Mouthwash may cure ‘the clap’

PARIS — In the 19th century, before the advent of antibiotics, Listerine mouthwash was marketed as a cure for gonorrhoea. More than 100 years later, researchers said Tuesday the claim may be true.

Uganda’s President Museveni takes commanding lead in early election results

KAMPALA — Veteran Ugandan President Yoweri Museveni held a commanding lead in early election results announced on Friday, while the party of his main challenger, Bobi Wine, said its leader was under effective house arrest.

The 81-year-old Mr. Museveni has ruled Uganda since seizing power in 1986 and is looking for a decisive victory to assert his political strength as speculation mounts about his eventual succession.

Results announced by the electoral commission from Thursday’s vote showed Mr. Museveni with 76.25% of the vote based on tallies from nearly half of polling stations. Mr. Wine trailed with 19.85%, with the remaining vote split among six other candidates.

Mr. Museveni had told reporters after casting his ballot that he expected to win with 80% of the vote “if there’s no cheating”.

Pop star-turned-politician Mr. Wine has alleged massive fraud during the election, which was held under an internet blackout following a campaign marred by violence.

Mr. Wine, whose legal name is Robert Kyagulanyi, called on his supporters on Thursday to protest, though there has been no sign of demonstrations so far.

His National Unity Platform (NUP) party wrote on its X account late on Thursday that the military and police had surrounded Mr. Wine’s house in the capital Kampala, “effectively placing him under house arrest”.

Police spokesperson Kituuma Rusoke told Reuters he was not aware of Mr. Wine being placed under house arrest.

Security forces confined Mr. Wine to his home for days after the last election in 2021, in which he was credited with 35% of the vote. The United States said that election was neither free nor fair, a charge rejected by Ugandan authorities.

The UN human rights office said last week that this year’s election was being held in an environment of “widespread repression and intimidation”.

Security forces repeatedly opened fire at Mr. Wine’s rallies, killing at least one person, and arrested hundreds of his supporters. The government said they were responding to lawless behavior.

A Museveni win would hand the former rebel leader a seventh term in office. He is widely believed to favor his son, military chief Muhoozi Kainerugaba, as his successor, though he has denied grooming Mr. Kainerugaba for the role.— Reuters

France’s government postpones budget talks to Tuesday

PARIS — France’s government suspended talks in parliament on its 2026 budget until Tuesday after lawmakers failed to reach a compromise, leaving the prime minister with the option of bypassing parliament to push the bill through unless he can bridge the divide.

That choice would risk a no confidence motion, which could lead to the collapse of government, unless it can find a compromise between the ideologically opposed hard-left France Unbowed (LFI) and the far-right National Rally (RN).

“The extremes have methodically voted for amendments to make the budget unvotable,” Budget Minister Amelie de Montchalin said on Friday in an interview on France 2 TV.

Prime Minister Sebastien Lecornu will on Friday propose an amended draft of the budget to try to reach a compromise before talks resume on Tuesday, according to Ms. Montchalin.

“There are things we have proposed that clearly do not work,” she said. “We saw that there were issues concerning local authorities, which is a major concern. It’s a matter of everyday life.”

If no compromise is found, Lecornu could choose to invoke Article 49.3 of the Constitution to push through the finance bill without a vote, after negotiating a text with all groups except the RN and LFI.

Mr. Lecornu has repeatedly vowed not to do that, saying he wishes for the parliament to come to an agreement.

The alternative could be to invoke Article 47 – an executive order allowing the government to pass the budget without parliamentary approval and which would make the bill a definitive law, even if a vote of no confidence were to bring down the government.— Reuters

Italy updates Arctic stance as Greenland tensions escalate

ROME — The Arctic has become a theatre of intensifying strategic rivalry, an Italian government paper that will be presented on Friday said, citing Russia’s “massive military presence” on its northern belt and the US pursuit of Greenland.

