Mouthwash may cure ‘the clap’

PARIS — In the 19th century, before the advent of antibiotics, Listerine mouthwash was marketed as a cure for gonorrhoea. More than 100 years later, researchers said Tuesday the claim may be true.

CICC warns against cybercrimes targeting consumers

CICC Acting Executive Director Renato “Aboy” A. Paraiso told BusinessWorld that consumer fraud usually involves website links mimicking official brand pages that offer items at “exorbitant” discounts and promotions. He warned that these websites may be phishing sites or, worse, financial fraud pages that can steal money.

“It’s actually illegal. So the number one red flag there is if you are redirected to a site instead of using the official applications of online marketplaces,” Mr. Paraiso said in an interview on the sidelines of the BusinessWorld Insights Cybersecurity Series forum.

“It is the most prevalent type of fraud because it is a passive kind of fraud, as most scammers right now are advertising these schemes,” he added.

In a report released last week, the CICC said it recorded a total of 6,453 cases of consumer fraud, accounting for 38% of reported cybercrimes in 2025.

This was followed by online fraud with 4,243 cases (23%), online harassment with 2,160 cases (11%), and identity theft with 1,626 cases (9%).

The report also showed that victims lost a total of nearly ₱418.2 million to consumer fraud, online fraud, hacking, and phishing during the same year.

To combat these cybercrimes, Mr. Paraiso said the CICC’s efforts are ongoing and will be further expanded in 2026.

He said the agency continues its information dissemination initiatives by partnering with various organizations, with plans to broaden these efforts next year.

“The number one weapon that we can rely on is really an informed and educated citizenry,” he said.

In recent weeks, the CICC partnered with digital service platform Maya and online lending application JuanHand for its “Scam Safe” initiative, which aims to protect Filipinos from the growing threat of online scams and cyber fraud.

Mr. Paraiso said that by 2026, the agency plans to partner with more private sector groups, including the Bankers Association of the Philippines and the Online Lending Association, to combat consumer fraud and address other concerns such as online gambling and child exploitation.

CICC’s Hotline 1326, a 24/7 action center, remains open for the public to lodge cybercrime-related complaints.

He assured that complainants would receive feedback on the status of their cases within 24 hours of filing, noting that this helps build public trust.

The CICC is an attached agency of the Department of Information and Communications Technology, the government’s main body tasked with combating and preventing cybercrime.— Edg Adrian A. Eva

Toyota eyes to keep market leadership in 2026

Toyota Motor Philippines (TMP) Corp. is aiming to maintain its 46% market share in 2026, with plans to introduce five more models in the same year.

“We are so happy to have hit 46% market share last year. And we want to keep that momentum as big as possible this year too,” said TMP President Masando Hashimoto in a press conference on Thursday.

To maintain this, he said that the company will be leveraging its connection with the car owners by “pursuing lifetime value even after the car purchase.”

“We will ensure that Toyota and Lexus are always there … That is what we have to do to keep our brand high,” he added.

Last year, TMP remained the industry leader after selling 229,447 Toyota and Lexus units. This is 5.2% higher compared to last year and accounted for 46% of the market share.

The top-selling Toyota models in 2025 were Vios (27,811 units), Avanza (24,704 units), and Hilux (23,735 units).

Meanwhile, the top-selling Lexus models were NXh (735 units), RXh (312 units), and LMh (296 units).

Across Toyota’s markets, sales-wise the country ranked 10th in 2025, while it ranked 23rd in terms of market.

Meanwhile, the Philippine automotive industry expects the market to grow between 491,000 to 510,000 this year, said Mr. Hashimoto.

“This number is actually the fourth biggest volume among Association of Southeast Asian Nations (ASEAN) countries, ahead of Vietnam, following Thailand’s 600,000,” he said.

“We are quite sure that this momentum of growth will be kept the same for the coming years. And we are again aiming for 46% of market share,” he added.

Despite cautious optimism, he said that the company will be introducing five more models this year.

“We have five exciting major models lined up and a lot of other improvements coming your way,” he said.

