Peso climbs as more economies begin to reopen

THE PESO strengthened for the third consecutive day on the back of market optimism on prospects of a gradual reopening of some economies as well as expectations of a dovish stance from the US Federal Reserve.

The local unit closed at P50.51 per dollar on Wednesday, surging by 16 centavos from its P50.67 finish on Tuesday, according to data from the Bankers Association of the Philippines.

The peso started the session at P50.62 versus the dollar. Its weakest showing was at P50.64, while its strongest was at its finish of P50.51 against the greenback.

Dollars traded increased to $498.5 million on Wednesday from the $363.53 million seen on Tuesday.

A trader said the peso’s strength came amid market optimism due to the gradual lifting of lockdowns in some parts of the world.

“Dollar-peso was sold off today on back of weaker dollar given the risk-on sentiment across the market with some countries slowly opening their economies,” the trader said in a phone call on Wednesday.

Reuters reported that Spain unveiled a four-phase plan on Tuesday to lift its lockdown as deaths related to the virus begin to subside.

According to Spanish Prime Minister Pedro Sanchez, the lifting of some restrictions will start on May 4 and its effectivity will vary per province.

The Spanish government said remote working will be recommended where possible until reaching the last phase of the plan towards the end of June, when beaches would also be able to reopen with the support of local authorities.

Spain joins other countries that have bared plans to gradually lift lockdown including France and Italy as well as some states in the US.

Meanwhile, another trader said the peso’s gain came ahead of another policy decision from the Fed this week.

“The peso appreciated today from profit-taking ahead of likely dovish cues from the US Federal Reserve policy meeting later this week,” the second trader said in an e-mail on Wednesday.

The Federal Reserve is widely expected on Wednesday to lift the interest rates that influence its fed funds target, a technical move that could keep interbank lending running smoothly and help prevent financial market disruption should the benchmark rate fall below zero.

The effective fed funds rate dropped as low as 0.04% twice in the past week. That matched the level set in December 2011, two years after the economy emerged from the last recession, heightening concerns among some investors that it could go negative for the first time in the wake of the Fed’s aggressive moves to limit market damage from the coronavirus outbreak.

The fed funds rate declined despite the $1.35 trillion in Treasury bills brought to the market in the past four weeks, as low rates on repurchase agreements and depressed yields on Treasury bills resulted in more inflows into the fed funds market.

A negative effective fed funds rate would imply that banks are willing to pay to lend funds overnight to each other, and indicate the market expects the Fed to take interest rates below zero.

The first trader sees the peso playing around the P50.40 to P50.70 levels versus the dollar, while the second trader gave a forecast range of P50.40 to P50.60. — L.W.T. Noble with Reuters

Shares extend climb ahead of Fed policy meeting

LOCAL SHARES sustained their gains on Wednesday, moving in step with regional peers, as investors reacted to the gradual reopening of economies and the meeting of the US Federal Reserve.