Italy has had observer status on the Arctic Council that oversees the region since 2013 and updated its policy as recent US-Danish tensions over Greenland sharpened focus on the area.

In the draft policy document that has been reviewed by Reuters, Rome pointed to Moscow’s renewed focus on the Arctic – “where energy and mineral resources vital to the country’s security are located” – which included a build-up of its military presence.

“The militarization of the region, the closer partnership between the Russian Federation and China, the end of Sweden and Finland’s neutrality following their accession to NATO, and the US position on Greenland are among the major drivers of change,” the document said.

US President Donald Trump has renewed calls for American control of Greenland to prevent Russia or China from occupying it. The island, an autonomous territory of Denmark, rejected the idea in talks held in Washington this week, exposing “fundamental” differences.

Italy flagged China’s attempt to raise its Arctic profile as a self-declared “near-Arctic state,” including growing interest in shipping along the Northern Sea Route and closer ties with Moscow that extend to military matters.

The document said the development of Arctic shipping routes opens up “significant prospects” for shipbuilders including Italy’s Fincantieri, which builds vessels that can operate in extreme environments.— Reuters

Wholesale price growth of NCR building materials steady in December

Price growth of bulk construction materials in the National Capital Region (NCR) steadied in December, the Philippine Statistics Authority (PSA) reported on Thursday.

Data from the PSA showed the construction materials wholesale price index (CMWPI) in NCR went up by 0.8% year on year in December, matching the pace in November. However, it was higher than the 0.2% annual growth posted in December 2024.

In 2025, the CMWPI growth average slowed to 0.1% from 0.6% in 2024.

The CMWPI is based on constant 2018 prices.

The PSA noted faster annual growths in sand and gravel at 0.2% in December from 0.1% in November, painting works (0.6% from 0.4%), and plywood (0.3% from -0.1%).

Slower year-on-year declines were seen in structural steel (-3% from -3.2%) and metal products (-0.7% from -0.8%).

Meanwhile, annual growths slowed in concrete products (2.4% from 2.5%), lumber (0.2% from 0.4%), G.I. sheet (0.1% from 0.2%), and tileworks (3.4% from 3.5%).

The indices of cement and glass and glass products saw steeper year-on-year declines at -1.5% from -1.4% and -0.2% from -0.1%, respectively.

According to the PSA, the easing in the average growth rate of the CMWPI in 2025 was driven by the downtrend in the year-on-year average growths of 12 out of the 20 commodity groups.

This was led by the structural steel subindex which declined 2% from the 0.9% growth a year earlier.

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., partly attributed the faster wholesale price growth of building materials in December 2025, compared to a year ago, to the “higher US dollar/peso exchange rate in recent months that increased importation costs for some construction materials with imported components.”

He also noted that weather-related disruptions reduced working days and construction activities in 2025, but was offset by the reconstruction of damaged homes, businesses, and infrastructure.

“The relatively slower [annual average] growth in construction materials wholesale prices could also reflect some slowdown in government spending especially on infrastructure, in view of the anti-corruption narrative/measures since the SONA on July 28, 2025 amid political noises related to the anomalous flood control projects,” he added.

Moving forward, Mr. Ricafort expects demand for construction materials to increase amid the series of rate cuts by the Fed and the central bank which reduced financing costs, increasing demand for loans to finance new investments and expansion projects. — Isa Jane D. Acabal

PHL orders Grok AI ban

The Philippines has ordered the ban of Grok, the generative artificial intelligence (AI) chatbot developed by X.AI Corp. (xAI), owned by Elon Musk over deepfake and growing threats involving women and minors.

This came after the Department of Information and Communications Technology (DICT) through its Cybercrime Investigation and Coordinating Center (CICC) ordered the National Telecommunications Technology (NTC) to block and take down access to Grok in the Philippines.

ICT Secretary Henry Rhoel R. Aguda said the agency is now working on a policy measure, through a department order, that would require users in the country to have their account verified.

