Mouthwash may cure ‘the clap’

PARIS — In the 19th century, before the advent of antibiotics, Listerine mouthwash was marketed as a cure for gonorrhoea. More than 100 years later, researchers said Tuesday the claim may be true.

Taiwan completes first undersea trial for domestically made submarine

TAIPEI — Taiwan completed the maiden underwater sea trial for its first domestically developed submarine on Thursday, a big milestone in a project aimed at strengthening deterrence against the Chinese navy and protecting vital sea lanes in the event of war.

Taiwan, which China claims as its own territory, has made the indigenous submarine program a key part of an ambitious project to modernize its armed forces as Beijing stages almost daily military exercises to assert its sovereignty claims.

The submarine program has drawn on expertise and technology from several countries, including the United States and Britain, a breakthrough for diplomatically isolated Taiwan, whose government rejects Beijing’s territorial claims.

Taiwan’s CSBC Corp which is leading construction of what is eventually planned to be eight submarines, said in a statement late on Thursday that the first ship, named the Narwhal, had completed its first underwater test at sea.

It said the submarine had carried out a “shallow-water submerged navigation test”.

“Submarines are a key strategic capability with deterrent power,” it said, after the test off the southern Taiwanese port of Kaohsiung.

The Narwhal had been due to be delivered to the navy in 2024, joining two existing submarines purchased from the Netherlands in the 1980s, but the program has been hit with delays.

“Due to constraints in the international environment and pressure from the Chinese communists, Taiwan’s indigenous submarine program has faced various difficulties and challenges from the beginning to the present,” CSBC said.

Taiwan has said it hopes to deploy at least two such domestically developed submarines by 2027, and possibly equip later models with missiles.

The first submarine, with a price tag of T$49.36 billion ($1.58 billion), will use a combat system by Lockheed Martin Corp and carry U.S.-made Mark 48 heavyweight torpedoes.

Taiwan’s armed forces are dwarfed by those of China, which has three operational aircraft carriers and ballistic missile submarines and is developing stealth fighter jets.

Taiwan is modernizing its military to be able to fight “asymmetric warfare,” using mobile and agile systems like submarines, drones and truck-mounted missiles to fend off its much larger adversary China.

Taiwan President Lai Ching-te announced in November 2025 that his government would spend an additional $40 billion on defense. — Reuters

Carney says he expects US administration to respect Canadian sovereignty

OTTAWA — Canadian Prime Minister Mark Carney, asked about reports that US officials had met separatists seeking independence for the province of Alberta, on Thursday said he expected the US administration to respect Canadian sovereignty.

The Financial Times said State Department officials had held three meetings with the Alberta Prosperity Project, a group that is pushing for a referendum on whether the energy-producing Western province should break away from Canada.

“We expect the US administration to respect Canadian sovereignty. I’m always clear in my conversations with President Trump to that effect,” Mr. Carney told a press conference.

Mr. Trump, he added, had never raised the question of Alberta separatism with him.

The APP, which says Ottawa’s policies are stifling the province, wants another meeting next month with State and Treasury officials to ask for a $500 billion credit facility, the Financial Times reported.

Alberta premier Danielle Smith said she wanted to stay part of Canada but noted that polls show 30% of the population was fed up with what it saw as Ottawa’s excessive interference.

Alberta is landlocked and Ms. Smith is pressing for another oil pipeline to the Pacific Coast. That would have to cross the neighboring province of British Columbia, whose premier David Eby has ruled out the idea.

Mr. Eby, whose relations with Ms. Smith are usually chilly, told reporters earlier that “to go to a foreign country and to ask for assistance in breaking up Canada … is treason”.

Last week, US Treasury Secretary Scott Bessent told a radio station: “I think we should let them come down into the US.”

Asked about a possible Alberta referendum, he replied: “People want sovereignty. They want what the US has got.”

Mr. Carney and Mr. Trump have repeatedly traded barbs in recent weeks. Mr. Carney, who calls the US president a skilled negotiator, suggests some of Mr. Trump’s recent comments could be tied to a review of the US-Mexico-Canada trade pact that is due to start later this year. — Reuters

Ex-Google engineer convicted of stealing AI secrets for Chinese companies

WILMINGTON, Delaware — Former Google software engineer Linwei Ding was convicted by a federal jury in San Francisco on Thursday of stealing AI trade secrets from the US tech giant to benefit two Chinese companies he was secretly working for, the US Department of Justice said on Thursday.

Mr. Ding, a 38-year-old Chinese national, was found guilty after an 11-day trial of seven counts of economic espionage and seven counts of theft of trade secrets for stealing thousands of pages of confidential information.

Each economic espionage charge carries a maximum 15-year prison term and $5 million fine, while each trade secrets charge carries a maximum 10-year term and $250,000 fine.

Mr. Ding is scheduled to appear at a status conference on February 3, according to the DOJ.

An attorney for Mr. Ding, also known as Leon Ding, did not immediately respond to a request for comment.

Mr. Ding was originally indicted in March 2024 on four counts of theft of trade secrets. A superseding indictment in February expanded the charges.

Mr. Ding’s case was coordinated through an interagency Disruptive Technology Strike Force, created in 2023 by the Biden administration.