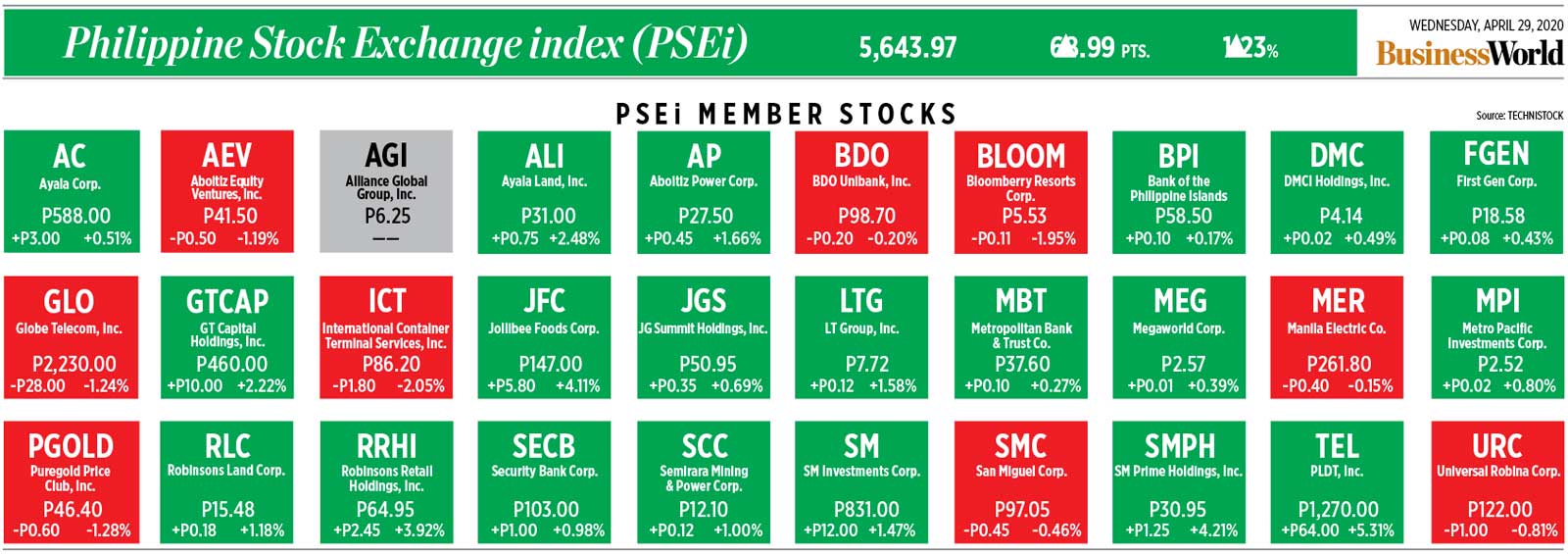

The benchmark Philippine Stock Exchange index (PSEi) picked up 68.99 points or 1.23% to close at 5,643.97 yesterday. The broader all shares index added 30.53 points or 0.89% to 3,425.28.

“Market continued to rebound today together with most of the regional markets on easing lockdowns that would start to reopen the economy and optimism on the US Fed meeting tonight to continue to maintain low interest rate so as to support their economy,” Diversified Securities, Inc. Equity Trader Aniceto K. Pangan said in a text message on Wednesday.

Some areas in the Philippines will be on their last day of enhanced community quarantine (ECQ) today, April 30, as the government moves them to a general community quarantine (GCQ) by May 1 for showing signs of being low-risk or medium risk to the coronavirus disease 2019 (COVID-19) pandemic.

This resulted in optimism among investors that the jumpstarting of economies in these areas will signal the recovery of the country after more than a month of lockdown in Luzon.

Philstocks Financial, Inc. Senior Research Analyst Japhet Louis O. Tantiangco also said investors are keeping a close watch on the Fed meeting.

“Investors are waiting for clues from the US’ monetary authority on how their policy stance would be and what would this mean for the US economy, one of the major economies of the globe,” Mr. Tantiangco said in a text message.

Most Asian stocks closed in green territory on Wednesday. Japan’s Topix index climbed 0.13%, China’s Shanghai Shenzhen CSI 300 Index added 0.46%, South Korea’s Kospi index grew 0.70%.

Back home, all sectoral indices at the local bourse ended the session with gains. Property rose 82.50 points or 2.94% to 2,887.73; mining and oil gained 57.30 points or 1.23% to 4,692.94; services improved 11.23 points or 0.83% to 1,349; holding firms increased 44.66 points or 0.81% to 5,509.37; industrials picked up 50.20 points or 0.67% to 7,465.39; and financials climbed 0.52 point or 0.04% to 1,169.87.

Value turnover stood at P4.54 billion with 584.34 million issues switching hands. Mr. Tantiangco said this is lower than the bourse’s year-to-date average of P5.78 billion, “showing that the rally lacks conviction.”

Advancers outran decliners, 110 against 78, while 49 names ended unchanged.

Foreign investors remained net sellers for the 31st straight day with net outflows worth P726.05 million, up from the previous day’s P471.71 million.

“(Today) is the last trading day for the week because of the Labor Day holiday. We may see some profit taking (today) which will limit its gains for the week,” AAA Southeast Equities, Inc. Research Head Christopher John Mangun said in an e-mail. — Denise A. Valdez

Stimulus bill’s test kit budget seen at P20-B

LEGISLATORS will propose a P20 billion budget to procure test kits which will allow a semblance of normalcy to return to many public areas like businesses and airports and help restart the economy.

Representative and House committee on economic affairs chair Sharon S. Garin of the AAMBIS-OWWA party list said at webinar hosted by the Shareholders’ Association of the Philippines Wednesday that the test-kit budget component of the proposed Philippine Economic Stimulus Act (PESA) is being firmed up in order to help build consumer and business confidence after the lockdown.

