Gov’t debt hits record high P13.86 trillion

By Luisa Maria Jacinta C. Jocson, Reporter

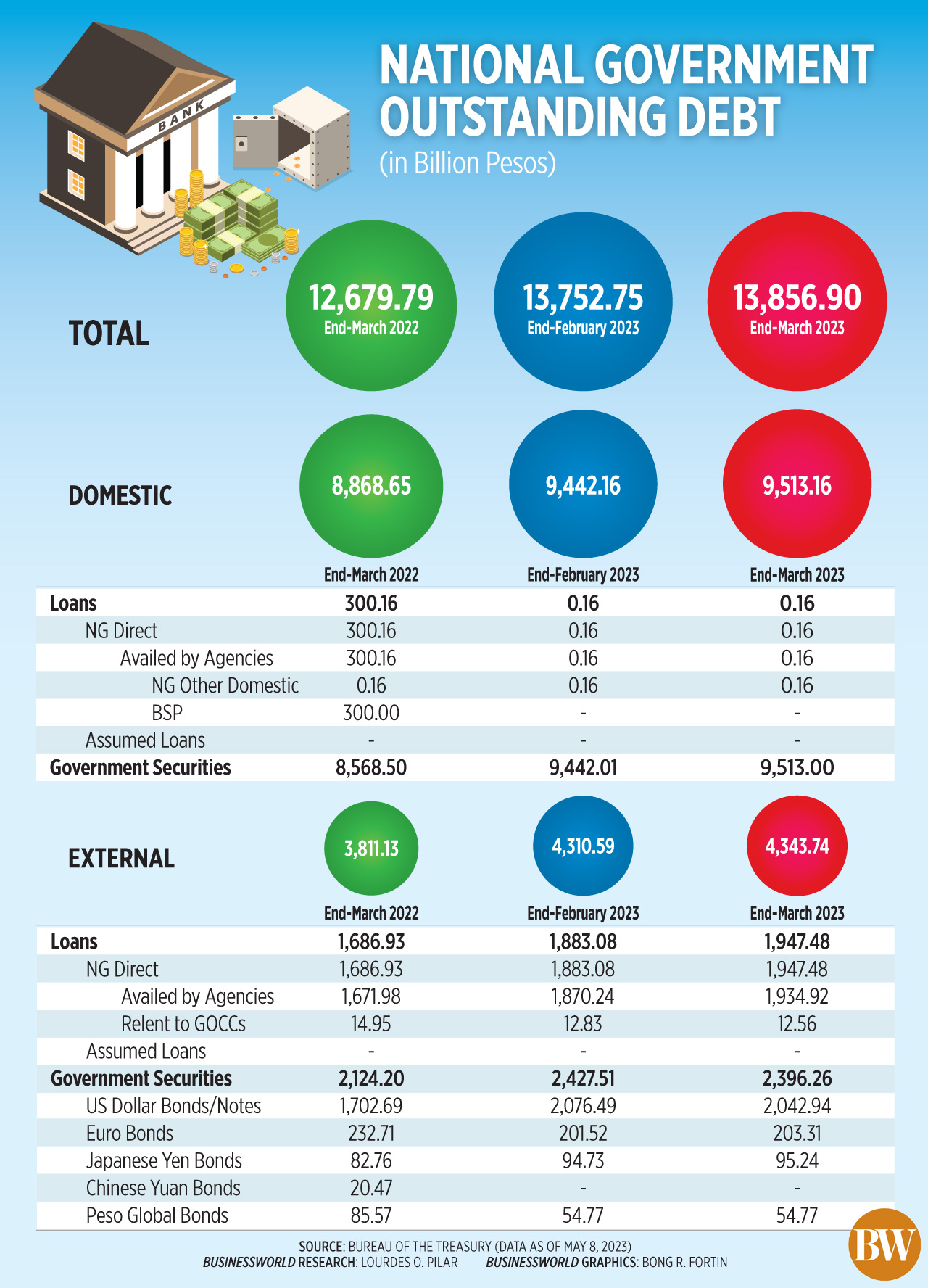

THE NATIONAL Government’s (NG) outstanding debt reached a record-high P13.86 trillion as of end-March, the Bureau of the Treasury (BTr) said on Monday.

Data from the BTr showed that outstanding debt inched up by 0.8% or P104.15 billion from the P13.75 trillion at the end of February, “primarily due to the net issuance of domestic and external debt.”

Year on year, the debt stock rose by 9.3% from P12.68 trillion. Overall debt increased by 3.3% from the P13.42 trillion as of end-December 2022.

Over half or 68.7% of total debt came from domestic sources, while the rest was owed to foreign creditors.

Over half or 68.7% of total debt came from domestic sources, while the rest was owed to foreign creditors.

At end-March, domestic debt rose by 7.3% to P9.51 trillion from P8.87 trillion a year ago. Month on month, it edged up by 0.8% from P9.44 trillion at end-February.

“In March, the P72.87-billion net issuance of domestic securities outweighed the P1.87-billion effect of local currency appreciation against the US dollar on onshore foreign currency denominated securities,” the BTr said in a statement.

Based on figures from the BTr, the peso appreciated by 1.6% to P54.318 as of end-March versus the US dollar from P55.21 as of end-February.

The government mainly borrows from domestic sources to mitigate foreign currency risk.

Meanwhile, foreign debt climbed by 14% to P4.34 trillion at end-March from P3.81 trillion in the previous year. Month on month, it went up by 0.8% from P4.31 trillion.

Broken down, external debt consisted of P1.95 trillion in loans and P2.4 trillion in global bonds.

“The increment in NG’s external obligation for the month was attributed to the P84.26-billion net availment of foreign loans and P18.53-billion impact of third-currency adjustments against the US dollar. These more than offset the P69.64-billion effect of local currency appreciation against the US dollar,” the BTr said.

As of end-March, the NG’s overall guaranteed obligations slipped by 0.8% to P384.12 billion from P387.19 billion in the prior month. Year on year, it declined by 6.6% from P411.04 billion.

“The latest net borrowings of the National Government may reflect the need to finance the budget deficits in recent months,” Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

The government’s budget deficit narrowed by 14.51% to P270.9 billion in the January-to-March period, lower than the P298.705-billion programmed deficit set by Development Budget Coordination Committee (DBCC).

This year, the government has set a budget deficit ceiling of P1.499 trillion, equivalent to 6.1% of gross domestic product.

“Recent trends in tax collections may have influenced more borrowing, but this is expected since the economy is also normalizing. Nevertheless, debt management should really be top priority making sure it is sustainable and manageable,” Union Bank of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion added in a Viber message.

Mr. Ricafort also said the implementation of lower individual tax rates at the start of this year also reduced government revenues, which prompted more borrowings.

He added that outstanding debt may continue to rise ahead of government dollar bond offerings.

National Treasurer Rosalia V. de Leon last month said that the government is planning to launch a retail dollar bond offering this May. The government might sell $1.5 billion worth of 5.5-year debt, she said.

As of end-December, the country’s debt-to-gross domestic product (GDP) ratio stood at 60.9%, improving from the 63.7% ratio as of end-September.

This is lower than the 61.8% target under the medium-term fiscal framework, but still above the 60% threshold considered manageable by multilateral lenders for developing economies.

The government aims to cut the debt-to-GDP ratio to less than 60% by 2025, and further to 51.5% by 2028.

This year, the government’s borrowing plan is set at P2.207 trillion.