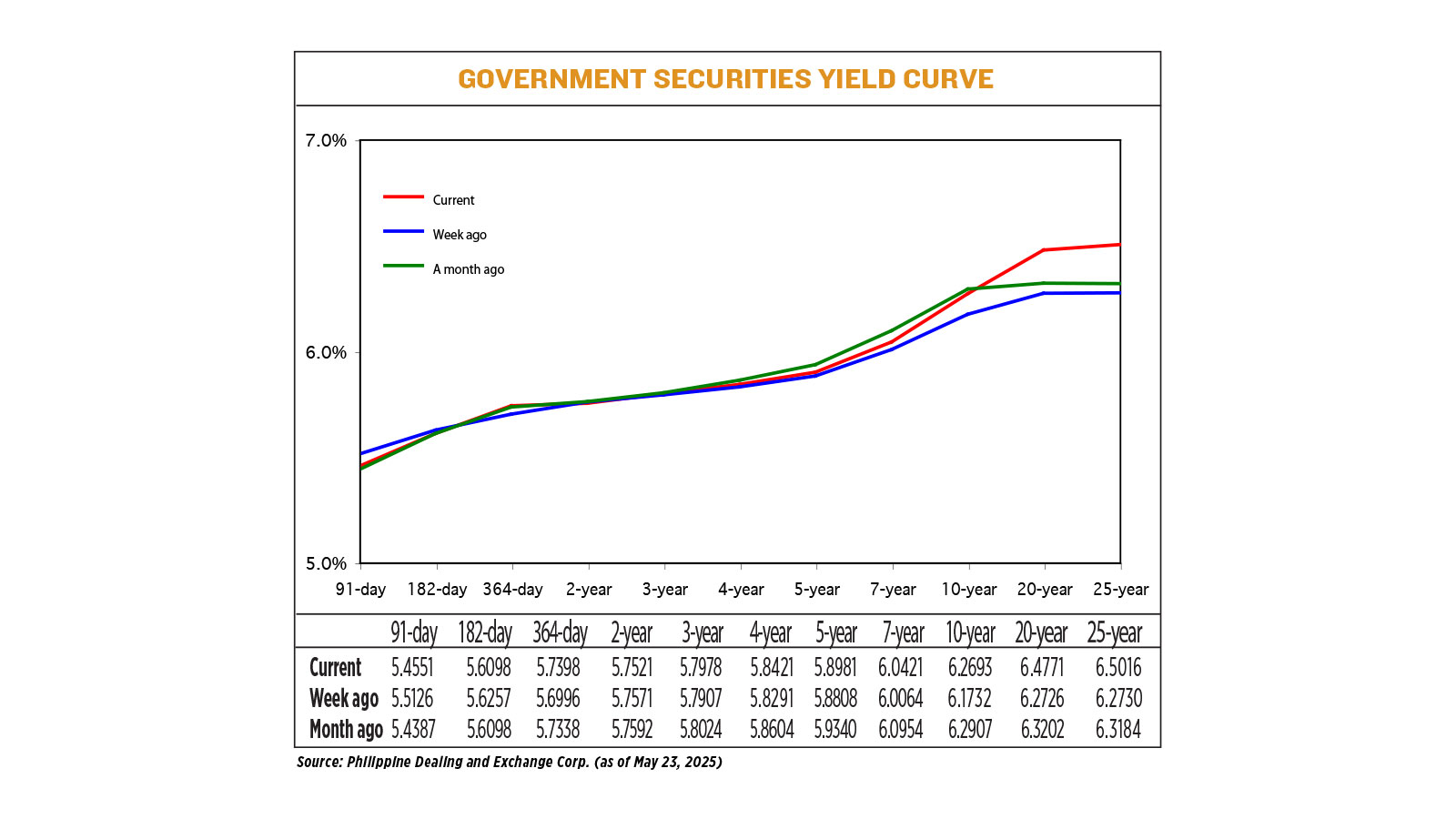

GS yields, which move opposite to prices, rose by an average of 5.13 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service Reference Rates as of May 23 published on the Philippine Dealing System’s website.