“We are proposing a P20 billion allotment for test kits. Massive siya (It will be massive), you can use it in airports and LGUs (local government units) can have it. Until we have a vaccine, then we still have to build up consumer confidence and business confidence as well. So it is kind of a way a stimulus because it will encourage people to go out. If you go to a hotel, you can oblige (visitors) to have tests,” she said.

Presidential Adviser for Entrepreneurship Jose Maria A. Concepcion III said at the same forum that business models will need to change after the coronavirus disease 2019 (COVID-19) pandemic.

“So many business models will really change and consumer confidence as well because if they don’t have confidence in the health situation, they’re not going to go out to the stores, to the restaurants… they’re going to stick to the very basics until they realize we’re over this virus or we have better control of our health situation,” he said.

Rep. Jose Maria Clemente S. Salceda, the House ways and means committee chairman from Albay estimated easing community quarantine (CQ) standards will allow labor participation to increase to 50% will also still dampening keep consumer, labor and business confidence.

“Without testing, a modified CQ will allow labor participation to increase from 23% to 50% but keep consumer, labor and business confidence stuck in the cave while risking a second wave that would compel another lockdown which both the economy and the government can no longer afford,” he said.

Eastwest Banking Corp. Vice Chairman, President and Chief Executive Officer Antonio C. Moncupa, Jr. said that the economic stimulus bill proposed in the House of Representatives “will help a lot,” but added that it is important to ensure that the financial system remains “sound, willing and able to finance the economy.”

“We need to keep the aggregate demand flowing. And for that to happen, financing has to continue flowing. It is the lifeblood that ensures that businesses are able to operate. The fiscal intervention is very good, but the question I have in mind is that of magnitude. It is the question of how sufficient or not sufficient those fiscal interventions will be,” he said.

The latest draft of PESA proposes to inject about P1.3 trillion to P1.4 trillion in the first year of the intervention period of 2020–2022 to help workers and businesses deal with the effects of COVID-19.

In a Viber message to BusinessWorld Tuesday, Rep. Stella Luz A. Quimbo of Marikina, who co-chairs the economic stimulus cluster of the Defeat COVID-19 Committee, said PESA will protect workers by “aiding businesses in augmenting their working capital so payroll costs are maintained and workers are retained.”

“Many businesses have become illiquid as a result of paying salaries and overhead despite not having revenue. Even firms that were profitable pre-COVID but have become illiquid post-COVID are unable to continue paying salaries. Thus, they could end up retrenching employees,” she said.

She said that micro, small and medium enterprises will be the priority, but large firms are also eligible and can avail of assistance “if funds are sufficient.”

“If large firms fold, more workers are at risk of lay-offs. The effect on unemployment could be large too, especially if the firms have strong linkages with other productive sectors of the economy. We hope to protect workers of businesses critically impacted by COVID, regardless of size. These subsidies and loans come with the condition that workers are retained,” she said. — Genshen L. Espedido

DTI to recommend optional COVID-19 testing for asymptomatic workers

TRADE SECRETARY Ramon M. Lopez said he will recommend coronavirus disease 2019 (COVID-19) testing priority for workers exhibiting symptoms, while offering testing as an option for “healthy” workers after the lockdown is lifted.

“’Yung medyo may sinat, masama ang pakiramdam — and therefore kung suspect — sila po ‘yung kailangan sigurong i-test bago sila mag-report for work. But those who are healthy — optional po ‘yun (Those who feel unwell — and are therefore suspect — should probably be tested before they report for work. But those who are healthy — that’s optional), Mr. Lopez said over DZMM radio Wednesday.

He said the post-pandemic workplace practices might involve having employees making a health declaration, recounting their travel history and possible contact with COVID-19 patients or with persons under investigation or monitoring.

Mr. Lopez said private companies can decide on whether or not to require all workers to be tested prior to restarting operations.

“As you all know, we are coming from a quarantine period… kung hindi tayo nagkasakit, malaki ‘yung chance naman na wala ho talaga tayong sakit (If we did not get sick, there’s a big chance that we don’t have COVID-19),” he said during the Laging Handa briefing Wednesday.

He said the trade and labor departments will soon release guidelines on minimum health requirements for businesses.