Prosecutors said Mr. Ding stole information about the hardware infrastructure and software platform that lets Google’s supercomputing data centers train large AI models.

Some of the allegedly stolen chip blueprints were meant to give Google, owned by Alphabet, an edge over cloud computing rivals Amazon.com, and Microsoft, which design their own, and reduce Google’s reliance on chips from Nvidia.

Prosecutors said Mr. Ding joined Google in May 2019 and began his thefts three years later, when he was being courted to join an early-stage Chinese technology company.

Google was not charged and has said it cooperated with law enforcement. The company did not immediately respond to a request for comment. — Reuters

Niger military ruler accuses France, Benin, Ivory Coast of sponsoring airport attack

NIAMEY — Niger’s military ruler Abdourahamane Tiani on Thursday blamed French, Benin, and Ivory Coast presidents for sponsoring the attack on Niamey international airport, an accusation he made without offering any evidence.

Gunfire and loud explosions echoed around Niger’s international airport in Niamey shortly before midnight in what two security sources described as a “terrorist attack”, before calm returned to the capital on Thursday morning.

Mr. Tiani accused French President Emmanuel Macron, Benin’s Patrice Talon, and Ivory Coast President Alassane Ouattara by name, while speaking on Niger’s state television after visiting the air base. He vowed retaliation.

“We have heard them bark, they should be ready to hear us roar,” he said, signaling further worsening of relationship between the Sahel nation, its neighbors he sees as French proxies in the region, and former colonial power.

The offices of the presidents of France, Benin, and Ivory Coast could not be immediately reached for comment.

Mr. Tiani also thanked the Russian troops stationed at the base for “defending their sector.”

Since seizing power, the military rulers in Niamey, like the military rulers in neighboring Mali and Burkina Faso, have cut ties with western powers and turned to Moscow for military support to tackle the insurgencies.

Niger state television reported that one of the several assailants killed was a French national, as footage showed several bloodied bodies on the ground. It provided no evidence.

URANIUM

Businesses and schools were open in the city of about 1.5 million, and people were moving about freely, apart from a cordoned-off zone near the airport which was heavily patrolled by defense and security forces, the Reuters witness said.

Two security sources described the overnight incident to Reuters as a “terrorist attack” and said security had been reinforced around the airport following an internal alert about an imminent attack on the site.

They said a store of uranium currently held at the airport had not been affected by the attack.

Nigerien authorities moved the uranium yellowcake late last year from the Somair mine in Arlit to the Niamey base for export after seizing control of the mine from French nuclear group Orano, according to two other sources, who estimated it to be around 1,000 metric tons of uranium.

Two more sources confirmed that the uranium was still at the airport at the time of the incident Wednesday night. Yellowcake, or uranium oxide concentrate, is a powdered form of uranium which can be processed to make fuel for nuclear power production.

AIRCRAFT DAMAGED DURING ATTACK

Pan-African carrier ASKY Airlines said two of its aircraft sustained minor damage during the incident while parked on the tarmac, while Ivory Coast’s national airline Air Cote d’Ivoire said an Airbus A319 was hit, damaging its fuselage and right wing.

Both companies said no passengers or crew were injured as the incident occurred outside operational hours.

An assessment was under way for the Airbus and the jet could be grounded for an extended period, potentially disrupting schedules, Air Cote d’Ivoire said in a statement.

The heavy gunfire began shortly before midnight on Wednesday and continued for over an hour, the Reuters witness said.

A video shared on social media platform X appeared to show the city’s night skyline illuminated by gunfire, though Reuters has not independently verified the footage.

The West African nation, like its Sahel neighbors Mali and Burkina Faso, has struggled to contain attacks from jihadist groups linked to al Qaeda and Islamic State that have killed thousands and displaced millions in the three nations. — Reuters