At the short end, yield movements were mixed. The rates of the 91- and 182-day Treasury bills (T-bills) went down by 5.75 bps and 1.59 bps week on week to 5.4551% and 5.6098%, respectively. On the other hand, the 364-day T-bill rose by 4.02 bps to yield 5.7398%.

At the belly of the curve, the two-year Treasury bond (T-bond) fell by 0.5 bp to fetch 5.7521%. Meanwhile, yields on the three-, four-, five- and seven-year bonds increased by 0.71 bp (to 5.7978%), 1.3 bps (5.8421%), 1.73 bps (5.8981%), and 3.57 bps (6.0421%), respectively.

At the long end, rates of the 10-, 20-, and 25-year T-bonds surged by 9.61 bps (to 6.2693%), 20.45 bps (6.4771%) and 22.86 bps (6.5016%), respectively.

GS volume traded amounted to P36.79 billion on Friday, lower than the P80.42 billion recorded a week prior.

“Local bonds traded on the back foot after US rates soared as Moody’s Ratings downgraded its credit rating one notch lower to “Aa1” from “Aaa,” aligning with Fitch Ratings and S&P Global Ratings,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said in an e-mail.

“US 30-year yields jumped above 5%, with the curve steepening significantly,” Mr. Aquino said. “Local bonds were not spared as yields traded 3-7 bps higher week on week despite the strong showing in the last 10-year auction.”

Moody’s US debt downgrade is raising concerns that investors could reevaluate their appetite for US government bonds, with the potential for rising yields to put pressure on stocks that are trading at elevated valuations, Reuters reported.

Moody’s decision to downgrade the US debt rating by a notch due to mounting government debt and rising interest expenses has rekindled fears of a broader investor reappraisal of US sovereign debt, which could drive up borrowing costs across the economy.

Benchmark 10-year yields, which influence mortgage rates as well as borrowing costs for companies and consumers, rose to over 4.5% early on Monday but the sell-off then moderated. On Tuesday, the bond market sell-off continued, with the 10-year yield last seen at 4.48%, slightly above where it closed on Monday.

Longer-dated 30-year yields rose more sharply, hitting a high of over 5% on Monday, the highest since November 2023, and flirting with that level again on Tuesday.

On Friday, the 30-year US bond yield, which on Thursday hit the highest since October 2023, fell in response to fresh tariff fears.

The yield was down 2.2 bps at 5.042%. The yield on benchmark US 10-year notes fell 3.6 bps to 4.517%.

Thirty-year bonds have taken the brunt of the price sell-off and posted the largest weekly increase in yields since April 7. Yields move the opposite direction to prices.

US President Donald J. Trump on Friday unleashed his latest trade threats, recommending 50% tariffs on European Union (EU) imports from June 1 and considering a 25% tariff on any Apple iPhones made outside the US.

Meanwhile, the Bureau of the Treasury (BTr) last week raised P30 billion as planned from its auction of reissued of 10-year papers, with total bids reaching P109.50 billion.

The papers are part of the P300 billion in new benchmark fixed-rate Treasury notes priced on April 15 and issued on April 28.

The BTr also raised an additional P10 billion via the same bonds from its tap facility window offering held after the auction proper.

The 10-year notes, which have a remaining life of nine years and 11 months, were awarded at rates ranging from 6.21% to 6.24%, bringing the average rate to 6.226%.

For this week, Mr. Aquino said GS yields may continue to be influenced by global market movements amid a lack of catalysts at home.

“The new 15-year supply could be another headwind, with markets seeing some duration fears at the moment after the sharp steepening move in the US,” he said.

On Tuesday, the government will offer P30 billion in reissued 20-year T-bonds with a remaining life of 13 years and eight months.

Jonathan L. Ravelas, senior adviser at professional service firm Reyes Tacandong & Co., said in a Viber message that GS yields may move sideways this week.

“Yields may move sideways to down, supported by dovish global sentiment and stable local macroeconomic data. However, external risks could still introduce some volatility,” he said. — Lourdes O. Pilar with Reuters