In particular, TMP plans to launch three new electrified models in the first half, which are the Urban Cruiser battery electric vehicle (EV), the RAV4 hybrid EV, and the Land Cruiser 300 hybrid EV.

These will be followed by the launches of the Land Cruiser FJ and the all-new Hilux.

Last year, TMP saw a 40% increase in the sale of its electrified models to 19,516 units.

This accounted for 9% of the total units sold by the company in 2025.

Since 2009, TMP has sold 44,228 electrified units as part of its continuing efforts toward carbon neutrality. —Justine Irish D. Tabile

Myanmar election delivers victory for military-backed party amid civil war

MYANMAR’S military-backed party has completed a sweeping victory in the country’s three-phase general election, state media said, cementing an outcome long expected after a tightly controlled political process held during civil war and widespread repression.

The Union and Solidarity Party (USDP) dominated all phases of the vote, winning an overwhelming majority in Myanmar’s two legislative chambers. It secured 232 of the 263 seats up for grabs in the lower Pyithu Hluttaw house and 109 of the 157 seats announced so far in the Amyotha Hluttaw upper chamber, according to results released on Thursday and Friday.

Myanmar’s parliament is expected to convene in March to elect a president, with a new government set to take over in April, pro-military Eleven Media Group reported earlier this month, citing junta spokesman Zaw Min Tun.

The final round of voting in late January brought an end to an election that began on December 28, more than four years after the military seized power in a coup that overturned the elected government of Nobel Peace Prize laureate Aung San Suu Kyi.

Myanmar has been in political turmoil since the coup, with the crushing of pro-democracy protests sparking a nationwide rebellion. Around 3.6 million people have been displaced, according to United Nations.

CRITICS SAY MILITARY STILL IN CHARGE

The 11-member Association of Southeast Asian Nations has said it would not endorse the process, and human rights groups and some western countries have also denounced the election as a sham.

Myanmar’s military government insists the polls were free and fair, and supported by the public.

Ms. Suu Kyi’s National League for Democracy was dissolved along with dozens of other parties, and some others declined to take part, drawing condemnation from critics who say the process was designed to entrench military rule.

Under Myanmar’s political system, the military is also guaranteed 25% of parliamentary seats, ensuring continued control even after power is formally transferred to a civilian-led administration.

PROXY FOR THE ARMED FORCES

The USDP was founded in 2010 after decades of military-led rule in the southeast Asian country, with the aim of serving as a proxy for the armed forces, also known as the Tatmadaw.

The party is chaired by a retired brigadier general and packed with other former high-ranking officers. It contested the poll with 1,018 candidates, a fifth of the total registered.

Junta chief Min Aung Hlaing is also expected to play a central role in the next administration.

He has defended the polls as a step toward stability, rejecting criticism from opponents and foreign governments and affirming that state responsibilities will be transferred to the elected government.

“Regardless of any changes among political parties or organizations in the country, Tatmadaw continues to carry out its responsibilities for national defense and security faithfully and without neglect up to the present day,” he was quoted by state media as saying on Monday.

TURNOUT DOWN AS FIGHTING HALTS VOTES

Turnout reached around 55% over all three phases, lower than the figure of around 70% in previous elections, including a 2015 vote that brought Ms. Suu Kyi to power, as well as the ill-fated 2020 poll, the results of which were cancelled by the junta before staging the coup.

Voting took place in 263 of Myanmar’s 330 townships, some of which are not under the complete control of the junta.

It was cancelled in many areas due to ongoing fighting between the military and armed ethnic groups, as well as local resistance forces that emerged after the 2021 coup.— Reuters

Indonesia vows market reform after $80 billion rout; bourse chief quits

JAKARTA/SINGAPORE — Indonesia’s chief economic minister promised increased financial market transparency and improved corporate governance on Friday, after the stock exchange chief resigned to take responsibility for a $80 billion share rout.

Airlangga Hartarto, at a news conference, said authorities were committed to stock market reform and that the country’s economic fundamentals remained sound.