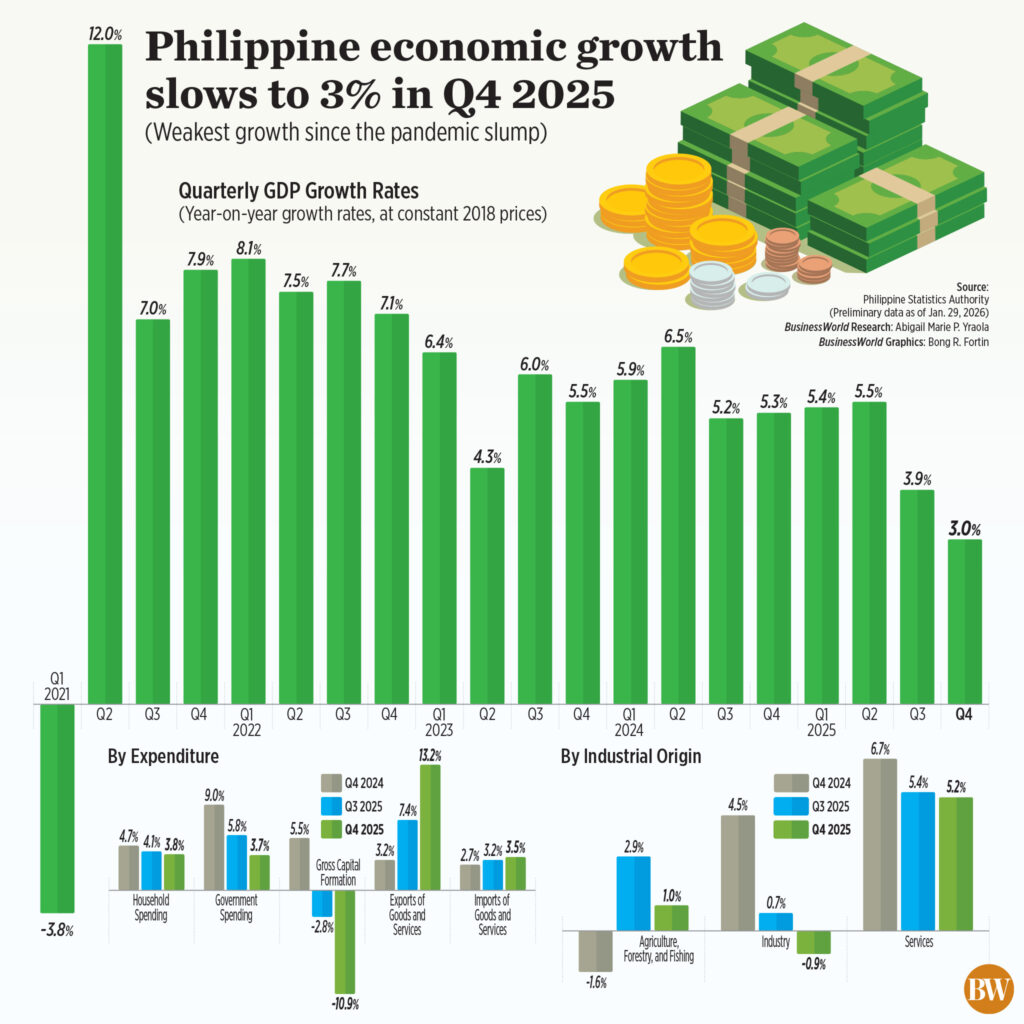

Philippine growth slumps to 4.4% in 2025, slowest in 5 years

By Katherine K. Chan, Reporter

PHILIPPINE economic growth sharply slowed to a post-pandemic low in the fourth quarter of 2025 as the flood control scandal continued to weigh on government spending, investments and consumer spending, dragging full-year expansion below target for the third straight year.

The Philippine Statistics Authority (PSA) reported on Thursday that the fourth-quarter gross domestic product (GDP) expanded by 3%, from 5.3% in the fourth quarter of 2024 and the revised 3.9% print in the third quarter of 2025.

The slowdown came as a surprise as the fourth quarter is typically a strong period for growth, thanks to holiday spending. The latest print stands out as the weakest fourth-quarter performance in five years or since the 8.2% contraction in the fourth quarter of 2020.

Excluding the pandemic period, it was the worst quarterly growth rate in 16 years or since the 1.8% in the fourth quarter of 2009, but matched the 3% in the third quarter of 2011.

On a seasonally adjusted quarter-on-quarter basis, the economy grew by 0.6%.

In 2025, the economy expanded by 4.4%, much weaker than the 5.7% growth in 2024.

This was the weakest pace in five years or when GDP declined by 9.5% in 2020. Excluding the pandemic, it was the slowest growth since the 3.9% expansion in 2011.

The full-year average also fell below the Development Budget Coordination Committee’s (DBCC) 5.5%-6.5% goal.

The latest growth likewise turned out weaker than market expectations, as a BusinessWorld poll of 18 economists last week yielded a median estimate of 4.2% for the October-to-December period and 4.8% for 2025.

Economy Secretary Arsenio M. Balisacan said the slower growth reflected the impact of adverse weather on economic activity and the corruption scandal on consumer and investor sentiment.

“Admittedly, the flood control corruption scandal also weighed on business and consumer confidence. These challenges unfolded alongside lingering global economic uncertainties,” he said during a briefing on Thursday.

Mr. Balisacan, who earlier expected full-year growth to come in at 4.8-5%, said he did not expect such a “sharp” slowdown. However, he said economic managers had expected there would be consequences for the reforms that were put in place in the aftermath of the graft scandal.

“It cannot be business as usual. Because otherwise, we may have growth this year, or last year, growth may be higher, but with corruption all over the place, or in infrastructure. That (growth) would not be expected to last. We would better have a slowdown, correct the problems, and build the trust of our people in the government,” Mr. Balisacan said.

A scandal linking government officials, lawmakers and private contractors to multibillion-peso corruption in flood control projects had dragged government spending and household consumption since the third quarter last year.

WEAK CONSUMPTION

In the fourth quarter, household consumption, which accounts for over 70% of the country’s GDP, rose by 3.8%, slowing from 4.7% a year ago and 4.1% in the third quarter. This was the slowest household spending growth since the -4.8% seen in the first quarter of 2021.

For the full-year, consumption growth slowed to 4.6% from 4.9% in 2024.

Meanwhile, government spending grew by 3.7% in the fourth quarter, weakening from 9% in the same period in 2024 and 5.8% in the third quarter. It was also the slowest since 2.6% in the first quarter of 2024.

Of the total, state expenditures in construction declined by 41.9% during the last three months of 2025, as the government increased scrutiny over infrastructure projects.

In 2025, government spending grew by 9.1%, faster than 7.3% in the previous year.