Areas like Metro Manila and CALABARZON remain under enhanced community quarantine until May 15, while moderate and low-risk areas have been placed under a more relaxed general community quarantine.

Presidential Adviser for Entrepreneurship and Go Negosyo founder Jose Ma. A. Concepcion has launched Project ARK (Antibody Rapid-test Kits), a private sector-led project to increase COVID-19 testing. — Jenina P. Ibañez

Trade dep’t to review food delivery pricing

THE DEPARTMENT of Trade and Industry (DTI) will review the pricing of food delivery services after a surge in adoption of such services during the enhanced community quarantine (ECQ).

“Pag-aaralan po. Bigyan niyo kami ng isang linggo. (We will study this. Give us a week),” Trade Secretary Ramon M. Lopez said over DZMM Wednesday.

He said the number of delivery services has increased due to higher demand.

“Dahil maraming providers ngayon, merong nag-cha-charge ng fixed cost. Merong nag–cha-charge ng percentage. So I think may competition din ‘yan kaya hindi kaagad naman pumapasok ang government kung nakikitang may competition. Ibig sabihin, may nag-po-provide ng mas mababang service fee, delivery fee at merong din namang mas mataas (But because there are many providers today, there are those that charge fixed fees while others charge a percentage of the bill. I think there’s competition there. Government doesn’t intervene right away if we see competition. That means there are those that provide lower or higher service and delivery fees),” he said.

Mr. Lopez said there have been complaints from the public about less-expensive delivery services becoming unavailable during periods of high demand.

The DTI has urged businesses to itemize their prices to make delivery fees more transparent.

Mr. Lopez said Wednesday that the DTI will meet with business groups on the latter’s request to implement a moratorium on demurrage/detention fees, port congestion charges, and other penalties for cargo stuck at ports due to the lockdown.

“Sinulatan natin ‘yung concerned na mga grupo tulad ho ng mga shipping lines. Ang sabi nila ay makikipagpulong sa amin kung ano ang kasagutan nila dito (We have written to the concerned groups like the shipping lines. They said they will meet with us to talk about their response),” he said. — Jenina P. Ibañez

Mindanao hog raisers to be assisted with Luzon, Visayas market logistics

HOG RAISERS in Mndanao will receive assistance in bringing their products to market in Luzon and the Visayas, the Department of Agriculture said.

“We are looking at an initial volume of 1,700 metric tons (MT) of pork from Davao and General Santos City that are available for immediate transport to Visayas and Luzon,” Agriculture Secretary William D. Dar said.

The DA has assigned Undersecretary for High Value Crops and Rural Credit Evelyn G. Laviña to organize hog raisers and logistics providers in Mindanao to bring the island’s surplus pork north.

“Davao hog raisers committed to ship surplus pork of 500 MT monthly, while those in General Santos and Cagayan de Oro can ship 3,000 MT monthly,” Ms. Laviña said.

The DA has said that the national pork inventory is sufficient for the second and third quarters, despite supply issues caused by the African Swine Fever (ASF) outbreak in Luzon.

Mr. Dar said that pork from Mindanao is safe for consumption and free from ASF.

“Right now our pork sufficiency is 93%, as we forecast a deficit by the end of the year, at 31 days. In lieu of pork, we enjoin consumers to shift to other protein sources like chicken, as we have an abundant supply of up to 233 days or until August 2021,” Mr. Dar said. — Revin Mikhael D. Ochave

DoST to offer food production livelihood training

THE DEPARTMENT of Science and Technology (DoST) said it will offer food production technology courses to help the government achieve food security and offer possible alternative livelihoods for persons affected by the coronavirus disease 2019 (COVID-19) pandemic.

In a virtual news conference Wednesday, the DoST’s Philippine Council for Agriculture, Aquatic, and National Resources Research and Development (PCAARRD) said the department will also participate in food distribution to affected communities.

PCCARD will tap its research resources to deliver the training courses, which will supplement the rest of the government’s efforts under the mandate of Republic Act 11469 or the Bayanihan to Heal as One Act.

The program is known as GALING, for Good Agri-Aqua Livelihood Initiatives towards National Goals.

GALING has three components: technology sharing, food distribution to affected communities and frontliners, and livelihood training in urban and community vegetable gardening, as well as backyard production of chicken and tilapia.