Proposed improvement measures include doubling the free float requirement of shares to 15%, allowing pension and insurance funds to increase capital market investment to 20% of their portfolio from 8%, and checking the affiliation of shareholders with ownership of less than 5%.

“The government guarantees protection for all investors by maintaining good governance and transparency,” Mr. Airlangga said.

Index provider MSCI flagged a possible downgrade of Indonesian stocks to “frontier” status on Wednesday due to concern about share ownership and trading transparency, triggering the steepest two-day share price fall since April.

Indonesia Stock Exchange CEO Iman Rachman resigned on Friday.

“I hope this is the best decision for the capital market. May my resignation lead to improvement in our capital market,” Iman told a press conference. “Hopefully, the index, which opened positively this morning, will continue to improve in the coming days.”

The Financial Services Authority (OJK) will ensure Iman’s resignation does not affect operations, an OJK official told reporters. It will take the lead in implementing reforms and aims to resolve the MSCI’s concerns by May, the official said.

“We remind all investors to remain calm and rational when making investment decisions,” said Inarno Djajadi, who overseas capital markets at the regulator.

The benchmark Jakarta Composite Index dropped more than 8% on Wednesday and Thursday but was last up 1.18%, a day after authorities announced the proposed measures to address MSCI’s concern and ease investor worry.

The rupiah was last at 16,790 to the US dollar, hovering near its weakest-ever rate of 16,985 set last week.

Someone had to take responsibility for the loss of confidence, said Mohit Mirpuri, portfolio manager at SGMC Capital in Singapore, referring to Iman.

“The bigger picture is a reset and an opportunity for the exchange to emerge stronger with clearer standards and governance,” Mr. Mirpuri said.

Foreign capital outflows have increased due to concern about how President Prabowo Subianto is widening the fiscal deficit and expanding state involvement in financial markets.

This month’s appointment of his nephew Thomas Djiwandono to the central bank and last year’s firing of respected finance minister Sri Mulyani Indrawati have shaken confidence in Mr. Prabowo’s stewardship.

Regulators said communication with MSCI has been positive and that they were awaiting a response to their proposed measures which they hoped to implement soon.

Their swift action appears to have allayed investor concern but sentiment remains fragile.

“Policymakers want to fix this,” said Paul Dmitriev, senior analyst and co-portfolio manager at Global X ETFs. “The government has every incentive to fix these issues as systemic outflows would be substantial and could materially impact the market.”

Foreign investors sold around a net $645 million worth of shares in the two-day selloff, exchange data showed. They sold $1 billion worth of shares in 2025. ($1 = 16,780 rupiah) — Reuters

Finance chief optimistic on growth despite 2025 GDP letdown

FINANCE SECRETARY Frederick D. Go is optimistic that the Philippine economy can recover and hit the government’s growth target on the back of faster, more productive spending.

Mr. Go said on Friday that he is “hopeful” that gross domestic product (GDP) growth can reach the government’s 5%-6% goal this year after expansion hit a post-pandemic low in 2025 due to the fallout from a corruption scandal linked to state infrastructure projects.

“I just have to say, though, that the whole year is four quarters. We’re not going to get there in the first quarter,” he said on the sidelines of an event.

Philippine GDP growth slowed to 3% in the fourth quarter from 5.3% in the same period a year prior and the revised 3.9% print in the third quarter, the government reported on Thursday.

This was the slowest print in nearly five years or since the 3.8% contraction in the first quarter of 2021. Outside of the pandemic, this was the worst since the 1.8% growth recorded in the fourth quarter of 2009, or during the Global Financial Crisis.

This brought full-year 2025 GDP growth to 4.4%, well below the government’s 5.5%-6.5% goal. This was slower than 2024’s 5.7% and was the weakest annual expansion since the 3.9% in 2011, counting out the 9.5% contraction in 2020 due to the pandemic.

These were below the 4.2% and 4.8% median estimates for fourth-quarter and full-year 2025 GDP growth in a BusinessWorld poll.