Mr. Balisacan said the government’s catch-up plan could help boost public spending, particularly construction, in the first quarter.

“The release of the approval of the budget for 2026 was delayed a bit,” he added. “And so that could also have a negative effect on spending, particularly for public construction.”

PSA data also showed that the country’s gross capital formation, the investment component of the economy, declined by 10.9% in the fourth quarter, the biggest drop since early 2021. This was a steeper decline than the -2.8% in the third quarter and a reversal from the 5.5% growth in the fourth quarter of 2024.

For 2025, investments fell by 2.1%.

BETTER EXPORTS

Meanwhile, exports growth provided some relief for the economy as it climbed by 13.2% in the fourth quarter, from 3.2% a year earlier and 7.4% in the third quarter. For the entire year, exports grew by an annual 8.1%.

Imports, meanwhile, expanded by 3.5% in the October-to-December period, from 2.7% in the previous year and 3.2% in the previous quarter, bringing its full-year growth to 5.1%.

The government forecasts goods exports and services exports to rise by 2% and 5%, respectively, this year.

According to the PSA, the agriculture, forestry, and fishing (AFF) sector posted 1% growth in the fourth quarter, while services expanded by 5.2%. However, the industry sector saw a 0.9% contraction in the fourth quarter.

In 2025, the AFF, services and industry sectors grew by 3.1%, 5.9%, and 1.5%, respectively.

National Statistician Claire Dennis S. Mapa said wholesale and retail trade and repair of motor vehicles and motorcycles were the top contributors to the country’s expansion.

Meanwhile, the Philippines’ gross national income went up by 3.9% in the fourth quarter. By yearend, it rose by 6.1%, easing from 7.7% in 2024.

The country’s net primary income likewise increased by 10.9% in the October-to-December period, bringing the 2025 average to 19.1%. This slowed from 26.6% in the prior year.

DELAYED RECOVERY

Meanwhile, Mr. Balisacan said the country’s chances for an early rebound might now be lower.

“(W)e see 2026 as a rally point for us,” he said. “And with all these developments taking place and our chairmanship of the ASEAN (Association of Southeast Asian Nations), it should be able to turn the corners around and get the economy back on its track as early as the… second quarter of this year.”

He noted that the lingering effects of the corruption mess and the delayed approval of the 2026 budget could prevent the economy from recovering in the first quarter of the year.

“We don’t expect that growth will recover to its peak in the first quarter because we expect some still lingering effects of those measures, especially that the budget for this year was released or was approved late,” he said.

On Jan. 5, President Ferdinand R. Marcos, Jr. signed the 2026 General Appropriations Act, allotting a P6.793-trillion budget for the government.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said the economic lags experienced in the fourth quarter may continue to spill over to the country’s near-term growth prospects.

“All this weakness looks set to bleed into the early part of this year, as we’ve yet to see any bottoming-out in government infrastructure spending in the monthly numbers, while surveyed expansion plans in the private sector continue to roll over sharply,” Mr. Chanco said in an e-mailed note.

The outlook for the Philippine economy remains dim, especially if persisting governance issues will be left unresolved, ANZ Research Chief Economist for Southeast Asia and India Sanjay Mathur noted.

“Looking forward, growth is likely to remain weak until governance-related issues are resolved, and public spending begins to improve,” he said in a report. “While support from net exports will likely be sustained over the next few months due to the AI (artificial intelligence)-related technology cycle, its overall impact will be limited.”

Meanwhile, Chinabank Research said the economy’s underperformance in the fourth quarter calls for a more urgent implementation of reforms, adding that the global uncertainties endanger the country’s external position.

“This underscores the need to further weather-proof the economy and quickly rebuild public confidence to support domestic demand, especially since the external front faces persisting headwinds from a highly uncertain and volatile global environment,” it said.

This year, the DBCC is targeting 5%-6% GDP growth.

BSP may cut despite Fed hold as growth disappoints

THE BANGKO SENTRAL ng Pilipinas (BSP) may deliver a sixth straight cut in February, despite the US Federal Reserve’s decision to stand pat, amid weaker-than-expected Philippine economic growth in the fourth quarter, analysts said.

“Despite the Fed standing pat, we believe BSP will be looking to domestic developments (such as) low inflation and disappointing GDP (gross domestic product) to make its call,” Metropolitan Bank & Trust Co. (Metrobank) Chief Economist Nicholas Antonio T. Mapa told BusinessWorld in a Viber message.

On Wednesday, the Fed held its benchmark rates steady at the 3.5%-3.75% range, maintaining its total cuts since September 2024 at 175 basis points (bps).

The BSP’s key policy rate stands at an over three-year low of 4.5%, bringing its interest rate differential with the Fed to 75 bps.

The Monetary Board has so far lowered benchmark borrowing costs by a cumulative 200 bps since it began its easing cycle in August 2024.

BSP Governor Eli M. Remolona, Jr. said last week that the Fed’s moves are only one of the many data points they are considering in their monetary policy decision. He added that they are now uncertain about delivering one more cut under the current easing cycle, even with a weak economy and benign inflation.

Philippine economic growth slumped to a five-year low of 3% in the fourth quarter of 2025, bringing the full-year print to 4.4%. This was below the government’s 5.5%-6.5% target for the year, as well as the BSP’s 3.8% forecast for the fourth quarter and 4.6% for the entire year.