“This is currently under review, I think, we can issue the department order next week which will require users [to have their] account verified,” Mr. Aguda said, adding that this will allow easy tracing of those who will abuse the use of AI.

In a media release, CICC said that the move to block Grok is in accordance with Republic Act 10175 or also known as the Cybercrime Prevention Act.

“This measure is intended to prevent the abuse of the tool and to safeguard the public from being exploited by its ability to manipulate content, produce sexually explicit materials, and generate deepfakes of real individuals without their consent,” CICC said.

It said that Grok AI enables the creation of pornographic content, especially child pornography which is against the law.

Further, Mr. Aguda said that Grok AI’s affiliate has reached out to the DICT, and is set to meet with the agency, and NTC to come up with a potential solution.

“We don’t want to block innovation. We don’t want to stifle or hinder progress… Other countries have shown the kinds of harm Grok AI can cause. So, the next question is: after we block Grok AI, what’s next?,” he said.— Ashley Erika O. Jose

PHIVOLCS warns of possible Kanlaon lahars amid Storm Ada

Several communities near Kanlaon Volcano in Negros Island are advised to prepare for possible lahars due to heavy rainfall from Tropical Storm Nokaen, locally named Ada, according to the Philippine Institute of Volcanology and Seismology (PHIVOLCS).

In an 11:00 a.m. advisory, PHIVOLCS said the forecasted rains from Ada may trigger lahars and muddy run-off in rivers and drainage areas around the volcano.

“Prolonged heavy rainfall could generate life-threatening lahars and sediment-laden streamflows on major channels draining the southern, western, and eastern slopes of Kanlaon Volcano,” PHIVOLCS said.

The bureau explained that post-eruption lahars can form when heavy rain washes away loose volcanic debris from recent eruptions and ashfall.

Meanwhile, non-eruption lahars can occur when recently landslide-exposed or weakened slopes, like those affected by Super Typhoon Tino in November 2025, collapse and send debris into rivers, threatening downstream communities.

PHIVOLCS said that communities that may be affected by lahars and sediment-laden streamflows include Bago City, La Carlota City, La Castellana, Moises Padilla, and San Carlos City in Negros Occidental.

It is also possible in Canlaon City in Negros Oriental, particularly along rivers and creeks such as Ibid, Cotcot, Talaptapan, Malaiba, Panubigan, Buhangin–Indurayan, Najalin, Inyawan, Maragandang, Panun-an, Intiguiwan, Camansi, Maao, Tokon-tokon, Masulog, Binalbagan, Taco, and Linothangan.

“These communities, as well as those further downstream of the above channels, are advised to prepare in case evacuation becomes necessary and to avoid traversing affected streams, even those farther downslope of the volcano,” PHIVOLCS said.

The bureau also reminded that Kanlaon lahars have been proven strong enough to carry large volumes of gravel and boulders, as shown during Super Typhoon Tino, posing a serious threat to communities.

Alert Level 2 remains in effect at Kanlaon Volcano, indicating increased unrest, according to PHIVOLCS.— Edg Adrian A. Eva

Philippines unveils ‘big bold reforms’ to shore up investor confidence

By Aubrey Rose A. Inosante, Reporter

The Philippine government on Friday pledged “big bold reforms” that are aimed at restoring investor trust as it tries to contain the economic fallout from a widening corruption scandal.

Finance Secretary Frederick D. Go said the economic team unveiled reforms before the largest names and groups in the private sector on Friday, which are expected to improve the ease of doing business and build the needed infrastructure.

“The briefing’s objective is clear, to inspire optimism, renew investor confidence, and encourage greater investments in the Philippines,” Mr. Go said during the “Big Bold Reforms: the Philippines 2026” press briefing held in Taguig City.

A corruption scandal over anomalous flood control projects has dampened investor sentiment and contributed to slower growth, household consumption and public spending.