“While the country is fighting COVID-19, DoST-PCAARRD will continue to strengthen its initiatives to have sustainable science and technology based livelihood options even after the enhanced community quarantine ends,” Science and Technology Secretary Fortunato T. dela Peña said. — Revin Mikhael Ochave

Debt-to-GDP ratio not expected to exceed 47%

THE DEBT-TO-GDP ratio is expected to remain below 47% even after government tapped more loans to help deal with the coronavirus disease 2019 (COVID-19) outbreak, Finance Secretary Carlos G. Dominguez III said.

He added that most taxes will remain relatively healthy when they eventually come in — after the lockdown disrupted tax season in April — because many of the taxes were computed against 2019 earnings, before the economy was impacted by the pandemic.

“We are looking at keeping at our debt-to-GDP ratio below 47% and so far I think we will hit that target because after all we have tax collections,” he said in a webinar organized by the Harvard Business Group Philippines.

Mr. Dominguez said while income taxes will reflect the strong economy in 2019, value-added tax (VAT) is expected to be significantly affected by the outbreak and the resulting lockdown.

The government’s economic team has prepared a P1.171 trillion package featuring social amelioration programs and well as tax and fiscal measures to help the Philippines recover from the public health emergency.

The package sets aside P830.47 billion for fiscal and monetary action, P305.218 billion for emergency support to the vulnerable sectors and P35.722 billion for medical expenses.

The economic stimulus component of the recovery program does not yet have a final funding level.

The P1.171 trillion package is equivalent to 6.3% of gross domestic product (GDP).

Mr. Dominguez has said that the Corporate Income Tax and Incentives Rationalization Act (CITIRA), if passed, can be deployed as a stimulus measure.

“You want a stimulus, it’s been sitting in Congress, pass it and you have a stimulus right away,” he said, referring to the CITIRA bill.

“I encourage (senators) to please pass the CITIRA bill because of tax incentives there that can act as stimulus to the economy,” he added.

The bill seeks to progressively reduce corporate income tax to 20% by 2029 from the current 30%. It will also rationalize fiscal incentives for investors.

The bill has been awaiting second reading in the Senate. It was certified as urgent by President Rodrigo R. Duterte, paving the way for its approval on second and third reading on the same day. — Luz Wendy T. Noble

Will employee aid during COVID-19 be tax-exempt?

A part from the health crisis, the other grim impact of the coronavirus pandemic is the disruption of business and workers’ livelihoods. To sustain operations, some companies have re-engineered their operations or adopted flexible work arrangements. Since staying at home has become a civic duty, the once home-work-home routine has been replaced by work-from-home arrangements for the more fortunate ones.

The less fortunate workers who are unable to carry out their normal work functions, however, are hard-pressed to make ends meet during the shutdown. Some employers who had reserves provided employee assistance in monetary form, including allowances, advance 13th– month pay, frontline bonuses, benefits, and hazard pay.

Are these payments, intended as employee financial aid during a crisis, tax-exempt?

CASH ALLOWANCE

As a general rule, any cash payment received by employees on account of their employment is considered compensation subject to income tax. Regardless of how companies call them — utilities allowance, grocery allowance, COVID-19 allowance, etc. — these payments represent additional disposable income to the employees. Thus, these payments are still taxable.

This is highlighted under Section 2.78.1(A)(6)(a) of Revenue Regulations (RR) No. 2-98, which provides that “fixed or variable transportation, representation and other allowances received by a public officer or employee or officer or employee of a private entity, in addition to the regular compensation fixed for his position or office, is compensation subject to withholding.”

However, allowances that fall within the threshold amounts for de minimis benefits under RR No. 11-2018, such as medical cash allowances to dependents, rice subsidies, uniform/clothing, laundry, and meal allowances, are exempted from tax.

13TH-MONTH PAY, BONUSES, AND OTHER BENEFITS

After Luzon was placed under quarantine in mid-March, the government encouraged employers in the private sector to pay the 13th-month pay in advance to their employees as a show of solidarity. Since the 13th-month pay is in the nature of a bonus, our tax rules provide that the first P90,000 received by an employee during the calendar year is exempt from income tax. Any amount paid in excess of the threshold is considered taxable income.