“We’re growing at 4.4%, so it’s not the end of the world,” Mr. Go said. “But having said that, again, all the fundamentals that allow the economy to grow at 5.5% are intact.”

“None of the macroeconomic fundamentals has changed. So, we should get back on track this year.”

He said they expect public spending to rebound this year, adding that officials have met to clear the spending program, with the top five spenders being the Public Works, Education, Health, Agriculture, and Transportation departments.

“The top five spenders were all there in that meeting, and we agreed with them what their spending will be, how much money will be released. I’m constantly coordinating with DBM (Department of Budget and Management) on the release of these funds because we need them to circulate in the economy.”

He added that they remain committed to fiscal discipline, which means smart spending while keeping the budget gap manageable.

“I sincerely believe it’s not about government spending more and more money every year — it’s about spending the same amount of money, perhaps an even lower amount of money, but using it for more quality and productive spending on projects that have a high multiplier effect.”

Mr. Go added that he also met with President Ferdinand R. Marcos Jr. on Friday on economic concerns.

RATE CUT

Following last year’s disappointing growth print, the Bangko Sentral ng Pilipinas (BSP) may deliver a sixth straight cut next month to prop up the economy, Standard Chartered Bank said.

Standard Chartered economist and foreign exchange analyst for ASEAN (Association of Southeast Asian Nations) Jonathan Koh said the BSP has room for another 25-basis-point (bp) cut amid sluggish growth and subdued inflation.

“So, with growth being soft, potentially coming in at the lower end of the government’s 5-6% forecast for this year, and with inflation being very benign, well within the BSP’s 2%-4% target range, I’m expecting the central bank to cut rates,” he said in a briefing in Makati on Friday. “I’m looking at a 25-basis-point cut in February.”

Standard Chartered’s latest growth forecast for this year stands at 5.7%, but Mr. Koh said they could cut this to around 5%. The government targets 5%-6% growth this year.

“I think sentiment needs to turn around before we actually see a real improvement in terms of growth,” he said.

He added that a protracted slowdown could give the BSP a reason to extend its easing cycle and deliver another 25-bp reduction for a terminal rate of 4%.

“I think if 2026 GDP growth risks falling below 5%, I think that could potentially lead to one more [cut].”

The Monetary Board has reduced benchmark borrowing costs by a total of 200 bps since August 2024, bringing the policy rate to 4.50%.

Last week, BSP Governor Eli M. Remolona, Jr. said another cut is uncertain, given current economic conditions. He added that while they will consider the GDP data, price stability remains their primary concern.

Mr. Koh also said they see the central bank trimming the reserve requirement ratio (RRR) to help boost liquidity that could potentially drive domestic demand.

“I think that’s on the table, potentially (in the) first half of the year,” he said.

The BSP reduced big banks’ RRR by 200 bps to 5% in March last year. It likewise cut digital banks’ reserve ratio by 150 bps to 2.5%, while that for thrift banks was lowered by 100 bps to 0%.

Meanwhile, Standard Chartered sees the peso trading at the P59-a-dollar level this year, with the greenback’s persistent weakness and Philippines’ ample foreign reserves to prevent it from sliding to the P60 range.

“I would say within the Asia region, peso is probably a currency that we are a bit more cautious on,” Mr. Koh said.

Downside risks for the peso include weaker service exports as the rise of artificial intelligence and shifting US policies could affect the business process outsourcing sector, as well as sluggish remittance growth.

Asked if the peso’s weakness could prevent the BSP from easing its policy stance further, Mr. Koh said: “How I see it now, my own view, is downside growth risk outweighs upside inflation risk.”

The central bank is mainly managing the exchange rate to curb inflationary pressures as a weak peso means the country would have to spend more on imports such as oil, he said.

PUBLIC TRUST

Addressing governance issues will be key to the Philippine economy’s recovery, another analyst said.

“The strains the Philippines are experiencing right now are twofold: public trust and tariffs,” Alvin Joseph A. Arogo, first vice president and chief economist at Philippine National Bank (PNB), said at a British Chamber of Commerce Philippines event on Thursday.