One of the biggest announcements was the restoration of the P4.32 billion funding gap for the Comprehensive Automotive Resurgence Strategy (CARS) program, which had offered car manufacturers fixed investment support and production-volume incentives.

“The government finalized a funding solution for the CARS program, and therefore, car manufacturers enrolled in the program can now be assured that the government will fulfill its commitment to investors,” Mr. Go said.

President Ferdinand R. Marcos Jr. had earlier vetoed the CARS program funding under the unprogrammed appropriations of the 2026 budget, along with P250 million for the Revitalizing the Automotive Industry for Competitiveness Enhancement (RACE) program.

Mr. Go said other reforms include visa‑free entry for Chinese businessmen and tourists for up to 14 days, as well as plans by the Bureau of Internal Revenue to roll out a digitized, risk‑based audit system this year and to reduce the frequency of Letters of Authority.

The Bureau of Customs is also rolling out a national single‑window trade facilitation platform.

Mr. Go also urged private sector stakeholders to capitalize on the Philippines’ chairship of the Association of Southeast Asian Nations (ASEAN) this year.

“This is a clear signal that the Philippines is moving forward decisively and not being distracted,” he added.

‘NOT A DOOMSDAY SCENARIO’

The Finance Chief also noted that the government’s current projection of 5-6% gross domestic product (GDP) growth this year remains above both the Southeast Asian and global averages, rejecting concerns that it signals a “doomsday scenario.”

“The growth target of north of 5% or better in 2026 should not be dismissed as a doomsday scenario. It’s not,” he said.

Economy Secretary Arsenio M. Balisacan earlier said the Philippines’ economic growth may have slowed to 4.8% to 5% in 2025 due to corruption.

Mr. Go said this forecast still outpaces the ASEAN growth average of 3.8% and the global growth average of 2.9%.

INFRASTRUCTURE PUSH

At the same time, government agencies are now ramping up infrastructure spending in early 2026 after a “rough” second half in 2025 due to the graft scandal.

Public Works Secretary Vivencio B. Dizon said the department aims to boost spending while ensuring funds are used wisely.

“Our target spend for the first quarter is anywhere between P200 billion to P250 billion in the first quarter,” Mr. Dizon said, noting that this depends on how much the government can raise.

He added the Department of Public Works and Highways (DPWH) will prioritize “basics” such as road and bridge maintenance, along with unfinished projects spanning hospitals and classrooms.

Meanwhile, the Department of Transportation (DoTr), which has most of its capital outlay allocated for foreign-assisted projects, said it can obligate around P60 billion in the first quarter.

“The budget for DoTr for the entire year right now is around P103 billion, and the DoTr center alone is like P75 billion. But we have unprogrammed appropriations so far as the loan process is concerned,” Transportation Secretary Giovanni Z. Lopez said.

In the same briefing, Mr. Go announced that the Department of Finance will begin reporting the general government debt-to-GDP ratio, along with national government debt, in line with International Monetary Fund (IMF) standards.

“Going forward, the data point shared with the media and our private stakeholders will be the general government debt, which currently stands at 54% to 55% of GDP,” he said.

This figure is well below the IMF’s 70% debt-to-GDP threshold.

Globe brings Starlink direct-to-cell technology in PHL

GLOBE TELECOM, Inc. has partnered with Elon Musk’s Starlink to bring its direct-to-cell satellite services in the Philippines, making the country the first in Southeast Asia to offer the technology.

“By leveraging Starlink’s low earth orbit satellites, we will bridge coverage gaps in what we called geographically isolated and disadvantaged areas, enabling Filipinos to access essential services,” Globe President and Chief Executive Officer Carl Raymond R. Cruz said during the signing of a memorandum of agreement for the partnership.

The technology is targeted to be commercially available by end March, Mr. Cruz said, adding that the company is working to lower the pricing of the services to make it more inclusive.

Starlink’s direct-to-cell technology connects users directly to its low-earth orbit (LEO) satellite, which provides text, voice, and data connectivity to users particularly in remote areas which lack coverage.