This, Mr. Mapa said, raises the odds of deeper easing by the Monetary Board, especially as inflation remains muted.

“The disappointing (fourth-quarter) print bolsters the case for additional easing from BSP while inflation remains subdued,” he said. “(The) window for BSP to provide accommodation remains open for the time being with monetary authorities likely opting to frontload cuts while the inflation objective is still in hand.”

Metrobank sees the BSP delivering a total of 50 bps in cuts this year to bring the key interest rate to 4% by yearend.

On the other hand, John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, said the central bank may opt to preserve easing space at its first meeting this year as the peso remains “sensitive.”

“A possible move for the BSP is a pause with a bias to cut later if inflation stays benign and growth remains soft,” he told BusinessWorld via Viber. “It helps keep the Philippine peso and inflation expectations better-anchored, especially with the currency still sensitive, while preserving easing space.”

The peso marked a new all-time low of P59.46 against the dollar on Jan. 15.

On Thursday, the local unit lost 20.5 centavos to close at P58.945 versus the greenback from its P58.74 finish on Wednesday, Bankers Association of the Philippines data showed.

“Matching the Fed’s stand is generally healthier for the peso in the near term, while any further BSP cut should be framed as contingent on inflation staying within target and on clearer evidence that demand is weakening enough to warrant added support,” Mr. Rivera said.

The Monetary Board is set to hold its first policy review this year on Feb. 19. — Katherine K. Chan

Balisacan still confident PHL can achieve upper middle-class status this year

By Aubrey Rose A. Inosante, Reporter

THE PHILIPPINES remains on track to graduate to upper middle-income country (UMIC) status this year, despite a sharp growth slowdown in 2025, the Department of Economy, Planning, and Development (DEPDev) said.

Economy Secretary Arsenio M. Balisacan said the Philippines can still achieve UMIC status this year despite the weaker-than-expected 4.4% gross domestic product (GDP) growth last year.

“We still have to redo the numbers, but with the 4.4% growth in 2025, we should still be able to reach the average income class status,” he told a briefing on Thursday.

The Philippines is still stuck in the lower middle-income bracket, having failed to advance out of it since 1987, despite posting a higher gross national income (GNI) per capita of $4,470 in 2024.

Under the World Bank’s latest country classification, the Philippines’ GNI per capita was only $26 shy of the World Bank’s adjusted GNI per capita requirement of $4,496-$13,935 for UMIC status.

The Washington-based lender is scheduled to release its updated annual country status thresholds in July.

Last year, Mr. Balisacan said the Philippines needs to sustain 6% growth from 2025 to 2026 to ensure its GNI per capita meets the UMIC threshold.

In 2025, Philippine GDP growth sharply slowed to 4.4%, from 5.7% in 2024. This was the weakest print in five years or since 2020 when GDP contracted by 9.5% amid the pandemic. Excluding the pandemic, it was the slowest growth since the 3.9% expansion in 2011.

Mr. Balisacan said the economy’s potential growth still stands at 6%, which makes the government confident about achieving its long-term goal of building a predominantly middle-class society under AmBisyon Natin 2040.

“Actually, the investments that we are making in human capital, particularly education and health and infrastructure, these can elevate that potential to an even higher one — 6.5% or even 7%,” Mr. Balisacan said.

Analysts said the Philippines achieving UMIC status carries symbolic weight but cautioned that it is a weak measure of real development.

“Graduation to UMIC is important symbolically but its real economic value will depend on whether it comes with deeper structural shifts that raise living standards more broadly,” John Paolo R. Rivera, a senior research fellow at the Philippine Institute for Development Studies, said in a Viber message.

Even modest growth can lift per capita income if supported by stable employment, remittance inflows, and manageable inflation, Mr. Rivera added.

Jose Enrique “Sonny” A. Africa, executive director of IBON Foundation, said UMIC status is a “mere bureaucratic category” used by the World Bank to guide lending and grant-making.

“It’s an extremely poor indicator of real development because, for instance, any UMIC status the Philippines might get will be amid growing poverty, hunger, and volatile poor quality work,” he said in a Viber message.

TEMPERED TARGETS

At the same briefing, Mr. Balisacan said the Development Budget Coordination Committee (DBCC) had tweaked the macroeconomic assumptions for foreign exchange rate and export growth, after cutting growth targets.

On external trade assumptions, the DBCC kept the goods export growth at 2% this year, unchanged from the June meeting.

It raised its goods export growth projection to 3% in 2027, from the earlier forecast of 2%.

“For the exports of services, we are assuming 5% for 2026 and the same growth for 2027,” he said.

The peso forecast range was widened to P58-P60 per dollar for 2026-2027, from the earlier projection of P56-P58 per dollar for 2025 until 2028, Mr. Balisacan said.

The peso has repeatedly breached the P59-a-dollar mark several times since November and sank to a record low of P59.46 on Jan. 15.

At its December meeting, the DBCC cut its GDP growth target to 5-6% for this year, from 6-7% previously. It set a 5.5-6.5% growth goal for 2027.

“Now, obviously, the lower growth for next year… will impact revenue collections relative to what we initially expected,” Mr. Balisacan said.