“It is essential for the Filipino people to regain public trust in order for strong growth to resume,” he said. “We could expect this weakness in public construction to last until the third quarter, using previous historical experience.”

Even with full-year 2025 growth falling well below market expectations and missing the government’s goal anew, this is “not a disaster,” Mr. Arogo said, adding that he expects the economy to post a “strong recovery” by 2027.

“A 4% growth is the envy of most developed economies. So, just to put it into perspective, 4% is slow for the Philippines, but it’s not a disaster. A disaster is what happened in 2020, when the economy shrank by close to 10%,” he said.

“There’s no need to panic, but some things must change. And at least, even without structural changes, the shift in sentiment alone will allow the Philippines to post stronger growth in 2027. So, 2026 is a critical year, but recovery next year is likely.” — Aubrey Rose A. Inosante, Justine Irish DP. Tabile, and Katherine K. Chan

South Korea, Japan defense ministers agree to upgrade cooperation

SEOUL — The defense ministers of South Korea and Japan agreed on Friday to upgrade defense cooperation and plan to work together in incorporating artificial intelligence and unmanned weapon systems, South Korea’s Defense Ministry said.

Japanese Defense Minister Shinjiro Koizumi and his South Korean counterpart Ahn Gyu-back held talks in Yokosuka, Japan, and agreed to conduct joint naval search-and-rescue drills, it said in a statement.

The two Asian allies of the United States have in recent months drawn closer in political ties under new leaders, as they looked to put behind years of frosty relations rooted in Japan’s occupation of the Korean peninsula in the early 20th century.

Mr. Ahn and Mr. Koizumi discussed working together to ensure peace and stability in the region amid the challenges of the global security environment and continuing defense cooperation with the United States, the ministry said.

The meeting follows talks they held in September in South Korea.

Earlier, South Korea’s Yonhap News Agency reported Mr. Koizumi told Mr. Ahn defense cooperation between the two countries, and with the United States, was more important than ever. — Reuters

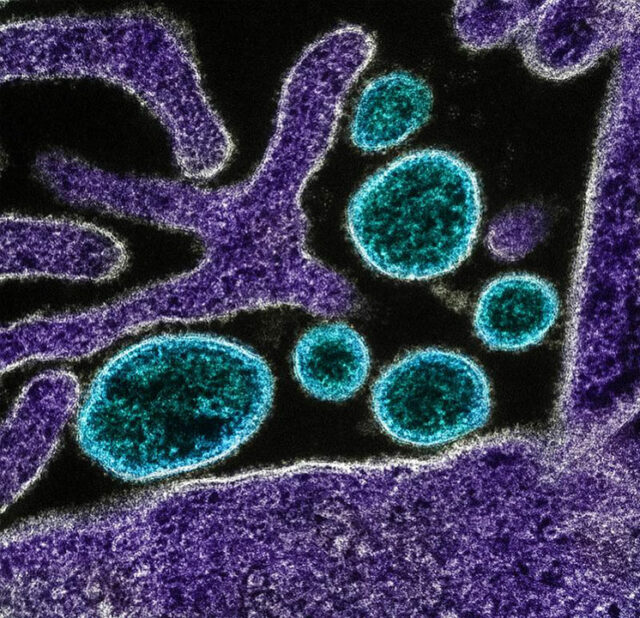

WHO sees low risk of Nipah virus spreading beyond India

HYDERABAD — There is a low risk of the deadly Nipah virus spreading from India, the World Health Organization said on Friday, adding that it did not recommend travel or trade curbs after two infections reported by the South Asian nation.

Hong Kong, Malaysia, Singapore, Thailand, and Vietnam are among the Asian locations that tightened airport screening checks this week to guard against such a spread after India confirmed infections.

“The WHO considers the risk of further spread of infection from these two cases is low,” the agency told Reuters in an email on Friday, adding that India had the capacity to contain such outbreaks.

“There is no evidence yet of increased human to human transmission,” it said, adding that it has coordinated with Indian health authorities.

But it did not rule out further exposure to the virus, which circulates in the bat population in parts of India and neighboring Bangladesh.