The same rule applies to other bonuses and “other benefits/incentives” received by an employee, which are considered compensation or disposable income under Section 2.78.1(A) of RR No. 2-98. They are generally treated as non-taxable subject to the P90,000 limit. While the cash allowance can also be considered “other benefits” given to the employees, the exemption would apply to payments that are in the nature of a bonus (to reward services) or similar payments that would incentivize employees due to the achievement of specific objectives that have been predetermined or that would motivate employees to work more.

HAZARD PAY

Our Labor Code does not provide for hazard pay. Only workers in the public sector are entitled to the benefit under Administrative Order No. 26 series 2020. Hence, any hazard pay in the private sector is discretionary, borne out of the generosity of the employer, unless granted in a collective bargaining agreement, company policy, or company practice.

Regardless of its source, Section 2.78.1(B)(13) of RR No. 2-98, as amended by RR No. 11–18 clearly provides that hazard pay is only exempt from income tax if given to Minimum Wage Earners (MWEs) who “were actually assigned to danger or strife-torn areas, disease-infected places, or in distressed or isolated camps, which expose them to great danger or contagion or peril to life.” If the precondition is not satisfied, the hazard pay is deemed taxable.

Thus, if the employee is not an MWE, any hazard pay given is taxable even if the employee works in areas which pose health risks due to unavoidable exposure to infectious diseases and the dangers of COVID-19, like hospitals, or other frontline work.

Let’s assume that this month, a frontline worker receives a special COVID–19 bonus of P35,000, a monthly hazard pay of P6,000, monthly grocery allowance of P2,000, and an advance on 13th-month pay of P60,000, for a total of P103,000. His total bonus payment for the month amounting to P95,000 will be exempt up to P90,000. Thus, the taxable amount would be P13,000, consisting of the P6,000 hazard pay, P2,000 grocery allowance, and the P5,000 bonus in excess of the P90,000 threshold.

To summarize, any payment made by employers to their employees to financially aid them during this pandemic is generally taxable, unless the law or regulations clearly provide otherwise. The rationale behind the stringent rule on tax exemptions is that taxes are the source of funds to support government expenditures.

Although there is a prevailing sentiment to exempt employee financial assistance from tax, tilting the balance against tax collection would only exacerbate an economy that experts say could be heading for a downturn. With the delayed tax collections due to the quarantine, the government is already scrambling for funds to support expenditures for social relief and medical provisions.

Nonetheless, in the absence of additional tax exemptions during this period, employers can still assist their employees by maximizing the exemptions that are already available, such as giving medical benefits to employees and dependents, group health insurance, hazard pay for MWEs, and benefits/incentives that could fall within the P90,000 tax-exempt threshold. The employer could also reimburse employees for expenses that are necessary to the business of the employer which the employees may be incurring while working from home (e.g., Internet data usage).

While employers are busy finding ways to stay afloat during the pandemic, undoubtedly, there is also an element of generosity and sincere concern for the welfare of people when employers dole out financial assistance. If total strangers can compel you to reach for your wallets, what wouldn’t you give for the people who work with you and help you with your business? Overall, the negative impact of this pandemic has been balanced by the generosity of these employers. Quoting Winston Churchill, “We make a living by what we get. We make a life by what we give.”

The views or opinions in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The firm will not accept any liability arising from the article.

Theresa Redencion S. San Diego is a Director at the Tax Services Department of Isla Lipana & Co., the Philippine member firm of the PwC network.

+63 (2) 8845-2728

theresa.redencion.s.san.diego@pwc.com

Temporary normal

I choose to make a distinction between what we now commonly refer to as the “new normal” as opposed to the way things were pre-COVID-19. In my opinion, what is now emerging from this pandemic — and the lockdown — is actually a “temporary normal” that may last for about two to three years, or until mass vaccination is available to protect people against the coronavirus.

And it is only after mass vaccination can we expect some form of “new normal” to persist. But this is not to say that we will not see a “return to normal” in some form or other. Simply put, all measures implemented now including wearing a mask in public and physical distancing, keeping seniors and children at home, are not something that will be required forever. These are temporary measures.

It is with some confusion, therefore, that I view the initiative at the House of Representatives to pass a national law that will set or impose quarantine rules for people going out of their homes for three years. Fact of the matter is, many people are so scared to get sick that they already choose not to go out unless absolutely necessary, without or without quarantine.