The government is targeting to collect P4.824 trillion this year, about 3.19% less than the P4.983 trillion goal set in the June 2025 meeting.

For 2027, the revenue collection target was cut by 4.55% to P5.122 trillion, while the revenue target for 2028 was also reduced by 5.86% to P5.568 trillion.

Mr. Balisacan said government efforts, particularly in light of the flood control project scandal, were focused not only on expanding expenditures but also on enhancing spending quality.

“(This will make) sure that what we spend will actually end up with better services and in the case of income transfers with the intended target groups and in many cases with low-income households,” he added.

BSP may tighten oversight on cryptocurrency

THE BANGKO SENTRAL ng Pilipinas (BSP) is working on regulations to tighten oversight on cryptocurrencies as part of efforts to deter crimes involving dirty money.

BSP General Counsel Roberto L. Figueroa said they plan to issue regulations that would complement the Anti-Money Laundering Act (AMLA).

“It’s been discussed several times how else we can make the law… have more teeth,” he told BusinessWorld on the sidelines of a central bank event on Friday.

“But at the same time, you know, these are new technologies,” he added. “When the AMLA was enacted into law… I mean, nobody was even thinking about cryptocurrency (back then), right? So, definitely, there are ongoing discussions about issuing regulations to cover (them).”

Last month, a former lawmaker linked to the flood control corruption scandal allegedly used cryptocurrency to move billions of pesos from the country to overseas.

Mr. Figueroa noted that authorities are struggling to trace financial crimes involving cryptocurrencies as its user data is treated with confidentiality.

“The problem with crypto is how are you going to… find it,” he said. “It’s like anonymous — you can’t tell who owns it, who sent it and who received it?”

The Anti-Money Laundering Council (AMLC) said last year that it was pushing amendments to the AMLA, including tighter monitoring of virtual asset service providers (VASP), in a move to keep the Philippines off the Financial Action Task Force’s list of countries with dirty money risks.

It also sought to align its regulations with international standards on anti-money laundering and countering the financing of terrorism.

The BSP has several regulations on virtual assets (VA), such as Circular No. 944, or the guidelines for virtual currency exchanges, and Circular No. 1108, which outlines guidelines for VASPs.

Asked if they plan to implement further regulations to address anonymity issues, Mr. Figueroa said: As we learn more about (the) technology that we can use to be able to… penetrate that anonymity, then definitely a regulation can be issued.”

However, the BSP official noted that they have yet to determine when they will roll out the regulation.

Based on the AMLC’s latest National Risk Assessment, VAs and VASPs in the country have medium to high vulnerability to money laundering risks.

“Inherent vulnerability is ‘high’ due to the anonymity and speed of VA transfers, including exposure to DeFi (decentralized finance) platforms, 24/7 availability, peer-to-peer transactions, transfers to/from unhosted wallets, and use of anonymity-enhancing features that enable rapid settlement,” according to the report.

VAs, such as cryptocurrencies, refer to a type of digital unit that can be traded, transferred, or used for payments and investments.

Meanwhile, VASPs are entities that handle the exchange of VAs for fiat currencies, as well as transferring or safeguarding them. — Katherine K. Chan

Ayala and Spinneys to launch 12 Metro Manila stores starting in Q4

LISTED Ayala Corp. and United Arab Emirates (UAE)-based supermarket chain Spinneys plan to open 12 stores across Metro Manila starting in the fourth quarter (Q4).

“Spinneys is a valuable addition to the Philippine grocery landscape,” Ayala Corp. Managing Director and Ayala Land Head of Leasing and Hospitality Mariana Zobel de Ayala said in a statement on Thursday.

“Premium grocery retail today is about more than what’s on the shelves — it’s about curation, service, and the joy of discovery. The entry of Spinneys brings a new dimension to grocery shopping, expanding the range of choices available locally and further enriching our dynamic retail landscape,” she added.

Spinneys is owned by Al Seer Group, a UAE-based consumer holding company with interests in food, retail, hospitality, shipyards, and construction across more than 20 countries.

Under the joint venture, Spinneys’ first stores will open at Ayala Malls U.P. Town Center in Quezon City and San Antonio Plaza Arcade in Makati City.

These stores will serve as anchor tenants in the Ayala Malls developments.

“Having spent many years in Dubai, I’ve seen how Spinneys has become a benchmark for premium grocery experiences. We’re thrilled to bring this globally best-in-class model to Ayala Malls, giving our customers access to the same high-quality, internationally inspired offerings here in the Philippines,” Ayala Malls Chief Operating Officer Paul Birkett said.

“Our aim is to deliver a thoughtfully curated grocery experience that reflects global standards, while remaining firmly grounded in local tastes and preferences.”

In October, Ayala Corp. and Spinneys entered into a partnership to open stores in the Philippines, marking Spinneys’ first expansion outside the Gulf region.

Through the partnership, Spinneys will introduce features from its Gulf Cooperation Council (GCC) operations to the Philippines, including imported goods, private-label products, and store design concepts from the region.

“The partnership also builds on Spinneys’ long-standing connection with the Philippines, where over 1,300 Filipinos already form part of its GCC workforce. The venture both strengthens avenues for Filipinos seeking opportunities abroad, as well as creates pathways for overseas workers to return home and contribute to the growth of local industry,” the company said.