Carried by fruit bats and animals such as pigs, the virus can cause fever and brain inflammation. It has a fatality rate ranging from 40% to 75%, with no cure, though vaccines in development are still being tested.

It spreads to humans from infected bats, or fruit they contaminate, but person-to-person transmission is not easy as it typically requires prolonged contact with those infected.

Small outbreaks are not unusual and virologists say the risk to the general population remains low.

The source of infection was not yet fully understood, said the WHO. It classifies Nipah as a priority pathogen because of a lack of licensed vaccines or treatments, a high fatality rate, and a fear it could mutate into a more transmissible variant.

NIPAH NOT NEW TO INDIA

The two health workers infected in India’s eastern state of West Bengal late in December are being treated in hospital, local authorities have said.

India regularly reports sporadic Nipah infections, particularly in its southern state of Kerala, regarded as one of the world’s highest-risk regions for the virus, linked to dozens of deaths since it first emerged there in 2018.

The outbreak is the seventh documented in India and the third in West Bengal, where outbreaks in 2001 and 2007 were in districts bordering Bangladesh, which reports outbreaks almost annually, the WHO said. — Reuters

Strong MSME engagement sets the stage for SM Supermalls’ 2026 programs

Nationwide malls drive MSME upskilling, growth, and sustainable enterprise

Building on strong MSME momentum in 2025, SM Supermalls is entering 2026 with a renewed and sharped focus on empowering Filipino entrepreneurs, leveraging its nationwide mall network to create tangible growth opportunities for micro, small, and medium enterprises (MSMEs).

Through its SM for MSMEs program, SM Supermalls empowered 920 new MSMEs and start-ups in 2025, with nearly 10% successfully transitioning into regular mall tenants through kiosks, counters, or in-line stores nationwide. Since its enhanced rollout in March 2024, the program has supported 2,288 unique MSMEs, providing real-world platforms where entrepreneurs can test, refine, and scale their businesses.

In 2025 alone, 28,761 MSME booth activations were mounted nationwide, driven by a growing consumer demand for locally made, experience-led products across food and beverage, beauty, wellness, and lifestyle categories.

Honoring MSME Excellence

The annual SM for MSMEs Wall of Champions recognized outstanding MSME awardees and finalists whose businesses demonstrated exemplified resilience, innovation, and community impact—serving as a tribute to Filipino entrepreneurship and its vital role in nation-building.

“The private sector has a role to play in enabling the future growth of the MSME sector,” said Steven Tan, President of SM Supermalls. “Supporting the grassroots economy is a long-term commitment we intend to uphold.”

Nation-Building Through Partnerships

From learning summits and curated markets to large scale trade fairs, SM Supermalls worked closely with key partners including the Department of Trade and Industry, Go Negosyo, media organizations, trade fair organizers, and MSME exhibitors to deliver meaningful, measurable outcomes for entrepreneurs nationwide.

According to the Department of Trade and Industry, MSMEs account for 99.63% of businesses and 66.58% of total employment in the Philippines, underscoring their critical role as the backbone of the national economy.

Major 2025 highlights included the DTI National Food Fair, Negros Trade Fair, Women Strong Trade Fair by WomenBizPH, VIYLine MSME Caravan, and the Go Negosyo MSME Summit 2025, which energized the SM Mall of Asia Music Hall with mentorship sessions and business insights, highlighted by Francis Kong’s talk, “Now and Next: The Trends in Business for MSMEs.”

Expanding Opportunities Beyond Metro Manila

Leveraging its nationwide footprint, SM Supermalls expanded regional trade fairs and themed marketplaces across Luzon, Visayas, and Mindanao, bringing high-visibility platforms closer to local communities and advancing more inclusive, region-led growth.

Kicking Off 2026 With Strong MSME Partnerships

To start 2026, SM Supermalls—together with government agencies, media partners, and trade fair organizers, will host and support a new slate of MSM focused events.