I view House Bill 6623, or the proposed New Normal for the Workplace and Public Spaces Act of 2020, unnecessary. The need for a mask and physical distancing are matters of commonsense, at this point. And I doubt very much if people will actually go back to pre-COVID-19 ways as soon as the quarantine order is lifted. Many people will still choose to be cautious.

In this line, do we really need a national law to make mandatory all over the country the wearing of masks in public spaces and workplaces for the next three years? Do we really need a national law to require the installation of hand washing or sanitizing stations in “high-touch” areas? Do we really need a national law to require temperature checks and physical distancing of at least one meter? Do we really need a national law to impose fines and penalties for violations?

Quarantine measures, by their very nature and cause, are always temporary. Through House Bill 6623, are we not trying to make the quarantine semi-permanent by stretching it beyond 60 days to three years? Do we really need a law that will highly regulate and manage the movement of people in public spaces such as markets and parks and the issuance of “new normal” permits by the local government units during this three-year period?

The proposed law even attempts to let the government regulate and manage privately organized gatherings in privately managed spaces, which can be dispersed by the LGU “after determination by authorities that the said gathering is not observing the Universal and Mandatory Safety Measures.” I hope the legal experts can weigh in on all these proposals, which seem unconstitutional to me.

Even assuming that HB 6623 is time-bound, and will last only three years, is it absolutely necessary to put all these measures in a national law? Moreover, with respect to regulating people’s movements in private spaces, can we actually impose a measure that will last that long? Also, who and how are “Universal and Mandatory Safety Measures” for this period going to be set?

Moreover, the proposed law will be effective for three years from the date of its enactment, or sooner upon official declaration of the end of the crisis by the President, on the recommendation of the Inter-Agency Task Force on Emerging and Infectious Diseases. For the sake of argument, what if the crisis ends in six months? Then the law’s effectivity will end as well? Then, what happens to all the preparations required by the law for business reopening, which will probably take at least a year to comply with?

Even businesses will be required by the proposed law to submit a “New Normal Workforce and Workplace Management Plan” to LGUs. This alone will take at least a year to implement, and further delay business reopening. And I doubt very much if there is enough expertise out there both in the private and public sectors to sign off and verify compliance of all commercial and business establishments “prior to the resumption of their operations.”

A news report in this paper also indicates that malls and other commercial establishments will be required to limit the number of people inside their premises and implement contact-less sales and customer service. How long will it take for businesses to implement such measures? Can they afford such measures now, after being closed for 60 days?

We need businesses to restart soon. It is bad enough that quarantine, to a large extent, deprives many people including seniors their freedom of movement. Many seniors are actually still employed, or are running businesses. And yet, they have been deprived of certain liberties primarily due to their age. Many seniors fend for themselves and do not have other people to care for them. But now, they cannot provide for themselves. The same goes for millions of wage earners.

The House Bill also has impractical provisions. It aims to keep suspended the operation of all motorcycle taxis; passengers in all types of public transportation will be required to wash or sanitize their hands before boarding the vehicle; and, passengers must pay only through “contactless” methods. Can we actually implement these measures? I can live with passengers being seated one seat apart and wearing a face mask at all times. But I don’t know if it is feasible to require hand-washing and contactless payments.

The also bill provides for “green lanes” on the road network for health care, emergency, law enforcement, and supply-chain vehicles. So, does this mean apportioning or blocking off a lane in every road or highway for such “green lanes” in the next three years? Is this not arbitrary? Will this apply even during non-emergency situations?

The bill also proposes the suspension of classes and other school activities until further notice, and that schools will be required to establish online learning platforms. The reality now is that many schools, particularly the smaller ones in the provinces, are already closing down because of dwindling enrollment. It is unlikely for many schools even in Metro Manila to afford online learning platforms for three years.

The bill’s provisions I support include requiring the Philippine Statistics Authority (PSA) to fast-track the implementation of the Philippine Identification System Act; requiring the Department of Information and Communications Technology (DICT) to expedite and fully implement a national broadband program; and, requiring all government agencies to develop and implement a system for facilitating government transactions through online platforms.

The other provisions, in my opinion, require more research and vetting. The proposed measures must be backed by empirical and scientific data, with respect to need, effectiveness, and duration. The national law should not be simply an attempt to provide a legal basis for prolonging quarantine measures, which may or may not have been effective in the fight against COVID-19.

Marvin Tort is a former managing editor of BusinessWorld, and a former chairman of the Philippines Press Council.