This landmark initiative is part of the Ayala-led telecommunications company’s commitment to ramp up its investment in technologies to help bridge the digital and connectivity gap in the Philippines.

At present, Globe said that it has achieved about 97% coverage in the country, and the balance 3%, which are considered underserved, can take advantage of the new technology being offered.

Information and Communications Technology Secretary Henry Rhoel R. Aguda said the agency is confident that the new technology will spur growth of the digital economy as this will enhance connectivity in the country.

Starlink’s direct-to-cell service is a satellite-to-mobile wireless technology launched by its parent company Space Exploration Technologies Corp. (SpaceX).

Although Globe is the first telecommunications company in the country to bring Starlink’s direct-to-cell services, Starlink has also inked a partnership with Converge ICT Solutions, Inc., making it an authorized reseller of Starlink kits in the Philippines.

Starlink continues to expand its satellite network to provide high-speed broadband to rural and remote areas, according to its website.— Ashley Erika O. Jose

Philippines’ infrastructure watchdog stalls operations as quorum lost

The Philippines’ Independent Commission for Infrastructure (ICI) formally said on Friday it cannot carry out official functions after resignations left the fact-finding body without a quorum, as the President hinted its investigative work has been completed.

In a statement, the ICI said the departures of Commissioners Rogelio “Babes” L. Singson and Rossana A. Fajardo, which took effect in late December, have left Chairperson Andres B. Reyes Jr. as the commission’s sole member.

Under Executive Order No. 94, which created the ICI, the body requires a majority of its three original members to conduct official business.

“As a collegial body, the ICI may take official action only with the approval of a majority of its members,” the ICI said.

“Consequently, following the resignation of its two commissioners, the Commission is unable to resume its official operations until a quorum is restored,” it added.

The leadership vacuum comes as the investigative body reports significant progress in its crackdown on infrastructure-related corruption. Since its inception in September last year, the ICI has referred eight cases to the Office of the Ombudsman involving nearly 100 individuals.

These investigations have already yielded three formal court cases filed by the Ombudsman, the arrest of 16 individuals, and the freezing of over P20 billion in assets through coordination with the Anti-Money Laundering Council.

President Ferdinand R. Marcos, Jr. hinted on Friday that the ICI’s mandate may be nearing its conclusion.

“Again, it all depends on the work that ICI still has,” Mr. Marcos reportedly told journalists in an interview. “But if the work is done, if all the information has been given to the department of justice and the Ombudsman, then the focus of the investigation will go through the DOJ and the Ombudsman.”

Before the current impasse, the ICI proposed wide-ranging reforms to prevent irregularities in large-scale projects, including automatic reporting of DPWH contracts over P30 million to the Bureau of Internal Revenue, live-streaming of investigative hearings, and a centralized contractor registry and blacklist, the commission said.

The body also called for the immediate suspension of payments for projects under serious review and the institutionalization of a permanent, independent fact-finding body.

Mr. Marcos noted that no decision has been made regarding the appointment of new commissioners to fill the vacancies. “If there is still a need, then we will [appoint],” he added.

Final Reporting

The ICI is currently consolidating its findings into a comprehensive report covering its operations from September 11 to December 31, 2025.

“The report will be submitted to the Office of the President for its consideration in determining the next steps for the Commission,” the ICI said.