DTI Region IV-A Coco Festival Food Fair

January 14–20, 2026 | SM City San Pablo

Featuring coconut-based products and local delicacies from MSMEs in Region IV-A.

Philstar Nakakalokal Bazaar

January 16–18| SM Seaside City Cebu

Showcasing homegrown food, fashion, crafts, and lifestyle brands from the Visayas and the Cordillera region, highlighting locally made MSME products.

The Silk Events Bazaar (upcoming)

January 28–February 10, 2026 | SM La Union

A curated lifestyle and artisan market offering MSMEs extended exposure in a tourism-driven destination

As SM Supermalls moves into 2026, SM for MSMEs continues to evolve as a scalable growth platform—transforming participation into opportunity, and opportunity into sustainable enterprise for Filipino entrepreneurs nationwide.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by publishing their stories on the BusinessWorld Web site. For more information, send an email to online@bworldonline.com.

Join us on Viber at https://bit.ly/3hv6bLA to get more updates and subscribe to BusinessWorld’s titles and get exclusive content through www.bworld-x.com.

[B-SIDE Podcast] Executive coaching and the Filipino workforce

Follow us on Spotify BusinessWorld B-Side

In this B-Side episode, BusinessWorld explores the evolving Filipino workforce through the lens of executive coaching. Tina Sioson, President of the International Coaching Federation (ICF) Philippines, breaks down skills-based hiring, common recruitment pitfalls, and strategies for Filipino professionals to thrive in 2026 and beyond.

Interview by Erika Sinaking

Audio editing by Jayson John Marinas

Follow us on Spotify BusinessWorld B-Side

Taiwan completes first undersea trial for domestically made submarine

TAIPEI — Taiwan completed the maiden underwater sea trial for its first domestically developed submarine on Thursday, a big milestone in a project aimed at strengthening deterrence against the Chinese navy and protecting vital sea lanes in the event of war.

Taiwan, which China claims as its own territory, has made the indigenous submarine program a key part of an ambitious project to modernize its armed forces as Beijing stages almost daily military exercises to assert its sovereignty claims.

The submarine program has drawn on expertise and technology from several countries, including the United States and Britain, a breakthrough for diplomatically isolated Taiwan, whose government rejects Beijing’s territorial claims.

Taiwan’s CSBC Corp which is leading construction of what is eventually planned to be eight submarines, said in a statement late on Thursday that the first ship, named the Narwhal, had completed its first underwater test at sea.

It said the submarine had carried out a “shallow-water submerged navigation test”.

“Submarines are a key strategic capability with deterrent power,” it said, after the test off the southern Taiwanese port of Kaohsiung.

The Narwhal had been due to be delivered to the navy in 2024, joining two existing submarines purchased from the Netherlands in the 1980s, but the program has been hit with delays.

“Due to constraints in the international environment and pressure from the Chinese communists, Taiwan’s indigenous submarine program has faced various difficulties and challenges from the beginning to the present,” CSBC said.

Taiwan has said it hopes to deploy at least two such domestically developed submarines by 2027, and possibly equip later models with missiles.

The first submarine, with a price tag of T$49.36 billion ($1.58 billion), will use a combat system by Lockheed Martin Corp and carry U.S.-made Mark 48 heavyweight torpedoes.

Taiwan’s armed forces are dwarfed by those of China, which has three operational aircraft carriers and ballistic missile submarines and is developing stealth fighter jets.

Taiwan is modernizing its military to be able to fight “asymmetric warfare,” using mobile and agile systems like submarines, drones and truck-mounted missiles to fend off its much larger adversary China.

