Yields on gov’t debt rise after BSP hike

YIELDS on government securities (GS) went up last week after the Bangko Sentral ng Pilipinas (BSP) hiked benchmark rates before a scheduled meeting in an “urgent” move to curb inflation.

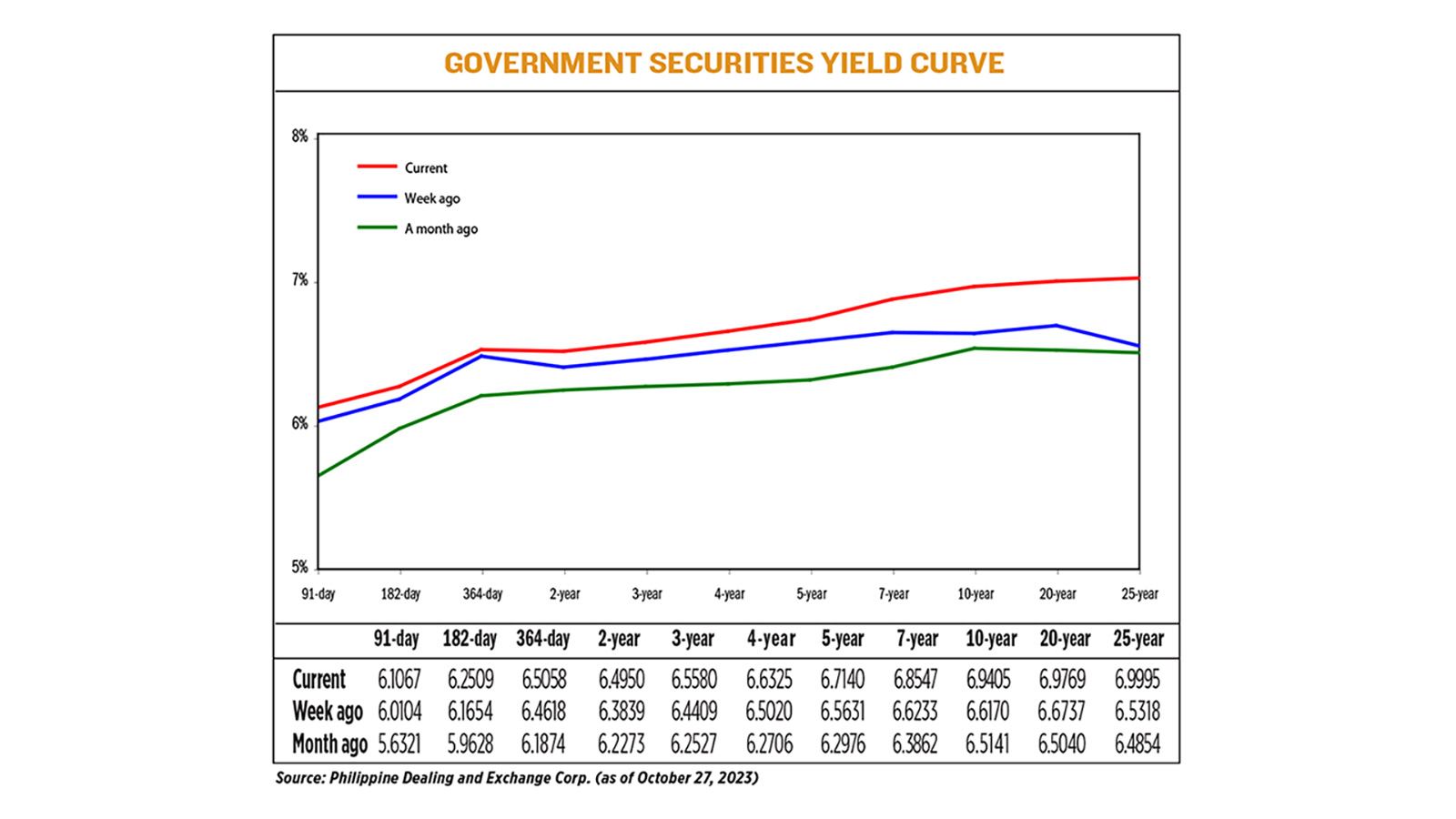

GS yields, which move opposite to prices, went up by an average of 18.74 basis points (bps) week on week, based on the PHP Bloomberg Valuation Service reference Rates as of Oct. 27 published on the Philippine Dealing System’s website.

Yields on the 91-, 182-, and 364-day Treasury bills (T-bills) rose by 9.63 bps (to 6.1067%), 8.55 bps (6.2509%), and 4.4 bps (6.5058%), respectively.

Rates at the belly of the curve climbed, with the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) rising by 11.11 bps (to 6.495%), 11.71 bps (6.558%), 13.05 bps (6.6325%), 15.09 bps (6.7140%), and 23.14 bps (6.8547%).

Likewise, at the long end, 10-, 20-, and 25-year debt papers rose by 32.35 bps (6.9405%), 30.32 bps (6.9769%), and 46.77 bps (6.9995%).

Total GS volume reached P13.69 billion on Friday, higher than P13.53 billion on Oct. 20.

“The upward adjustment in yield levels were driven by market pricing of the off-cycle policy hike by the BSP along with the broadly defensive tone in primary and secondary fixed-income market trading,” ATRAM Trust Corp. Head of Fixed Income Strategies Lodevico M. Ulpo, Jr. said in an e-mail.

The BSP delivered an off-cycle 25-bp rate hike last week to help tame soaring inflation, bringing total increases to 450 bps since May 2022.

This brought the key rate to 6.5%. The overnight deposit and lending facility interest rates were also raised to 6% and 7%, respectively.

Headline inflation climbed to 6.1% year on year in September from 5.3% in August. In the first nine months, inflation averaged 6.6%.

Mr. Remolona also said that another policy rate hike would be considered at the scheduled Monetary Board meeting on Nov. 16 “if things are worse than we thought.”

Looking ahead, the bond trader expects higher inflation expectations to push yields higher this week.

Mr. Ulpo likewise expects the market to be defensive this week.

“A broad steepening of the yield curve owing to upcoming auctions in the next couple of weeks will likely exert some steepening pressure on the curve, while [this] week’s shortened trading days may also thin out market liquidity,” he said. — M.I.U. Catilogo