In the interim, the commission stated it is focusing on safeguarding all records and evidence in its custody to ensure that ongoing legal proceedings are not compromised.— Erika Mae P. Sinaking

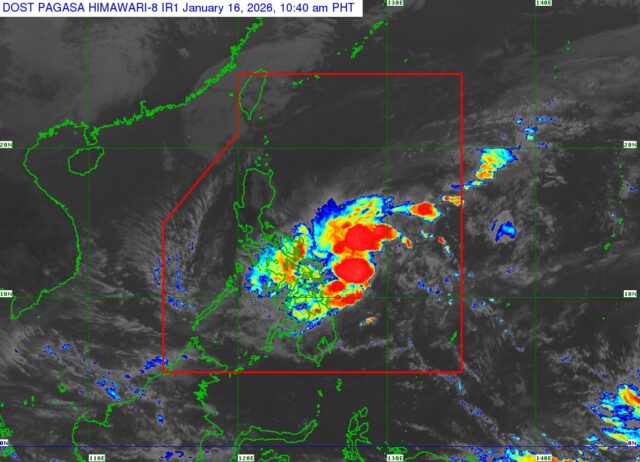

Signal No. 1 up in more than a dozen areas amid Tropical Storm Ada

Storm Signal No. 1 has been raised in more than a dozen areas due to Tropical Storm Nokaen, locally named Ada, according to the Philippine Atmospheric, Geophysical and Astronomical Services Administration (PAGASA) advisory on Friday.

The affected areas include the eastern portion of Camarines Norte, Camarines Sur, Catanduanes, Albay, Sorsogon, Masbate, Northern Samar, Samar, and Eastern Samar, PAGASA said in its 11:00 a.m. advisory.

The signal is likewise in effect in Biliran, the northern and central portions of Leyte, the eastern portion of Southern Leyte, Dinagat Islands, and Siargao–Bucas Grande Islands.

PAGASA said that under Storm Signal No. 1, winds of up to 61 kilometers per hour may be experienced within the next 36 hours, which could cause minimal to minor damage to properties made of light materials.

The weather bureau added that the highest wind signal that may be hoisted throughout the passage of Nokaen is Signal No. 2.

The storm has maintained its strength, packing maximum sustained winds of 65 kilometers per hour and gusts of up to 80 kph.

It was last located 325 kilometers east of Guiuan, Eastern Samar, moving northward at 15 kph.

As for its track, PAGASA said Nokaen is likely to pass close to Eastern Samar and Northern Samar on Saturday, then near Catanduanes from Saturday evening through Sunday.

Although the latest tracking shows that the storm is not expected to make landfall, PAGASA said a possible landfall over Samar cannot be ruled out due to the cyclone’s wide forecast cone, which indicates potential changes in direction.

Meanwhile, PAGASA also issued an orange heavy rainfall warning over Northern Samar and Eastern Samar, where rainfall of up to 200 millimeters is expected from Friday to Saturday noon.

This means that up to 200 liters of rain per square meter may fall over the affected areas, which could trigger flooding even in non–flood-prone locations, as well as landslides in moderate- to high-risk areas, PAGASA said in a separate 11:00 a.m. advisory.— Edg Adrian A. Eva

Taiwan aims to be strategic AI partner in US tariff deal

TAIPEI — Taiwan aims to become a close strategic partner with the United States in the area of artificial intelligence (AI) after striking a deal to cut tariffs and boost its investment in the country, Vice Premier Cheng Li-chiun said on Friday.

The administration of President Donald Trump has pushed the major producer of semiconductors for greater investment in the United States, specifically in turning out chips that power AI.

“In this negotiation, we promoted two-way Taiwan–US high-tech investment, hoping that in the future we can become close AI strategic partners,” Mr. Cheng said in comments livestreamed from a press conference in Washington.

Mr. Cheng led the talks that clinched Thursday’s trade deal, which cuts tariffs on many of Taiwan’s exports, and directs new investments in the US technology industry, but it could also irritate China.

China regards democratically-ruled Taiwan as its own territory and strongly objects to high-level US-Taiwan exchanges. Taiwan rejects Beijing’s sovereignty claims.

US Commerce Secretary Howard Lutnick said Taiwan companies would invest $250 billion to boost production of semiconductors, energy and artificial intelligence in the United States.

The figure includes $100 billion already committed by chipmaker TSMC in 2025, with more to come, he added.

Taiwan will also guarantee an additional $250 billion in credit to facilitate further investment, the Trump administration said.