Shares in Ayala Corp. fell by 2.77% to P526 apiece on Thursday. — Alexandria Grace C. Magno

Midcap, dividend indexes beat PSEi, says PSE president

MIDCAP and Dividend-Yield indexes outperformed the Philippine Stock Exchange index (PSEi) in the past two years despite market headwinds, the bourse chief said.

“Despite headwinds and volatility in the stock market, the PSE MidCap and PSE Dividend Yield indices have significantly outperformed the PSEi in the last two years,” PSE President and Chief Executive Officer Ramon S. Monzon said in a statement on Tuesday.

Data from the PSE showed that the Dividend Yield index rose 22.4% in 2024 and 2.37% in 2025. The MidCap Index posted stronger gains of 29.1% in 2024 and 20.17% in 2025.

In contrast, the PSEi fell 7.3% in 2025 to close at 6,052.92, after posting a 1.2% gain in 2024.

The PSEi tracks the 30 largest and most actively traded common stocks listed on the local bourse and serves as a benchmark for the Philippine equity market.

INDEX CHANGES

Meanwhile, the Exchange on Monday updated the composition of its key indexes.

RL Commercial REIT, Inc. (RCR) will be added to the PSEi, replacing Alliance Global Group, Inc. (AGI), effective Feb. 2.

In the PSE MidCap Index, AGI will replace RCR. Apex Mining Co., Inc. will be added, while DoubleDragon Corp. will be removed.

Universal Robina Corp. will return to the PSE Dividend Yield Index, while OceanaGold (Philippines), Inc. will join as a new constituent. The Keepers Holdings, Inc. and Security Bank Corp. will be removed from the index.

“The regular index review ensures that the companies included in the indices are the best representatives of these benchmarks based on our set criteria,” Mr. Monzon said.

Following the review, the PSE MidCap Index will include Alliance Global Group (AGI), Apex Mining (APX), Asia United Bank (AUB), Bloomberry Resorts (BLOOM), Cosco Capital (COSCO), D&L Industries (DNL), Ginebra San Miguel (GSMI), The Keepers Holdings (KEEPR), Megaworld (MEG), MREIT, Inc. (MREIT), Manila Water (MWC), Nickel Asia (NIKL), OceanaGold Philippines (OGP), Philippine National Bank (PNB), Robinsons Land (RLC), Robinsons Retail Holdings (RRHI), Security Bank (SECB), Philippine Seven (SEVN), Synergy Grid & Development Phils. (SGP), and Wilcon Depot (WLCON).

The updated PSE Dividend Yield Index will include AREIT, Inc. (AREIT), China Banking Corp. (CBC), Citicore Energy REIT Corp. (CREIT), DMCI Holdings, Inc. (DMC), D&L Industries, Inc. (DNL), Globe Telecom, Inc. (GLO), LT Group, Inc. (LTG), Metropolitan Bank & Trust Company (MBT), Manila Electric Company (MER), MREIT, Inc. (MREIT), Nickel Asia Corp. (NIKL), OceanaGold (Philippines), Inc. (OGP), Puregold Price Club, Inc. (PGOLD), RL Commercial REIT, Inc. (RCR), Robinsons Land Corp. (RLC), Robinsons Retail Holdings, Inc. (RRHI), Semirara Mining and Power Corp. (SCC), Synergy Grid & Development Phils., Inc. (SGP), PLDT Inc. (TEL), and Universal Robina Corp. (URC).

The PSE MidCap Index tracks 20 high-liquidity mid-sized companies outside the top 30 PSEi by market capitalization. The PSE Dividend Yield Index covers 20 liquid companies selected based on their strong three-year average dividend yields. — Alexandria Grace C. Magno

Dinagyang 2026: Developing a vibrant cultural hub

Iloilo City, TIEZA sign MoA to push city as meeting destination

THE CITY of Iloilo was filled with a variety of celebrations unfolding simultaneously over the fourth weekend of January, from dance competitions and float parades, to street food stalls and mall concerts, which meant only one thing — it was the height of the Dinagyang Festival.

The annual celebration, which gets its name from the Hiligaynon word dagyang that means “merrymaking,” first started in 1967, when a replica of the Señor Santo Niño de Cebu was brought to Iloilo. Its evolution as a religious and cultural festival reflects the devotion of Ilonggo Catholics to the Child Jesus.

Its 58th edition this year, with the theme “Bugay sang Ginoo, Bugal sang mga Ilonggo” (Blessings of the Lord, Pride of the Ilonggos), embodies the mindset of the local government as it continues to develop the city both for Dinagyang Festival and for overall tourism.

“Last year, more than 150 MICE (meetings, incentives, conferences, and exhibitions) events happened at the Iloilo Convention Center, and we want to sustain and improve those events,” Raisa S. Treñas, mayor of Iloilo City, told the visiting Manila media on Jan. 23.

In 2024, the Department of Tourism recorded about 1 million tourist arrivals in Iloilo City. This marked a 12.95% increase from 886,283 tourist arrivals in 2023.

In late 2023, the city was named the Philippines’ first UNESCO Creative City of Gastronomy, which Ms. Treñas cited as a major draw for visitors.

“Tourists really consider Iloilo City not only because of the facilities that we have, but because we are now known for gastronomy,” she said.