Taiwan President Lai Ching-te announced in November 2025 that his government would spend an additional $40 billion on defense. — Reuters

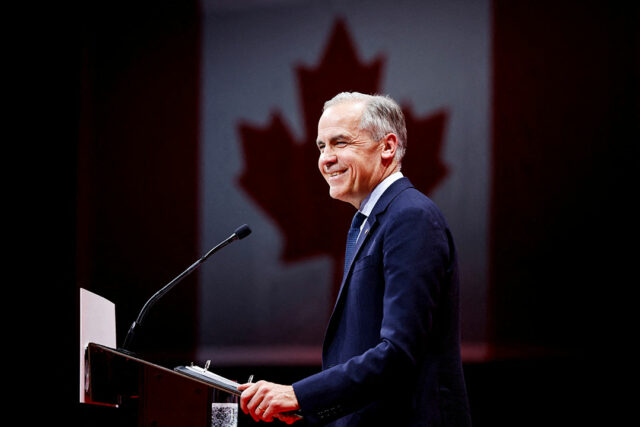

Carney says he expects US administration to respect Canadian sovereignty

OTTAWA — Canadian Prime Minister Mark Carney, asked about reports that US officials had met separatists seeking independence for the province of Alberta, on Thursday said he expected the US administration to respect Canadian sovereignty.

The Financial Times said State Department officials had held three meetings with the Alberta Prosperity Project, a group that is pushing for a referendum on whether the energy-producing Western province should break away from Canada.

“We expect the US administration to respect Canadian sovereignty. I’m always clear in my conversations with President Trump to that effect,” Mr. Carney told a press conference.

Mr. Trump, he added, had never raised the question of Alberta separatism with him.

The APP, which says Ottawa’s policies are stifling the province, wants another meeting next month with State and Treasury officials to ask for a $500 billion credit facility, the Financial Times reported.

Alberta premier Danielle Smith said she wanted to stay part of Canada but noted that polls show 30% of the population was fed up with what it saw as Ottawa’s excessive interference.

Alberta is landlocked and Ms. Smith is pressing for another oil pipeline to the Pacific Coast. That would have to cross the neighboring province of British Columbia, whose premier David Eby has ruled out the idea.

Mr. Eby, whose relations with Ms. Smith are usually chilly, told reporters earlier that “to go to a foreign country and to ask for assistance in breaking up Canada … is treason”.

Last week, US Treasury Secretary Scott Bessent told a radio station: “I think we should let them come down into the US.”

Asked about a possible Alberta referendum, he replied: “People want sovereignty. They want what the US has got.”

Mr. Carney and Mr. Trump have repeatedly traded barbs in recent weeks. Mr. Carney, who calls the US president a skilled negotiator, suggests some of Mr. Trump’s recent comments could be tied to a review of the US-Mexico-Canada trade pact that is due to start later this year. — Reuters

Ex-Google engineer convicted of stealing AI secrets for Chinese companies

WILMINGTON, Delaware — Former Google software engineer Linwei Ding was convicted by a federal jury in San Francisco on Thursday of stealing AI trade secrets from the US tech giant to benefit two Chinese companies he was secretly working for, the US Department of Justice said on Thursday.

Mr. Ding, a 38-year-old Chinese national, was found guilty after an 11-day trial of seven counts of economic espionage and seven counts of theft of trade secrets for stealing thousands of pages of confidential information.

Each economic espionage charge carries a maximum 15-year prison term and $5 million fine, while each trade secrets charge carries a maximum 10-year term and $250,000 fine.

Mr. Ding is scheduled to appear at a status conference on February 3, according to the DOJ.

An attorney for Mr. Ding, also known as Leon Ding, did not immediately respond to a request for comment.

Mr. Ding was originally indicted in March 2024 on four counts of theft of trade secrets. A superseding indictment in February expanded the charges.

Mr. Ding’s case was coordinated through an interagency Disruptive Technology Strike Force, created in 2023 by the Biden administration.

Prosecutors said Mr. Ding stole information about the hardware infrastructure and software platform that lets Google’s supercomputing data centers train large AI models.

Some of the allegedly stolen chip blueprints were meant to give Google, owned by Alphabet, an edge over cloud computing rivals Amazon.com, and Microsoft, which design their own, and reduce Google’s reliance on chips from Nvidia.

Prosecutors said Mr. Ding joined Google in May 2019 and began his thefts three years later, when he was being courted to join an early-stage Chinese technology company.

Google was not charged and has said it cooperated with law enforcement. The company did not immediately respond to a request for comment. — Reuters