‘CLOSE PARTNERS’

Mr. Cheng called the deal “win-win”, adding that it would also encourage US investment in Taiwan. The United States is the island’s most important international backer and arms supplier, despite the lack of formal diplomatic ties.

The investment plan is company-led, rather than driven by the government, and Taiwan companies will continue to invest at home, Mr. Cheng added.

“We believe this supply-chain cooperation is not ‘move,’ but ‘build.’ We expand our footprint in the US and support the US in building local supply chains, but even more so, it is an extension and expansion of Taiwan’s technology industry.”

Investments would also cover AI servers and energy, Taiwan Economy Minister Kung Ming-hsin told reporters in Taipei, adding that it was up to companies to reveal the chip-related amounts.

TSMC ROLE

In a statement TSMC, the world’s main producer of advanced AI chips welcomed the prospect of “robust” trade pacts between the United States and Taiwan, adding that all its investment decisions were based on market conditions and customer demand.

“The market demand for our advanced technology is very strong,” it said. “We continue to invest in Taiwan and expand overseas.”

Once signed, the deal, will need to be ratified by Taiwan’s parliament, where the opposition has the most seats and which has expressed concern about the “hollowing out” of the crucial chip industry under a US trade deal.

The objective was to bring 40% of Taiwan’s entire chip supply chain and production to the United States, Mr. Lutnick told CNBC in an interview on Thursday. If they were not built in the United States, the tariff was likely to be 100%.

Mr. Kung said he did not know how the figure of 40% had been calculated but Taiwan estimated that by 2036, the production split between Taiwan and the United States would be 80/20 for the advanced chips, those of five nanometers and below.

“This round of deployment will strengthen the resilience of Taiwan–US and global semiconductor supply,” he said.

“A moderate level of global diversification is also necessary. Going forward, the biggest AI orders will come from the US market.”

The semiconductor investment was the largest in US history, Mr. Lutnick said in a post on X, alongside a picture of himself with Mr. Cheng, Taiwan’s top trade representative Yang Jen-ni and US Trade Representative Jamieson Greer.

“US advanced manufacturing coupled with this deal will bring chip production back home, create high-paying American jobs, and secure our economic and national security for decades,” he added.— Reuters

Brazil’s Bolsonaro transferred to roomier cell in new prison after judge’s order

BRASILIA — Former Brazilian President Jair Bolsonaro was transferred on Thursday to Brasilia’s Papuda Penitentiary Complex, providing him with upgraded accommodations after an order from Supreme Court Justice Alexandre de Moraes, the court said.

Mr. Bolsonaro had been carrying out his 27-year sentence for plotting a coup in a much smaller cell at Brazil’s Federal Police Superintendency.

Mr. Bolsonaro’s legal defense did not immediately respond to a request for comment on the decision.

Mr. Moraes argued that Mr. Bolsonaro might be in better conditions to receive medical assistance and weekly visits from his family in the penitentiary complex than he had in the superintendency. The judge’s decision came after complaints from Mr. Bolsonaro’s family and lawyers about his condition at the cell.

Mr. Bolsonaro is set to serve his sentence in a building known as Papudinha, where other Brazilian politicians have been jailed, including Anderson Torres, Brazil’s Justice minister under his administration.

The ex-president’s new prison cell has about 65 square meters (699.65 square feet), bigger than the 12-square-meter-room he had been in up to this point. The cell includes a bedroom, a bathroom, a kitchen, a living room and an outdoor space, the court said, and added that he will serve his sentence alone.

Carlos and Eduardo Bolsonaro, sons of the former president, said in separate posts on social media that Mr. Bolsonaro should have been transferred to house arrest instead.

The far-right leader, who has a history of surgeries related to a stabbing he suffered in his abdomen during a 2018 campaign event, has been seeking permission to serve his sentence under “humanitarian house arrest”, which Mr. Moraes has denied, citing flight risk.— Reuters