Yields on government debt mixed

By Bernadette Therese M. Gadon, Researcher

YIELDS on government securities ended mixed last week as the market remained defensive after the Bangko Sentral ng Pilipinas’ (BSP) dovish move.

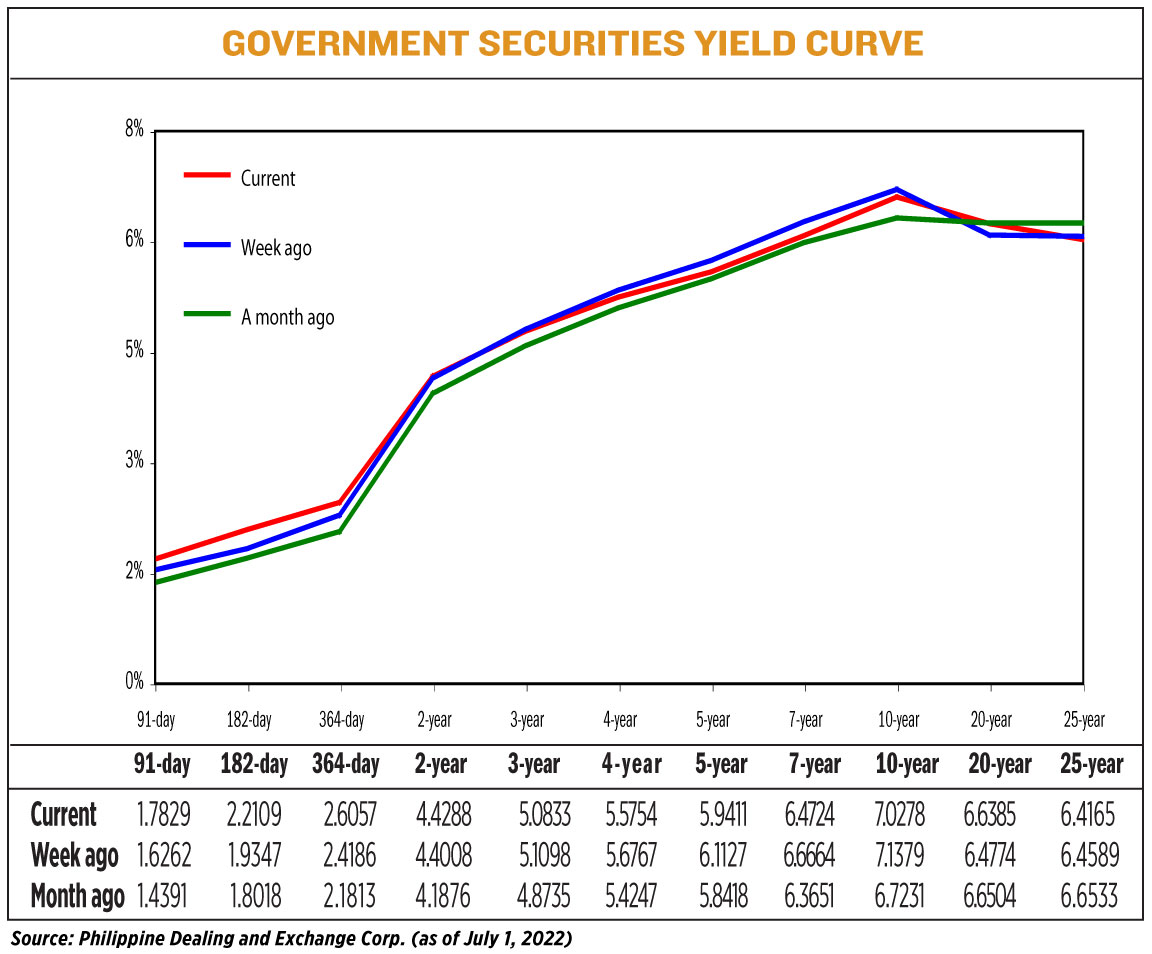

Debt yields, which move opposite to prices, increased by an average of 1.48 basis points (bps) week on week, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates as of July 1 published on the Philippine Dealing System’s website.

Yields were mixed across the board on Friday, with the short end of the curve ending higher. The rates of the 91-, 182-, and 364-day Treasury bills rose by 15.67 bps, 27.62 bps, and 18.71 bps week on week to 1.7829%, 2.2109%, and 2.6057%, respectively.

Yields at the belly of the curve edged lower, except for that on the two-year debt, which increased by 2.80 bps to 4.4288%. Meanwhile, rates of the three-, four-, five-, and seven-year Treasury bonds (T-bonds) fell by 2.65 bps (to 5.0833%), 10.13 bps (5.5754%), 17.16 bps (5.9411%), and 19.4 bps (6.4724%).

The long end of the curve was mixed as the 20-year debt gained 16.11 bps to yield 6.6385%, while the rates of the 10- and 25-year papers decreased by 11.01 bps (7.0278%) and 4.24 bps (6.4165%), respectively.

GS volume reached P7.51 billion on Friday, higher than the P5.25 billion seen on June 24.

“Peso bond yields ended mixed [last] week, but sentiment remained defensive over expectations for BSP policy rate to be lower than Fed by yearend,” First Metro Asset Management, Inc. (FAMI) said via Viber message.

“The relatively dovish move of BSP [on June 23] has led to further peso depreciation and widened the risk and term premiums for local bonds,” it added.

FAMI added that this resulted in the seven-year T-bonds offered last week being rejected as the market has “excessively priced risk premium.”

Likewise, a bond trader said in an e-mail that the Bureau of the Treasury’s (BTr) rejection of all bids for its T-bond offer last week triggered a rally that brought yields about 15 to 20 bps lower.

BSP Governor Felipe M. Medalla last week said the central bank may consider a more aggressive rate hike at its Aug. 18 meeting if inflation keeps its upward momentum, but noted the decision will remain data dependent.

Early in June, ahead of the US Federal Reserve’s decision to increase its own rates by 75 bps at its own meeting that month, Mr. Medalla said he is not keen on raising borrowing costs by more than 25 bps per meeting.

The BSP on June 23 raised benchmark interest rates by 25 bps for a second straight meeting to cool rising prices. At that meeting, it raised its average inflation forecast for this year to 5% from 4.6% previously, well above its 2-4% target.

Meanwhile, on Tuesday, the Treasury rejected all the offers for its offer of reissued seven-year T-bonds with a remaining life of 6.9 years and a coupon rate of 6.5% after the market asked for higher yields due to inflationary pressures and expectations of further monetary tightening.

Bids for the papers reached P62.253 billion, almost double the P35 billion on offer.

Rates bid by banks reached 6.849% to 7%. Had the BTr made a full award, the tenor would have fetched an average rate of 6.947%.

For the week, analysts said that the market will be mostly taking cues from the upcoming release of May inflation data.

The bond trader expects the curve to move sideways, adding that the maturity of three-year bonds worth P104 billion on July 4 may increase liquidity in the market.

“Inflation path would keep investors on the edge as the prints in the coming months are likely to be above 6%,” FAMI said.

“The rebound of oil prices beyond $120/bbl (barrel), the peso depreciating above P55 as well as the pass-through effects of these two would likely lead to faster clips of inflation. With that, we think that bond yields may still surprise on the upside in the third quarter,” it added.

The central bank sees headline inflation picking up further and settling within the 5.7-6.5% range in June. Inflation stood at 5.4% in May, the fastest in three and a half years.

The Philippine Statistics Authority will release June inflation data on July 5.