In light of this, Iloilo City and the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) signed a memorandum of agreement (MoA) on Friday, allotting P17.6 million over the next five years to develop the city into a MICE destination.

“This partnership for us is very important because, last year, the MICE Center in Iloilo presented to me the schedule of activities for all the MICE events, and January was already fully booked,” Ms. Treñas said, pointing out the one-year booking waitlist for TIEZA’s Iloilo Convention Center.

Meanwhile, an estimated 350,000 visitors flocked to Dinagyang-related events on the festival’s final day on Jan. 25, according to the Iloilo City Police Office.

THE FINAL WEEKEND

It was bright and sunny on the final weekend of the Dinagyang Festival which saw several major events including the Kasadyahan sa Kabanwahanan, a celebration of competing cultural festivals from across the province, on Jan. 24; and the Ati Tribes Competition, featuring tribal performers in Ati warrior gear presenting the history of Panay, on Jan. 25.

The Tultugan Festival from Maasin, Iloilo, showcasing elaborate bamboo set pieces to represent their town, won the Kasadyahan sa Kabanwahanan. They bested seven other Iloilo towns and clinched a P1.2-million cash prize.

The winner of Dinagyang’s Ati Tribes Competition this year was Tribu Salognon, representing Jaro National High School from Jaro, Iloilo City. Their performance, which had the traditional dance component honoring the Señor Santo Niño while also incorporating designs inspired by the endangered maral or Visayan leopard cat, earned them a P1.5-million cash prize.

The winning school also received an additional P10 million in infrastructure projects, coming from the Iloilo City government’s Special Education Fund.

“Beyond the drums, the dances, and the vibrant colors, Dinagyang plays a vital role in the life of our city. It is a powerful engine of tourism and economic activity,” said Mayor Treñas in her speech on Jan. 24.

“Every year, thousands of visitors come to Iloilo, filling our hotels, supporting our restaurants, boosting local businesses, and creating livelihood opportunities for performers, artisans, vendors, transport workers, and many others,” she added. “Dinagyang is one of the reasons Iloilo is what it is today.”

Aside from the Dinagyang Festival, the city government also celebrated TIEZA’s help in redeveloping public plazas in Molo, La Paz, and Jaro, alongside the MICE partnership.

“Iloilo City is strategically positioned to fulfill its vision of becoming a leading hub for MICE, supported by its advantageous geographic location, expanding direct air connectivity from major Asian destinations, diverse tourism assets, and a highly skilled service workforce,” TIEZA chief operating officer Mark Lapid said at the signing on Jan. 23.

“We are confident that this collaboration will accelerate the growth of Iloilo’s MICE industry and deliver substantial economic benefits to the Ilonggo community.” — Brontë H. Lacsamana

DMCI Power eyes Q2 decision on P3-B Semirara-Mindoro cable

DMCI POWER Corp. (DPC) said it expects a government decision by the second quarter (Q2) on its proposal to build a P3-billion submarine cable linking the islands of Semirara and Mindoro.

Speaking to reporters on Wednesday, DPC President Antonino E. Gatdula, Jr. said the company submitted the proposal to the Department of Energy (DoE) in November last year for the construction of a 19-kilometer subsea cable that would transmit electricity to Mindoro.

“We’re working on the submarine cable… maybe everything will become clearer in the next quarter,” he said.

If approved, the company aims to begin the project’s two-year construction period within the year.

“We call it a bridge project. We don’t need to wait for the connection of Batangas and Mindoro to lower the cost of power in Mindoro. The fastest option is through Semirara and Mindoro, as this route has the shortest distance,” Mr. Gatdula said.

At present, combined power demand in Occidental and Oriental Mindoro exceeds 100 megawatts (MW), most of which is supplied by bunker- and diesel-fired plants, he said.

Due to the island’s heavy reliance on diesel and bunker fuel — which are typically more expensive than other energy sources — Mindoro faces high generation costs that are partly subsidized.

To improve power supply on Mindoro, DPC is proposing to develop more than 2,100 MW of additional capacity using a mix of coal, wind, and solar technologies.

“We need a strong baseload: 30 MW coal, and then the rest can be supplied using RE (renewable energy). And we will connect Mindoro and Semirara. And we will displace the bunker and diesel,” Mr. Gatdula said.

He added that the company plans to build a 100-MW wind farm to harness the island’s wind potential, as well as a solar facility with up to 2,000 MW of capacity.

DPC said that constructing the submarine cable and supplying electricity from Semirara to Mindoro could result in at least P2 billion in annual savings in the universal charge for missionary electrification (UCME), which is collected from on-grid consumers to subsidize power generation in off-grid areas.

“When we computed the savings, based on the current price of diesel and bunker, there will be not less than P2 billion per year of savings in UCME because we will displace the bunker and diesel,” Mr. Gatdula said.

The company said it is looking to tap foreign expertise for the construction of the proposed subsea cable.

Established in 2006, DPC focuses on supplying electricity to off-grid small and remote islands. It has 188.3 MW of installed capacity and operates thermal, bunker, diesel, and wind power plants in Masbate, Oriental Mindoro, Palawan, and Antique.

DPC is a subsidiary of Consunji-led DMCI Holdings, Inc., which has business interests in construction, real estate, mining, power, cement, and water services. — Sheldeen Joy Talavera